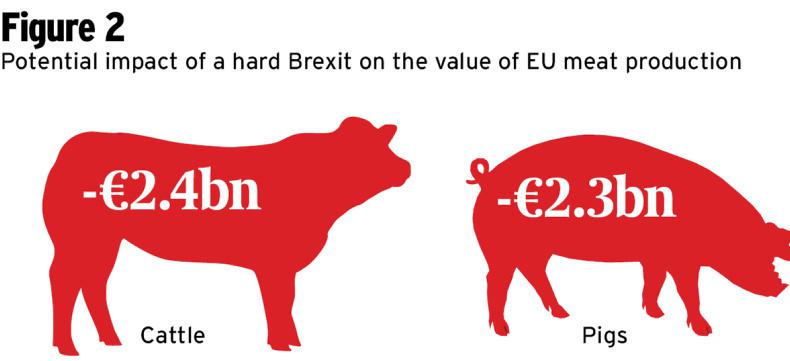

UECBV, the EU umbrella trade association for the meat processing industry, has published a report warning of a collapse in meat trade with the UK if there is a hard Brexit. The headline numbers are a drop in the value of €2.4bn in the value of beef and €2.3bn in the value of pigmeat as a result of a predicted 84% drop in trade between the EU27 and the UK in beef, 76% in sheepmeat and 46% in pigmeat.

The report also advises that as many as 32,000 jobs could be lost in the industry across the EU27. The loss of trade with the UK is predicted to leave the EU considerably oversupplied, with beef at 116% of consumption, and that is before any further access to the EU market as a result of trade discussions. Currently, the EU28 is at 102% self-sufficiency in beef production.

The report predicts a drop in the market value of beef by 8% as a result of the loss of trade with the UK, which is inevitable given an average tariff burden of 50% in the meat sector but as much as 100% in some categories. Manufacturing beef, mainly taken from the forequarter of the animal and used in making burgers and mince, is the product that carries the highest tariff under WTO rates, while applying the tariffs on striploins would increase their price by 36%.

Interestingly, away from agriculture, cars are one of the largest EU27 exports to the UK and they carry a 7.9% tariff, which is not at a prohibitive level as is the case with meat.

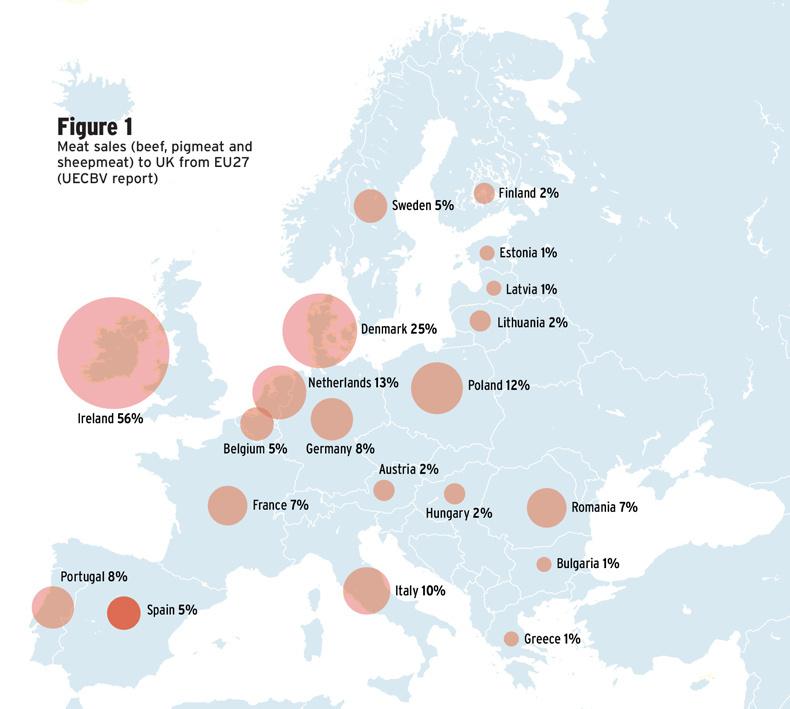

The report also confirms that Ireland will be hardest hit as it exports more beef, pigmeat and sheepmeat than all of the other EU27 countries combined. Ireland currently supplies 56% of the EU27 meat exports to the UK and therefore Brexit will hit the Irish meat industry hardest of all. After Ireland, Denmark is the EU country most exposed.

The report says a hard Brexit presents the worst outcome once the UK leaves the EU. It explores in detail the complexities of third-country imports accessing the EU and the high level of scrutiny this product is subject to. Veterinary checks and customs controls are an inevitable consequence of the UK being a third country without a specific trade agreement after Brexit.

The report puts a cost on the UK doing business with the EU as a third country which is an additional cost to the range of tariffs on different meat products. Veterinary certification and inspection checks along with associated port costs amount to €635 per consignment.

There is also a raft of paperwork that has to be completed to gain customs clearance when entering the EU from a third country which UECBV estimates would add between 5% and 8% on a consignment.

The report estimates that document checks at borders would increase wait times by three hours while product inspections would cause a five-hour delay.

It is calculated that this would cost an extra €21/t approximately, amounting to an increase of between 2% and 5% on meat products. That is considered a conservative estimate by the report and it points out that it frequently takes 30 hours for a truck to enter the EU from Turkey.

The report produces a series of recommendations designed to minimise the negative impact of the UK leaving the EU on the meat industry. Among these is a call for a “sufficiently long transitional period” to allow businesses adjust to the new arrangements and agree a future trading relationship that creates a minimum burden for business.

It also calls for regulatory convergence between the UK and EU after Brexit, something that may be difficult if the UK wants to do business with the US.

Wilbur Ross, the US trade secretary, said on a visit to London recently that the UK should depart from EU regulation standards and adopt something closer to the US model.

The final recommendation is for use of market support mechanisms to facilitate transition for business and use of sealed containers for units in transit through the UK and investment in port facilities to accommodate the increased level of activity expected once the UK leaves the EU.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: