Irish farmers will be relieved that the Mercosur side failed to respond as positively as expected to the recent EU offers on beef (70,000t access quota) and ethanol/sugar (100,000t offer).

Despite several technical meetings in the margins of the WTO ministerial conference in Buenos Aires this week, the EU has not been persuaded of any meaningful progress on about 15 issues including dairy, wine and spirits. That has meant that despite both EU and Mercosur enthusiasm for a deal, there is stalemate, which suits Irish and EU beef and sugar producers well.

Meanwhile, the political agreement reached between the EU and Japan in July has moved on to the next stage with completion of the legal text on the details. Last Friday’s announcement in Brussels marks an important milestone on Irish and EU agri-food exports securing access to the Japanese markets at a dramatically reduced tariff level.

The next steps in the approval process are legal verification of the text by the EU and Japan, or “legal scrubbing.” When this is complete, the agreement will be translated into the languages of the member states and go before Parliament and member states for approval. It is expected it will be signed during 2018 and come into effect before the end of the current mandate in 2019.

What does the deal mean on agri-food tariffs?

Currently, Ireland and the EU exports to Japan under WTO most favoured nation (MFN) tariffs. These range from €3.60/kg (equivalent) plus 4.3% of value on pigmeat, 38% on beef, 21% on offal and 29.8% on cheese.

Under the EU-Japan treaty, these would drop over time (up to 15 years) to 9% on beef and virtual elimination on pigmeat and dairy. The Japanese do, however, retain a safeguard mechanism to protect the market in the event of huge oversupply.

The EU has secured a 50,000t beef quota excess that is independent of this mechanism. The agreement between the EU and Japan will place Irish and EU exporters on similar tariff arrangements to Australia and New Zealand and align any future EU tariffs with any future concessions made to other countries.

Value to Irish farmers

Despite the high level of tariffs on agri-food produce, Irish exporters did €56m worth of business with Japan in 2016, which was an increase of 45% on 2015, making Japan the 22nd most important export destination for Irish agri food exports (Bord Bia/CSO).

Pigmeat is the main product exported, with total meat exports accounting for 40% of total value, while dairy exports at €18m in 2016 represent over 30% of all agri-food exports from Ireland to Japan.

Seafood and beverages make up the majority of other exports to Japan. In terms of volume, sales of pigmeat from Ireland to Japan have more than doubled in the first nine months of 2017, reaching 5,800t.

Beef exports have been confined to offal, tongues in particular, with approximately 1,200t exported in 2017 up to end of September.

As well as the very high tariff rates on beef, the other great constraint is the restriction that only beef from cattle that are under 30 months is eligible to export to Japan under Ireland’s current controlled risk BSE status.

Market opportunity

Japan is one of the markets in the world that has less domestic production capacity than there is demand for produce. That said, it is still a seriously protected market, with the Japanese government particularly anxious to support its domestic industry.

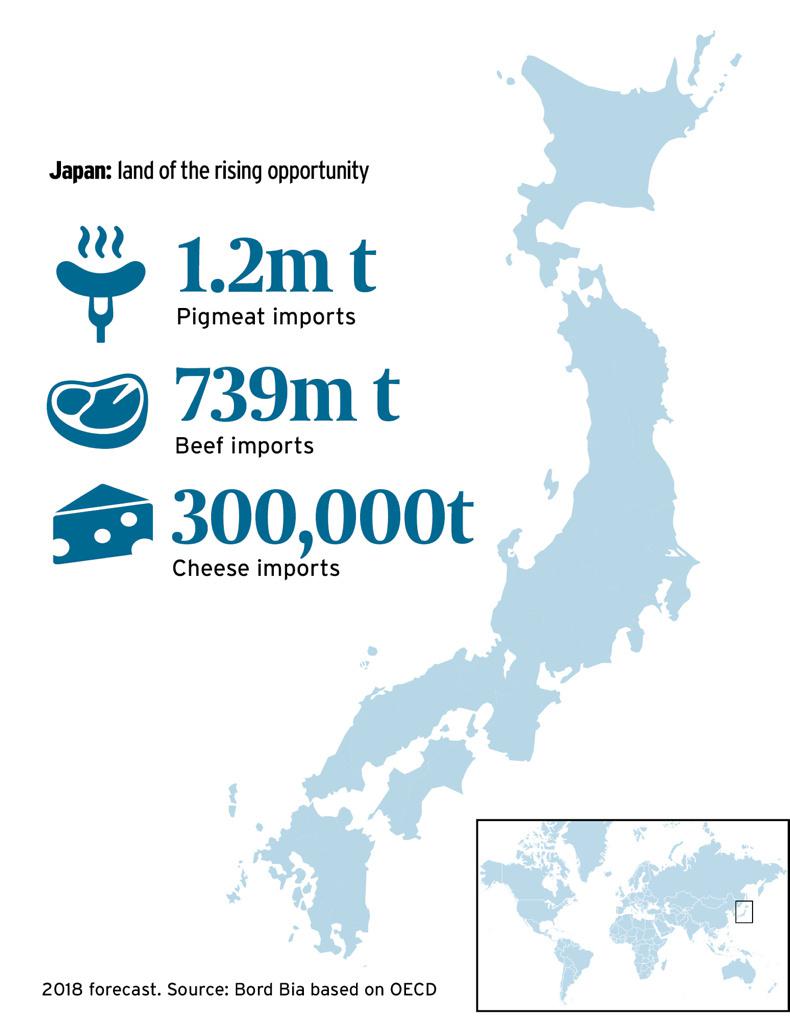

According to Bord Bia/OECD figures, Japan is forecast to import 1.2m tonnes carcase weight equivalent (CWT) in 2018. Even though Irish sales have doubled in volume to 5,800t, this is still miniscule compared with the overall market size and therefore there is a real opportunity once the tariff barrier is eliminated.

It will also be equally attractive for the major pigmeat exporters of Europe such as Spain and Denmark, which will create competition for Chinese buyers and indeed EU customers.

EU and Irish exports will be more competitive with the US and Canada, who currently supply over half the Japanese market, because of the tariff elimination.

On beef, it it is estimated by Bord Bia/OECD that Japan will import 739m tonnes CWT in 2018. The market is currently dominated by Australia, which supplies over 50% of Japanese imports and the USA, which supplies almost 40%.

Beef potential

With Ireland as part of the EU on the same reducing tariff track as Australia, there is great potential to grow beef exports to Japan. If we can achieve low-incidence BSE status, our supply base can be extended to include all cattle, which could grow the market further.

On dairy, the biggest demand is for cheese, with approximately 300,000t required annually and Japan is only 15% self-sufficient. Australia and New Zealand, who are working towards a phasing out of tariffs, dominate Japanese imports with 58% of the cheese import market.

The USA has 11% and the Netherlands and Germany have a combined 15%, despite the high 29.8% tariff levels currently in place. Once these are reduced and eventually removed after 15 years, Irish and EU cheese exports will be very competitive with Australia and New Zealand.

Japan also imported 30,000t of powder and 12,000t of butter in 2016.

The Japanese trade deal is the best ever secured for farmers. However, it will be 2019 before it comes into effect and then tariffs will be reduced step by step, taking up to 15 years to complete the process. Therefore, it is good news for Irish farmers in the long-term, but won't help the market in the immediate future.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: