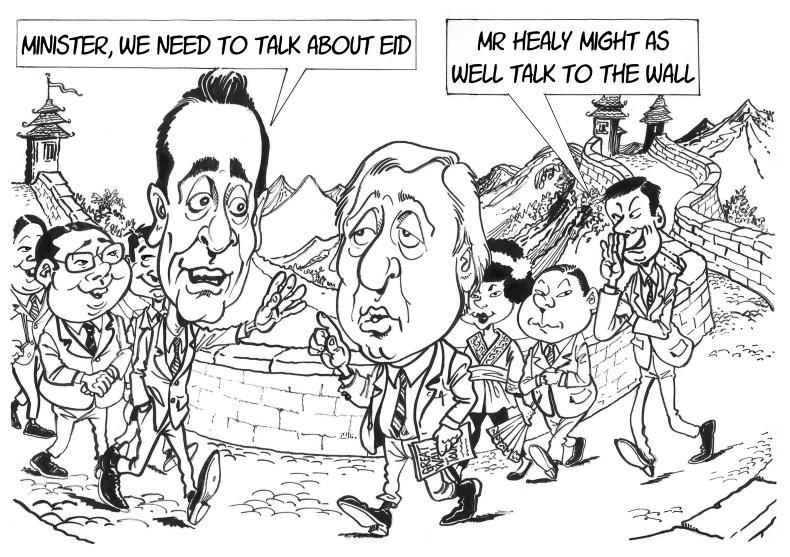

Minister for Agriculture Michael Creed is leading one of the largest ever Bord Bia trade missions to China this week. Minister Creed and Bord Bia CEO Tara McCarthy are flanked by a heavyweight delegation from the Irish beef processing industry, with both Mark Goodman, managing director of ABP International, and Niall Browne, Dawn Meats CEO, in attendance.

At this early stage in the development of the market, the minister and Bord Bia will play a central role in helping Irish beef secure a foothold in China. Irish processors will rely heavily on them to prepare the political and commercial landscape necessary for them to start doing business.

In a country where building trust and relationships is key to securing new business, the value for Irish beef processors of being part of a ministerial-led delegation when introduced to potential new customers cannot be underestimated.

The China strategy has to have the interests of Irish farmers at its core and not just the interests of a small group of privately owned meat processors

Minister Creed and Bord Bia need to use their position of influence to shape the strategy for Irish beef in the Chinese market – a strategy that has the interests of Irish farmers at its core and not just the commercial interests of a small group of privately owned meat processors.

If the Chinese market is to be developed in a way that delivers for farmers, neither Minister Creed nor Bord Bia can allow these Irish processors – that are so keen to at this stage in the process be part of “team Ireland” – to jump ship and go it alone as soon as they see a commercial advantage.

In this column a number of weeks ago, we highlighted the relevance of a report published by Bord Bia in 2010 when it comes to developing a strategy for Irish beef in the Chinese market.

The report set out a roadmap for how the Irish food and drinks industry should approach global export opportunities, such as the one that gaining access to the Chinese market presents for our beef sector.

A central plank was the importance of collaboration rather than competition in ensuring that the brand position was created and the value of the market protected.

As Phelim O’Neill and Thomas Hubert, who are accompanying the Irish and EU missions to China, report this week, Bord Bia presented research it commissioned to the industry emphasising the need to enter China as “Brand Ireland”. In a country that is so welcoming of branded beef imports, where the brand assures providence and safety, there is an opportunity for Brand Ireland beef to be positioned at the upper end of the market.

However, the warning to processors was clear: this will only be delivered if they don’t undermine the Irish proposition by undercutting each other.

Ultimately, time will not only tell if anyone was listening to the Bord Bia message, but also the extent to which the industry is influenced by it. Traditionally, the semi-state organisation has tended to play it safe with policy closely aligned to the direction of travel in which the industry is heading. However, in the case of maximising the value of the Chinese beef market for Irish exports, Bord Bia has challenged the industry to do things differently in a very public way with Brand Ireland.

There can be no excuses. If developed correctly, China, currently importing 10% of all beef traded on the global market, has the potential to be developed into a high-value, high-volume destination for Irish beef exports in the same way it has for Irish dairying and pigmeat – the core products that have increased the value of Irish exports to China from €200m in 2010 to €1bn at present. Get it wrong and we merely have access to another commodity market where we gain market share through being the lowest cost supplier.

Notwithstanding his reluctance to get involved in commercial matters, the stakes for Irish farmers are too high for Minister Creed to simply park all the good work he and his Department have done to date and leave it up to a few privately owned Irish processors to decide how we advance in the market. Given the unique exposure of the Irish beef industry to Brexit, the opportunity to secure the flexibility at EU level around state aid rules to allow Bord Bia take more of a commercial influence in shaping how we develop the Chinese market should be explored.

GRASS & MUCK: farmers need machines that are tuned for Irish conditions

The New Holland DiscCutter mounted mower-conditioner as seen on Tuesday in Gurteen College ahead of Thursday's FTMTA Grass & Muck event.Weather conditions over the past few months clearly demonstrate the need for Irish farmers to have access to high-output, reliable machines that can get jobs done quickly.

The window of opportunity for carrying out weather-dependent field work seems to be getting tighter and tighter each year.

The sheer volume of work that has been carried out across Irish farms over the past two weeks has been phenomenal, whether planting potatoes, sowing corn or even getting slurry spread on livestock farms.

It is essential, as we strive to grow and develop our agri sector, that farmers continue to have access to the latest technology, not only to drive efficiencies but to ensure we can meet ever more stringent environmental regulations.

We have seen how developments in this area have transformed our ability to make much better use of organic fertilisers, whether it be slurry spreading technologies that improve the utilisation of nutrients and reduce emissions on livestock farms, or the spreading precision necessary to allow tillage farms to utilise pig and poultry manure efficiently.

The FTMA’s Grass & Muck event taking place today (Thursday) provides an ideal opportunity for farmers and contractors to see the latest machines and technologies in action. As usual, there will be a particular focus on equipment required to harvest our largest annual crop: grass.

Given the importance of the crop to our livestock sector and the vulnerability of feed value to weather conditions, it is essential that we continue to see technology advances both in the area of improving quality and harvesting efficiency. However, in all aspects, it is essential that new technologies/machines come to the market at a price point that does not put them out of reach of the sector.

In recent years, we have seen the price of new tractors increase at a pace that far exceeds the price of agricultural commodities – largely due to the need for new emission technologies.

Likewise, many of the environmental enhancing technologies on implements have significantly added to the purchase price.

In many cases, the adoption of these new technologies would not be economically viable at farm level without support through TAMS.

In the upcoming CAP reform, supporting farmers who wish to invest in new technologies that reduce emissions or allow for better utilisation of input should be seen as a key part of any new environmental measures.

MILK PRICE: a cut is a cut

We have received various challenges in recent days over our reporting of milk prices paid by dairy processors. Processors that held the base price but reduced support payments believe that we were unfair to describe this as a cut in the milk price paid as the base price remained unchanged. Given the increased prevalence of what processors are calling support or top-up payments, there is clearly a need to update the terminology used when discussing the monthly milk price.

What most farmers want to know is the price per litre they are going to receive. How this payment is structured is of less immediate relevance. Therefore, in news reports we will continue to report the combined milk price for each processor and how this compares to the previous month – whether it is up or down. This combined price will reflect the base milk price plus or minus any support payments. Ultimately, processors need to move to reporting prices in euro per kilo milk solids, as that is how farmers are ultimately paid.

Regardless of how it is portrayed, the latest round of cuts will come as a major disappointment to farmers due to the improved sentiment in global markets. In recent weeks, butter prices have increased €400/t with skim up by €100/t. Processors will point out that at current commodity prices, the basket of dairy products translates into a price of 28c/l. Nevertheless, the upward trend and improved market sentiment should give farmers confidence on price for the remainder of the year.

Read more:

Processors announce April milk cheque cut

China: a cashless, online society

Minister for Agriculture Michael Creed is leading one of the largest ever Bord Bia trade missions to China this week. Minister Creed and Bord Bia CEO Tara McCarthy are flanked by a heavyweight delegation from the Irish beef processing industry, with both Mark Goodman, managing director of ABP International, and Niall Browne, Dawn Meats CEO, in attendance.

At this early stage in the development of the market, the minister and Bord Bia will play a central role in helping Irish beef secure a foothold in China. Irish processors will rely heavily on them to prepare the political and commercial landscape necessary for them to start doing business.

In a country where building trust and relationships is key to securing new business, the value for Irish beef processors of being part of a ministerial-led delegation when introduced to potential new customers cannot be underestimated.

The China strategy has to have the interests of Irish farmers at its core and not just the interests of a small group of privately owned meat processors

Minister Creed and Bord Bia need to use their position of influence to shape the strategy for Irish beef in the Chinese market – a strategy that has the interests of Irish farmers at its core and not just the commercial interests of a small group of privately owned meat processors.

If the Chinese market is to be developed in a way that delivers for farmers, neither Minister Creed nor Bord Bia can allow these Irish processors – that are so keen to at this stage in the process be part of “team Ireland” – to jump ship and go it alone as soon as they see a commercial advantage.

In this column a number of weeks ago, we highlighted the relevance of a report published by Bord Bia in 2010 when it comes to developing a strategy for Irish beef in the Chinese market.

The report set out a roadmap for how the Irish food and drinks industry should approach global export opportunities, such as the one that gaining access to the Chinese market presents for our beef sector.

A central plank was the importance of collaboration rather than competition in ensuring that the brand position was created and the value of the market protected.

As Phelim O’Neill and Thomas Hubert, who are accompanying the Irish and EU missions to China, report this week, Bord Bia presented research it commissioned to the industry emphasising the need to enter China as “Brand Ireland”. In a country that is so welcoming of branded beef imports, where the brand assures providence and safety, there is an opportunity for Brand Ireland beef to be positioned at the upper end of the market.

However, the warning to processors was clear: this will only be delivered if they don’t undermine the Irish proposition by undercutting each other.

Ultimately, time will not only tell if anyone was listening to the Bord Bia message, but also the extent to which the industry is influenced by it. Traditionally, the semi-state organisation has tended to play it safe with policy closely aligned to the direction of travel in which the industry is heading. However, in the case of maximising the value of the Chinese beef market for Irish exports, Bord Bia has challenged the industry to do things differently in a very public way with Brand Ireland.

There can be no excuses. If developed correctly, China, currently importing 10% of all beef traded on the global market, has the potential to be developed into a high-value, high-volume destination for Irish beef exports in the same way it has for Irish dairying and pigmeat – the core products that have increased the value of Irish exports to China from €200m in 2010 to €1bn at present. Get it wrong and we merely have access to another commodity market where we gain market share through being the lowest cost supplier.

Notwithstanding his reluctance to get involved in commercial matters, the stakes for Irish farmers are too high for Minister Creed to simply park all the good work he and his Department have done to date and leave it up to a few privately owned Irish processors to decide how we advance in the market. Given the unique exposure of the Irish beef industry to Brexit, the opportunity to secure the flexibility at EU level around state aid rules to allow Bord Bia take more of a commercial influence in shaping how we develop the Chinese market should be explored.

GRASS & MUCK: farmers need machines that are tuned for Irish conditions

The New Holland DiscCutter mounted mower-conditioner as seen on Tuesday in Gurteen College ahead of Thursday's FTMTA Grass & Muck event.Weather conditions over the past few months clearly demonstrate the need for Irish farmers to have access to high-output, reliable machines that can get jobs done quickly.

The window of opportunity for carrying out weather-dependent field work seems to be getting tighter and tighter each year.

The sheer volume of work that has been carried out across Irish farms over the past two weeks has been phenomenal, whether planting potatoes, sowing corn or even getting slurry spread on livestock farms.

It is essential, as we strive to grow and develop our agri sector, that farmers continue to have access to the latest technology, not only to drive efficiencies but to ensure we can meet ever more stringent environmental regulations.

We have seen how developments in this area have transformed our ability to make much better use of organic fertilisers, whether it be slurry spreading technologies that improve the utilisation of nutrients and reduce emissions on livestock farms, or the spreading precision necessary to allow tillage farms to utilise pig and poultry manure efficiently.

The FTMA’s Grass & Muck event taking place today (Thursday) provides an ideal opportunity for farmers and contractors to see the latest machines and technologies in action. As usual, there will be a particular focus on equipment required to harvest our largest annual crop: grass.

Given the importance of the crop to our livestock sector and the vulnerability of feed value to weather conditions, it is essential that we continue to see technology advances both in the area of improving quality and harvesting efficiency. However, in all aspects, it is essential that new technologies/machines come to the market at a price point that does not put them out of reach of the sector.

In recent years, we have seen the price of new tractors increase at a pace that far exceeds the price of agricultural commodities – largely due to the need for new emission technologies.

Likewise, many of the environmental enhancing technologies on implements have significantly added to the purchase price.

In many cases, the adoption of these new technologies would not be economically viable at farm level without support through TAMS.

In the upcoming CAP reform, supporting farmers who wish to invest in new technologies that reduce emissions or allow for better utilisation of input should be seen as a key part of any new environmental measures.

MILK PRICE: a cut is a cut

We have received various challenges in recent days over our reporting of milk prices paid by dairy processors. Processors that held the base price but reduced support payments believe that we were unfair to describe this as a cut in the milk price paid as the base price remained unchanged. Given the increased prevalence of what processors are calling support or top-up payments, there is clearly a need to update the terminology used when discussing the monthly milk price.

What most farmers want to know is the price per litre they are going to receive. How this payment is structured is of less immediate relevance. Therefore, in news reports we will continue to report the combined milk price for each processor and how this compares to the previous month – whether it is up or down. This combined price will reflect the base milk price plus or minus any support payments. Ultimately, processors need to move to reporting prices in euro per kilo milk solids, as that is how farmers are ultimately paid.

Regardless of how it is portrayed, the latest round of cuts will come as a major disappointment to farmers due to the improved sentiment in global markets. In recent weeks, butter prices have increased €400/t with skim up by €100/t. Processors will point out that at current commodity prices, the basket of dairy products translates into a price of 28c/l. Nevertheless, the upward trend and improved market sentiment should give farmers confidence on price for the remainder of the year.

Read more:

Processors announce April milk cheque cut

China: a cashless, online society

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: