The future of the country’s tillage farmers continues to be under threat and there is no silver bullet to address fundamental questions regarding its viability.

However, if farmers are willing to diversify their operations and consider changing practices, then a future can be carved out.

These were the findings of a 97-page report produced by the joint Oireachtas committee on agriculture on Wednesday. The report is titled the Future of the Tillage Sector in Ireland.

Listen to committee chair, Pat Deering TD, in our podcast below:

Central to this, however, is the continuation of a well-funded CAP in a post-Brexit scenario as well as access to credit, establishing crop insurance and the renewal of the glyphosate licence.

Between September and October, the committee heard submissions from groups such as the IFA, the Irish Grain Growers and the IOFGA as well as industry stakeholders including Boortmalt, Teagasc and Science Foundation Ireland.

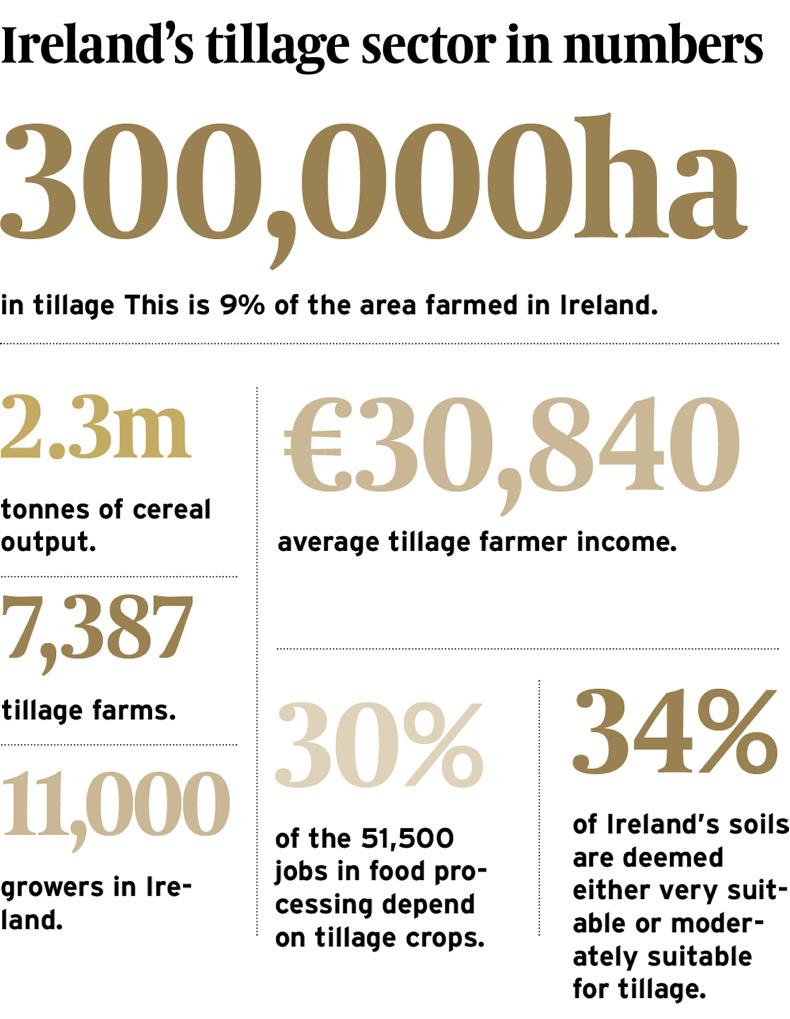

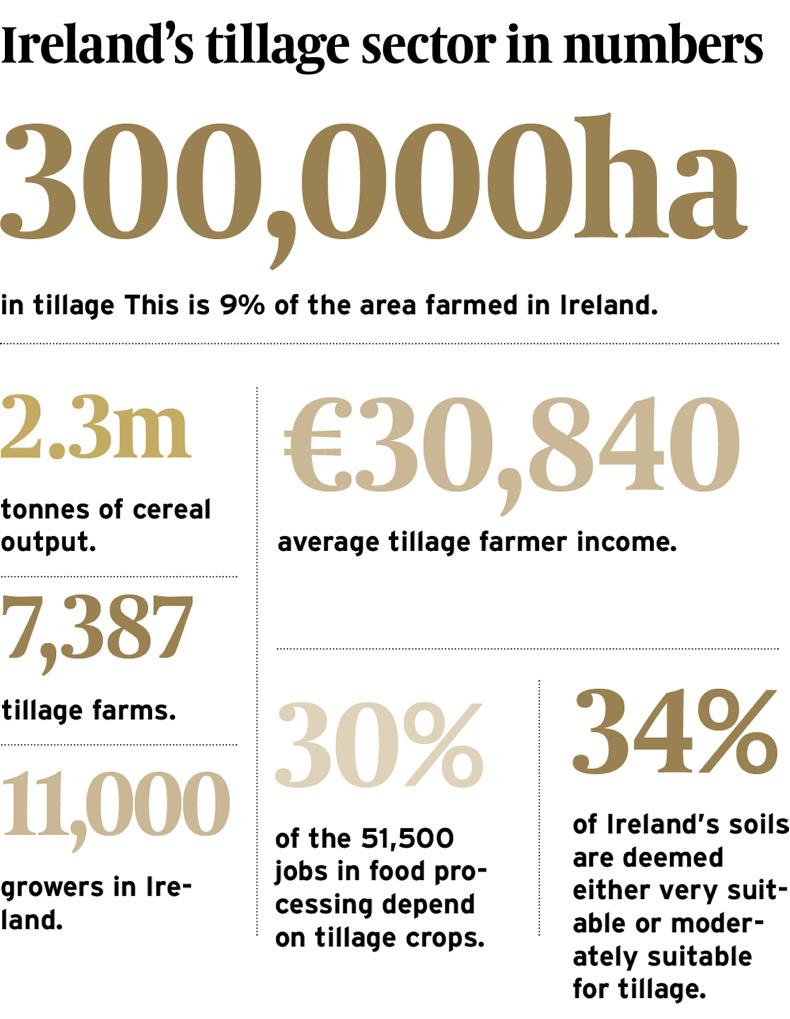

Despite enduring four years of downward pressure on prices, the report recognises the stature and significance of the sector.

“Tillage farming generates the second-highest income in Irish farming, after dairy, and also receives the largest direct payments …

“The prospects for the tillage sector in Ireland may be reasonably positive if the sector is managed appropriately in the coming years.

“Demand for tillage produce will increase in the coming decades; provided that extremes of weather do not become the norm, Irish tillage farmers may well find the coming decades particularly profitable.”

The report states there is the potential for all crops to significantly increase yields and hectares, but only if there is a market for them.

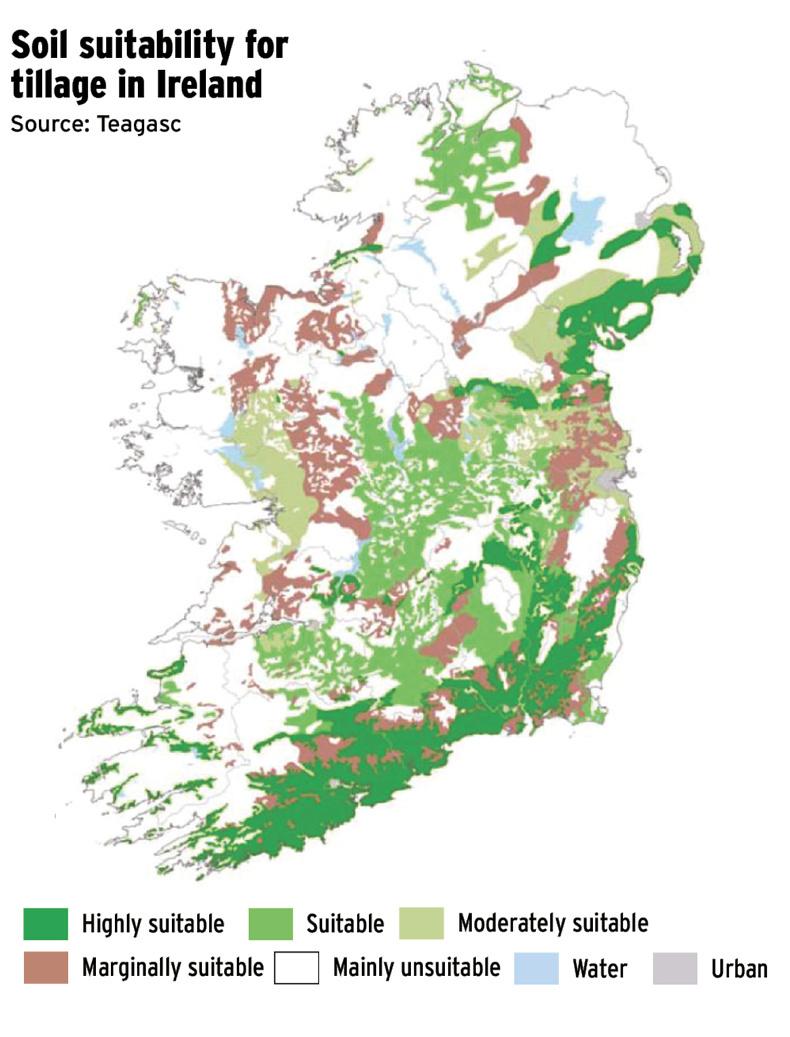

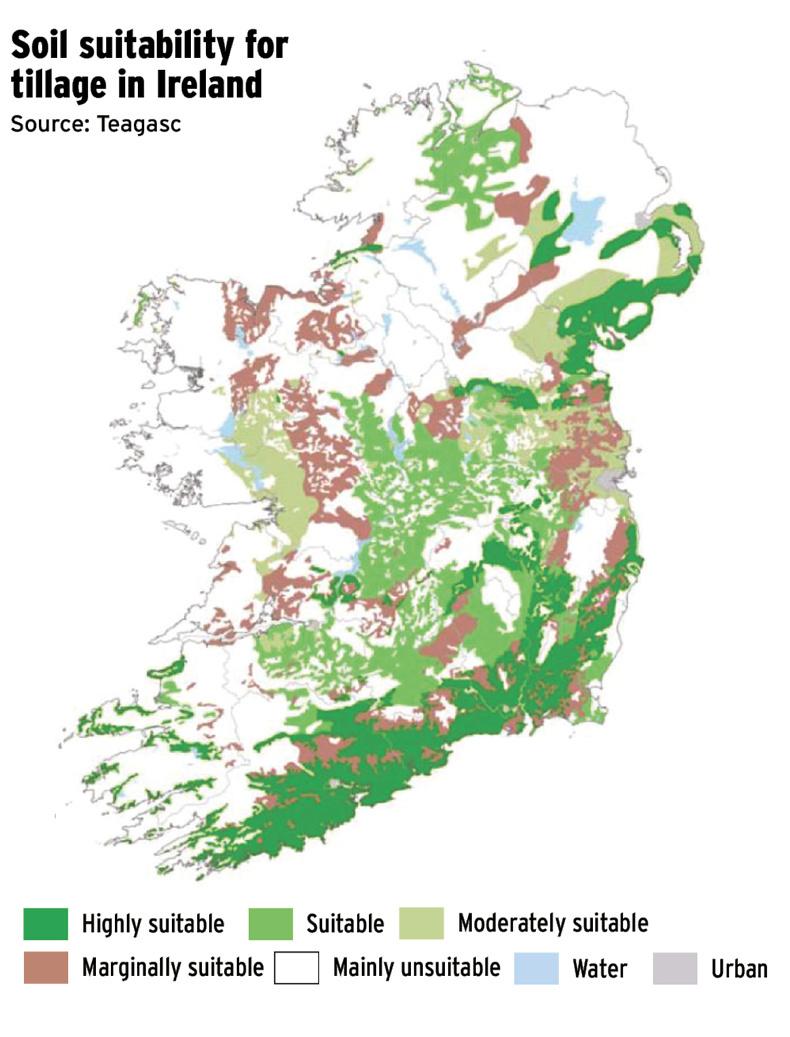

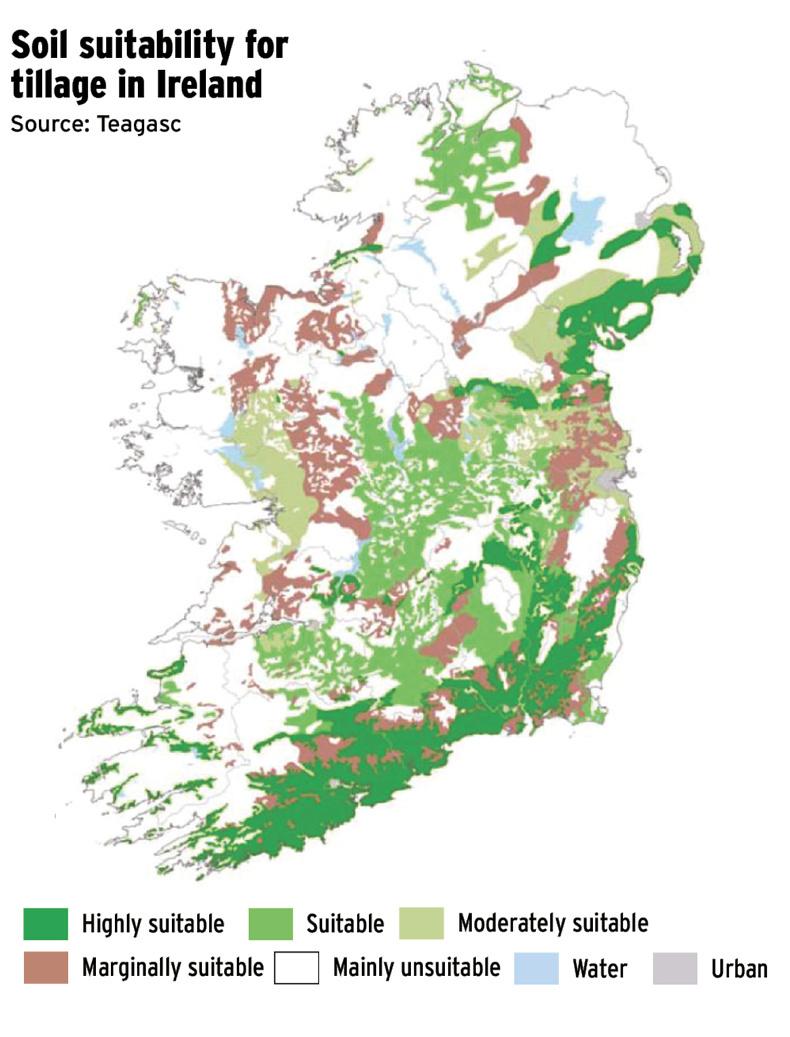

It also calls for policies “which encourage the use of as much suitable land for tillage as possible.”

However, given the competition for land from dairy farmers, it is difficult to see how such a policy would be introduced.

Covering a range of topics from GM to organics and from malting barley to Brexit, ultimately, the report boils down to three conclusions:

1 The CAP budget must be maintained and used in a targeted and effective manner.

2 A new tillage sector plan be developed to provide a roadmap until 2050.

3 That access to finance remain a priority. Access to finance will be essential in helping farmers diversify, mitigate risk, or increase efficiency.

Chair of the Oireachtas agriculture committee Pat Deering said he hopes the report will be used to further drive change in the sector.

“We’ve put lots of work and lots of time into this report. We like to think that it is the beginning of a conversation. The tillage sector is in a crisis and has been for a number of years so we felt we needed to start a conversation about what can be done to try to help the farmers there. It’s no silver bullet.

“The loss of the beet sector had a bigger impact on tillage than people would realise. It was a very serious loss to the wider industry. The problems in the tillage sector here, I feel, can be traced from the demise of the beet sector.”

Deering also thanked his committee and those who contributed to the report.

Sugar beet

Ireland’s beet industry has been left behind and can no longer compete on a European stage, according to the report.

While there are opportunities to develop niche aspects within the sector, there appears to be no large-scale commercial opportunities here.

“Other member states have established sugar industries which can more readily increase production to meet demand whereas Ireland no longer has a sugar processing industry,” the report states.

“In addition to this challenge, increased production in the EU will likely drive sugar prices downwards, leaving Ireland at a further competitive disadvantage.

The report points out that at present, the EU produces roughly 50% of the total global beet sugar production. However, only 20% of global sugar production comes from beet.

The Irish sugar beet industry was closed in 2006 by the company now called Greencore. Beet Ireland, led by Michael Hoey and Pat Cleary, has been trying for years to re-establish the industry but to no avail. Question remains whether the group can resurrect the sector and if it makes financial sense.

As part of its recommendations, the report states that due to the fact that the beet crop is now small in terms of hectares and used primarily as an animal feed, there is no industrial future for the sector.

“The Committee recommends that in the absence of a sugar processing industry in Ireland, consideration should be given to determining at least small-scale processing of sugar beet in Ireland to supply sugar beet molasses to Irish póitín producers.”

Malting

The difficulties of the malting sector have been well-publicised in recent times. Once the Rolls Royce crop of the sector, margins and profits have been continuously eroded.

The report states that at current returns, the future for malting growers is bleak. “Malting barley was reported to offer returns of about €50/t [per acre], which raises serious questions of the viability of malting barley growers in the long-term.”

It added that “the attainment of a higher price for cereal crops for the purpose of brewing or distilling is unlikely to grow unless Irish output can be meaningfully distinguished from imported produce”.

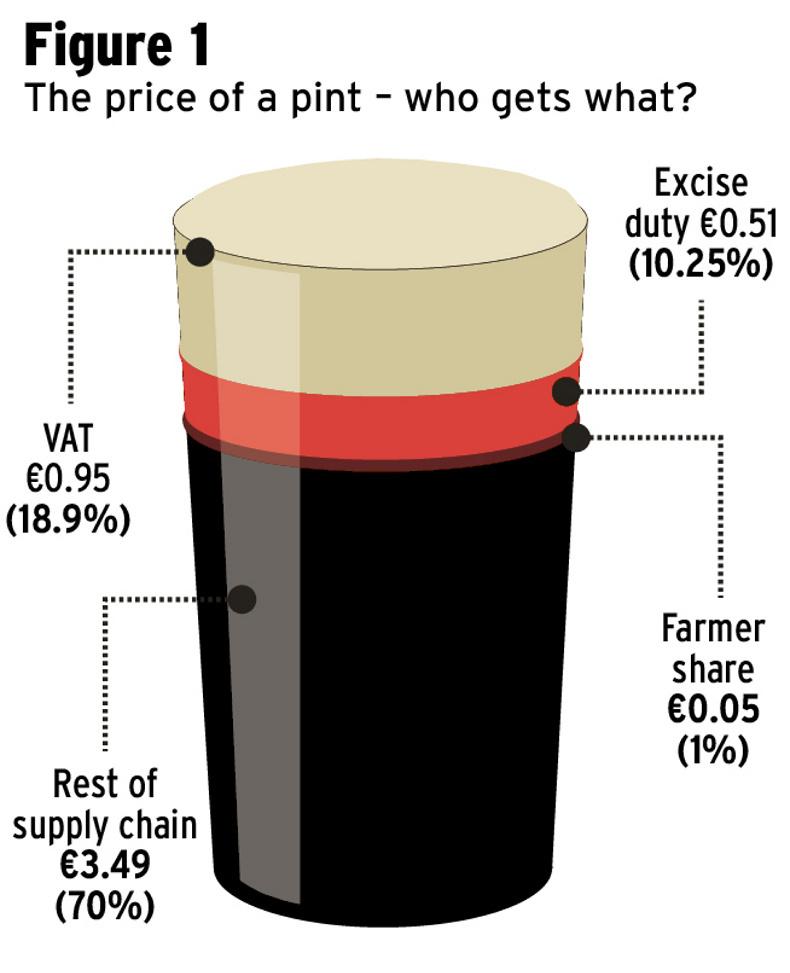

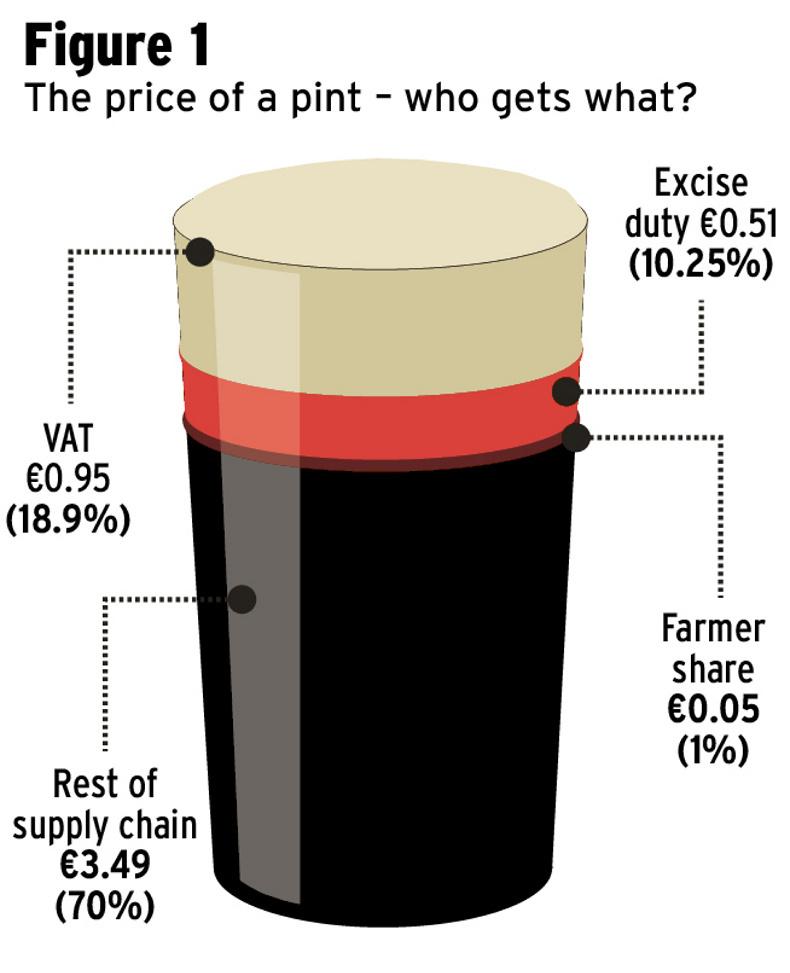

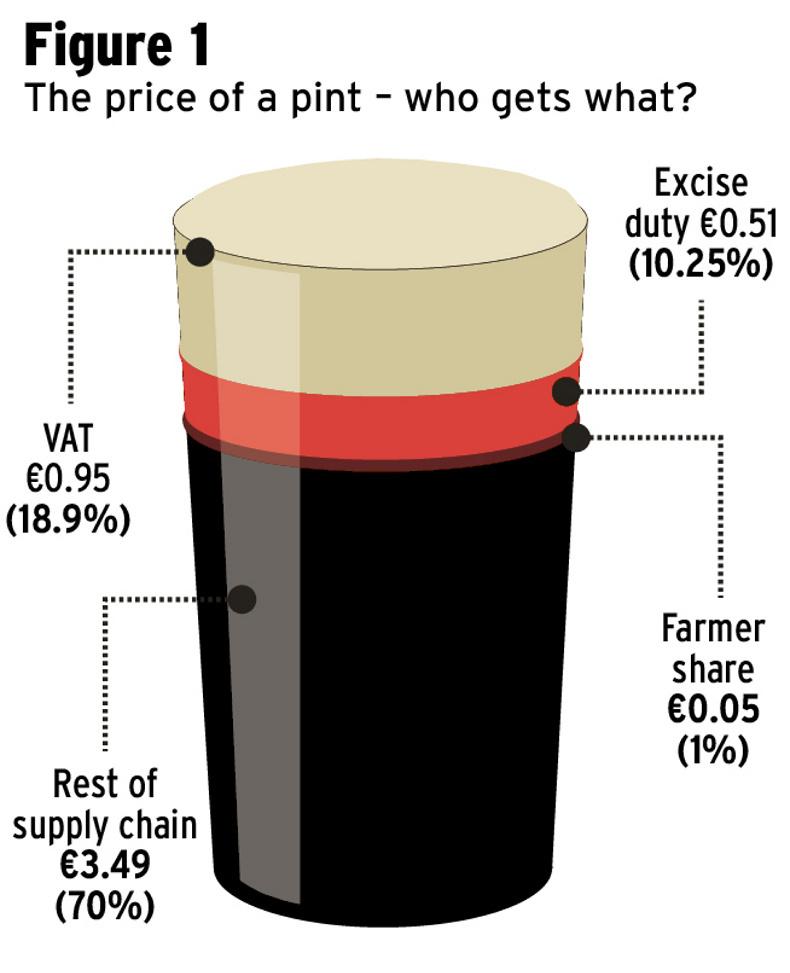

The work of the committee went further into this and looked at the farmer share from a €5 pint of Guinness where malt is a key ingredient. The reports says that the farmer receives just 1% or 0.05c from the price of a pint of Guinness.

To counteract uncertainty and volatility in the sector, the report recommends the need “to establish long-term contracts with brewers and distillers in Ireland. These contracts could provide long-term security to farmers who would be guaranteed an outlet for produce for several years. This would also allow these farmers to invest appropriately in their farms.”

Finally on malting, the report suggests a fair trade-style system leveraged by Bord Bia could result in a “payment of an additional cent per pint unit produced, [which] would be equivalent to a 20% price increase for the farmer.”

Organic

An organic tillage sector will never be large-scale but has the potential to deliver for those involved, the report surmises.

While rapid growth has occurred in the sector, it remains a minority offering.

“Organic tillage itself totalled just 2,280ha in 2016; however, this was a significant increase of 650ha (a 40% increase) on 2015,” according to the Irish Organic Farmers and Growers Association (IOFGA).

“Organic farming is thus beset by challenges and would appear to be unlikely to become the dominant method of farming in Ireland; rather, organic farming will provide a premium to producers for whom certain conditions are met.”

The committee’s report does say organic has a significant role to play in higher-value end products and boosting biodiversity “due to the non-use of pesticides and herbicides”.

Ultimately, the report calls for the creation of a new organic action plan for the tillage sector which would “determine the size of any potential market for organic produce” before further incentivising substantial increase in organic tillage farming.

Energy crops

The report goes through the options for energy generation from tillage land, whether by growing energy crops or converting it to solar farms.

If the existing 4,500ha of energy crops grew to 66,800ha, it would generate half of Ireland’s 2020 renewable energy targets. New potential markets are identified, such as aviation fuel from Irish-grown camelina. Yet the committee points out the lack of economic studies into the viability of these industries, which would be essential to attract farmers after previous failures to develop miscanthus, willow and oilseed rape oil supply chains.

Beyond their potential to generate renewable energy, the report also highlights the risk of converting tillage farms to livestock enterprises because of additional greenhouse gas emissions and associated financial penalties.

Genetically modified (GM) crops

The report addresses the contentious, and often polarising, topic of crop genetics and genetically modified (GM) crops.

It argues that GM can do more in terms of output and yield with fewer acres and fewer litres of water. It says that GM can play a key role in feeding an expanding global population.

The report is balanced on the polarising views on GM crops, but it would appear it is too advanced in thinking GM crops are readily available to be used in Ireland today.

In reality, GM technology is years away from being used in any sort of commercial way in Ireland.

“Scepticism of GMO is ingrained in the psyche of many consumers throughout the EU which has hampered uptake of the technology.

“This debate on GM must be science-based and must clearly and convincingly counter spurious arguments against it; whilst also recognising real concerns and the potential harm that GM could pose.”

The report does note that there are unproven health concerns regarding GM crops and says it “would be foolhardy to dismiss” these.

“The GM debate appears to have evolved in recent years; no longer focusing on the scientific merits of GM, rather, reservations are expressed largely on the grounds of ethics.”

Chair: Pat Deering – Fine GaelVice chair: Jackie Cahill – Fianna Fáil

TDs: Marcella Corcoran-Kennedy – Fine Gael; Martin Kenny – Sinn Féin; Charlie McConalogue – Fianna Fáil; Willie Penrose – Labour; Thomas Pringle – Independents for Change.Senators: Paul Daly – Fianna Fáil; Tim Lombard – Fine Gael; Pádraig MacLochlainn – Sinn Féin; Michelle Mulherin – Fine Gael.Who the committee heard from?

Between September and October 2017, the joint committee heard submissions from: The Irish Grain Growers, the Irish Farmers Association, Teagasc, Alcohol Beverage Federation of Ireland, Irish Organic Farmers’ and Growers’ Association, Science Foundation Ireland, Boortmalt NV and Minch Malt Ltd.

IFA: The Oireachtas committee “is not really getting to grips with how serious the problem is. I won’t say it’s too little too late, it’s a help but they need to roll up their sleeves and do something. They need to get this over to the Department of Agriculture and get the Minister to start making a few decisions. There are actually no policies coming out of Agriculture House.”Irish Grain Growers: “We welcome the launch of this report. While we need time to digest the report it comes as somewhat of a relief the recognition by political parties of the importance of a sustainable tillage sector. We feel it has been left rudderless for far too long.” IOFGA: It’s been needed for quite some time, especially with the growth in the sector and the increase specifically in livestock, but also the fact that we’re getting much more added-value products. We have a new organic regulation coming out in 2021. It is imperative that we have a self-sustained production system. Proposals lack bite

The joint Oireachtas committee’s report should be welcomed for what it is. A cross-party recognition that the Irish tillage sector has been under pressure for years with a less than favourable outlook for growers here.

However, the recommendations, admittedly aimed at starting a conversation that will hopefully lead to something more concrete being put in place in the shape of a tillage action plan, lack any great bite.

Also, the industry representation which appeared before the committee is quite narrow. Where statements regarding the viability of the beet sector are being made, then surely Michael Hoey, who has been campaigning for the resurrection of the sector, should have been consulted.

Similarly, larger farmers such as Kevin Nolan and the Whyte family as well as more vegetable farmers should have appeared before the committee.

The committee must be lauded for being brave enough to argue the merits of both organic and GM crops given how differing the views can be, but one misstep was proposing the reestablishment of the camelina crop for use in the transport sector. A group of farmers who tried to grow it five years ago and got stung would sooner forget about the crop.

There are undoubted missed opportunities around the area of import substitution and setting tangible targets. One target should be reducing the CAP contribution to a tillage farmer’s income from its current 85% to closer to 50% through proper strategy around value-added crops.

With Brexit on the horizon and a diminishing CAP budget to follow, the report’s recommendation that the CAP budget must be maintained could be viewed as a short-term approach.

Read more

Farmers get 1% of price of pint of Guinness

Tillage management: heavy rain should end any further planting plans

Grain prices largely static despite weaker futures

The future of the country’s tillage farmers continues to be under threat and there is no silver bullet to address fundamental questions regarding its viability.

However, if farmers are willing to diversify their operations and consider changing practices, then a future can be carved out.

These were the findings of a 97-page report produced by the joint Oireachtas committee on agriculture on Wednesday. The report is titled the Future of the Tillage Sector in Ireland.

Listen to committee chair, Pat Deering TD, in our podcast below:

Central to this, however, is the continuation of a well-funded CAP in a post-Brexit scenario as well as access to credit, establishing crop insurance and the renewal of the glyphosate licence.

Between September and October, the committee heard submissions from groups such as the IFA, the Irish Grain Growers and the IOFGA as well as industry stakeholders including Boortmalt, Teagasc and Science Foundation Ireland.

Despite enduring four years of downward pressure on prices, the report recognises the stature and significance of the sector.

“Tillage farming generates the second-highest income in Irish farming, after dairy, and also receives the largest direct payments …

“The prospects for the tillage sector in Ireland may be reasonably positive if the sector is managed appropriately in the coming years.

“Demand for tillage produce will increase in the coming decades; provided that extremes of weather do not become the norm, Irish tillage farmers may well find the coming decades particularly profitable.”

The report states there is the potential for all crops to significantly increase yields and hectares, but only if there is a market for them.

It also calls for policies “which encourage the use of as much suitable land for tillage as possible.”

However, given the competition for land from dairy farmers, it is difficult to see how such a policy would be introduced.

Covering a range of topics from GM to organics and from malting barley to Brexit, ultimately, the report boils down to three conclusions:

1 The CAP budget must be maintained and used in a targeted and effective manner.

2 A new tillage sector plan be developed to provide a roadmap until 2050.

3 That access to finance remain a priority. Access to finance will be essential in helping farmers diversify, mitigate risk, or increase efficiency.

Chair of the Oireachtas agriculture committee Pat Deering said he hopes the report will be used to further drive change in the sector.

“We’ve put lots of work and lots of time into this report. We like to think that it is the beginning of a conversation. The tillage sector is in a crisis and has been for a number of years so we felt we needed to start a conversation about what can be done to try to help the farmers there. It’s no silver bullet.

“The loss of the beet sector had a bigger impact on tillage than people would realise. It was a very serious loss to the wider industry. The problems in the tillage sector here, I feel, can be traced from the demise of the beet sector.”

Deering also thanked his committee and those who contributed to the report.

Sugar beet

Ireland’s beet industry has been left behind and can no longer compete on a European stage, according to the report.

While there are opportunities to develop niche aspects within the sector, there appears to be no large-scale commercial opportunities here.

“Other member states have established sugar industries which can more readily increase production to meet demand whereas Ireland no longer has a sugar processing industry,” the report states.

“In addition to this challenge, increased production in the EU will likely drive sugar prices downwards, leaving Ireland at a further competitive disadvantage.

The report points out that at present, the EU produces roughly 50% of the total global beet sugar production. However, only 20% of global sugar production comes from beet.

The Irish sugar beet industry was closed in 2006 by the company now called Greencore. Beet Ireland, led by Michael Hoey and Pat Cleary, has been trying for years to re-establish the industry but to no avail. Question remains whether the group can resurrect the sector and if it makes financial sense.

As part of its recommendations, the report states that due to the fact that the beet crop is now small in terms of hectares and used primarily as an animal feed, there is no industrial future for the sector.

“The Committee recommends that in the absence of a sugar processing industry in Ireland, consideration should be given to determining at least small-scale processing of sugar beet in Ireland to supply sugar beet molasses to Irish póitín producers.”

Malting

The difficulties of the malting sector have been well-publicised in recent times. Once the Rolls Royce crop of the sector, margins and profits have been continuously eroded.

The report states that at current returns, the future for malting growers is bleak. “Malting barley was reported to offer returns of about €50/t [per acre], which raises serious questions of the viability of malting barley growers in the long-term.”

It added that “the attainment of a higher price for cereal crops for the purpose of brewing or distilling is unlikely to grow unless Irish output can be meaningfully distinguished from imported produce”.

The work of the committee went further into this and looked at the farmer share from a €5 pint of Guinness where malt is a key ingredient. The reports says that the farmer receives just 1% or 0.05c from the price of a pint of Guinness.

To counteract uncertainty and volatility in the sector, the report recommends the need “to establish long-term contracts with brewers and distillers in Ireland. These contracts could provide long-term security to farmers who would be guaranteed an outlet for produce for several years. This would also allow these farmers to invest appropriately in their farms.”

Finally on malting, the report suggests a fair trade-style system leveraged by Bord Bia could result in a “payment of an additional cent per pint unit produced, [which] would be equivalent to a 20% price increase for the farmer.”

Organic

An organic tillage sector will never be large-scale but has the potential to deliver for those involved, the report surmises.

While rapid growth has occurred in the sector, it remains a minority offering.

“Organic tillage itself totalled just 2,280ha in 2016; however, this was a significant increase of 650ha (a 40% increase) on 2015,” according to the Irish Organic Farmers and Growers Association (IOFGA).

“Organic farming is thus beset by challenges and would appear to be unlikely to become the dominant method of farming in Ireland; rather, organic farming will provide a premium to producers for whom certain conditions are met.”

The committee’s report does say organic has a significant role to play in higher-value end products and boosting biodiversity “due to the non-use of pesticides and herbicides”.

Ultimately, the report calls for the creation of a new organic action plan for the tillage sector which would “determine the size of any potential market for organic produce” before further incentivising substantial increase in organic tillage farming.

Energy crops

The report goes through the options for energy generation from tillage land, whether by growing energy crops or converting it to solar farms.

If the existing 4,500ha of energy crops grew to 66,800ha, it would generate half of Ireland’s 2020 renewable energy targets. New potential markets are identified, such as aviation fuel from Irish-grown camelina. Yet the committee points out the lack of economic studies into the viability of these industries, which would be essential to attract farmers after previous failures to develop miscanthus, willow and oilseed rape oil supply chains.

Beyond their potential to generate renewable energy, the report also highlights the risk of converting tillage farms to livestock enterprises because of additional greenhouse gas emissions and associated financial penalties.

Genetically modified (GM) crops

The report addresses the contentious, and often polarising, topic of crop genetics and genetically modified (GM) crops.

It argues that GM can do more in terms of output and yield with fewer acres and fewer litres of water. It says that GM can play a key role in feeding an expanding global population.

The report is balanced on the polarising views on GM crops, but it would appear it is too advanced in thinking GM crops are readily available to be used in Ireland today.

In reality, GM technology is years away from being used in any sort of commercial way in Ireland.

“Scepticism of GMO is ingrained in the psyche of many consumers throughout the EU which has hampered uptake of the technology.

“This debate on GM must be science-based and must clearly and convincingly counter spurious arguments against it; whilst also recognising real concerns and the potential harm that GM could pose.”

The report does note that there are unproven health concerns regarding GM crops and says it “would be foolhardy to dismiss” these.

“The GM debate appears to have evolved in recent years; no longer focusing on the scientific merits of GM, rather, reservations are expressed largely on the grounds of ethics.”

Chair: Pat Deering – Fine GaelVice chair: Jackie Cahill – Fianna Fáil

TDs: Marcella Corcoran-Kennedy – Fine Gael; Martin Kenny – Sinn Féin; Charlie McConalogue – Fianna Fáil; Willie Penrose – Labour; Thomas Pringle – Independents for Change.Senators: Paul Daly – Fianna Fáil; Tim Lombard – Fine Gael; Pádraig MacLochlainn – Sinn Féin; Michelle Mulherin – Fine Gael.Who the committee heard from?

Between September and October 2017, the joint committee heard submissions from: The Irish Grain Growers, the Irish Farmers Association, Teagasc, Alcohol Beverage Federation of Ireland, Irish Organic Farmers’ and Growers’ Association, Science Foundation Ireland, Boortmalt NV and Minch Malt Ltd.

IFA: The Oireachtas committee “is not really getting to grips with how serious the problem is. I won’t say it’s too little too late, it’s a help but they need to roll up their sleeves and do something. They need to get this over to the Department of Agriculture and get the Minister to start making a few decisions. There are actually no policies coming out of Agriculture House.”Irish Grain Growers: “We welcome the launch of this report. While we need time to digest the report it comes as somewhat of a relief the recognition by political parties of the importance of a sustainable tillage sector. We feel it has been left rudderless for far too long.” IOFGA: It’s been needed for quite some time, especially with the growth in the sector and the increase specifically in livestock, but also the fact that we’re getting much more added-value products. We have a new organic regulation coming out in 2021. It is imperative that we have a self-sustained production system. Proposals lack bite

The joint Oireachtas committee’s report should be welcomed for what it is. A cross-party recognition that the Irish tillage sector has been under pressure for years with a less than favourable outlook for growers here.

However, the recommendations, admittedly aimed at starting a conversation that will hopefully lead to something more concrete being put in place in the shape of a tillage action plan, lack any great bite.

Also, the industry representation which appeared before the committee is quite narrow. Where statements regarding the viability of the beet sector are being made, then surely Michael Hoey, who has been campaigning for the resurrection of the sector, should have been consulted.

Similarly, larger farmers such as Kevin Nolan and the Whyte family as well as more vegetable farmers should have appeared before the committee.

The committee must be lauded for being brave enough to argue the merits of both organic and GM crops given how differing the views can be, but one misstep was proposing the reestablishment of the camelina crop for use in the transport sector. A group of farmers who tried to grow it five years ago and got stung would sooner forget about the crop.

There are undoubted missed opportunities around the area of import substitution and setting tangible targets. One target should be reducing the CAP contribution to a tillage farmer’s income from its current 85% to closer to 50% through proper strategy around value-added crops.

With Brexit on the horizon and a diminishing CAP budget to follow, the report’s recommendation that the CAP budget must be maintained could be viewed as a short-term approach.

Read more

Farmers get 1% of price of pint of Guinness

Tillage management: heavy rain should end any further planting plans

Grain prices largely static despite weaker futures

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: