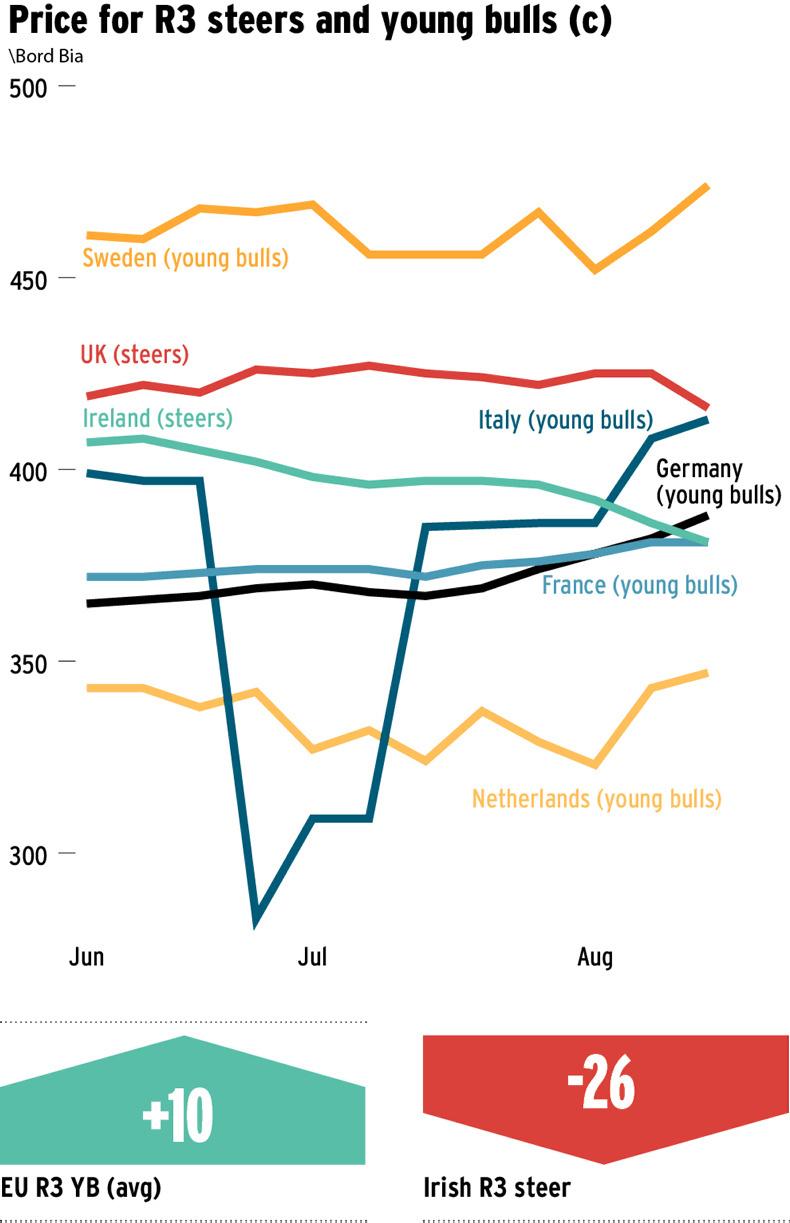

At the start of June this year, Irish farmgate prices had closed to within 12c/kg for R3 steers compared with the equivalent grade in Britain. This was the closest it had been for several years and at that point Irish cattle prices were the highest of all in our main eurozone markets, with just Swedish and British prices higher than Irish.

At the beginning of June, Irish prices were €4.07/kg for R3 steers compared with the equivalent of €4.19/kg being paid in Britain. Elsewhere in Europe at the beginning of June, R3 young bulls were making €3.72/kg in France, the largest market for Irish beef after the UK. However, by the middle of August, French prices had increased to €3.81/kg for R3 young bulls, while Irish prices had fallen by 26c/kg to €3.81/kg for R3 steers.

Prices in Italy and Germany have also been on the rise while Irish prices fell. In Italy, R3 young bulls were making €3.99/kg back in June but have increased by 14c/kg since to €4.13/kg. German prices for R3 young bulls have increased from €3.65/kg to €3.88/kg.

The Netherlands, which traditionally has weak farmgate beef prices but is an important market for Irish beef exports, was broadly stable over the summer, moving up from €4.43/kg in June to €3.47/kg in the middle of August.

Outside the EU, prices have fallen in the US and Australia. American prices were the equivalent of €4.25/kg in June but have since fallen by 81c/kg to €3.44/kg. In Australia, prices fell by the equivalent of 32c/kg from €3.54/kg to €3.22/kg. In Brazil, prices have been stable, increasing by the equivalent 2c/kg from €2.16/kg to €2.18/kg.

Outside Britain and Ireland, most beef produced is presented as young bulls and this is the figure used for comparison. Irish steer prices were running close to 110% of the EU average when compared with R3 young bulls in June, but this figure is now back to 1c/kg less than the EU average. With young bulls having an extra 15% growth potential, their price advantage over Irish steers is now even more dramatic. Comparing Irish R3 steer prices with the EU steer only average, Ireland was within 2c/kg of this at the beginning of June but this gap had widened to 12c/kg by the middle of August, leaving Irish R3 steers at 95.7% of the EU average.

In the 12-week period between June and August, Irish R3 steers lost 26c/kg of value at a time when prices increased in our five main eurozone markets. While prices fell in the UK over the same period, it was by just the equivalent of 3c/kg to €4.16/kg which was 35c/kg more than for the equivalent animal in Ireland and almost three times the difference of 12c/kg back at the beginning of June.

Factories have complained about the difficulty the weakening of sterling has caused in doing business with the UK. Over the period from 4 June to 19 August, sterling weakened from a euro being worth 87.5p to being worth 91.1p.

We don’t know to what extent this 4% swing in currency contributed to the almost threefold increase in the price gap between Irish and British steers. However, compared with the main eurozone countries Irish beef is exported to, prices have increased between 4c/kg and 23c/kg during the time ours fell by 26c/kg.

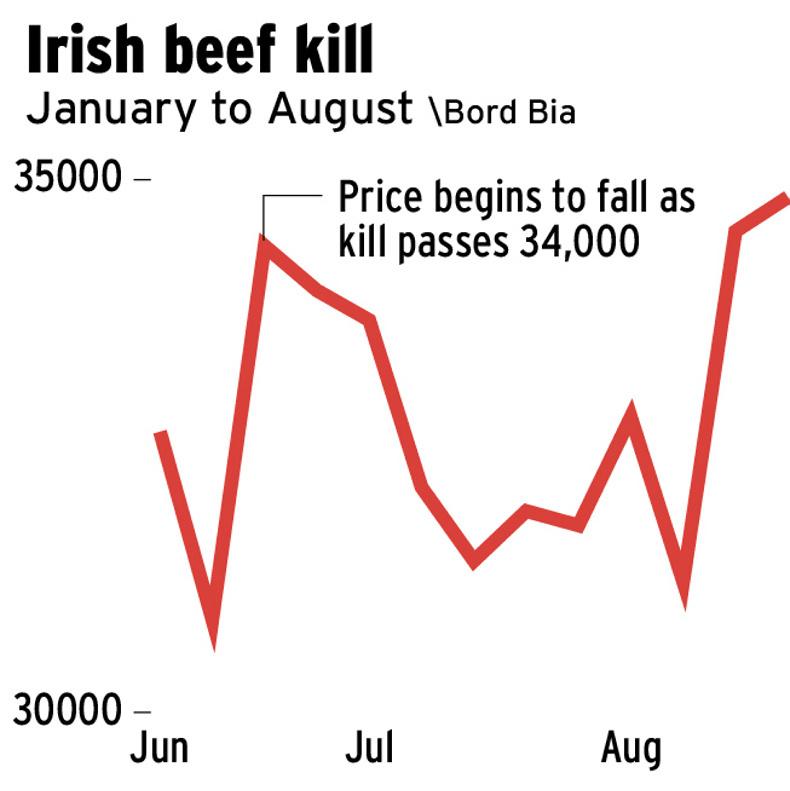

Based on these Bord Bia figures, it is clear that when Irish factories are faced by any flush of cattle this time of year, farmgate prices take the hit.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: