A 70,000t beef quota offer has been on the table for a few weeks now and there are fears that this offer will be increased further in an attempt to secure a deal at the WTO ministerial conference which is being held in Buenos Aires starting on 11 December. The Mercosur countries, particularly Brazil, were thought to be unimpressed with a 70,000t offer and are looking for at least twice that, but so far the EU has stood firm with the 70,000t offer.

Before that, a further round of negotiations between the EU and Mercosur are scheduled to start in Brussels on 29 November, but so far there has been no indication that the present EU offer will be increased. Opposition to the original offer was led by Ireland and France with the full support of 11 member states in total, not enough for a blocking minority. European Commission president Jean-Claude Juncker has been extensively lobbied against making any further beef offer.

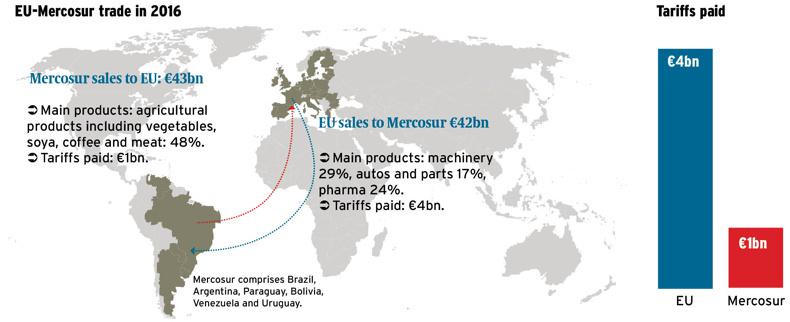

The trade wing of the European Commission, which has the negotiating mandate are aggressively pursuing trade deals and with the conclusion of CETA and political agreement secured with Japan, Mercosur is the next target. It is an attractive proposition in the widest sense of trade (see map) but is a nightmare for beef- and sugar-producing farmers in particular.

The decision by the EU to end production quotas in September follows that taken with the dairy sector in 2015. Increased sugar production in the EU is predicted following the end of quotas and that sector correctly identify that now is not the time to increase access to the EU sugar market from outside.

The beef sector has employed a similar argument. EU consumption has been shrinking for the past decade and greater vulnerability is felt by EU beef producers following the Brexit decision, which has the potential to remove the UK as a major beef market from the EU. There is the further twist in Brexit negotiations that allocate existing import quotas for the EU 28 to the EU 27, plus the UK. The idea took shape that these would be allocated pro rata depending on who used them.

WTO angle

However, this has run into a problem. A number of countries including Brazil and Argentina from Mercosur have objected to this at WTO arguing that having a quota spread between the EU 27 and the UK isn’t as attractive as having a single quota spread over the original EU 28. They are looking for additional quota access, in theory the same level of access to the EU 27 as previously to the EU 28. This has the potential to increase market access for the sensitive sectors further. It very much needs to be borne in mind in any trade negotiations that gives access to agricultural produce.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: