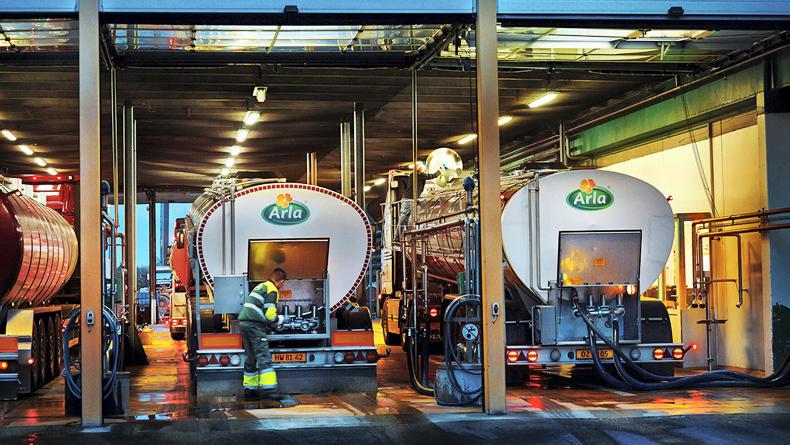

Arla Foods has announced a 1c/l increase in August for its 12,700 suppliers stretching from Sweden to the UK. Johnnie Russell, director of the co-op’s UK branch Arla Foods amba, said this would translate into a 0.81p/l increase for British farmers to 29.98p/l.

““The current market situation is characterised by strong demand and low stocks of fat and this is driving up prices for products containing fat,” Russell said. “Meanwhile, the protein market remains stable, however at a low level.”

Müller, another continental co-op collecting in the UK, said would raise its British price by 1.5p/l in August.

Three months of increases for Lactalis

In France, Lactalis, the world’s third largest milk processor, has announced a series of 1c/l monthly rises for the 5.6bn litres it collects annually in its home country. This will take the price to 34c/l in July, 35c/l in August and 36c/l in September at 4.1% fat and 3.3% protein.

“This evolution was expected by milk suppliers following the real difficulties of 2016 and must be matched by an increase in the price of our products,” said Lactalis group managing director Daniel Jaouen, hinting at tension on dairy prices across the supply chain from farmers to retailers in recent weeks. He added the new price was negotiated with producers’ organisations.

Read more

Milk price fell globally in 2016

Arla Foods has announced a 1c/l increase in August for its 12,700 suppliers stretching from Sweden to the UK. Johnnie Russell, director of the co-op’s UK branch Arla Foods amba, said this would translate into a 0.81p/l increase for British farmers to 29.98p/l.

““The current market situation is characterised by strong demand and low stocks of fat and this is driving up prices for products containing fat,” Russell said. “Meanwhile, the protein market remains stable, however at a low level.”

Müller, another continental co-op collecting in the UK, said would raise its British price by 1.5p/l in August.

Three months of increases for Lactalis

In France, Lactalis, the world’s third largest milk processor, has announced a series of 1c/l monthly rises for the 5.6bn litres it collects annually in its home country. This will take the price to 34c/l in July, 35c/l in August and 36c/l in September at 4.1% fat and 3.3% protein.

“This evolution was expected by milk suppliers following the real difficulties of 2016 and must be matched by an increase in the price of our products,” said Lactalis group managing director Daniel Jaouen, hinting at tension on dairy prices across the supply chain from farmers to retailers in recent weeks. He added the new price was negotiated with producers’ organisations.

Read more

Milk price fell globally in 2016

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: