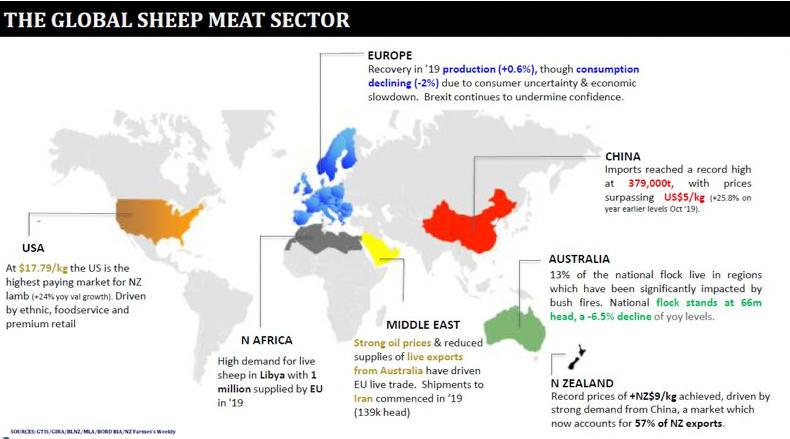

African swine fever (ASF) in the Chinese pig herd has had a massive influence on the global meat trade in 2019.

On the sheep front, it underpinned sheepmeat imports into China reaching a new record of 379,000t, with increased demand also driving average prices above US$5/kg or the equivalent of €4.50/kg.

Global sheep sector hightlights presented at the Bord Bia Meat Market Seminar.

This was one of several global sheepmeat highlights presented by sheep sector manager Declan Fennel at Bord Bia’s Meat Market Seminar on Friday.

New opportunities

Fennell said that China is still regarded as a high-volume, low-value market, but pointed out that ASF is developing new opportunities for higher-value cuts.

The Chinese market accounted for some 57% of New Zealand exports in 2019, with increased demand also setting record prices of NZ$9/kg or €5.37/kg.

The fact that the availability of sheepmeat for export continues to tighten and more is being directed to China is reducing volumes destined for EU markets.

Declan presented provisional data which shows New Zealand filling just 49.9% of its tariff-free EU quota of 228,389t.

New ground

The US is also setting new ground in terms of sheepmeat prices. At an average of NZ$17.79/kg (€10.62/kg), the US has overtaken the EU as the highest-paying market for New Zealand sheepmeat.

Declan Fennell, sheep sector manager, meat division, Bord Bia. Picture Colm Mahady / Fennells

Declan said that this is being driven by the US increasing in importance as a destination for high-value cuts within food service and premium retail, while ethnic demand is also bolstering prices paid.

Sheep prices in Australia also reached record levels in 2019, with three successive years of drought reducing flock numbers in some areas and curtailing recovery in the national flock.

The current bushfires are also likely to have a devastating effect on the sheep flock, with a recent report issued by Meat and Livestock Australia showing 13% of the national flock (8.6m head) located in regions where wildfires are raging.

Tighter availability of sheep for live export from Australia to Middle Eastern markets has developed market opportunities for increased live exports from the EU

The tighter supplies in Australia and greater volumes being redirected to the US and Chinese markets are reducing export volumes to traditional Australian markets.

Tighter availability of sheep for live export from Australia to Middle Eastern markets has developed market opportunities for increased live exports from the EU.

Increased oil prices have also strengthened the purchasing power of Middle Eastern nations. Saudi Arabia and Iran have been two particularly strong markets, with live exports to Iran commencing in 2019 and reaching a significant figure of 139,000 head.

Live exports from the EU to north African markets also performed excellently after a slow start to 2019. Exports to Libya are estimated to have increased to almost 1m sheep, with Spain a major benefactor of the increased demand.

Lower volumes

The EU has also benefited from lower volumes of Spanish lamb, with the EU market subdued for much of 2019 and not helped by low temperatures and wet conditions in May, followed by extreme temperatures in June and July.

Declan also highlighted that uncertainty in the UK due to Brexit and higher volumes being pushed on to the EU market at lower prices interfered with normal trading patterns and had a negative influence on the trade.

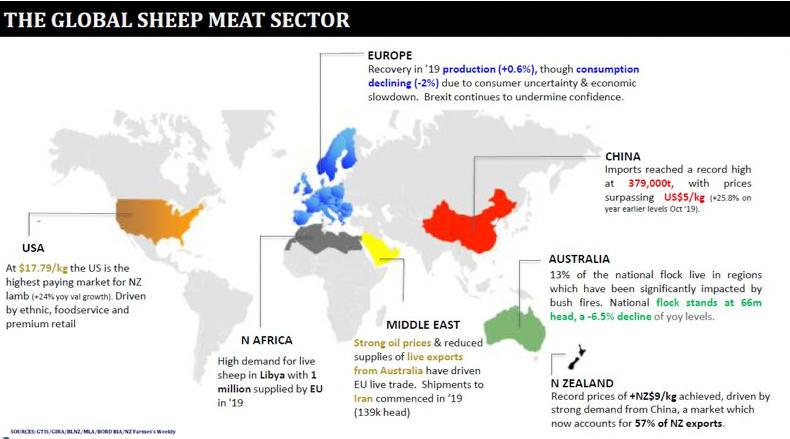

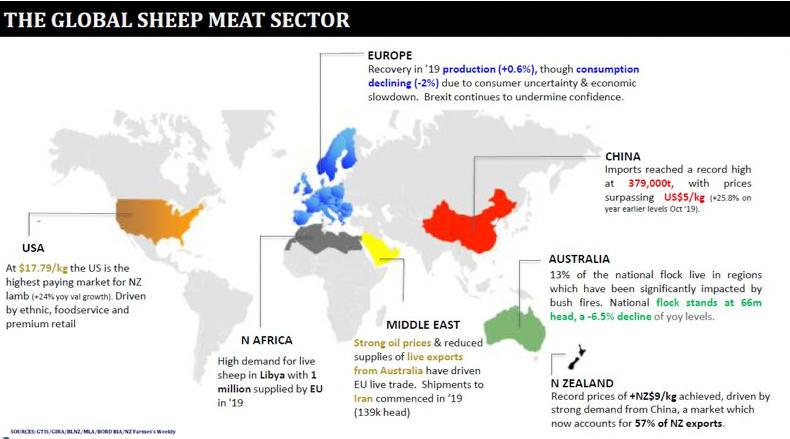

African swine fever (ASF) in the Chinese pig herd has had a massive influence on the global meat trade in 2019.

On the sheep front, it underpinned sheepmeat imports into China reaching a new record of 379,000t, with increased demand also driving average prices above US$5/kg or the equivalent of €4.50/kg.

Global sheep sector hightlights presented at the Bord Bia Meat Market Seminar.

This was one of several global sheepmeat highlights presented by sheep sector manager Declan Fennel at Bord Bia’s Meat Market Seminar on Friday.

New opportunities

Fennell said that China is still regarded as a high-volume, low-value market, but pointed out that ASF is developing new opportunities for higher-value cuts.

The Chinese market accounted for some 57% of New Zealand exports in 2019, with increased demand also setting record prices of NZ$9/kg or €5.37/kg.

The fact that the availability of sheepmeat for export continues to tighten and more is being directed to China is reducing volumes destined for EU markets.

Declan presented provisional data which shows New Zealand filling just 49.9% of its tariff-free EU quota of 228,389t.

New ground

The US is also setting new ground in terms of sheepmeat prices. At an average of NZ$17.79/kg (€10.62/kg), the US has overtaken the EU as the highest-paying market for New Zealand sheepmeat.

Declan Fennell, sheep sector manager, meat division, Bord Bia. Picture Colm Mahady / Fennells

Declan said that this is being driven by the US increasing in importance as a destination for high-value cuts within food service and premium retail, while ethnic demand is also bolstering prices paid.

Sheep prices in Australia also reached record levels in 2019, with three successive years of drought reducing flock numbers in some areas and curtailing recovery in the national flock.

The current bushfires are also likely to have a devastating effect on the sheep flock, with a recent report issued by Meat and Livestock Australia showing 13% of the national flock (8.6m head) located in regions where wildfires are raging.

Tighter availability of sheep for live export from Australia to Middle Eastern markets has developed market opportunities for increased live exports from the EU

The tighter supplies in Australia and greater volumes being redirected to the US and Chinese markets are reducing export volumes to traditional Australian markets.

Tighter availability of sheep for live export from Australia to Middle Eastern markets has developed market opportunities for increased live exports from the EU.

Increased oil prices have also strengthened the purchasing power of Middle Eastern nations. Saudi Arabia and Iran have been two particularly strong markets, with live exports to Iran commencing in 2019 and reaching a significant figure of 139,000 head.

Live exports from the EU to north African markets also performed excellently after a slow start to 2019. Exports to Libya are estimated to have increased to almost 1m sheep, with Spain a major benefactor of the increased demand.

Lower volumes

The EU has also benefited from lower volumes of Spanish lamb, with the EU market subdued for much of 2019 and not helped by low temperatures and wet conditions in May, followed by extreme temperatures in June and July.

Declan also highlighted that uncertainty in the UK due to Brexit and higher volumes being pushed on to the EU market at lower prices interfered with normal trading patterns and had a negative influence on the trade.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: