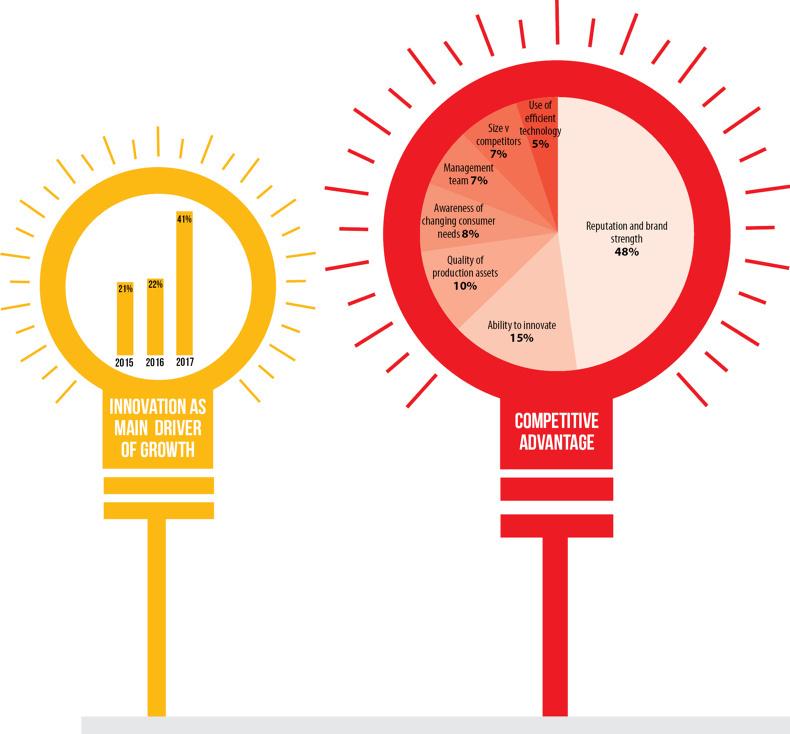

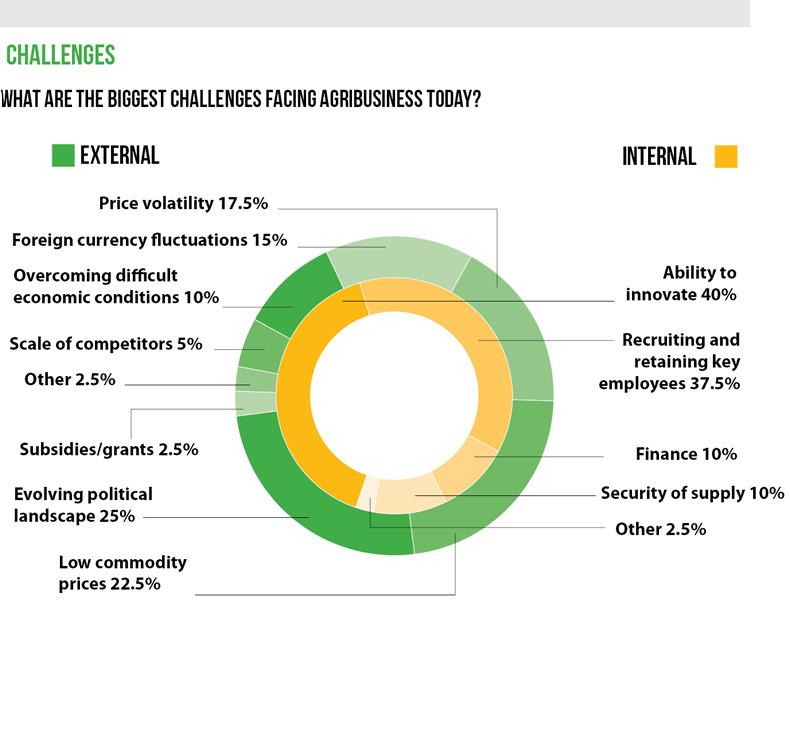

The 2018 Irish Farmers Journal/KPMG Agribusiness global survey focuses on innovation and compares the results to the last three years. Globally, innovation was seen as the most important factor in driving future business growth. Forty-one per cent of respondents say innovation is the most important factor driving the future growth of their business. This is up from 22% in 2016 and 21% in 2015. However, 40% of respondents cite innovation as the most significant challenge facing their businesses in the coming years – up from 24% in 2016 and 20% in 2015.

R&D seen as key to the business

With regards to R&D, 95% of respondents say it is important to their business. This is up from 78% in 2016 and 82% in 2015.

Sixty-three per cent of respondents say it is very important to their business. This is up from 34% last year and compares with 42% in 2015.

More being spent on R&D

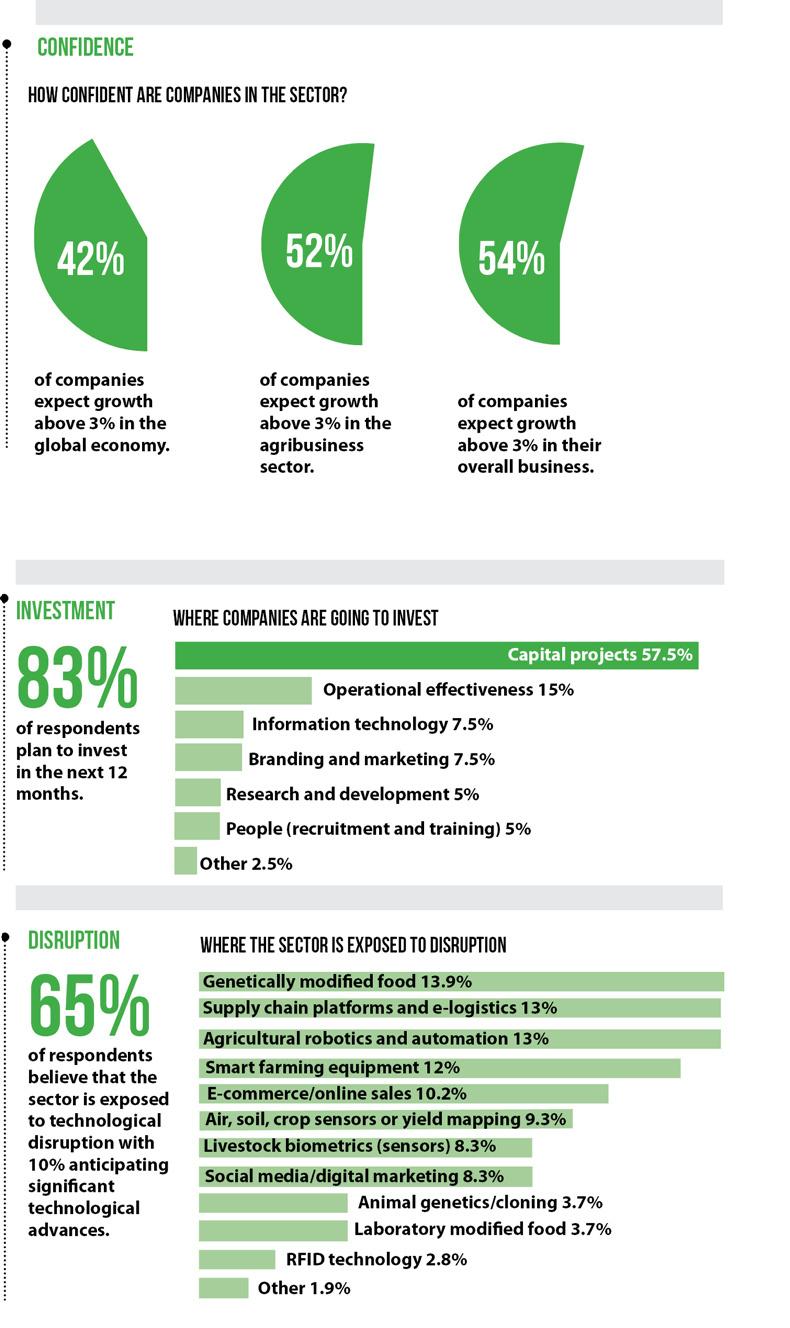

Spend on R&D as a percentage of turnover has increased over the last three years from less than 30% of companies spending between 2% and 4% of turnover on R&D to over 47% in 2017. Meanwhile, those spending less than 1% has fallen from 61% to less than 33%. The majority of respondents (48%) plan on spending between 2% and 4% of turnover on R&D this year. That is an increase on 2016, when 32% said they would spend this percentage. It is also up on 2015, when 29% said they would spend this amount.

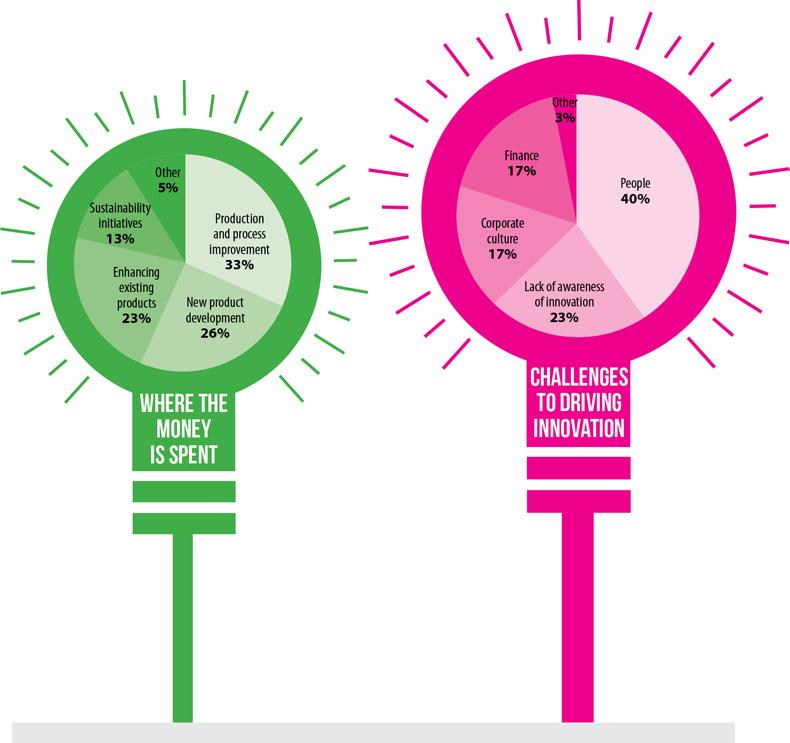

Most R&D spending is in process improvement

The majority of spending on R&D has been on production and process improvement for the last three years. Approximately one-third of all R&D is in this area and is pretty stable over the last number of years at around 33%. New product development accounts for around one-quarter of all spend on R&D. Spend on sustainability is also stable at around 13%, with the balance being spent on enhancing existing products.

People are the greatest challenge to driving innovation

Forty per cent of respondents identified people as the biggest challenge in driving innovation.

This is consistent over the last three years. Finance was the second biggest challenge in 2015, but this has fallen to fourth position this year. A lack of awareness of innovation is seen as the second major challenge and identified by 23% of respondents. The third largest challenge to driving innovation centres on corporate culture.

Ability to innovate seen as a competitive advantage

In 2017, companies identified their ability to innovate as the second most important competitive advantage after reputation and brand. Over the last three years, respondents have increasingly identified the ability to innovate as a key competitive advantage. It has moved from fourth position to second, overtaking scale and integration, which have fallen to sixth and seventh position, respectively.

Governments could do more to support innovation

Overall, 36% of respondents feel that government could do more to support R&D innovation. As few as 28% of respondents felt the support was satisfactory.

Methodology

The research for the survey was conducted by KPMG and was based on a representative sample of agribusinesses in the main agri-producing regions of the world.

The survey, which consisted of 33 questions across a range of agribusiness-related topics was sent to the senior management of a wide cross-section of businesses with the sector. All quotes used throughout the survey were submitted by respondents.

The survey was made available to respondents in hard copy and was also available electronically.

We would like to thank all the respondents for taking the time to complete the agribusiness survey and we hope you find our results informative and insightful. We welcome any feedback and suggestions that you feel could improve our 2019 Agribusiness survey.

“Government should allow competition on the railway in terms of private locomotives (and trains in general). Monopoly in railway transport increases costs and slows down the supply chain from field to port.”

“Due to our geographic location we are unable to receive or be considered for capital grants. The most serious challenges are emerging in the form of Brexit. In light of this, the state aid rules constraints need to be reviewed.”

“More grants to support capital investment.”

“Prioritise market access.”

“Lowering port import costs. Ports are effectively Government monopolies that charge whatever they need to recover costs. This does not encourage efficiency and therefore adds cost to the production chain.”

“Continuous development and promotion of training and education programmes at third level, ensuring a strong talent pool with world-class skills remains available to the sector.”

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: