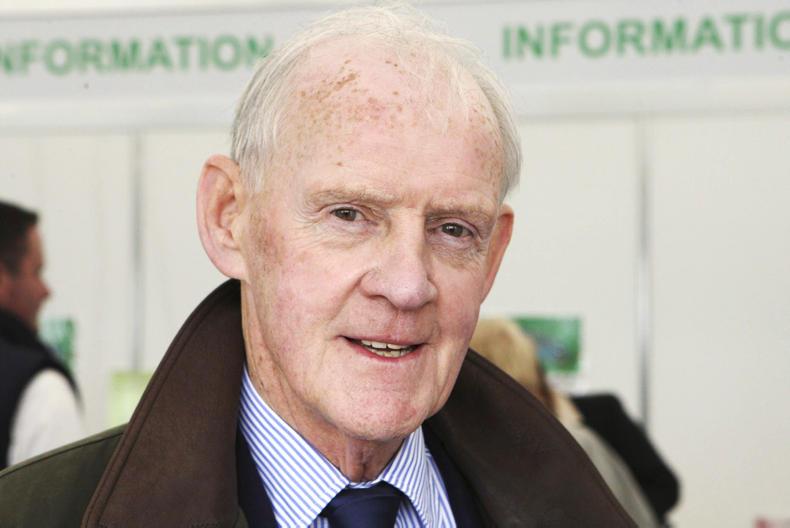

Pressure within the sector has undoubtedly concentrated minds within Lakeland Dairies and Fane Valley to co-operate in dairy processing, although Fane Valley chief executive Trevor Lockhart says that the joint venture approach has been under consideration since long before milk prices crashed.

It’s widely reckoned that dairy processors in Northern Ireland have been under-writing milk prices paid to producers as prices for milk powders have continued to fall. Some have been drawing on other resources to support their milk prices and some have sustained considerable losses doing so. The volatile cycle of the global market for dairy products has come round to a very low point.

For Fane Valley Dairies, this has followed on from a period of more than 18 months when it was riding the crest of a wave and paying top of the league ex-farm milk prices. That enabled it to build up a direct supply milk pool of close to 250m litres from zero in April 2012 (prior to which Fane Valley purchased its ex-farm milk through United Dairy Farmers).

Milk pool

Much of the milk pool came from former suppliers to United and to Town of Monaghan Co-op in the Banbridge area.

While dairy farmers have benefitted in the short term from higher milk prices as processors in the North battled to attract suppliers, the ultimate result could have been the loss of another processing business – as has occurred with several dairies in NI since deregulation of milk marketing in 1995. Ironically, in his position as vice chair of the processors organisation, Dairy UK, Lockhart mentioned that possibility to the emergency meeting of the NI Assembly Agriculture Committee last week in evidence about the current crisis in the dairy sector.

Now the decision of Lakeland Dairies and Fane Valley to bring these two milk processing businesses together will put the two co-operative societies in a stronger position.

However, with Glanbia Cheese, Glanbia Ingredients Ireland, Aurivo, Strathroy, United Dairy Farmers/Dale Farm and the newly formed LacPatrick Co-op all seeking year-round supplies of quality milk, the competition hasn’t disappeared. More likely there will be continuing pressure for further consolidation of dairy businesses.

The challenge now will be for the management of Lakeland Dairies to make the joint venture sustainable.

With Fane Valley Feeds and other NI-based compounders having grown sales of feed south of the border, there has been competitive pressure there also on Lakeland Feeds. The JV with Lakeland on the feed and stores businesses will remove an element of competition but also potentially make some savings within the overall business, through scale of raw material buying power and greater efficiency of deliveries.

If Fane Valley management can repeat their Northern success south of the border in building the stores business, this agribusiness JV could be very positive for the group. The concept of co-operatives co-operating looks like a better bet for Fane Valley than continuing as a relatively small producer of milk powder and butter. As shareholders in the second-largest dairy in Ireland, the two co-ops share the prospect of greater sustainability, as befits businesses that have been around for over 100 years.

Fane Valley Dairies: Armaghdown Creameries Ltd

The business of Fane Valley Dairies is incorporated in Armaghdown Creameries Ltd, which has been a major profit generator for Fane Valley for decades. However, the most recent published accounts indicate a loss of £1.13m on record turnover of £106.3m during the year to 30 September 2014. This loss was after an exceptional write-down of £1.67m in the value of stock items at the year end, with notes to the accounts indicating that “milk powder sales fell dramatically” in the fourth quarter.

The previous year showed a more normal post-tax profit of £0.72m on sales of £92m. Gross profit margin in 2014 dropped to 0.6% (from 2.7% in 2013). The business has no borrowings, with the accounts indicating interest receivable of £53,000 against interest payable of £16,000.

Fane Valley Group

Fane Valley Group accounts for the year ended 30 September 2014 reported a pre-tax profit of £6.8m (down by £1.9m) on group turnover of £553m (up by 4%). The turnover includes sales of £336m within the Linden Food Group (including its share of the Slaney Foods joint venture).

Fane Valley’s net asset position as stated in the accounts strengthened by 5% to £73.6m and net debt fell by 9% to around £46m at year end. A new head office, warehousing and distribution centre was acquired near Moira in July 2014.

Tonnage sold by Fane Valley Feeds was up by 4% but revenues dropped by 6% due to lower prices, linked to lower costs of raw materials.

Lakeland Dairies Co-op

Lakeland Dairies Co-op reported a 15% increase in turnover to €625.8m (£491m) and operating profit up by 10% to €12.9m (£10m) during the year to 31 December 2014. Profit before tax rose by 5% to €10.9m (£8.6m). It closed the year with shareholders’ funds of €90.5m (£71m).

The construction of Lakeland’s new global logistics centre at Newtownards was completed during 2014, an investment of €10m (£8m).

Ice cream and UHT dairy manufacturing facilities at Killeshandra were upgraded and the new investment continues. This will increase the potential milk powder production there to 130,000t annually, from the current 90,000t. The Bailieboro site also produces 24,000t of butter and butter products.

SHARING OPTIONS