Despite reporting a 40% increase in its third-quarter operating profit to $568m, US-based meat and poultry processor Tyson Foods has cut its full-year earnings guidance to between $3.10 and $3.20 a share, below its previous forecast for earnings of $3.30 to $3.40.

Tyson, one of the largest beef packers in the US, processing more than 130,000 head of cattle per week, cited the challenging market conditions currently faced by its beef division as the reason for the downgrade in the company’s earnings guidance. Beef is Tyson’s biggest division, accounting for 42% of group sales in 2014.

For its third quarter, Tyson’s beef division recorded an operating loss of $7m compared with an operating profit of $101m for the same period last year. The company blamed the loss on the high cost of cattle, weak exports as a result of the strengthening US dollar and competition from cheaper proteins. As a result, the company warned that its beef division should be “near break-even” for the full financial year. Tyson added that the weakness of exports alone had shaved $84m off its third-quarter results.

Other divisions

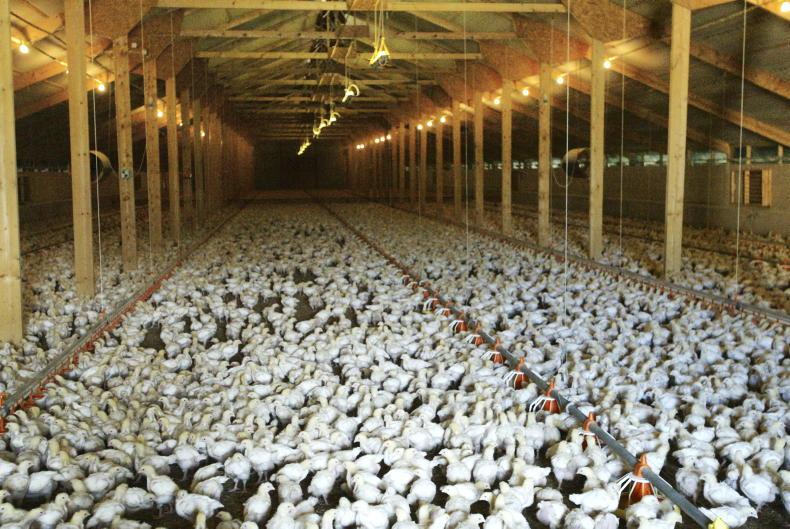

Tyson’s other divisions performed better over the quarter, with its poultry division recording an increase in operating profit of more than 60% to $313m. The group’s prepared foods division returned an operating profit if $197m, having made a $1m loss for the same period last year. However, operating profits in Tyson’s pork division halved to $64m, with tight margins and weak exports blamed.

Overall, the group reported a 4% increase in sales to $10.1bn, while net profit for the quarter increased by almost a third to $343m, or 83c a share. However, this failed to meet analyst forecasts of 93c a share and resulted in Tyson’s share price falling by almost 10% to $39.96 at close of business yesterday.

SHARING OPTIONS