Recent growth in Irish sheepmeat performance has been replicated in 2016. Sheep throughput increased by 3% to 2.67m head and provided the platform for a further 3% increase in export volumes, with the total volume of sheepmeat exported rising 1,470t to 49,000t.

Speaking at last Friday’s Bord Bia meat market seminar, Declan Fennell said this increase in export volumes translated to export values increasing 4% to €240m. There was also a 49% increase in live exports, which reached 48,000 head in 2016.

Challenging environment

Declan described the sheep sector’s performance as solid in light of 2016 presenting a challenging global environment to trade in, with average prices easing 1c/kg to €4.83/kg.

He highlighted five key areas as having the greatest influence with currency movements, oil prices, religious/cultural festivals, Brexit and fifth-quarter pressure all leaving their own mark in 2016. While all of these aspects influenced the trade in 2016, they will also have a big bearing on trade prospects for 2017.

Currency movements

Huge shifts in the value of sterling to euro was the currency fluctuation pertaining most to sheep trading. A weakening in the value of sterling to euro increased the competitiveness of British exports in key European markets from late September/early October onwards. This couldn’t have occurred at a worse time as it coincided with an increase in British throughput and left Irish exports in a weaker negotiating position.

The reduction in the value of sterling also reduced the competitiveness of New Zealand exports and direct returns for product exported.

As a result, New Zealand is now placing more emphasis on alternative markets and it will be interesting to see if it affects volumes of lamb exported to the UK in the first quarter of 2017, the peak exporting period to Britain and the EU for new-season New Zealand lamb.

Oil prices

The upshot of low oil prices is reduced fuel prices. However, there is a negative for exports to Middle Eastern nations where the economy is built on oil production.

Declan explains that it is customary practice for governments in these oil-rich states to provide a subsidy to its citizens for purchasing products for important religious festivals. These subsidies were reduced or removed in some Middle East markets in 2016, leading to reduced consumer spending, with the Ramadan festival particularly hit.

Religious/cultural festivals

While there was reduced consumer spending in some Middle East nations around religious festivals, they remain a vital outlet that have the ability to significantly boost markets.

Ramadan has disappointed in recent years, with consumption lowered due to the festival now falling (moves forward two weeks each year) at a period when there is only a few hours of darkness (tradition to fast during daylight hours).

Eid al-Adha has become a much more important festival in recent years, with sheep throughput at Irish processing plants exceeding 70,000 in the week leading up to the festival, while live exports hit a three-year high of 48,036 head, with most occurring in August in advance of the festival.

Brexit

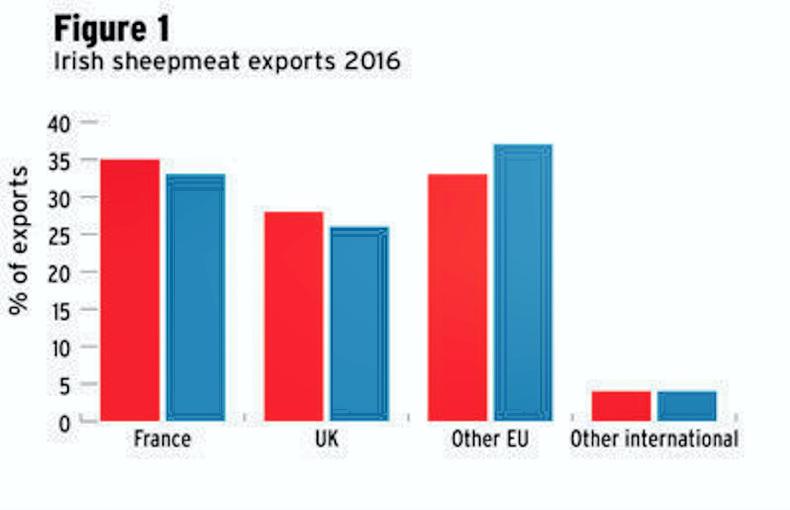

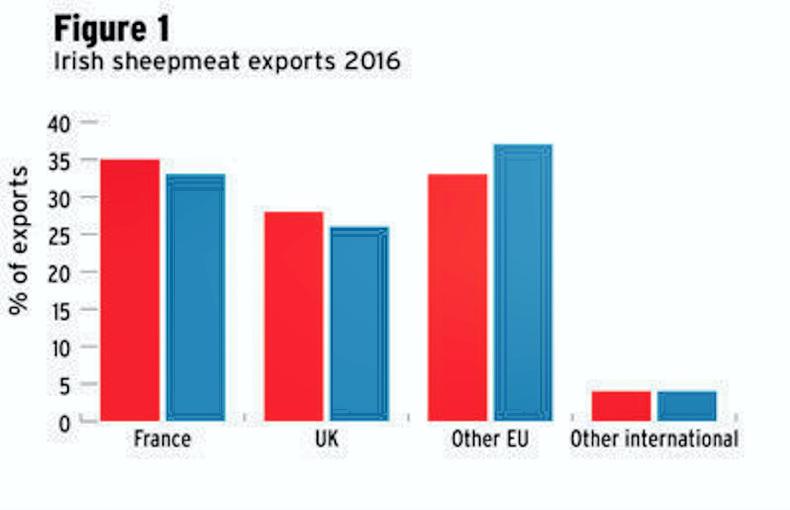

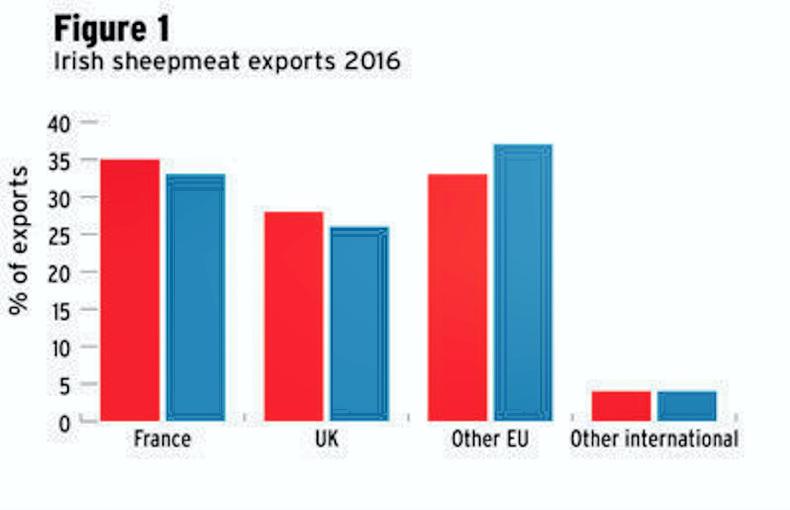

This factor has already been touched on, as it is the driving force behind sterling currency fluctuations. Its importance in an Irish context is that 95% of its exports (generally between 90,000t and 100,000t) are targeted at the EU 28 market. 26% of Irish exports, or 12,740t, is to the UK market as reflected in Figure 1. This fell by 2% in 2016 with exports restricted by currency fluctuations.

This factor has already been touched on, as it is the driving force behind sterling currency fluctuations. Its importance in an Irish context is that 95% of its exports (generally between 90,000t and 100,000t) are targeted at the EU 28 market. 26% of Irish exports, or 12,740t, is to the UK market as reflected in Figure 1. This fell by 2% in 2016 with exports restricted by currency fluctuations.

If exports from New Zealand to the UK are also reduced, Declan says it could push more lamb into other EU markets Ireland is active in.

Fifth quarter pressure

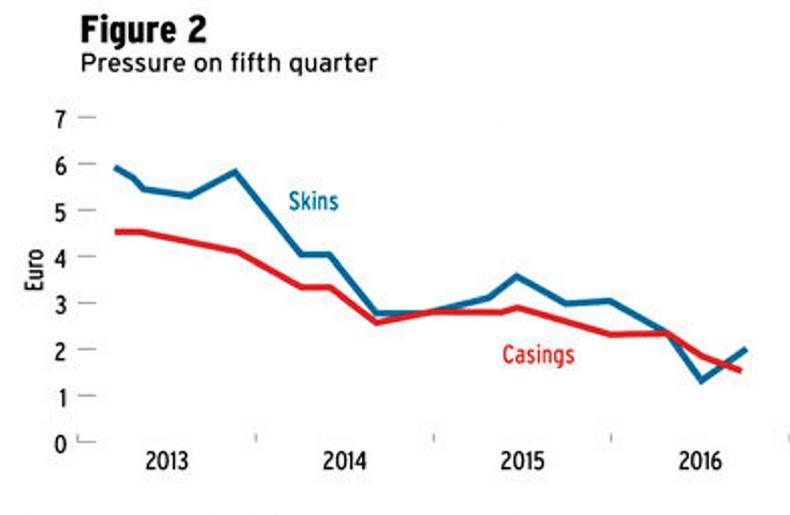

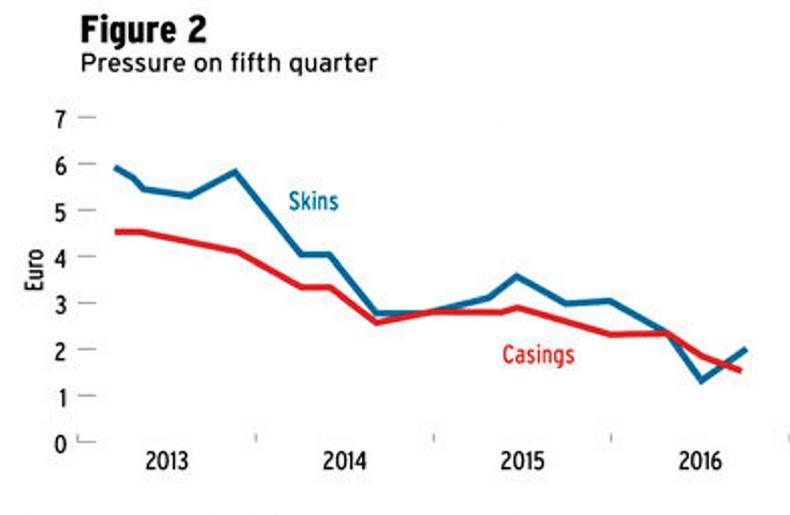

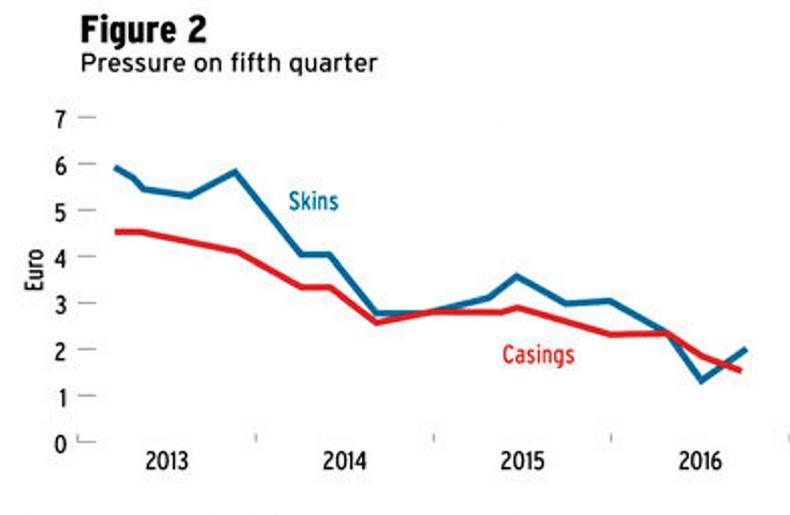

The market for skins and co-products or edible offal has come under increasing pressure in recent years, as demonstrated in Figure 2. Last year was a particularly poor year for skins and casings, with skins falling to a value of just over €1 midway during the year.

The market for skins and co-products or edible offal has come under increasing pressure in recent years, as demonstrated in Figure 2. Last year was a particularly poor year for skins and casings, with skins falling to a value of just over €1 midway during the year.

Declan says the downward pressure is stemming primarily from a slowdown in the fashion industry and also from new environmental standards putting heavy pressure on tanneries in China, the market for three out of every four skins produced worldwide.

Many small tanneries have closed and this is adding to reduced market demand.

The Russian market has also plummeted and, according to Declan, this is stemming from a collapse in the value of the ruble and also a refocus on supporting domestic product.

Ewe and ram kill underpins

higher throughput

Throughput in Irish processing plants increased by 81,000 in 2016. However, the increase stemmed from an unusual source with ewe and ram throughput increasing by 83,000 head. There were a number of reasons behind the lift.

Tight grass supplies and poor performance saw some farmers moving unproductive animals faster, while a higher ewe flock is leading to a naturally higher culling rate.

Added to this is a reported higher carryover of ewe lambs and lower-cost hoggets enticing farmers to upgrade their breeding flock.

Hogget throughput increased by 42,000 in the first half of the year, with a higher carryover from the 2015 season.

This is also likely to be a significant factor in 2017, with throughput of spring lambs falling by 43,000 or 3% to 1,596,000 head.

Spring lambs were running even further behind 2015 levels from August to October, with the shortfall reduced somewhat in the runup to Christmas by higher throughput.

The reduction also fails to take into account imports of sheep from Northern Ireland for direct slaughter increasing by 63,757 head.

Declan predicts hogget throughput in 2017 will rise further and will exceed 700,000 head.

The driver behind reduced spring lamb throughput is stemming from two areas. Lower lamb performance earlier in the season delayed drafting rates and is increasing numbers carried over into the new year.

The second is a growing worry for the sector and is a shift by more producers to later lambing. This is leading to an uneven supply balance and higher numbers coming on stream later in the year.

Read more

Exposure to Brexit raises stakes for new market access

Live sheep exports increase 49% to 48,000 head

Recent growth in Irish sheepmeat performance has been replicated in 2016. Sheep throughput increased by 3% to 2.67m head and provided the platform for a further 3% increase in export volumes, with the total volume of sheepmeat exported rising 1,470t to 49,000t.

Speaking at last Friday’s Bord Bia meat market seminar, Declan Fennell said this increase in export volumes translated to export values increasing 4% to €240m. There was also a 49% increase in live exports, which reached 48,000 head in 2016.

Challenging environment

Declan described the sheep sector’s performance as solid in light of 2016 presenting a challenging global environment to trade in, with average prices easing 1c/kg to €4.83/kg.

He highlighted five key areas as having the greatest influence with currency movements, oil prices, religious/cultural festivals, Brexit and fifth-quarter pressure all leaving their own mark in 2016. While all of these aspects influenced the trade in 2016, they will also have a big bearing on trade prospects for 2017.

Currency movements

Huge shifts in the value of sterling to euro was the currency fluctuation pertaining most to sheep trading. A weakening in the value of sterling to euro increased the competitiveness of British exports in key European markets from late September/early October onwards. This couldn’t have occurred at a worse time as it coincided with an increase in British throughput and left Irish exports in a weaker negotiating position.

The reduction in the value of sterling also reduced the competitiveness of New Zealand exports and direct returns for product exported.

As a result, New Zealand is now placing more emphasis on alternative markets and it will be interesting to see if it affects volumes of lamb exported to the UK in the first quarter of 2017, the peak exporting period to Britain and the EU for new-season New Zealand lamb.

Oil prices

The upshot of low oil prices is reduced fuel prices. However, there is a negative for exports to Middle Eastern nations where the economy is built on oil production.

Declan explains that it is customary practice for governments in these oil-rich states to provide a subsidy to its citizens for purchasing products for important religious festivals. These subsidies were reduced or removed in some Middle East markets in 2016, leading to reduced consumer spending, with the Ramadan festival particularly hit.

Religious/cultural festivals

While there was reduced consumer spending in some Middle East nations around religious festivals, they remain a vital outlet that have the ability to significantly boost markets.

Ramadan has disappointed in recent years, with consumption lowered due to the festival now falling (moves forward two weeks each year) at a period when there is only a few hours of darkness (tradition to fast during daylight hours).

Eid al-Adha has become a much more important festival in recent years, with sheep throughput at Irish processing plants exceeding 70,000 in the week leading up to the festival, while live exports hit a three-year high of 48,036 head, with most occurring in August in advance of the festival.

Brexit

This factor has already been touched on, as it is the driving force behind sterling currency fluctuations. Its importance in an Irish context is that 95% of its exports (generally between 90,000t and 100,000t) are targeted at the EU 28 market. 26% of Irish exports, or 12,740t, is to the UK market as reflected in Figure 1. This fell by 2% in 2016 with exports restricted by currency fluctuations.

This factor has already been touched on, as it is the driving force behind sterling currency fluctuations. Its importance in an Irish context is that 95% of its exports (generally between 90,000t and 100,000t) are targeted at the EU 28 market. 26% of Irish exports, or 12,740t, is to the UK market as reflected in Figure 1. This fell by 2% in 2016 with exports restricted by currency fluctuations.

If exports from New Zealand to the UK are also reduced, Declan says it could push more lamb into other EU markets Ireland is active in.

Fifth quarter pressure

The market for skins and co-products or edible offal has come under increasing pressure in recent years, as demonstrated in Figure 2. Last year was a particularly poor year for skins and casings, with skins falling to a value of just over €1 midway during the year.

The market for skins and co-products or edible offal has come under increasing pressure in recent years, as demonstrated in Figure 2. Last year was a particularly poor year for skins and casings, with skins falling to a value of just over €1 midway during the year.

Declan says the downward pressure is stemming primarily from a slowdown in the fashion industry and also from new environmental standards putting heavy pressure on tanneries in China, the market for three out of every four skins produced worldwide.

Many small tanneries have closed and this is adding to reduced market demand.

The Russian market has also plummeted and, according to Declan, this is stemming from a collapse in the value of the ruble and also a refocus on supporting domestic product.

Ewe and ram kill underpins

higher throughput

Throughput in Irish processing plants increased by 81,000 in 2016. However, the increase stemmed from an unusual source with ewe and ram throughput increasing by 83,000 head. There were a number of reasons behind the lift.

Tight grass supplies and poor performance saw some farmers moving unproductive animals faster, while a higher ewe flock is leading to a naturally higher culling rate.

Added to this is a reported higher carryover of ewe lambs and lower-cost hoggets enticing farmers to upgrade their breeding flock.

Hogget throughput increased by 42,000 in the first half of the year, with a higher carryover from the 2015 season.

This is also likely to be a significant factor in 2017, with throughput of spring lambs falling by 43,000 or 3% to 1,596,000 head.

Spring lambs were running even further behind 2015 levels from August to October, with the shortfall reduced somewhat in the runup to Christmas by higher throughput.

The reduction also fails to take into account imports of sheep from Northern Ireland for direct slaughter increasing by 63,757 head.

Declan predicts hogget throughput in 2017 will rise further and will exceed 700,000 head.

The driver behind reduced spring lamb throughput is stemming from two areas. Lower lamb performance earlier in the season delayed drafting rates and is increasing numbers carried over into the new year.

The second is a growing worry for the sector and is a shift by more producers to later lambing. This is leading to an uneven supply balance and higher numbers coming on stream later in the year.

Read more

Exposure to Brexit raises stakes for new market access

Live sheep exports increase 49% to 48,000 head

This factor has already been touched on, as it is the driving force behind sterling currency fluctuations. Its importance in an Irish context is that 95% of its exports (generally between 90,000t and 100,000t) are targeted at the EU 28 market. 26% of Irish exports, or 12,740t, is to the UK market as reflected in Figure 1. This fell by 2% in 2016 with exports restricted by currency fluctuations.

This factor has already been touched on, as it is the driving force behind sterling currency fluctuations. Its importance in an Irish context is that 95% of its exports (generally between 90,000t and 100,000t) are targeted at the EU 28 market. 26% of Irish exports, or 12,740t, is to the UK market as reflected in Figure 1. This fell by 2% in 2016 with exports restricted by currency fluctuations.  The market for skins and co-products or edible offal has come under increasing pressure in recent years, as demonstrated in Figure 2. Last year was a particularly poor year for skins and casings, with skins falling to a value of just over €1 midway during the year.

The market for skins and co-products or edible offal has come under increasing pressure in recent years, as demonstrated in Figure 2. Last year was a particularly poor year for skins and casings, with skins falling to a value of just over €1 midway during the year.

SHARING OPTIONS