For manufacturing dairy businesses, higher butterfat and protein impact positively on milk price. There are significant variations in milk solids production between farms, processors and regions. Calculating a milk solids comparison helps reduce this variation.

Poor milk solids delivered can be for a variety of different reasons – but the main reasons for poor fat and protein production are because farmers are using low milk solids genetics, don’t have good grassland paddocks, or because herds have to be indoors more due to heavy ground conditions or higher annual rainfall.

The majority of milk in the Republic of Ireland is paid for on a milk solids basis – that means a value on the fat and the protein and a deduction on the water element.

As cow genetics, soil type, grass quality and weather differ between counties, regions and farms, by calculating a price per kilo of milk solids we neutralise to a large extent the effect of poor milk fat and protein on price.

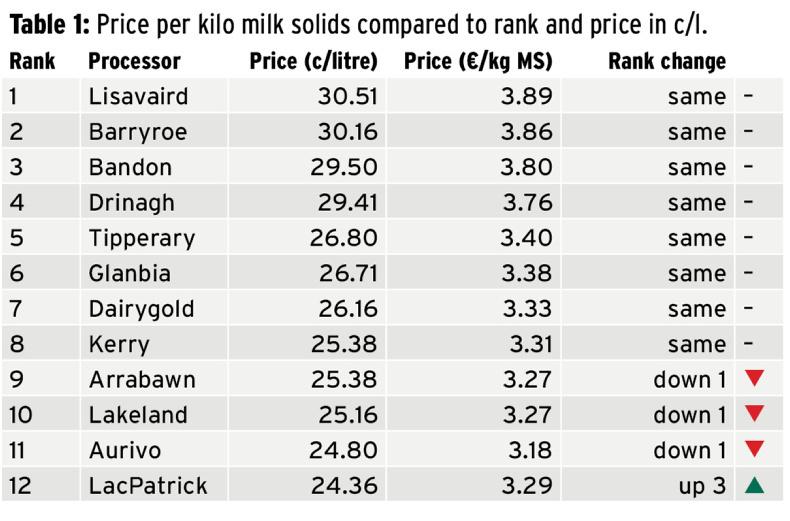

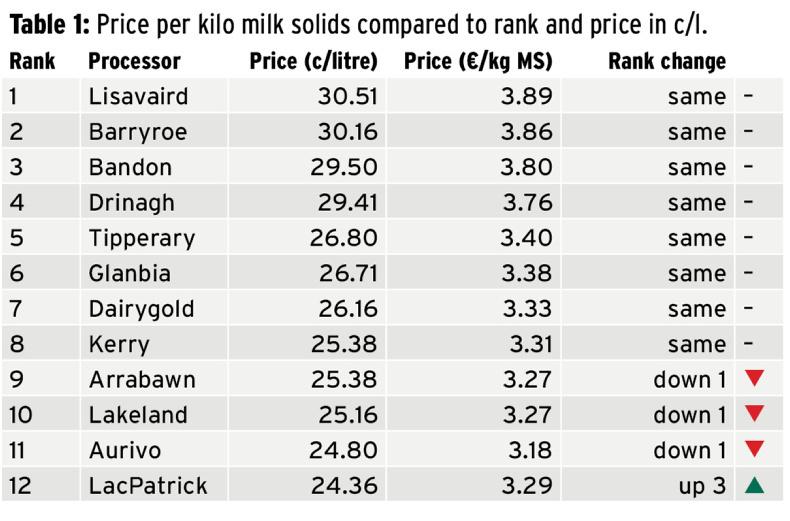

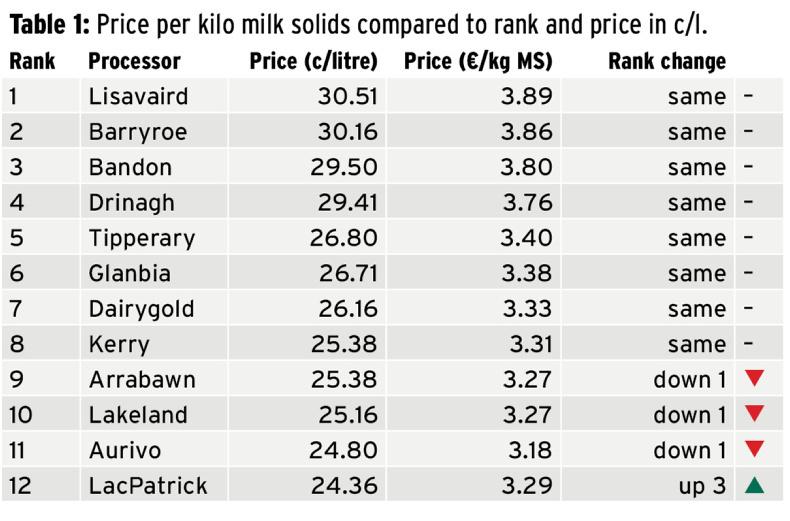

When we calculate this euro-per-kilo milk solids price, we see some change on ranking in the lower half of the table (Table 1) but little or no major impact overall. The overall trend and positioning is still the same in the main.

Definition

The simplest definition of the Irish Farmers Journal/KPMG milk price review is the total amount of money paid out to manufacturing suppliers (not liquid) in a calendar year divided by the total volume (litres) of milk delivered which allows us calculate a cent/litre price.

Paying for milk solids rather than volume essentially means that the processors are sending a signal to the supplier that they want higher milk solids (more fat and protein) and the higher the price they can pay for solids then the stronger the signal is that they want more milk solids. Higher milk solids allows the processor make more cheese or powder, etc, so hence they can afford to pay farmers more for higher milk solids.

In some respect, the cent per litre figure discriminates against those processors that traditionally have a supply base with low milk solids. To investigate this and in effect to neutralise this as one of the issues for differences between processors, we divided the total pot of money paid out for milk and divided it by the total amount of milk solids purchased. To calculate the total milk solids collected, we totalled the monthly volume of milk solids and subsequently totalled the annual volume of milk solids purchased. When we divide the total money paid out by the total milk solids we are able to calculate a price per kilo milk solids. We are using the average fat and protein percentages for the month to calculate the monthly milk solids production.

Results

When we compare the ranking of processors in cent/litre compared to €/kg milk solids, we can see the majority of milk processors ranked the same. The price ranges from Lisavaird paying €3.89 per kilo milk solids down to Aurivo paying €3.18/kg milk solids.

LacPatrick, who are ranked last when we look at it on a cent/litre basis, actually jumped up to ninth (from 12th) when we calculate on a milk solids basis. In cent-per-litre terms, they paid out 24.36c/l but in euro-per-kilo milk solids they paid out €3.29/kg milk solids, which ranks them ninth out of 12. Aurivo rank lowest on euro-per-kilo milk solids at €3.18/kg milk solids.

Arrabawn, Lakeland and Aurivo all dropped down one position in rank when comparing on euro-per-kilo milk solids basis.

Read more

Milk price review: Lisavaird regains top spot

The review: what it means for farmers

Milk price review: churning the results

Full coverage of the KPMG / Irish Farmers Journal milk price review

For manufacturing dairy businesses, higher butterfat and protein impact positively on milk price. There are significant variations in milk solids production between farms, processors and regions. Calculating a milk solids comparison helps reduce this variation.

Poor milk solids delivered can be for a variety of different reasons – but the main reasons for poor fat and protein production are because farmers are using low milk solids genetics, don’t have good grassland paddocks, or because herds have to be indoors more due to heavy ground conditions or higher annual rainfall.

The majority of milk in the Republic of Ireland is paid for on a milk solids basis – that means a value on the fat and the protein and a deduction on the water element.

As cow genetics, soil type, grass quality and weather differ between counties, regions and farms, by calculating a price per kilo of milk solids we neutralise to a large extent the effect of poor milk fat and protein on price.

When we calculate this euro-per-kilo milk solids price, we see some change on ranking in the lower half of the table (Table 1) but little or no major impact overall. The overall trend and positioning is still the same in the main.

Definition

The simplest definition of the Irish Farmers Journal/KPMG milk price review is the total amount of money paid out to manufacturing suppliers (not liquid) in a calendar year divided by the total volume (litres) of milk delivered which allows us calculate a cent/litre price.

Paying for milk solids rather than volume essentially means that the processors are sending a signal to the supplier that they want higher milk solids (more fat and protein) and the higher the price they can pay for solids then the stronger the signal is that they want more milk solids. Higher milk solids allows the processor make more cheese or powder, etc, so hence they can afford to pay farmers more for higher milk solids.

In some respect, the cent per litre figure discriminates against those processors that traditionally have a supply base with low milk solids. To investigate this and in effect to neutralise this as one of the issues for differences between processors, we divided the total pot of money paid out for milk and divided it by the total amount of milk solids purchased. To calculate the total milk solids collected, we totalled the monthly volume of milk solids and subsequently totalled the annual volume of milk solids purchased. When we divide the total money paid out by the total milk solids we are able to calculate a price per kilo milk solids. We are using the average fat and protein percentages for the month to calculate the monthly milk solids production.

Results

When we compare the ranking of processors in cent/litre compared to €/kg milk solids, we can see the majority of milk processors ranked the same. The price ranges from Lisavaird paying €3.89 per kilo milk solids down to Aurivo paying €3.18/kg milk solids.

LacPatrick, who are ranked last when we look at it on a cent/litre basis, actually jumped up to ninth (from 12th) when we calculate on a milk solids basis. In cent-per-litre terms, they paid out 24.36c/l but in euro-per-kilo milk solids they paid out €3.29/kg milk solids, which ranks them ninth out of 12. Aurivo rank lowest on euro-per-kilo milk solids at €3.18/kg milk solids.

Arrabawn, Lakeland and Aurivo all dropped down one position in rank when comparing on euro-per-kilo milk solids basis.

Read more

Milk price review: Lisavaird regains top spot

The review: what it means for farmers

Milk price review: churning the results

Full coverage of the KPMG / Irish Farmers Journal milk price review

SHARING OPTIONS