The European Commission sheep and goat meat market updates include three elements – a regular market dashboard, weekly prices and a periodical market analysis and outlook.

The latest dashboard was released on 30 May and includes some interesting data. The EU sheep sector is dominated by a small number of large-scale producers. The UK, with Scotland leading the way in terms of numbers, Spain, Greece and France are listed as together accounting for 68% of total production ,with Romania, Ireland, Germany and Italy accounting for another 22%. This leaves 10% split between the remaining EU member states.

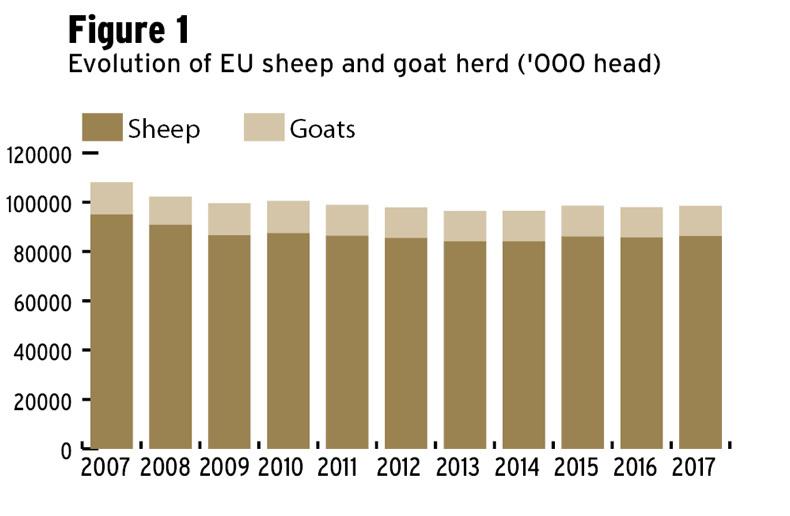

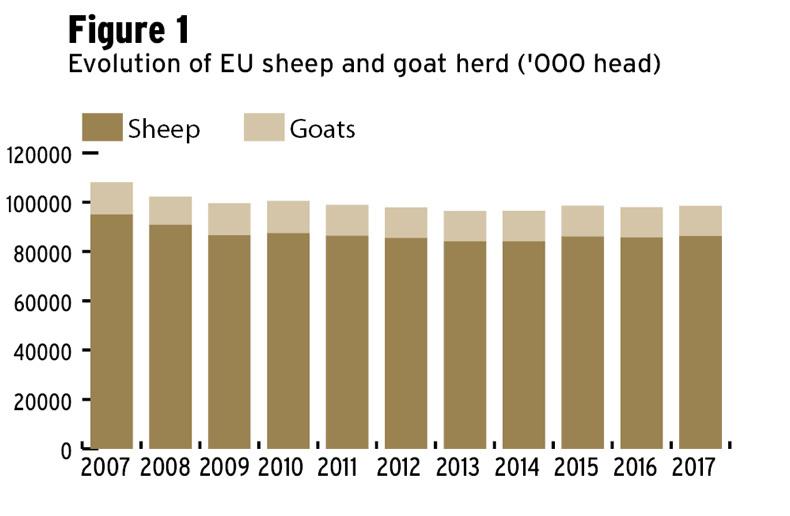

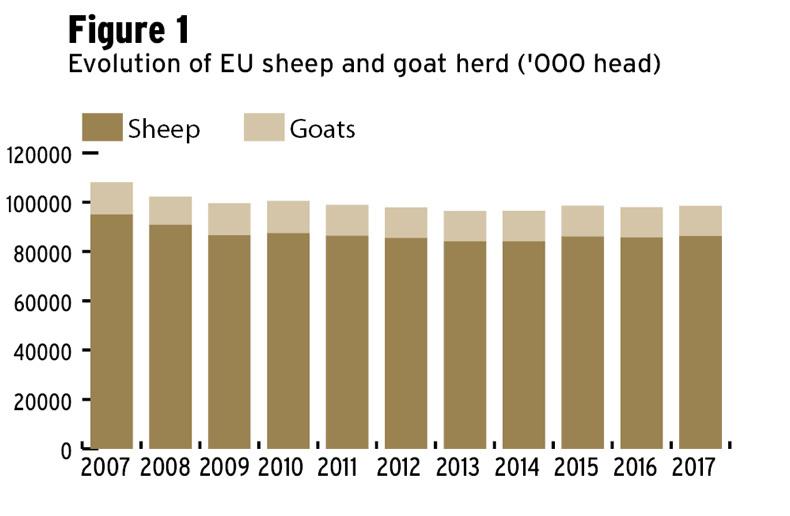

Sheep and goat numbers have recovered marginally in recent years, as detailed in Figure 1, with a high percentage of this recovery underpinned by flock recovery in the UK and Ireland. Numbers are predicted to at least remain steady in 2018 and this is the driver of the EU’s net sheepmeat production, which is predicted to increase from 902,000t in 2017 to 917,000t in 2018.

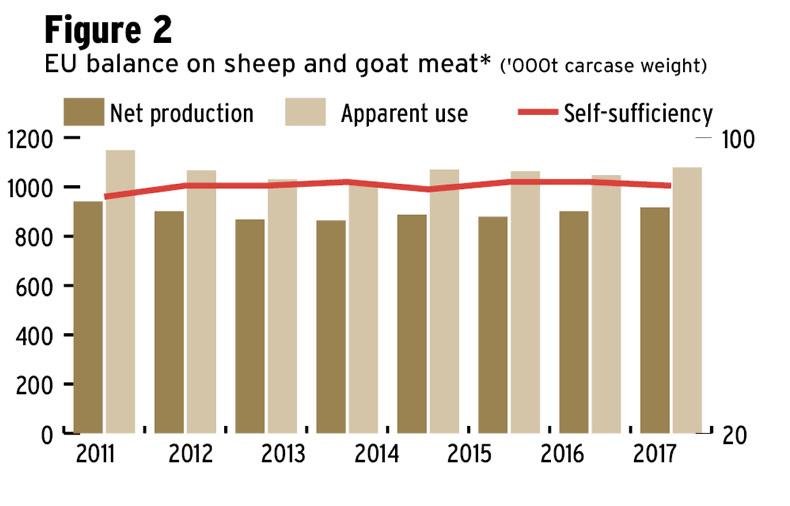

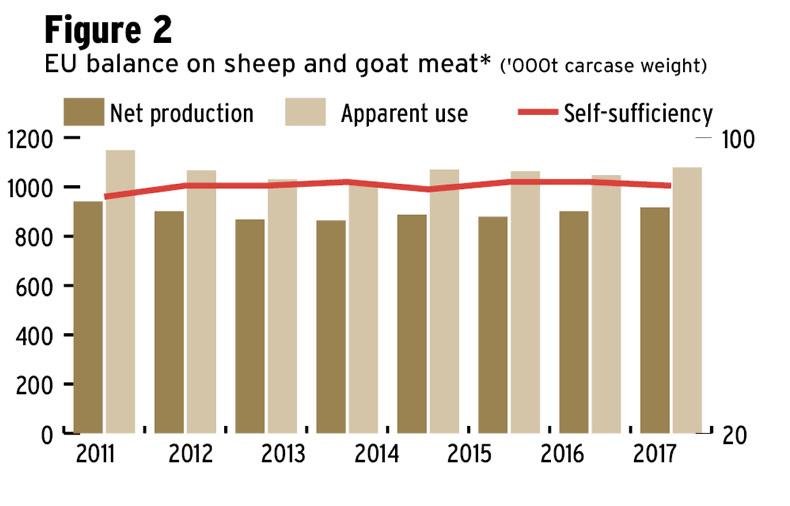

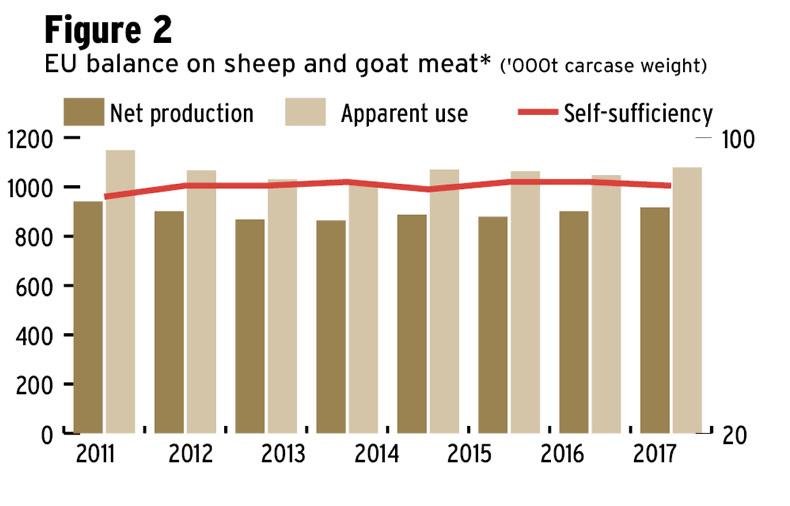

Higher mortality rates in spring may hit this forecast but some commentators predict a higher culling rate of ewes which may boost throughput in the short term. Consumption is predicted to increase by an even greater level than the lift in production, resulting in self-sufficiency falling 1% to 87%.

Sheepmeat imports

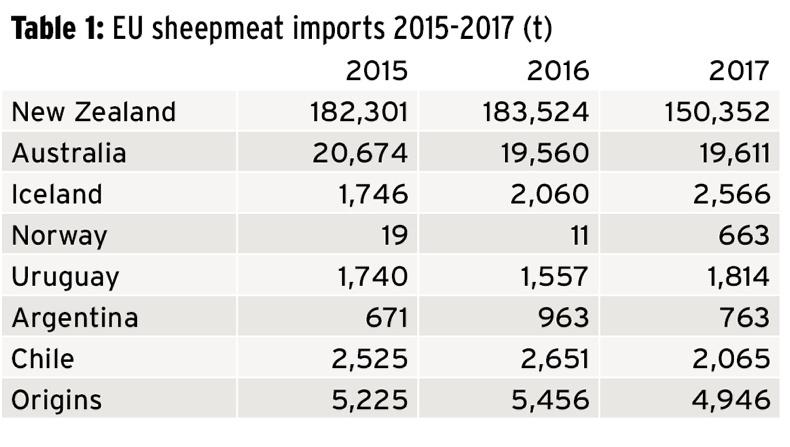

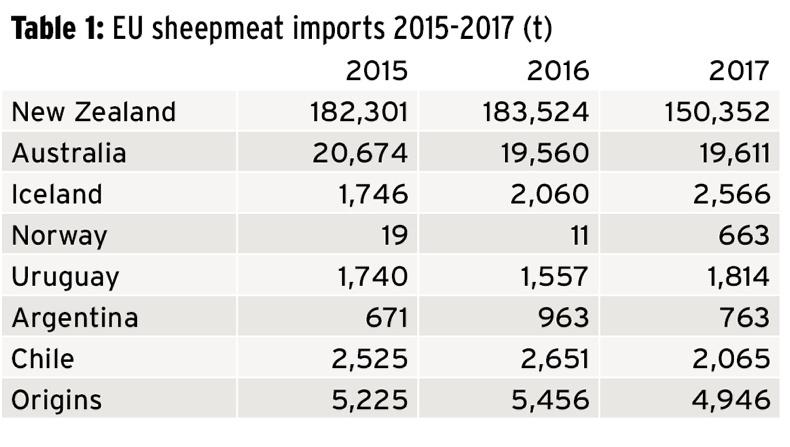

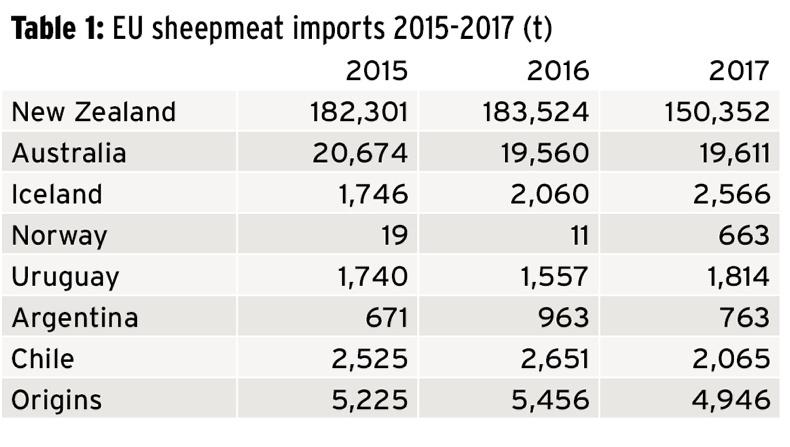

Sheep and goat meat imports into the EU were recorded at 181,000t in 2017, a sharp reduction from 213,000t and 212,000t in 2016 and 2015, respectively. The reduction in imports stemmed from a significantly lower volume of New Zealand sheepmeat imports, as reflected in Table 1.

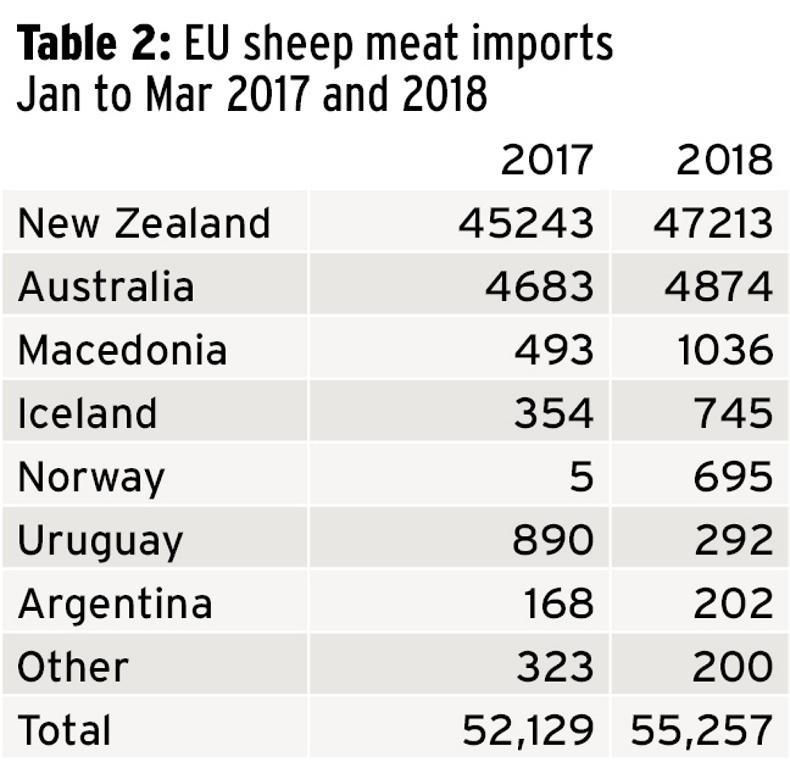

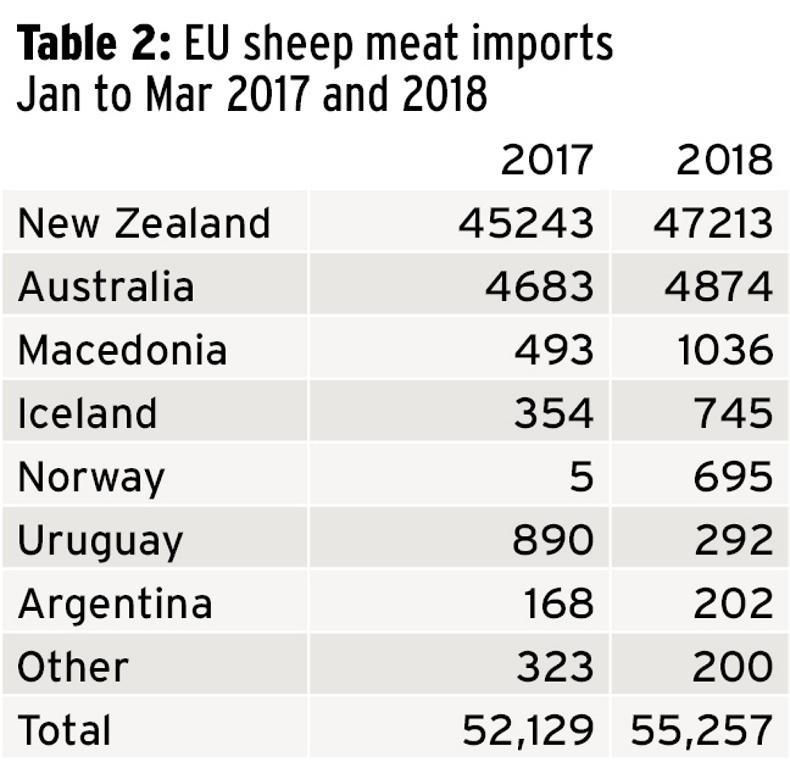

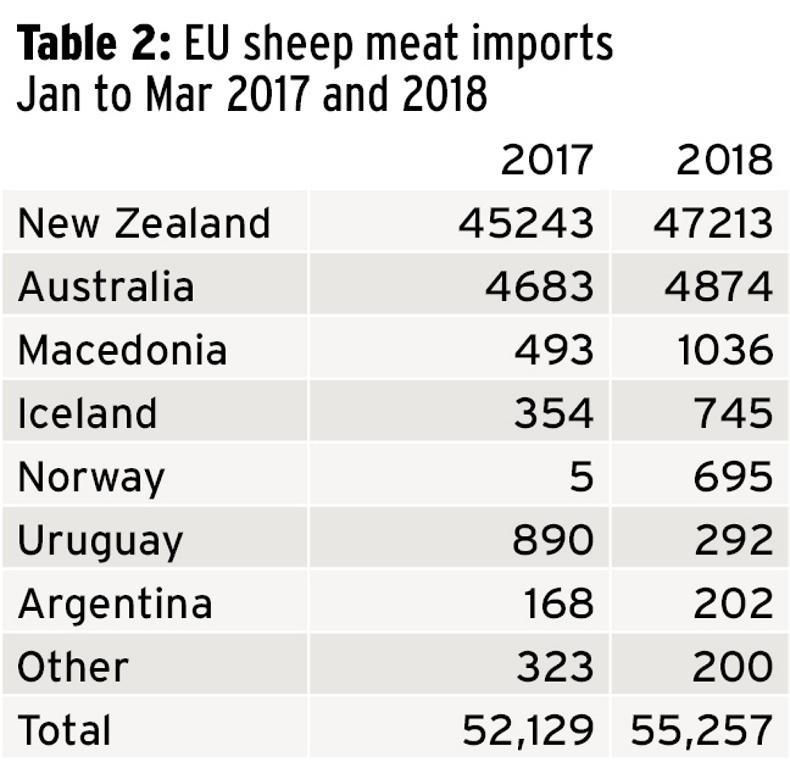

Data for the first three months of 2018 shows only a slight lift in imports in 2018, as detailed in Table 2. This is at a time when New Zealand imports into the UK market in particular are traditionally at their strongest level, which suggests that New Zealand imports will remain at a low level in 2018. There are also a number of other elements influencing New Zealand sheepmeat exports. Production remains under pressure, with the sector continuing to face stern challenges from competing enterprises.

New Zealand sheep farmers are witnessing higher returns, with sheepmeat prices increasing from the equivalent of just under €3.50/kg in May 2017 to in the region of €4.40/kg in May 2018. Prices have risen by 25c/kg to 35c/kg in recent weeks. This is likely to leave New Zealand sheep in a competitively weaker position. While on the subject, Australian sheep prices have also rallied in the last month to six weeks and have increased by close to 40c/kg to lie shy of €4/kg.

The other distraction for sheepmeat exports destined for the EU market is continued growth in demand in China and Hong Kong. The European Commission report shows imports of sheep and goat meat in the first three months of 2018 lifting by a massive 20,000t to reach 100,000t. The increase in imports shows why Irish processors are so keen for negotiations in gaining access for sheepmeat to be advanced.

Exports of sheep and goat meat from the EU to Hong Kong in the first three months of the year increased from 1,901t in 2017 to 2,225t in 2018. While low in volume, there was also significant growth recorded in exports to Israel (from 989t to 1,755t), and Turkey (from 381t to 920t). This growth failed to compensate for a net reduction in exports from 15,502t in 2017 to 13,408t in 2018. Exports to Libya halved from 4,641t to 2,261t, with political unrest continuing to hamper the market.

Irish sheep prices have come under considerable pressure in the last two weeks, with farmgate prices reducing in the region of 80c/kg to €1/kg in the last two weeks.

Figure 3 details sheep prices as reported to the European Commission by member states for select sheep producing nations. The prices are up to the week beginning 21 May so do not reflect the Irish and other region price cuts. It is interesting to note that British prices were the highest in Europe in recent weeks having surpassed French prices, which have traditionally held prime position.

British prices have been boosted in recent months by relatively tight supplies combining with strong demand and lower import volumes. Spain has been highlighted by Irish processors as increasing exports in recent weeks and contributing to price pressure.

The European Union recently agreed a decision to commence negotiations on a free-trade agreement between the EU and Australia. Australia has always been envious of New Zealand’s tariff-free quota for sheepmeat and will no doubt be pushing for greater sheepmeat access. While the EU is not self-sufficient in sheepmeat, any increase in the quota allocations should be resisted in light of Brexit and unknown trade disruptions.

When do Ramadan and Eid al-Adha fall?

The Muslim festival of Ramadan is of particular interest to the sheep industry due to the spike in sheep consumption that religious festivals generate. The exact date on which Ramadan starts and ends differs from year to year. This is due to the fact that the festival falls on the ninth month of the Islamic calendar but the precise start and end date is dictated by the sighting of a new moon. This means that the starting date can also vary between regions, with the festival starting on the evening of 15 May in Europe and north, Africa and a day later in other regions.

The end of Ramadan and start of Eid al-Fitr, a two-to-three-day celebration which marks the end of 29 or 30 days of fasting (if the new moon is not visible the month lasts 30 days), is expected to begin on the evening of 14/15 June 2018. The festival also comes forward each year and this is due to the Islamic lunar calendar being about 11 days shorter than the solar calendar.

Breaking of fasting

The degree of fasting for Ramadan is based on the level of commitment, with devout followers fasting from all food and drink from sunrise to sunset. The longer day length at this time of year makes fasting particularly challenging, with only a short window to consume food and drink.

It is therefore not surprising that demand for sheep and goat meat has been surpassed in recent years by demand for the Eid al-Adha festival, which is expected to take place in 2018 around the dates of 21 August to 25 August. This festival has underpinned the largest volume of weekly throughput in recent years and has also delivered a significant boost to live exports in the weeks leading up to the religious festival. Festivals in predominantly Muslim countries centre on sharing a sheep or goat with families and poorer members of society.

Why the importance?

Figures differ between sources but a study undertaken in 2015 lists in the region of 1.8bn Muslim adherents or about 24% of the then world population. The greatest percentage is located in the Asia-Pacific region followed by the Middle East and north African region. The latest reports show Europe possessing a Muslim population in excess of 44m, but this number is now expected to be higher following recent migration from north African countries.

France has the largest Muslim population, with in excess of 5.5m Muslim inhabitants. Germany is not far behind and is predicted to have a population of around 5m with the UK next with about 4m Muslims. There are close to 3m Muslims living in Italy, while Spain, the Netherlands and Belgium all have in the region of 1m Muslims.

Read more

Developing a worm control programme for your farm

Sheep Farming Management Notes

The European Commission sheep and goat meat market updates include three elements – a regular market dashboard, weekly prices and a periodical market analysis and outlook.

The latest dashboard was released on 30 May and includes some interesting data. The EU sheep sector is dominated by a small number of large-scale producers. The UK, with Scotland leading the way in terms of numbers, Spain, Greece and France are listed as together accounting for 68% of total production ,with Romania, Ireland, Germany and Italy accounting for another 22%. This leaves 10% split between the remaining EU member states.

Sheep and goat numbers have recovered marginally in recent years, as detailed in Figure 1, with a high percentage of this recovery underpinned by flock recovery in the UK and Ireland. Numbers are predicted to at least remain steady in 2018 and this is the driver of the EU’s net sheepmeat production, which is predicted to increase from 902,000t in 2017 to 917,000t in 2018.

Higher mortality rates in spring may hit this forecast but some commentators predict a higher culling rate of ewes which may boost throughput in the short term. Consumption is predicted to increase by an even greater level than the lift in production, resulting in self-sufficiency falling 1% to 87%.

Sheepmeat imports

Sheep and goat meat imports into the EU were recorded at 181,000t in 2017, a sharp reduction from 213,000t and 212,000t in 2016 and 2015, respectively. The reduction in imports stemmed from a significantly lower volume of New Zealand sheepmeat imports, as reflected in Table 1.

Data for the first three months of 2018 shows only a slight lift in imports in 2018, as detailed in Table 2. This is at a time when New Zealand imports into the UK market in particular are traditionally at their strongest level, which suggests that New Zealand imports will remain at a low level in 2018. There are also a number of other elements influencing New Zealand sheepmeat exports. Production remains under pressure, with the sector continuing to face stern challenges from competing enterprises.

New Zealand sheep farmers are witnessing higher returns, with sheepmeat prices increasing from the equivalent of just under €3.50/kg in May 2017 to in the region of €4.40/kg in May 2018. Prices have risen by 25c/kg to 35c/kg in recent weeks. This is likely to leave New Zealand sheep in a competitively weaker position. While on the subject, Australian sheep prices have also rallied in the last month to six weeks and have increased by close to 40c/kg to lie shy of €4/kg.

The other distraction for sheepmeat exports destined for the EU market is continued growth in demand in China and Hong Kong. The European Commission report shows imports of sheep and goat meat in the first three months of 2018 lifting by a massive 20,000t to reach 100,000t. The increase in imports shows why Irish processors are so keen for negotiations in gaining access for sheepmeat to be advanced.

Exports of sheep and goat meat from the EU to Hong Kong in the first three months of the year increased from 1,901t in 2017 to 2,225t in 2018. While low in volume, there was also significant growth recorded in exports to Israel (from 989t to 1,755t), and Turkey (from 381t to 920t). This growth failed to compensate for a net reduction in exports from 15,502t in 2017 to 13,408t in 2018. Exports to Libya halved from 4,641t to 2,261t, with political unrest continuing to hamper the market.

Irish sheep prices have come under considerable pressure in the last two weeks, with farmgate prices reducing in the region of 80c/kg to €1/kg in the last two weeks.

Figure 3 details sheep prices as reported to the European Commission by member states for select sheep producing nations. The prices are up to the week beginning 21 May so do not reflect the Irish and other region price cuts. It is interesting to note that British prices were the highest in Europe in recent weeks having surpassed French prices, which have traditionally held prime position.

British prices have been boosted in recent months by relatively tight supplies combining with strong demand and lower import volumes. Spain has been highlighted by Irish processors as increasing exports in recent weeks and contributing to price pressure.

The European Union recently agreed a decision to commence negotiations on a free-trade agreement between the EU and Australia. Australia has always been envious of New Zealand’s tariff-free quota for sheepmeat and will no doubt be pushing for greater sheepmeat access. While the EU is not self-sufficient in sheepmeat, any increase in the quota allocations should be resisted in light of Brexit and unknown trade disruptions.

When do Ramadan and Eid al-Adha fall?

The Muslim festival of Ramadan is of particular interest to the sheep industry due to the spike in sheep consumption that religious festivals generate. The exact date on which Ramadan starts and ends differs from year to year. This is due to the fact that the festival falls on the ninth month of the Islamic calendar but the precise start and end date is dictated by the sighting of a new moon. This means that the starting date can also vary between regions, with the festival starting on the evening of 15 May in Europe and north, Africa and a day later in other regions.

The end of Ramadan and start of Eid al-Fitr, a two-to-three-day celebration which marks the end of 29 or 30 days of fasting (if the new moon is not visible the month lasts 30 days), is expected to begin on the evening of 14/15 June 2018. The festival also comes forward each year and this is due to the Islamic lunar calendar being about 11 days shorter than the solar calendar.

Breaking of fasting

The degree of fasting for Ramadan is based on the level of commitment, with devout followers fasting from all food and drink from sunrise to sunset. The longer day length at this time of year makes fasting particularly challenging, with only a short window to consume food and drink.

It is therefore not surprising that demand for sheep and goat meat has been surpassed in recent years by demand for the Eid al-Adha festival, which is expected to take place in 2018 around the dates of 21 August to 25 August. This festival has underpinned the largest volume of weekly throughput in recent years and has also delivered a significant boost to live exports in the weeks leading up to the religious festival. Festivals in predominantly Muslim countries centre on sharing a sheep or goat with families and poorer members of society.

Why the importance?

Figures differ between sources but a study undertaken in 2015 lists in the region of 1.8bn Muslim adherents or about 24% of the then world population. The greatest percentage is located in the Asia-Pacific region followed by the Middle East and north African region. The latest reports show Europe possessing a Muslim population in excess of 44m, but this number is now expected to be higher following recent migration from north African countries.

France has the largest Muslim population, with in excess of 5.5m Muslim inhabitants. Germany is not far behind and is predicted to have a population of around 5m with the UK next with about 4m Muslims. There are close to 3m Muslims living in Italy, while Spain, the Netherlands and Belgium all have in the region of 1m Muslims.

Read more

Developing a worm control programme for your farm

Sheep Farming Management Notes

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: