Forest certification is a system, which verifies that forests and woodlands are managed according to principles of sustainable forest management (SFM). While certification is often viewed as an environmental scheme, it is also market-oriented, as its benefits extend far beyond the forest gate.

It relates not just to the forest, but to what happens the timber after it leaves the forest to enter the wood processing and manufacturing cycle. Chain of custody (CoC) certification is required by timber processors such as sawmills and panel board mills, along with furniture manufacturers and paper producers.

However, CoC certification can only be achieved if the timber has been sourced from certified forests to begin with.

Forests are independently assessed before they are granted certification by one – or both – certification bodies, which in Ireland are the Forest Stewardship Council (FSC) and the Programme for the Endorsement of Forest Certification (PEFC).

Ireland’s sawmills and panel board mills export over 80% of their products and their international buyers and eventual consumers expect timber to be certified.

All major timber processors have CoC certification and Coillte, Northern Ireland Forest Service and Irish Forest Unit Trust forests are certified, but private forests are not.

There are three key questions asked by private forest owners before committing to certification:

Do I really need it?Is it difficult to achieve?; andHow much will it cost?Do I need certification?

Certification hasn’t been an issue up until recently for private forest owners because timber processors could purchase 30% of their logs from uncertified forests and still be allowed to stamp their products with the FSC or PEFC brands. Some mills are now about to exceed the 30% threshold, so will have to turn away timber from uncertified forests.

When a timber buyer exceeds the 30% threshold, further timber for that year has to be sourced from certified forests, so uncertified forests have limited outlets for logs.

In the short term, private forest owners will find sufficient markets, but in the medium to long term, market opportunities will be limited, as total timber production from privately owned – mainly farm – forests is forecast to reach 50% of all production by 2026 .

Is certification difficult to achieve?

Most well-managed forests with good management plans in place are sustainably managed and so can achieve certification.

However, a number of important procedures need to be followed, including stakeholder consultation.

Is certification costly?

Cost is likely to be the most contentious issue in achieving certification. The actual cost won’t be determined until the current project – funded by the Forest Service – to achieve a group forest certification template is in place.

The two participating forestry groups in the pilot scheme are the Forest Owners Co-operative Society and the North East Forestry Group. The findings of the pilot scheme will be published in June next year.

Forest certification in Munster

Forest certification is becoming increasingly important in Ireland as timber production increases from private forest owners. How seriously forest owners are taking certification could be judged by the large turnout at two recent certification events organised by the Irish Timber Growers Association (ITGA) in association with the Irish Forest Unit Trust (IForUT) in Toorlougher, Co Limerick, and last month’s public information meeting, Getting your forest certified, organised by the Forest Owners Cooperative Society (FOCS) in Macroom.

Timber growers

The ITGA field day visited IForUT’s forests located on the foothills of Slieve Felim. These forests form part of the trust’s Toorlougher management unit, which straddles the Tipperary-Limerick border. The unit comprises over 100ha of certified mixed-aged forests, with a further 127ha currently being added to the certification management plan.

The field day explored important procedures to be followed, including stakeholder consultation, management plan preparation, mapping, watercourse management, recording features such as archaeological and old woodland sites, chemical use and harvesting site management.

“Water considerations are a vital component in the management planning inToorlougher,” maintained Donal Whelan, ITGA technical director. Toorlougher forest slopes to the Clare River, so particular care has to be taken to avoid excessive water runoff during harvesting and reforestation which has been carried out nearby. “A little over a mile upstream is a special area of conservation (SAC), so harvesting has to be carried out with care and at times of heavy rainfall, the operation is suspended,” he said. To add to the restrictions, the entire management unit is within a hen harrier special protection area (SPA).

The IForUT foresters Darryn McDowell, Oisin Meagher and Stacey Bradley outlined the step-by-step approach to preparing the forest for an audit by a certification body. They emphasised the importance of a detailed forest management plan, which forms the basic building block in complying with certification requirements. “Last October, we successfully completed our 10-year FSC certification re-evaluation audit,” said ITGA chair and IForUT managing director Brendan Lacey. “We are the only large-scale private forest owner in Ireland to have FSC certification.”

The trust’s foresters outlined unforeseen challenges, such as forest management in sites where reforestation has been carried out after the storm damage in 2014. Operations discussed were harvesting – thinning and clearfell – and reforestation of cleared areas, along with associated work including species selection, planting, vegetation control and fertilisation.

The Forest Owners Co-op

The main outcome of the FOCS meeting in Macroom, chaired by Tim McCarthy, was to proceed to have the co-op’s forests certified to FSC standard within two years.

Teagasc’s John Casey and Eugene Curran of the Forest Service stressed the importance of certification from a grower’s perspective, while Conor McSwiney of GP Wood sawmills gave the industry view. “Markets for processed timber demand certification and all large processors and users of wood products in Ireland subscribe to certification,” he told the large attendance.

Karl Coggins of the Forest Service outlined the pilot project on timber certification. “This will develop a template for efficient certification of private forests, through group certification schemes,” he said.

Michael Greaney from Cloyne, who is a participant in the pilot project, praised both FOCS and the North East Forestry Group for achieving the exacting standards set by the Forest Service before they were selected for the pilot scheme. He said that any process benefiting private owners accessing the market, getting the best prices for logs and adding value to their plantations would get co-op members’ respect and support. Further information at www.focs.ie.

Early 2017 log prices up by 14% compared with final quarter in 2016

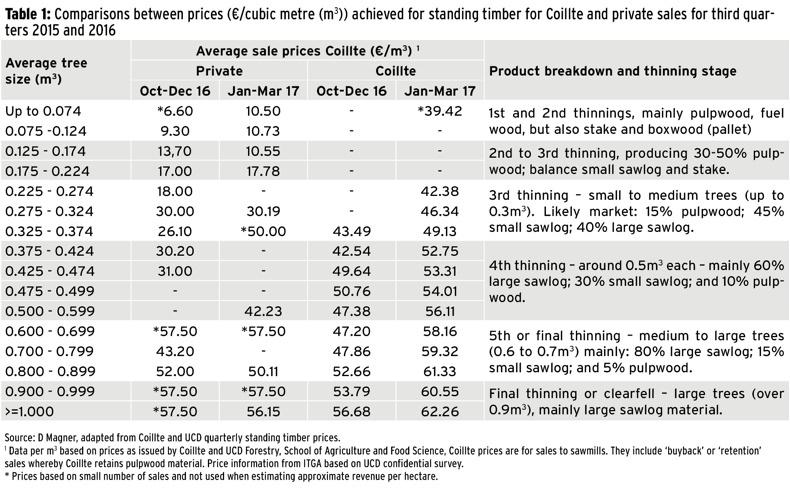

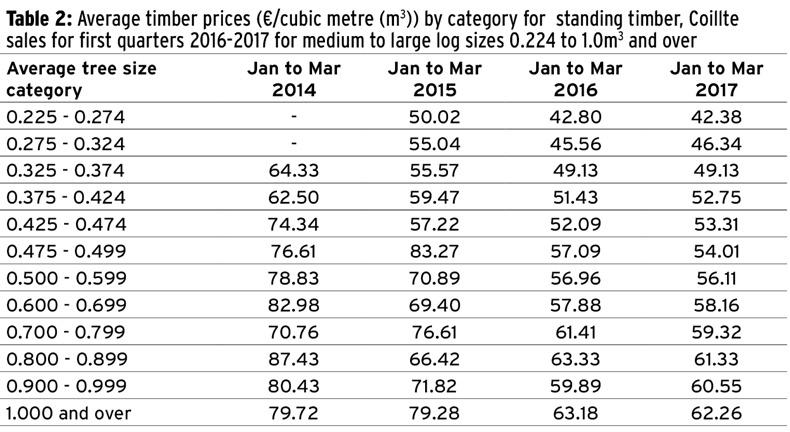

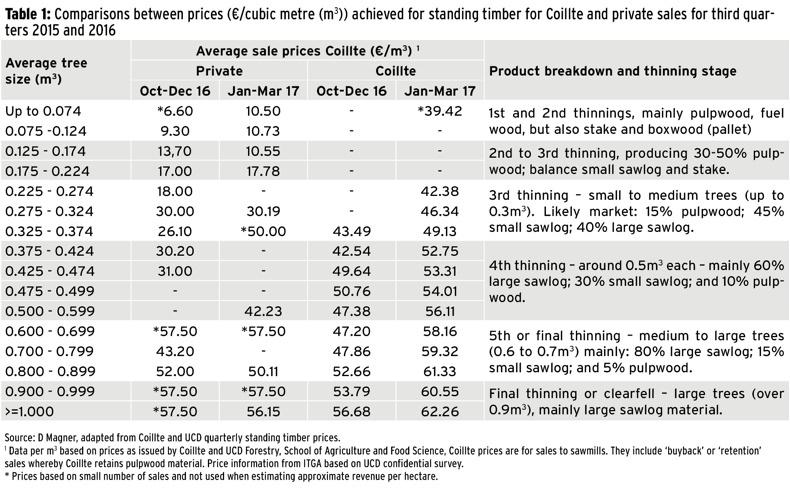

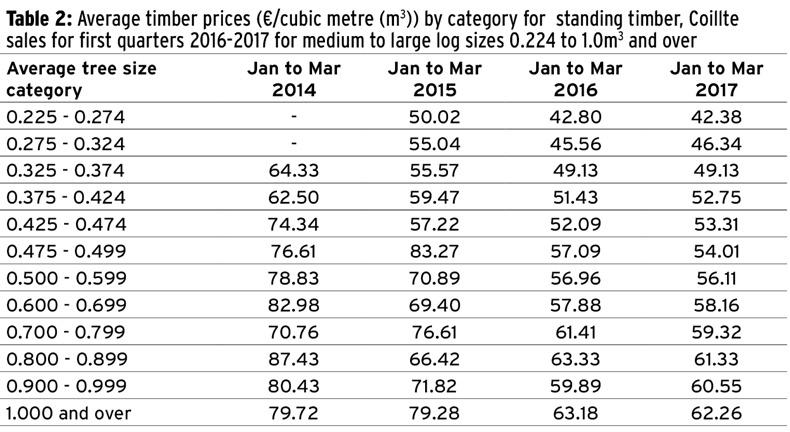

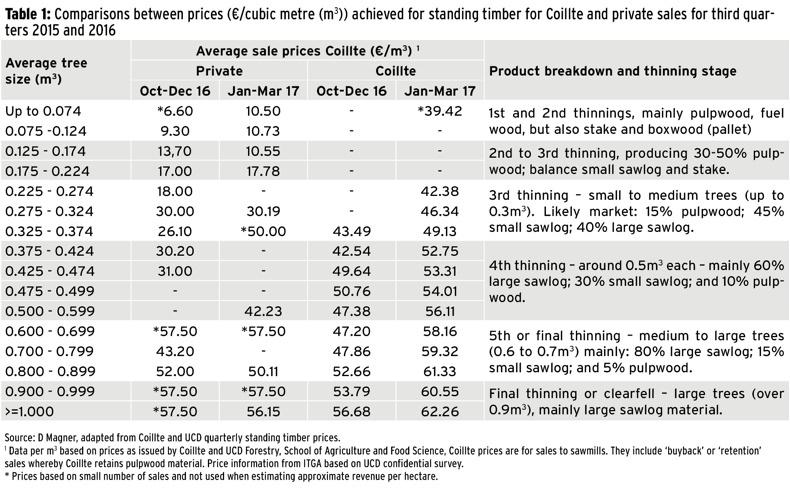

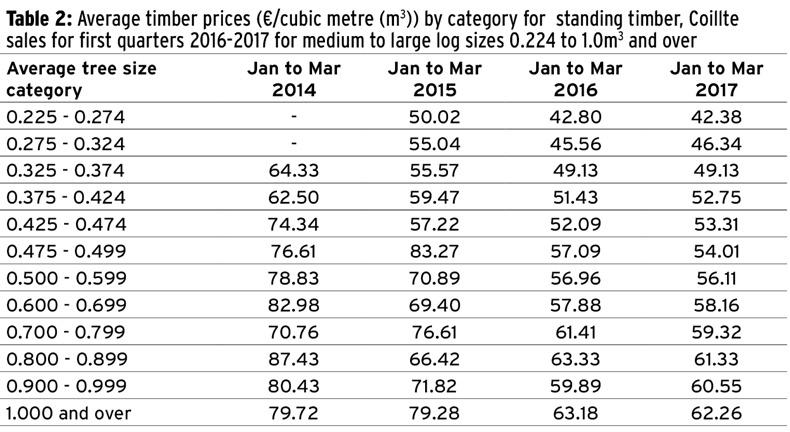

Timber prices for Coillte sales increased by an average of 14% during the period January to March compared with the final quarter of 2016 (Table 1). Prices for first quarter are broadly the same as the first quarter last year, but down by 18% compared with prices for the same period in 2015 and down by almost 25% compared with 2014 for medium to large logs (Table 2).

Coillte prices are for standing sales of medium to large logs, as the company retains small logs (pulpwood) for its panel board mills. As a result, the private sector relies on data from Wood Price Quarterly (WPQ) for small logs usually from first thinnings.

So, while the WPQ provides price data for all log size categories, most private growers will be interested in the prices achieved for small logs – pulpwood and fuel wood categories – as these are harvested from first and second thinnings or crops established from 1992 to 2001. The WPQ, which is issued by UCD in collaboration with the Irish Timber Growers Association (ITGA) for the private sector is finding its feet and still relies on prices from a small number of sales while Coillte prices cover a much larger number of transactions.

The WPQ therefore has to be treated with care when trying to assess price trends. However, for the four log size categories from .074m3 to .224m3, prices are holding firm, but prices for the larger log sizes are too inconsistent to draw firm conclusions on trends.

A spokesperson for the sawmilling sector maintained that log prices have increased for the current quarter – April to June.

He said that this price increase is down to strong demand for a scarce resource, despite Coillte making more logs available. There is general agreement that the increased supply of logs from private growers is not materialising. While log prices are down compared with 2014 and 2015, they have held up well despite current market uncertainty.

Brexit has had a significant impact on log prices since the value of sterling began to fall from €1.30 to €1.17 against the Euro by the end of last year and there has been little sign of a recovery – at the time of writing it sits at €1.14.

The advice to forest owners with crops approaching first or second thinning is to sell, as prices are solid without being spectacular. Delaying thinning is not going to add value to the crop.

On the other hand, clearfells can be delayed if price expectations are not realised. In this instance, a further thinning may be carried out, which can create revenue of between €1,800 and €2,500/ha for mature well-stocked Sitka and Norway spruce crops, while the value and volume of the remaining crop will continue to increase.

Forest certification is a system, which verifies that forests and woodlands are managed according to principles of sustainable forest management (SFM). While certification is often viewed as an environmental scheme, it is also market-oriented, as its benefits extend far beyond the forest gate.

It relates not just to the forest, but to what happens the timber after it leaves the forest to enter the wood processing and manufacturing cycle. Chain of custody (CoC) certification is required by timber processors such as sawmills and panel board mills, along with furniture manufacturers and paper producers.

However, CoC certification can only be achieved if the timber has been sourced from certified forests to begin with.

Forests are independently assessed before they are granted certification by one – or both – certification bodies, which in Ireland are the Forest Stewardship Council (FSC) and the Programme for the Endorsement of Forest Certification (PEFC).

Ireland’s sawmills and panel board mills export over 80% of their products and their international buyers and eventual consumers expect timber to be certified.

All major timber processors have CoC certification and Coillte, Northern Ireland Forest Service and Irish Forest Unit Trust forests are certified, but private forests are not.

There are three key questions asked by private forest owners before committing to certification:

Do I really need it?Is it difficult to achieve?; andHow much will it cost?Do I need certification?

Certification hasn’t been an issue up until recently for private forest owners because timber processors could purchase 30% of their logs from uncertified forests and still be allowed to stamp their products with the FSC or PEFC brands. Some mills are now about to exceed the 30% threshold, so will have to turn away timber from uncertified forests.

When a timber buyer exceeds the 30% threshold, further timber for that year has to be sourced from certified forests, so uncertified forests have limited outlets for logs.

In the short term, private forest owners will find sufficient markets, but in the medium to long term, market opportunities will be limited, as total timber production from privately owned – mainly farm – forests is forecast to reach 50% of all production by 2026 .

Is certification difficult to achieve?

Most well-managed forests with good management plans in place are sustainably managed and so can achieve certification.

However, a number of important procedures need to be followed, including stakeholder consultation.

Is certification costly?

Cost is likely to be the most contentious issue in achieving certification. The actual cost won’t be determined until the current project – funded by the Forest Service – to achieve a group forest certification template is in place.

The two participating forestry groups in the pilot scheme are the Forest Owners Co-operative Society and the North East Forestry Group. The findings of the pilot scheme will be published in June next year.

Forest certification in Munster

Forest certification is becoming increasingly important in Ireland as timber production increases from private forest owners. How seriously forest owners are taking certification could be judged by the large turnout at two recent certification events organised by the Irish Timber Growers Association (ITGA) in association with the Irish Forest Unit Trust (IForUT) in Toorlougher, Co Limerick, and last month’s public information meeting, Getting your forest certified, organised by the Forest Owners Cooperative Society (FOCS) in Macroom.

Timber growers

The ITGA field day visited IForUT’s forests located on the foothills of Slieve Felim. These forests form part of the trust’s Toorlougher management unit, which straddles the Tipperary-Limerick border. The unit comprises over 100ha of certified mixed-aged forests, with a further 127ha currently being added to the certification management plan.

The field day explored important procedures to be followed, including stakeholder consultation, management plan preparation, mapping, watercourse management, recording features such as archaeological and old woodland sites, chemical use and harvesting site management.

“Water considerations are a vital component in the management planning inToorlougher,” maintained Donal Whelan, ITGA technical director. Toorlougher forest slopes to the Clare River, so particular care has to be taken to avoid excessive water runoff during harvesting and reforestation which has been carried out nearby. “A little over a mile upstream is a special area of conservation (SAC), so harvesting has to be carried out with care and at times of heavy rainfall, the operation is suspended,” he said. To add to the restrictions, the entire management unit is within a hen harrier special protection area (SPA).

The IForUT foresters Darryn McDowell, Oisin Meagher and Stacey Bradley outlined the step-by-step approach to preparing the forest for an audit by a certification body. They emphasised the importance of a detailed forest management plan, which forms the basic building block in complying with certification requirements. “Last October, we successfully completed our 10-year FSC certification re-evaluation audit,” said ITGA chair and IForUT managing director Brendan Lacey. “We are the only large-scale private forest owner in Ireland to have FSC certification.”

The trust’s foresters outlined unforeseen challenges, such as forest management in sites where reforestation has been carried out after the storm damage in 2014. Operations discussed were harvesting – thinning and clearfell – and reforestation of cleared areas, along with associated work including species selection, planting, vegetation control and fertilisation.

The Forest Owners Co-op

The main outcome of the FOCS meeting in Macroom, chaired by Tim McCarthy, was to proceed to have the co-op’s forests certified to FSC standard within two years.

Teagasc’s John Casey and Eugene Curran of the Forest Service stressed the importance of certification from a grower’s perspective, while Conor McSwiney of GP Wood sawmills gave the industry view. “Markets for processed timber demand certification and all large processors and users of wood products in Ireland subscribe to certification,” he told the large attendance.

Karl Coggins of the Forest Service outlined the pilot project on timber certification. “This will develop a template for efficient certification of private forests, through group certification schemes,” he said.

Michael Greaney from Cloyne, who is a participant in the pilot project, praised both FOCS and the North East Forestry Group for achieving the exacting standards set by the Forest Service before they were selected for the pilot scheme. He said that any process benefiting private owners accessing the market, getting the best prices for logs and adding value to their plantations would get co-op members’ respect and support. Further information at www.focs.ie.

Early 2017 log prices up by 14% compared with final quarter in 2016

Timber prices for Coillte sales increased by an average of 14% during the period January to March compared with the final quarter of 2016 (Table 1). Prices for first quarter are broadly the same as the first quarter last year, but down by 18% compared with prices for the same period in 2015 and down by almost 25% compared with 2014 for medium to large logs (Table 2).

Coillte prices are for standing sales of medium to large logs, as the company retains small logs (pulpwood) for its panel board mills. As a result, the private sector relies on data from Wood Price Quarterly (WPQ) for small logs usually from first thinnings.

So, while the WPQ provides price data for all log size categories, most private growers will be interested in the prices achieved for small logs – pulpwood and fuel wood categories – as these are harvested from first and second thinnings or crops established from 1992 to 2001. The WPQ, which is issued by UCD in collaboration with the Irish Timber Growers Association (ITGA) for the private sector is finding its feet and still relies on prices from a small number of sales while Coillte prices cover a much larger number of transactions.

The WPQ therefore has to be treated with care when trying to assess price trends. However, for the four log size categories from .074m3 to .224m3, prices are holding firm, but prices for the larger log sizes are too inconsistent to draw firm conclusions on trends.

A spokesperson for the sawmilling sector maintained that log prices have increased for the current quarter – April to June.

He said that this price increase is down to strong demand for a scarce resource, despite Coillte making more logs available. There is general agreement that the increased supply of logs from private growers is not materialising. While log prices are down compared with 2014 and 2015, they have held up well despite current market uncertainty.

Brexit has had a significant impact on log prices since the value of sterling began to fall from €1.30 to €1.17 against the Euro by the end of last year and there has been little sign of a recovery – at the time of writing it sits at €1.14.

The advice to forest owners with crops approaching first or second thinning is to sell, as prices are solid without being spectacular. Delaying thinning is not going to add value to the crop.

On the other hand, clearfells can be delayed if price expectations are not realised. In this instance, a further thinning may be carried out, which can create revenue of between €1,800 and €2,500/ha for mature well-stocked Sitka and Norway spruce crops, while the value and volume of the remaining crop will continue to increase.

SHARING OPTIONS