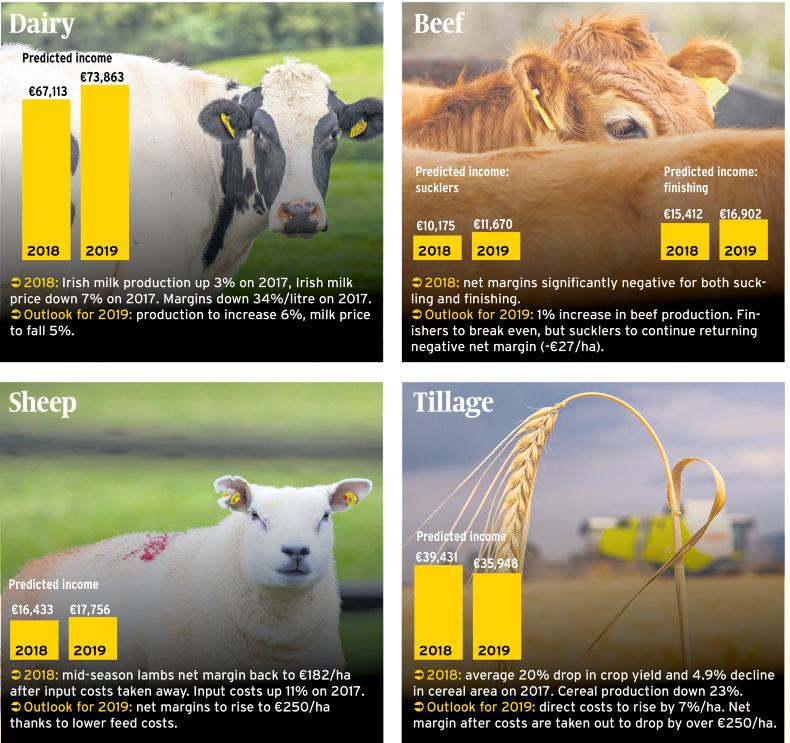

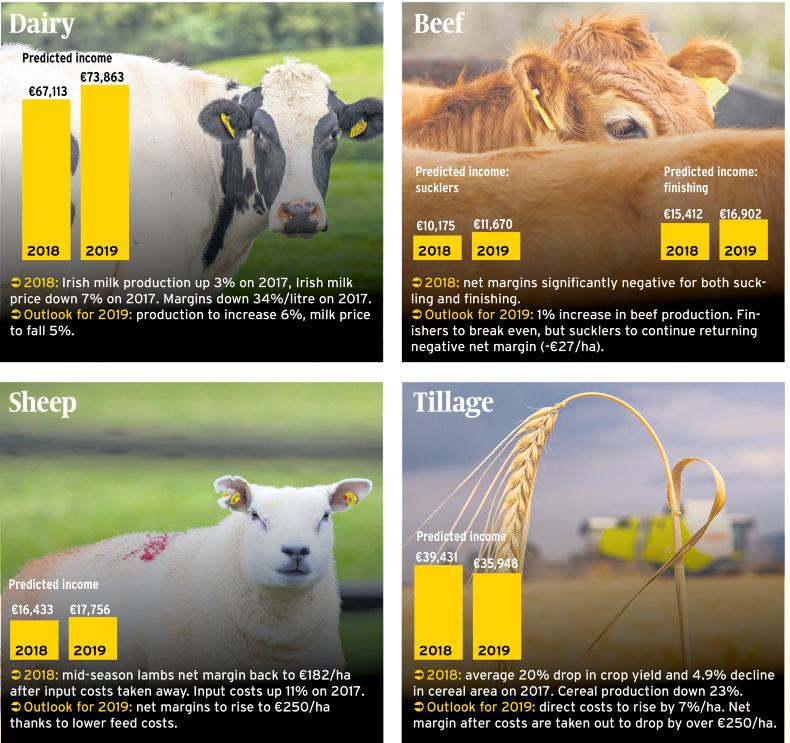

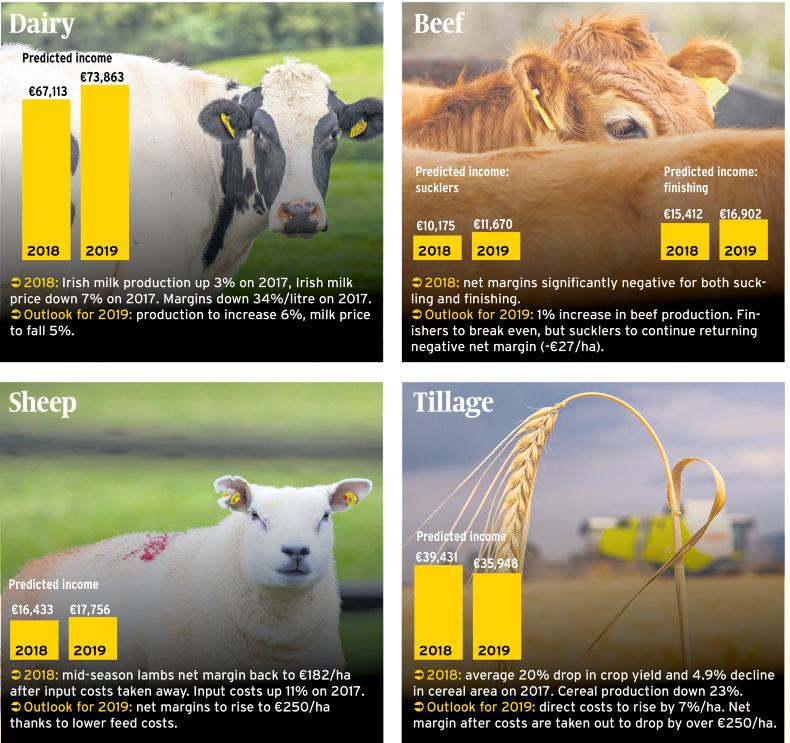

Teagasc estimates that agricultural income across all sectors has dropped by 15% this year, but is set for a 17% rebound in 2019.

Family farm income across the most common dairy, beef, sheep and tillage enterprises, however, is predicted to have fallen by 16% in 2018 and recovering by only 8% next year, according to Teagasc’s annual review and outlook.

“In 2018, the big story was increasing feed use on grassland farms,” said Teagasc economist Trevor Donnellan. “In 2019 it will be a return to more normal feed use, partly offset by higher use of fertiliser” – assuming normal weather and a Brexit withdrawal agreement.

Dairy farms took the most severe income cut this year, losing 22% on the good figures achieved in 2017. Milk prices dropped by 7%, but the feed bill delivered the toughest blow, with the average dairy cow eating 1,400kg of feed, up 38%. “This was very farm-specific,” said Teagasc’s Emma Dillon, with feed usage stable in the north and west, but up 40% in the east and 60% in the south.

A good back end has allowed farmers to increase milk supply late into the autumn, offsetting some earlier losses. Dairy feed costs are forecast to fall by a third next year, restoring average net margins to 10.8c/l – though increasing supply in New Zealand poses a milk price threat.

Drystock farms told a similar story, with feed costs increasing more than 30% across cattle and sheep enterprises. Beef finishers were hardest hit, with pressure on their margins leading to a drop in the price of younger cattle at marts.

Beef prices were higher in the first half of the year, but have dropped since the summer drought drove scores of extra cattle to European factories, said Teagasc’s Jason Loughrey.

Prices are expected to remain stable next year, but reduced feed costs for finishers should allow them to pay an extra 4% for young stock in 2019, he added.

Sheep farm income was protected by a 6% rise in lamb prices this year and should see margins increase next year.

Pigs

Pig farmers have had a “very tough year,” said Teagasc’s Ciaran Carroll, with their margin over feed dropping to 33c/kg – 17c short of breakeven point. Each pig produced this year made a loss of €14 for the farmer.

Feed costs soared as cattle and sheep farmers competed for supplies, while reduced Chinese import and increased north American supply pushed pigmeat prices down. The spread of African swine fever in China is likely to result in a mass cull there. “Their cloud has a silver lining,” said Carroll. “It is expected that pigmeat will rise as a result.”

If the US-China trade war continues, Europe would be the natural supplier for recovering Chinese imports, with Irish pig farmers returning to profitability in the second half of 2019.

Read more

Dairy hits Food Harvest expansion target

Listen: farm incomes drop 15% – Teagasc

Tillage sector bucks trend – for better or worse

Teagasc estimates that agricultural income across all sectors has dropped by 15% this year, but is set for a 17% rebound in 2019.

Family farm income across the most common dairy, beef, sheep and tillage enterprises, however, is predicted to have fallen by 16% in 2018 and recovering by only 8% next year, according to Teagasc’s annual review and outlook.

“In 2018, the big story was increasing feed use on grassland farms,” said Teagasc economist Trevor Donnellan. “In 2019 it will be a return to more normal feed use, partly offset by higher use of fertiliser” – assuming normal weather and a Brexit withdrawal agreement.

Dairy farms took the most severe income cut this year, losing 22% on the good figures achieved in 2017. Milk prices dropped by 7%, but the feed bill delivered the toughest blow, with the average dairy cow eating 1,400kg of feed, up 38%. “This was very farm-specific,” said Teagasc’s Emma Dillon, with feed usage stable in the north and west, but up 40% in the east and 60% in the south.

A good back end has allowed farmers to increase milk supply late into the autumn, offsetting some earlier losses. Dairy feed costs are forecast to fall by a third next year, restoring average net margins to 10.8c/l – though increasing supply in New Zealand poses a milk price threat.

Drystock farms told a similar story, with feed costs increasing more than 30% across cattle and sheep enterprises. Beef finishers were hardest hit, with pressure on their margins leading to a drop in the price of younger cattle at marts.

Beef prices were higher in the first half of the year, but have dropped since the summer drought drove scores of extra cattle to European factories, said Teagasc’s Jason Loughrey.

Prices are expected to remain stable next year, but reduced feed costs for finishers should allow them to pay an extra 4% for young stock in 2019, he added.

Sheep farm income was protected by a 6% rise in lamb prices this year and should see margins increase next year.

Pigs

Pig farmers have had a “very tough year,” said Teagasc’s Ciaran Carroll, with their margin over feed dropping to 33c/kg – 17c short of breakeven point. Each pig produced this year made a loss of €14 for the farmer.

Feed costs soared as cattle and sheep farmers competed for supplies, while reduced Chinese import and increased north American supply pushed pigmeat prices down. The spread of African swine fever in China is likely to result in a mass cull there. “Their cloud has a silver lining,” said Carroll. “It is expected that pigmeat will rise as a result.”

If the US-China trade war continues, Europe would be the natural supplier for recovering Chinese imports, with Irish pig farmers returning to profitability in the second half of 2019.

Read more

Dairy hits Food Harvest expansion target

Listen: farm incomes drop 15% – Teagasc

Tillage sector bucks trend – for better or worse

SHARING OPTIONS