The deal between ABP Food Group and the Linden Foods Group is strategic. For Linden, the 50:50 joint venture will allow its Slaney Foods business capitalise on the global reach of the ABP Food Group. As the potential for Irish beef exports extends beyond Europe, routes to market become increasingly complex. Developing the US and Chinese markets will not only require scale but also heavy investment in the brand development and marketing necessary to secure new business. While a significant player in the Irish beef and sheep market, Slaney Foods as a sole entity would have struggled to develop its reach into new markets.

Surprise to the industry

It will certainly come as a surprise to the industry that ABP has entered into a joint venture, having traditionally acquired businesses outright. Also the relationship between Linden Foods and ABP would have traditionally been strained, especially north of the border where the two businesses compete aggressively for stock. It will be interesting to see if this competition remains as the deal does not include Linden Foods' beef business in Northern Ireland.

However, there are clear benefits in the deal for ABP. It further reinforces its grip on the premium retail business both in Ireland and Britain. Slaney Foods and Irish Country Meats (ICM) have developed strong business with Lidl, Tesco and Marks & Spencer. The move will also strengthen ABP’s supply chain and reduce the group’s need for inter-trading with other processors. In recent years, Slaney Foods has invested heavily in developing a state of the art cattle slaughter and de-boning facility, increasing capacity to 85,000 head per annum, or 6% of the national kill.

Focus on the sheep meat business

The move also sees the ABP Group further increase its focus on the sheep meat business. Prior to the acquisition of the RWM Food Group in Britain in 2011, the only ABP factory to process sheep meat was ABP Lurgan with an annual throughput of 180,000 sheep per annum. The RWM acquisition increased sheep throughput for the group to over one million head per annum. ICM currently controls around 40% of the Irish sheep kill, with processing facilities in Belgium also.

There is no doubt that this deal will add value to the supply chain. However, the question for farmers is how much will pass back to them? The increasing dominance of the ABP Food Group in both Britain and Ireland is certainly causing concern. At present, ABP controls 22% of the Irish cattle kill along with 18% of the UK kill. Should the Competition Authority approve the current deal, the group's share of the Irish kill will increase to 28%. While the Irish Farmers Journal factory price leagues showed ABP to have been aggressive in the market for in-spec steers and heifers in the first half of 2015, traditionally the group's performance has lagged behind its competitors.

Reaction from farmers

IFA National Livestock Committee chair Henry Burns said the proposed investment causes "serious concerns" for cattle and sheep farmers over competition and the concentration of the kill.

“Competition in the beef and lamb trade is always a contentious issue between farmers and factories," he said. "Farmers are rightly concerned with the over-dominance of a number of major players at both processing and retail level."

General secretary of the ICSA Eddie Punch said he is "perturbed" about the proposed deal. He said the beef industry "is already highly concentrated. We think that the Competition Authority should cast a cold eye on this in light of the fact the beef industry is dominated by ABP, Kepak and Dawn Meats already."

He added that "there's not enough competition for stock and the fact is that ABP is also very dominant in the beef industry in the UK. This is the last thing the beef industry wants."

Michael Doran, a dairy and beef farmer from Duncormick, south Wexford, who sells 90% of his cattle to Slaney Meats, said he and other farmers in the area were concerned and shocked when they heard the news. "There is a lack of independent players in the field already. This will further decrease competition in the beef processing industry," he said.

He also drew attention to the fact that Linden Foods and ABP remain competitors in the north. "This probably means there will be less competition in the north now they are in partnership in the south."

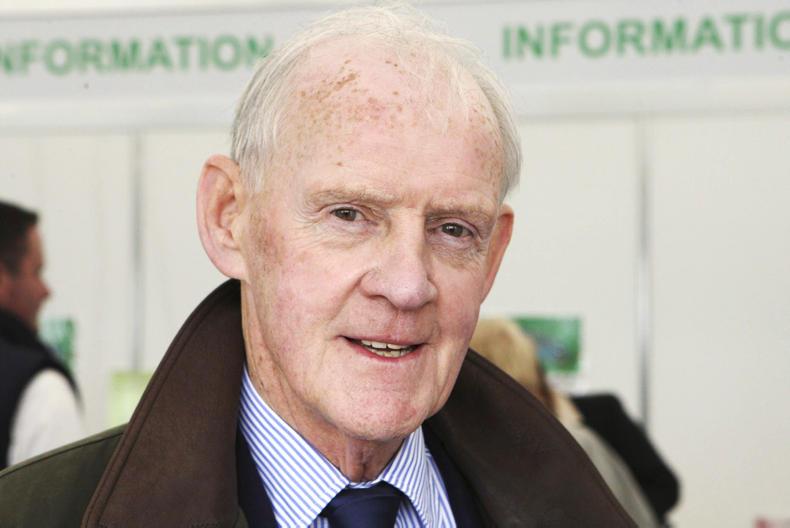

Angus Woods, a sheep and cattle farmer in Co Wicklow, who supplies cattle to Slaney Meats in Bunclody, Co Wexford, and lambs to ICM in Camolin, said he was "shocked" by the news.

"It is disappointing to lose another competitor in the industry," he said. "ABP already have a huge presence in the UK and in parts of Europe. Is it going to take over the whole continent?"

Woods supplies between 800 and 900 lambs a year to ICM. "While these big deals are made between processors, farmers are the ones left struggling to get a fair return from the market," he added.

Read more

ABP to acquire 50% stake in Slaney Meats and Irish Country Meats

SHARING OPTIONS