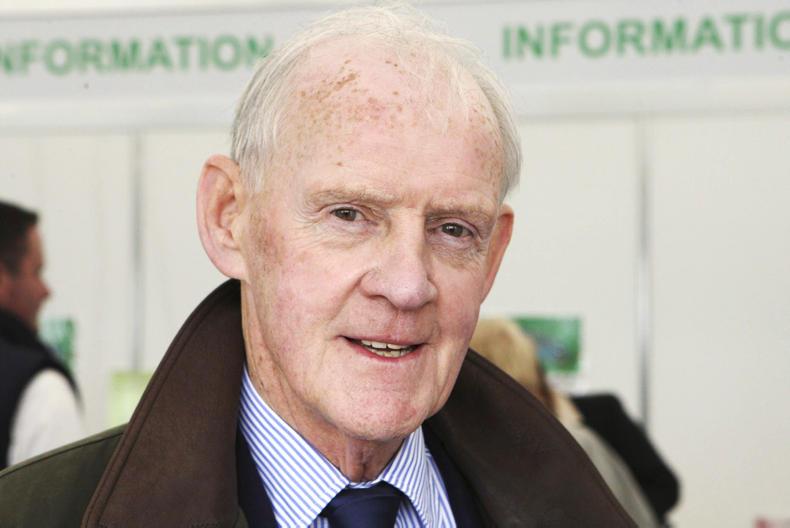

Last week, Larry Goodman’s ABP Food Group put the whole issue of farm levies back under the spotlight. The decision to cease the automatic collection of the European Involvement Fund (EIF) levy on behalf of farmers was, according to ABP, in response to farmer disquiet.

Larry Goodman was never known to worry greatly about what farmers wanted or liked, yet he picked up on farmer disquiet with the IFA levy in factories and marts to land a blow on the organisation.

Few could argue that in the run-up to the events of last November – and in the intervening period – farmers have been expressing their anger with the IFA through the cancellation of levies – particularly the portion collected through meat factories and marts.

Nevertheless, the move took the industry, which has always tended to move en masse around such sensitive issues, and indeed the IFA by surprise. It is the first time I can recall that ABP chose to embark on a solo run on what it knew in advance would be a very sensitive issue. ABP and Larry Goodman were never known before to bow to farmer interests where they didn’t overlap perfectly with their own. We can be certain in this instance, therefore, that it suited Larry Goodman and ABP first and foremost to make it more difficult for the IFA to have its levies collected in his factories.

All this suggests that there is something bigger at play. The IFA believes that ABP is trying to use levies as a lever to force it to drop its opposition to the proposed joint venture between ABP and Slaney Foods. It is encouraging to see that in this instance the levy has clearly not influenced IFA policy, despite the financial fallout.

While ABP has strenuously denied any link, the fact that it has not extended the same level of transparency to all levies raises questions. Our examination of levies brings into focus the dubious insurance deduction made by factories on farmers – which in the case of cows is over twice that of the EIF levy.

The insurance is a unilateral deduction made by factories on cattle that they have visually inspected and believe will be passed fit in their entirety for human consumption. Where they have any doubt from this inspection, insurance isn’t deducted and animals are processed at owners’ risk – in many cases without the prior knowledge of farmers.

From a farmers’ perspective, this insurance should be a much bigger issue than the EIF levy, both in terms of the cost and lack of transparency. It is not subject to insurance industry regulation and farmers do not have an option for opting out or accessing an alternative provider.

Last week, Larry Goodman created a precedent that – if established for the right reason – he must now extend to even more costly levies imposed on farmers. It now falls to him to set the example on insurance and make it an opt-in arrangement, like the EIF payment. Even the option for farmers to opt out would be a start.

By doing so, he will give credibility and authenticity to his reasons for doing what he did with the IFA and create the opportunity for farmers to have choice on insurance for cattle going to the factory.

Otherwise, the reason for last week’s move will be seen as landing a blow to damage Ireland’s largest farm representative organisation at a time when it is vulnerable and restructuring its operations in the aftermath of the crisis of last autumn.

Whatever the reason for Goodman’s decision, the IFA cannot ignore the impact of the move on the financial viability of the organisation. It was too easy for the committee to recommend that the existing membership/levy model was the most fair and equitable.

Of course, we could argue that at €15 per €10,000 of sales, the EIF represents good value for money – and it does. But as we outline this week, the corporate governance and verification process around the EIF are not fit for purpose. Goodman seized on the IFA failing to act decisively on something that clearly remains a very serious issue among farmers.

On pages 18-20, we carry out an in-depth look at the wider levy collection business in factories, dairies, marts and grain merchants. It will no doubt shock farmers to find out that they are paying up to €50m per annum in the form of levies for various services and schemes. While the EIF levy receives much attention, the reality is it is less than 10% of all levies collected from farmers.

Read more

Analysis: €50m in levies taken from farmers

Levies back under scrutiny two months after June approval of status quo

Industry not following Goodman's lead

Levy collectors must stand over their accounts - Bergin

Levies back under scrutiny two months after June approval of status quo

Ongoing dispute sparks big reaction from farmers

Larry and the levies: the IFA responds

Don't reply to Larry's letter - Healy

Larry Goodman and the IFA - a history

The governance of all farm organisations

Last week, Larry Goodman’s ABP Food Group put the whole issue of farm levies back under the spotlight. The decision to cease the automatic collection of the European Involvement Fund (EIF) levy on behalf of farmers was, according to ABP, in response to farmer disquiet.

Larry Goodman was never known to worry greatly about what farmers wanted or liked, yet he picked up on farmer disquiet with the IFA levy in factories and marts to land a blow on the organisation.

Few could argue that in the run-up to the events of last November – and in the intervening period – farmers have been expressing their anger with the IFA through the cancellation of levies – particularly the portion collected through meat factories and marts.

Nevertheless, the move took the industry, which has always tended to move en masse around such sensitive issues, and indeed the IFA by surprise. It is the first time I can recall that ABP chose to embark on a solo run on what it knew in advance would be a very sensitive issue. ABP and Larry Goodman were never known before to bow to farmer interests where they didn’t overlap perfectly with their own. We can be certain in this instance, therefore, that it suited Larry Goodman and ABP first and foremost to make it more difficult for the IFA to have its levies collected in his factories.

All this suggests that there is something bigger at play. The IFA believes that ABP is trying to use levies as a lever to force it to drop its opposition to the proposed joint venture between ABP and Slaney Foods. It is encouraging to see that in this instance the levy has clearly not influenced IFA policy, despite the financial fallout.

While ABP has strenuously denied any link, the fact that it has not extended the same level of transparency to all levies raises questions. Our examination of levies brings into focus the dubious insurance deduction made by factories on farmers – which in the case of cows is over twice that of the EIF levy.

The insurance is a unilateral deduction made by factories on cattle that they have visually inspected and believe will be passed fit in their entirety for human consumption. Where they have any doubt from this inspection, insurance isn’t deducted and animals are processed at owners’ risk – in many cases without the prior knowledge of farmers.

From a farmers’ perspective, this insurance should be a much bigger issue than the EIF levy, both in terms of the cost and lack of transparency. It is not subject to insurance industry regulation and farmers do not have an option for opting out or accessing an alternative provider.

Last week, Larry Goodman created a precedent that – if established for the right reason – he must now extend to even more costly levies imposed on farmers. It now falls to him to set the example on insurance and make it an opt-in arrangement, like the EIF payment. Even the option for farmers to opt out would be a start.

By doing so, he will give credibility and authenticity to his reasons for doing what he did with the IFA and create the opportunity for farmers to have choice on insurance for cattle going to the factory.

Otherwise, the reason for last week’s move will be seen as landing a blow to damage Ireland’s largest farm representative organisation at a time when it is vulnerable and restructuring its operations in the aftermath of the crisis of last autumn.

Whatever the reason for Goodman’s decision, the IFA cannot ignore the impact of the move on the financial viability of the organisation. It was too easy for the committee to recommend that the existing membership/levy model was the most fair and equitable.

Of course, we could argue that at €15 per €10,000 of sales, the EIF represents good value for money – and it does. But as we outline this week, the corporate governance and verification process around the EIF are not fit for purpose. Goodman seized on the IFA failing to act decisively on something that clearly remains a very serious issue among farmers.

On pages 18-20, we carry out an in-depth look at the wider levy collection business in factories, dairies, marts and grain merchants. It will no doubt shock farmers to find out that they are paying up to €50m per annum in the form of levies for various services and schemes. While the EIF levy receives much attention, the reality is it is less than 10% of all levies collected from farmers.

Read more

Analysis: €50m in levies taken from farmers

Levies back under scrutiny two months after June approval of status quo

Industry not following Goodman's lead

Levy collectors must stand over their accounts - Bergin

Levies back under scrutiny two months after June approval of status quo

Ongoing dispute sparks big reaction from farmers

Larry and the levies: the IFA responds

Don't reply to Larry's letter - Healy

Larry Goodman and the IFA - a history

The governance of all farm organisations

SHARING OPTIONS