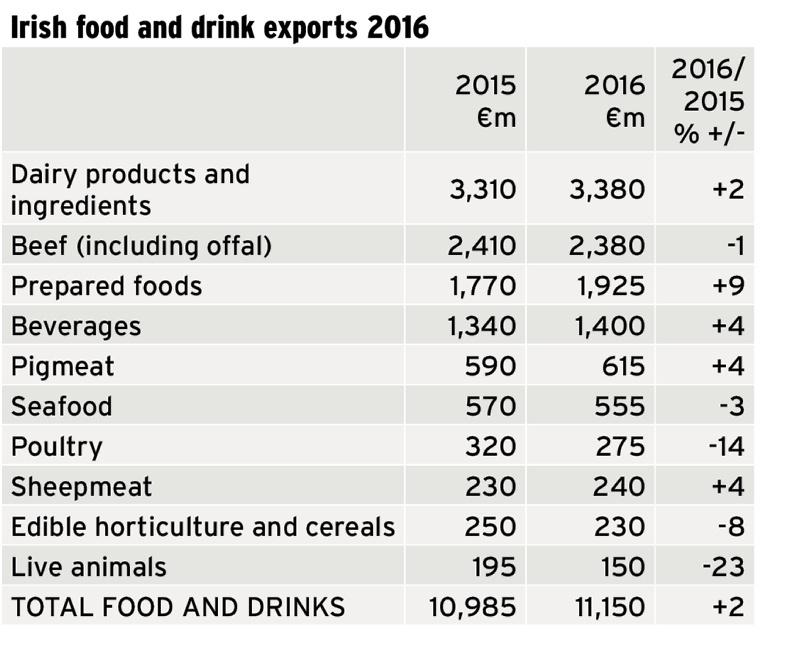

€3.38bn

Dairy exports were valued at €3.38bn, an increase of 2%

Dairy product and ingredient exports rose by 2% to €3.38bn last year. Dairy exports have grown by 50% in five years, rising from €2.25bn in 2010 to €3.3bn last year.

Irish milk supplies rose by 5% last year, while international dairy prices were down for much of the year but rallied in the second half of the year.

Specialised nutritional dairy powders were the strongest growth category in 2016, while whey, whole milk powder and yoghurt also grew. Butter exports fell as higher volumes were offset by lower prices. Cheese too had higher volumes but lower prices.

Exports to the UK fell by 10% in value to €840m and exports to other EU markets fell by 6% to €880m.

However, exports to international markets grew by 19% to €1.66bn – or almost half of all dairy exports. Asia led the way, increasing by 31%, to account for 23% of total dairy exports.

€2.38bn

Beef exports were valued at €2.38bn, a decrease of 1%

Beef exports fell 1% to €2.38bn, despite a 5% increase in the number of cattle slaughtered at export meat plants and a total of 535,000t of beef for export. The volume increase offset a drop of more than 6% in average cattle prices.

The UK took half of all Irish beef exports, a drop of 2%. The 270,000t exported to the UK was worth €1.1bn. Irish exports to the UK were 12% less competitive due to weakened sterling.

Exports to continental Europe grew by 9% to 240,000t but again the higher volume of beef was dampened by lower prices. The continental European market trade amounted to €1bn.

International markets recorded the biggest growth in 2016, climbing to 25,000t worth €60m. Growth areas for Irish beef included the Philippines, the US and Switzerland.

€275m

Poultry exports decreased by 14%

Poultry exports fell by 14% to €275m. This was due to stronger supplies across the EU and lower prices.

The value of trade to Ireland’s biggest poultry market, the UK, fell by more than 10% last year due to lower volumes and a significant reduction in prices. The UK accounted for €235m or 85% of the total Irish poultry exports.

The value of exports to other European markets also fell by around 30% to €20m.

€615m

Pigmeat exports increased by 4%

Pigmeat exports increased by 4% to €615m.

A 3% increase in Irish production, a modest increase in EU output and higher global prices led to an improvement in the market for Irish pigmeat last year.

Irish pig producer prices were up 2% at €1.46/kg, while European prices were 3% higher in 2016 compared to 2015.

Pig slaughterings at export meat plants were up 3% to 3.26m head, equating to 285,000t.

Currency fluctuations cut the British trade by 4% to 88,000t worth €345m last year.

China remained the

second largest export market for Irish pigmeat, taking 65,000t last

year.

Sheepmeat exports grew by over 4% to €240m last year.

Total sheep disposals rose 3% last year to 2.67m head. Some 49,000t of sheepmeat was available for export and steady average lamb prices of €4.81/kg resulted in the 4% increase in the value of exports.

Export volumes to France and the UK fell by 2% and 4% respectively but key growth markets in Europe were Germany, Belgium, Sweden and Denmark.

€150m

Livestock exports declined by 23% to €150m

Livestock exports fell by 23% from €195m in 2015 to €150m last year.

Cattle exports fell by 18% to 146,000hd, with the biggest fall (50%) recorded in the finished cattle bracket, mainly exported to the UK. Calf export numbers fell by 16% to 73,000hd as tighter transport regulations restricted trade and Irish calf prices were less competitive.

Weanling and store exports were 14% ahead of 2015 as new market access to Turkey and a renewal of trade to north Africa countered the reduced demand from markets such as Italy. In all, 49,000hd of weanlings and stores were exported.

Cattle exports to non-EU markets such as Turkey and Libya more than doubled last year.

Some 46,000hd of live sheep were exported to France, Belgium Netherlands and Germany last year. Live pig exports to Northern Ireland fell by 18% to 414,000hd due to strong demand at home and shifting exchange rates.

SHARING OPTIONS