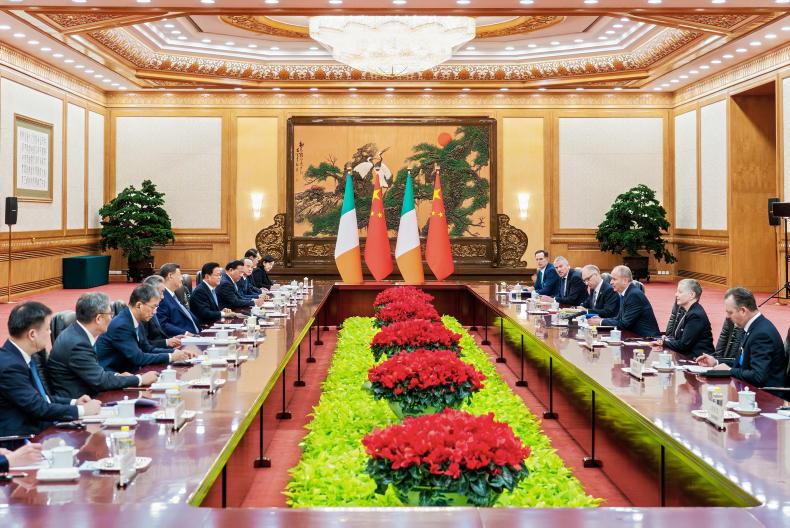

This week European Commissioner for Agriculture Phil Hogan is leading a group of senior business executives on a mission to China and Japan. First-time visitors will be seeing firsthand what is needed to do business in this rapidly developing market.

Others, like many of the delegation, will see it as part of an ongoing process to begin and maintain supplies to this huge market.

Importance to Ireland

Since the move to a market economy, China has experienced decades of double-digit economic growth, making it the second-largest economy in the world. It has a population of 1.4bn, a third of whom have been lifted out of poverty by the sustained economic growth. However, 100m of the population are still considered to live in poverty. Two things in particular make it an exciting prospect for the Irish food industry. First, it has an ever-increasing middle class who prioritise quality food above price. Secondly, its huge population and mountainous terrain, which leaves only 11% of the land arable, means food supply security is always an issue. This is where Ireland can fit in.

We are already approved for dairy and pigmeat. Beef remains a work in progress, hopefully coming to fruition later this year. Irish participation was limited in China to Glanbia, which has targeted it as a developing market to complement its huge business in the US, and Bord Bia through its Asia office. It is clearly a market with huge potential, and Irish beef factories are confident they can quickly build business there if they can get approval. A developing and expanding market for Irish beef is something farmers urgently need.

Are others interested?

The Chinese market is attractive to every major food exporter. New Zealand, Australia, Argentina, Uruguay and Brazil are all suppliers already. Brazil is an interesting case. In May last year Ireland had a visit from the Chinese Premier Mr Li Keqiang, which was heralded as a sign business was imminent. We are still waiting, but when he left Ireland his next stop was Brazil who had seven factories approved by June 2015 and more added in the following months bringing it up to around twenty at present. What’s more, by February this year, Brazil had displaced Australia as the top-volume supplier of beef, putting in 20,000t in the first two months, with Australia and Uruguay contributing a further 30,000t between them.

Is there still an opening?

In a market like this, the answer is always yes. Brazil brings low prices and huge volumes to the table but, with much of its cattle sourced from tropical breeds, the eating quality is not very high. New Zealand, Uruguay and Argentina are all viewed as having better beef cattle, which reflects the fact that they have a low or in some cases non-existent presence of tropical breed genetics in their cattle. Ireland too can pitch at the higher-value end of the market.

This has been done successfully in the dairy sector, where Ireland and Germany are the go-to countries for China in sourcing infant formula, much more trusted than their own domestic production. It was clear from the Chinese organised events during the visit that quality and product integrity were crucial, with the hosts keen to showcase a huge organic farm development on the outskirts of Shanghai. In the seminar that followed on Green Agriculture and Sustainable Trade, the Origin Green story delivered by James McDonnell, who heads the Bord Bia Asia office, struck a particular chord.

What do we need to do?

In the case of dairy and pig meat it is a case of building and upgrading the market as we go, with China already the next most important destination after the UK for these products. One issue is tariffs on entry. These are currently at 15% for food products though, as one seminar highlighted, they often are unilaterally hiked by up to 10% overnight. This would also apply to beef if we got approval and we would be at a disadvantage with New Zealand, which has a zero tariff on its exports to China, while Australia signed a trade deal in 2014 with China which puts it on a reducing rate, leading to elimination of tariffs by 2023. South American countries are also currently on 15%.

The EU has been engaging with China on tariffs and this was again raised by Commissioner Hogan in meetings with Chinese ministers and officials.

Was it a success?

The line about it being too early to judge the impact of the French revolution attributed to a senior Chinese politician reflects the slow pace at which business is developed. It will be on Chinese terms and conditions and nothing will change that behaviour. The Commissioner and the business delegation knew this and didn’t go expecting to bring huge orders with them. It is, however, part of the relationship building process that has to be done and repeated. They appreciate political interest at a senior level and the fact that the Commissioner dedicated several days to the visit and participating in a range of events does cement that relationship. Also, as the rapid development of business with Brazil for beef in the second half of 2015 demonstrated, when the mood takes them they can move really fast. It won’t be a quick win by the Commissioner rather a milestone along the way in securing a market well worth the effort.

SHARING OPTIONS