After plunging in 2015, Chinese dairy import demand appears resurgent this year, with imports for the first half of 2016 up more than 30% year-on-year in volume terms. The latest figures from China show total dairy imports from January to June 2016 at 1.2m tonnes, a sharp increase from the previous year when imports for the first half of 2015 were below 930,000t.

At these sort of levels, it’s conceivable that the volume of dairy imported by China by the end of the year could reach the lofty heights we saw in 2013 and 2014. However, a note of caution is warranted.

While these figures suggest Chinese demand has recovered, the price point of dairy commodities has certainly changed for the country’s buyers. Despite import volumes increasing by almost a third in the first half of this year, the value of imports has increased by less than 13% to just over €3bn.

Bottoming out

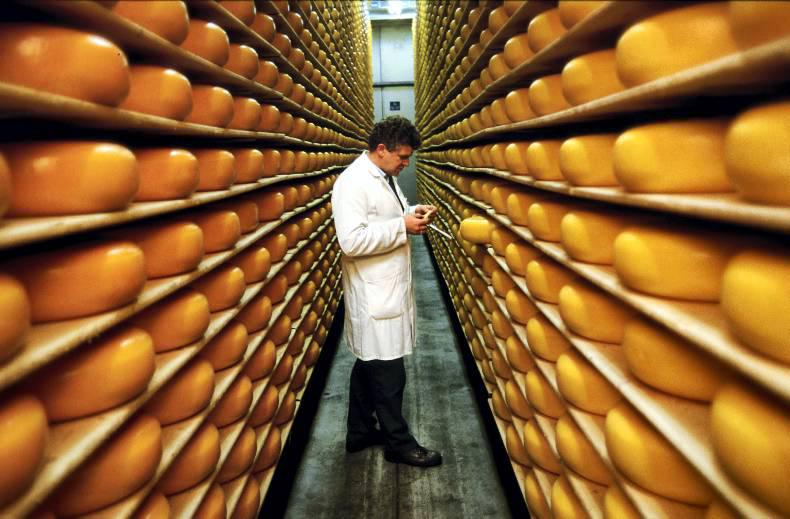

The bottoming out of global dairy commodity markets has certainly attracted Chinese buyers into the market so far this year. China has become the largest importer of butter from the EU 28 and is Ireland’s second largest market for dairy exports after the UK.

The big question will be if demand can be sustained now that we are seeing definitive price increases for butter and cheese, particularly in Europe.

At the same time, the bulk of Chinese dairy imports are accounted for by milk powders, which have struggled to gain any real upward price momentum. Whole and skimmed milk powder as well as whey powder account for a combined 53% of Chinese dairy imports, but prices for these commodities remain at stubbornly low levels.

Chinese imports of WMP alone are almost 25% ahead of this time last year at 294,000t but export prices for WMP have made only modest gains since February. However, in its latest report on the health of the global dairy market, the USDA said that milk powder prices may finally be in the “early stages of a recovery” as lower global supplies, coupled with the increased demand from China, help to lift the market.

Oversupplied

The USDA did warn that world prices for SMP are likely to remain challenged and could hamper a recovery in milk powder prices. Massive supplies of SMP for export in the US, coupled with a substantial volume of SMP product in intervention storage in the EU, mean the world market is currently overhung with stocks of SMP.

“These recent increases in milk powder prices may be the first sign of a realignment of markets that are slowly coming into balance as the milk oversupply situation is corrected. Nevertheless, while prices may trend upwards for the balance of the year, this progress will probably be unsteady and will likely be hampered by the substantial stocks of SMP. Any significant recovery appears unlikely until well into 2017,” added the USDA.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: