In last week’s paper, we saw how Chinese dairy imports had recovered by more than 20% in volume terms to 2.3bn tonnes in 2016. This was driven by strong growth in demand for infant formula (+25%) and whole milk powder (WMP +21%) in particular.

Figures released from New Zealand this week give some further indication as to the current health of Chinese demand for dairy. In December 2016, New Zealand exported close to 119,000t of whole and skim milk powder (SMP) to China, a 13% increase compared with last year.

This is the highest level that New Zealand milk powder exports to China have been since 2013 – a record year for Chinese demand.

December is always a big month for Chinese dairy buyers as they look to take advantage of the tariff-free window on dairy products delivered in the month of January.

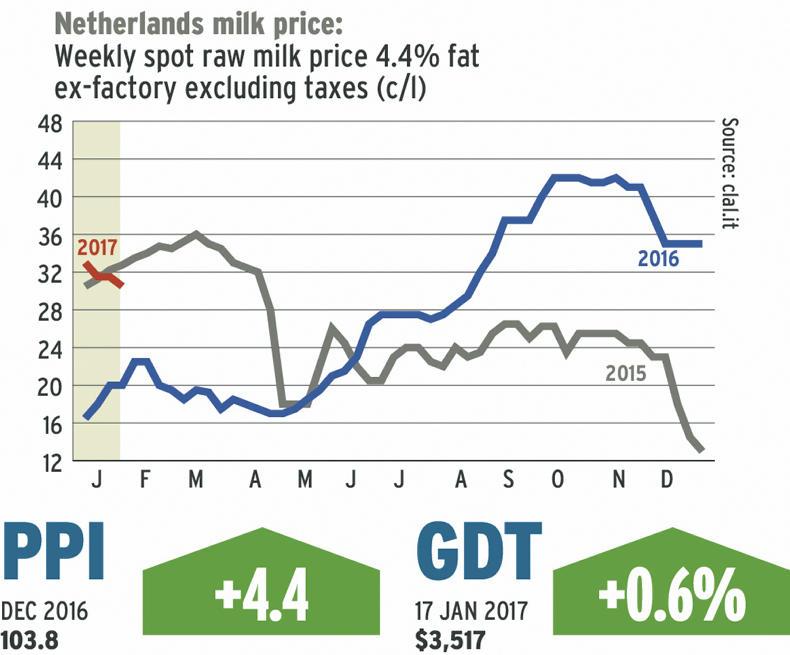

This surge in buying activity is the principal reason we saw WMP prices surge to highs of about $3,500/t through November and December, which helped boost the GDT index in the last months of 2016.

After this flurry of activity, Chinese buying has dropped off in January as expected and this has contributed to the modest slide in WMP prices to below $3,300/t.

The slowdown in milk production in New Zealand means the outlook on WMP prices remains positive.

However, for SMP, the slow unwinding of the EU Commission’s massive intervention stocks continues to set a low ceiling on market returns.

SHARING OPTIONS