Glanbia has had a good run of it. Its share price is up 50% year on year. It successfully spun out a further 6% to farmers in June and the co-op is now valued in excess of €2bn.

But Glanbia’s decision to lower its base milk price last week raises questions over the company’s pricing model and margin protection in the processing joint venture, GII. But it’s not just dairy farmers who are concerned, as dry shareholders and grain suppliers are also questioning the inequality of the co-op dividend policy.

Transparent complexity

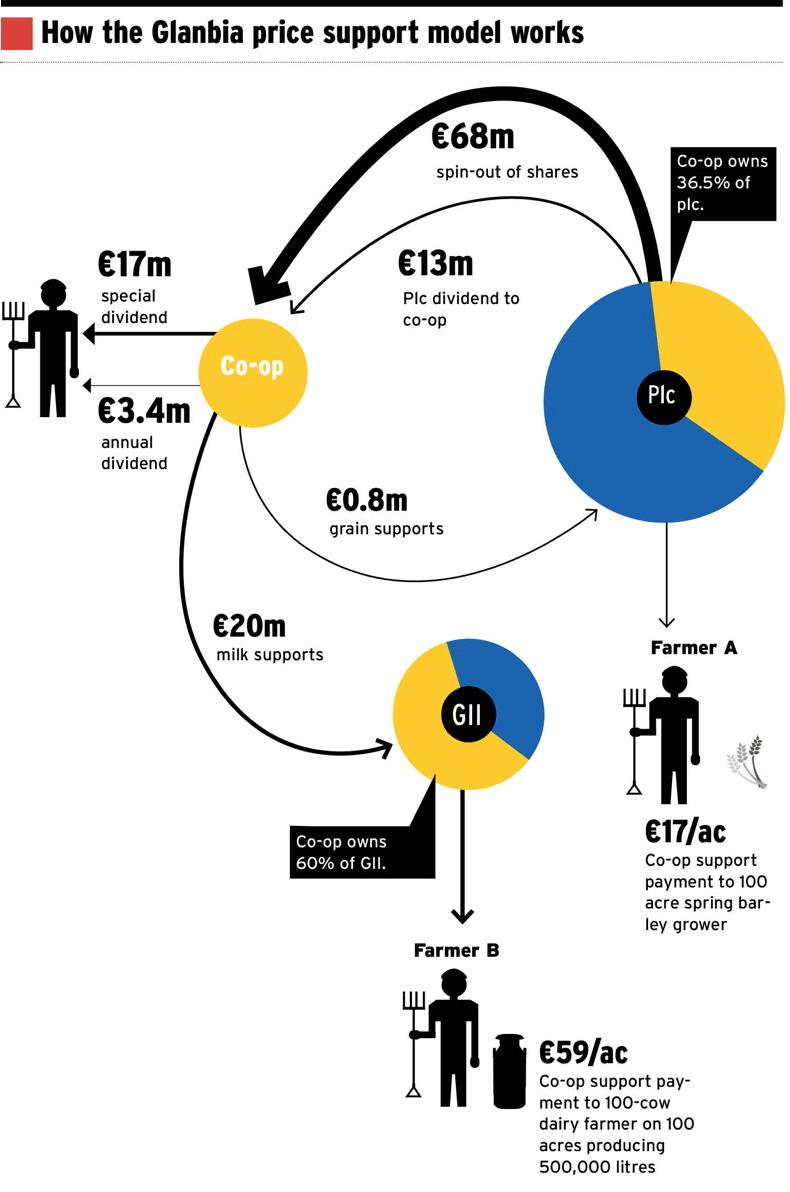

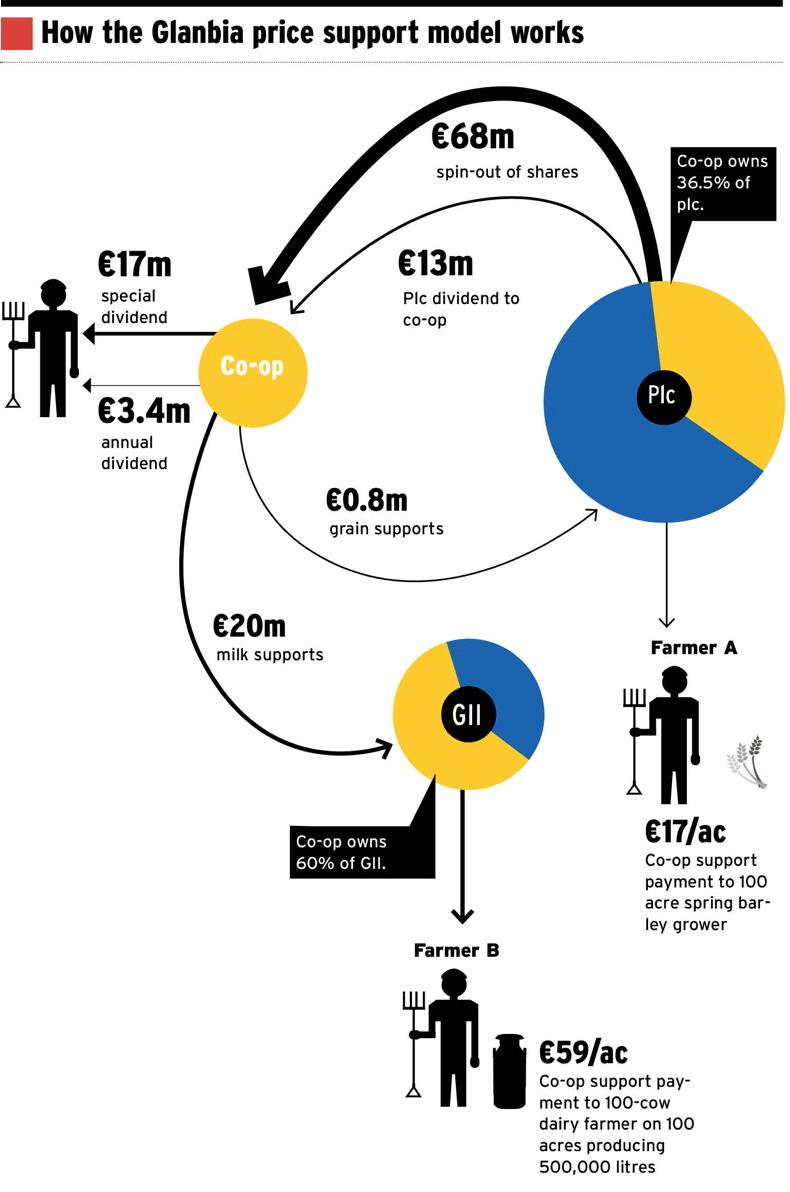

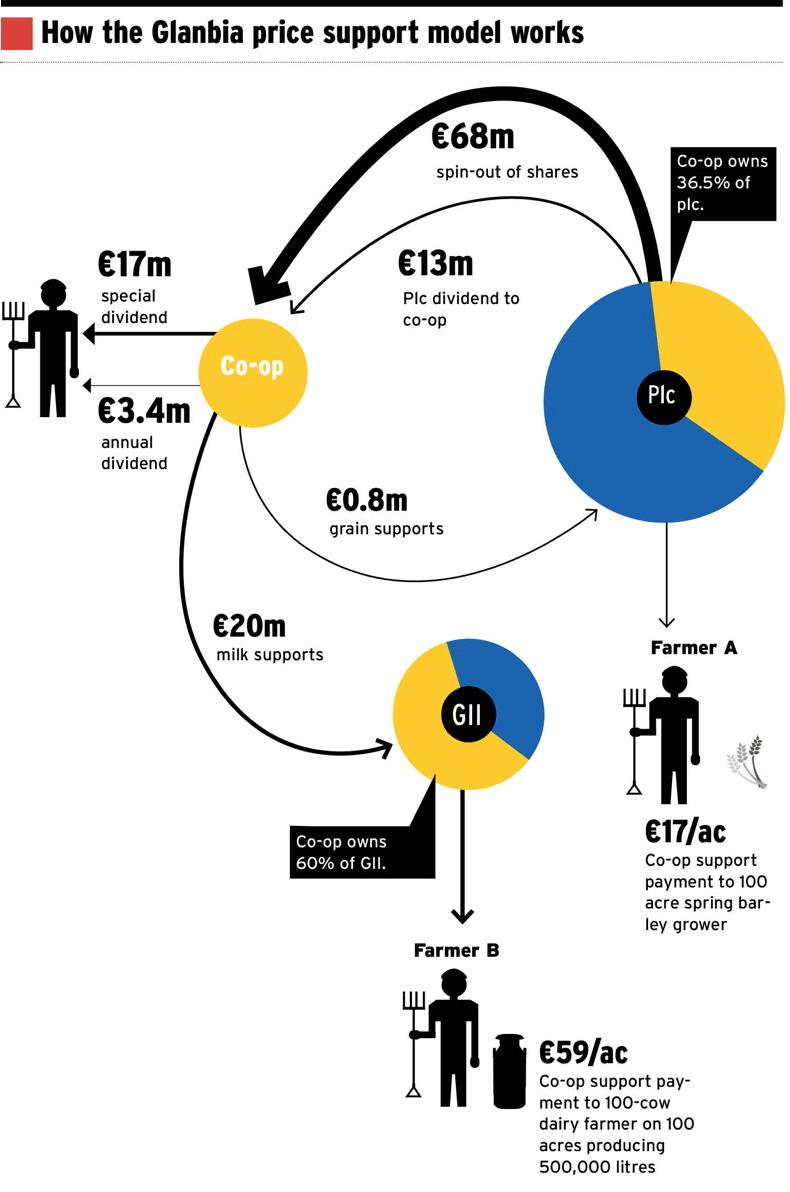

While the Glanbia model is transparent (as shown in the graphic), the flow of money and how bonuses and rebates are funded is complex. In simple terms, the dairy (GII) and grain (plc) businesses are clear in that they will pay a commercial market price for grain or milk. Supports for grain and milk prices along with rebates for feed and fertiliser are delivered from the co-op’s funds.

click here for PDF of graphic

The plc is the income engine and the co-op’s largest investment. The co-op, with 15,500 members, has only one income stream – the plc dividend, which was €13m in 2014. The co-op pays part of this dividend (10c/share) to co-op shareholders directly. This was €3.4m in 2014.

Following the share spin-out, when the co-op reduced its share in the plc from 41.2% to 36.5%, the co-op retained €68m from all co-op members to bolster its reserves.

It is to pay out 25% of this in a special dividend, which amounts to €17m. The balance (€51m) will be drip-fed to milk and grain supplier members to support prices as determined by the co-op board into the future. Most farmers understand that this is the equivalent of selling a field, spending 25% of it today and putting the other 75% into a savings account to pay bonuses into the future. The co-op has committed €20m to milk for 2015 (1c/litre on 1.8bn litres), along with €0.8m to grain (€5/t).

Margin protection at GII

Glanbia suppliers have invested significantly (with original share spin-out) and would be right to question the pricing policy adopted by its board. GII has since invested about €235m, including €185m at Belview. Processing 1.8bn litres, GII is the largest milk processor in the country – it has the scale, efficiency and product mix advantages that would allow it to pay the leading milk price.

A core founding principle of GII was to allow farmers control the processing arm of a dairy business, a business for which Glanbia plc was not getting the return on capital the market required.

Last year, GII had a turnover of €899m, an operating profit of €35m and a net profit of €32m. This provided an operating margin of 3.9% – almost double that of its industry peers. It also delivered a strong milk price in 2014 and was fourth in the KPMG Milk Price League. So it is efficient.

But operating profit margins can come from two places – processing efficiency or paying low milk prices.

This is a tight-margin business, and every cent matters. For example, if GII increased the milk price by as little as 1c for all milk, this would cost €18m and drop margins to 1.9% – more into line with industry peers. So why then does it not reduce its margin and pay an extra cent?

While covenants (terms where performance targets must be met) from banks may provide an answer, they only tell part of the story. GII’s debt is significant (€172m at year end) and it has a debt-to-earnings ratio of 3.9 times.

But this is a highly bankable business. It buys milk at a price, covers the cost of processing it, and sells it at a higher price. Whether the margin is 1% or 4%, any bank would finance it and still get paid.

Return on investment

Another factor is that Glanbia plc requires a return on its investment in GII. This is reasonable, provided its returns expectations are realistic.

After all, the plc wanted to divest from processing because it wasn’t satisfied with the returns it was making in the first place.

So what would be a reasonable return? Glanbia plc and its shareholders are now used to making large margins. Last year, it made 7% margin overall, driven by 12% in performance nutrition and dragged by the 3.7% margins in agri-trading and consumer foods.

While GII may seem insignificant to a big Glanbia plc, it is by no means insignificant and each business unit must contribute to the bottom line. Glanbia plc’s

share of GII profits amounted to €13m in 2014, accounting for 5% of overall plc earnings.

In the future, GII will also begin to pay a dividend back to the plc. How much this will be has yet to be agreed, but questions need to be asked around such a policy and where the money will come from to pay this. Will it inevitably come out of the milk price?

An inequitable policy? Difference between supports to grain and dairy farmers

To best explain this, take two typical farmers who each own 100 acres and are co-op members. Farmer A is a 100-acre spring barley grower, uses 35t of fertiliser and supplies 300t of grain. Farmer B is a 100-cow dairy farmer producing 500,000 litres, uses 100t of feed and 80t of fertiliser.

Taking co-op rebates for fertiliser and feed (€5/t) and the bonuses for milk and grain (1c/l and €5/t) this amounts to €1,675 for Farmer A (tillage) and €5,900 for Farmer B (dairy). This means the dairy farmer is getting €59/acre – four times the amount of the tillage farmer at only €17/acre. This raises the question of the fairness of this policy.

Glanbia is clear and says it wants to reward the loyal active farmer. However, in true co-op ethos, all members are equal and one member equals one vote.

Furthermore, GII’s policy on milk supply agreements (MSAs) and linkages to co-op membership is difficult to justify. While MSA protects all parties including farmers, is it reasonable to expect that a co-op member should only get his share of plc cashflows if he has signed an MSA with a joint venture company?

Kerry co-op pays out the Kerry Group plc dividend in a cheque every year to each shareholder. This is treated by farmers as a different source of income and a return on an investment that is directly related to the shareholding held in the co-op. However, the drawback is it has ended up that down through the years, many of the shares are now not owned by active members/dairy farmers. Another key difference is that Kerry dairy farmers don’t own or control their dairy processing arm. But looking at the recent milk price performance at GII, farmers may question what is the advantage of owning one? Is it time Glanbia removed the complexity around prices and simply paid the shareholder his share of the dividends or asset sales by means of a cheque each year?

Grain price

Glanbia plc purchased 210,000t of grain this year, making it the largest buyer and processor of grain in the country. However, the green barley price announced this week of €130/t with an €8 bonus for wheat, is up to €5 lower than other buyers.

While it is true Glanbia offers a forward-selling option, the green price sets a benchmark for others in the industry. Over 30% of its grain is now going to premium markets, such as malting barley, gluten free oats and roasting barley.

While co-op members can receive a bonus of €5 for each tonne, almost 800 grain suppliers are not co-op members. The co-op is addressing this and grain suppliers can now buy shares. But unlike the dairy farmer who can pay over the next four years, there is no deferred payment system for grain suppliers.

Comment

In the ethos of co-op principles, the Board of the co-op must deliver on its responsibility to all its members – be they grain or milk suppliers or dry shareholders. The board also has a responsibility to separate itself from the plc and GII, as they are commercial organisations set up to maximise returns for shareholders.

Glanbia has had a good run of it. Its share price is up 50% year on year. It successfully spun out a further 6% to farmers in June and the co-op is now valued in excess of €2bn.

But Glanbia’s decision to lower its base milk price last week raises questions over the company’s pricing model and margin protection in the processing joint venture, GII. But it’s not just dairy farmers who are concerned, as dry shareholders and grain suppliers are also questioning the inequality of the co-op dividend policy.

Transparent complexity

While the Glanbia model is transparent (as shown in the graphic), the flow of money and how bonuses and rebates are funded is complex. In simple terms, the dairy (GII) and grain (plc) businesses are clear in that they will pay a commercial market price for grain or milk. Supports for grain and milk prices along with rebates for feed and fertiliser are delivered from the co-op’s funds.

click here for PDF of graphic

The plc is the income engine and the co-op’s largest investment. The co-op, with 15,500 members, has only one income stream – the plc dividend, which was €13m in 2014. The co-op pays part of this dividend (10c/share) to co-op shareholders directly. This was €3.4m in 2014.

Following the share spin-out, when the co-op reduced its share in the plc from 41.2% to 36.5%, the co-op retained €68m from all co-op members to bolster its reserves.

It is to pay out 25% of this in a special dividend, which amounts to €17m. The balance (€51m) will be drip-fed to milk and grain supplier members to support prices as determined by the co-op board into the future. Most farmers understand that this is the equivalent of selling a field, spending 25% of it today and putting the other 75% into a savings account to pay bonuses into the future. The co-op has committed €20m to milk for 2015 (1c/litre on 1.8bn litres), along with €0.8m to grain (€5/t).

Margin protection at GII

Glanbia suppliers have invested significantly (with original share spin-out) and would be right to question the pricing policy adopted by its board. GII has since invested about €235m, including €185m at Belview. Processing 1.8bn litres, GII is the largest milk processor in the country – it has the scale, efficiency and product mix advantages that would allow it to pay the leading milk price.

A core founding principle of GII was to allow farmers control the processing arm of a dairy business, a business for which Glanbia plc was not getting the return on capital the market required.

Last year, GII had a turnover of €899m, an operating profit of €35m and a net profit of €32m. This provided an operating margin of 3.9% – almost double that of its industry peers. It also delivered a strong milk price in 2014 and was fourth in the KPMG Milk Price League. So it is efficient.

But operating profit margins can come from two places – processing efficiency or paying low milk prices.

This is a tight-margin business, and every cent matters. For example, if GII increased the milk price by as little as 1c for all milk, this would cost €18m and drop margins to 1.9% – more into line with industry peers. So why then does it not reduce its margin and pay an extra cent?

While covenants (terms where performance targets must be met) from banks may provide an answer, they only tell part of the story. GII’s debt is significant (€172m at year end) and it has a debt-to-earnings ratio of 3.9 times.

But this is a highly bankable business. It buys milk at a price, covers the cost of processing it, and sells it at a higher price. Whether the margin is 1% or 4%, any bank would finance it and still get paid.

Return on investment

Another factor is that Glanbia plc requires a return on its investment in GII. This is reasonable, provided its returns expectations are realistic.

After all, the plc wanted to divest from processing because it wasn’t satisfied with the returns it was making in the first place.

So what would be a reasonable return? Glanbia plc and its shareholders are now used to making large margins. Last year, it made 7% margin overall, driven by 12% in performance nutrition and dragged by the 3.7% margins in agri-trading and consumer foods.

While GII may seem insignificant to a big Glanbia plc, it is by no means insignificant and each business unit must contribute to the bottom line. Glanbia plc’s

share of GII profits amounted to €13m in 2014, accounting for 5% of overall plc earnings.

In the future, GII will also begin to pay a dividend back to the plc. How much this will be has yet to be agreed, but questions need to be asked around such a policy and where the money will come from to pay this. Will it inevitably come out of the milk price?

An inequitable policy? Difference between supports to grain and dairy farmers

To best explain this, take two typical farmers who each own 100 acres and are co-op members. Farmer A is a 100-acre spring barley grower, uses 35t of fertiliser and supplies 300t of grain. Farmer B is a 100-cow dairy farmer producing 500,000 litres, uses 100t of feed and 80t of fertiliser.

Taking co-op rebates for fertiliser and feed (€5/t) and the bonuses for milk and grain (1c/l and €5/t) this amounts to €1,675 for Farmer A (tillage) and €5,900 for Farmer B (dairy). This means the dairy farmer is getting €59/acre – four times the amount of the tillage farmer at only €17/acre. This raises the question of the fairness of this policy.

Glanbia is clear and says it wants to reward the loyal active farmer. However, in true co-op ethos, all members are equal and one member equals one vote.

Furthermore, GII’s policy on milk supply agreements (MSAs) and linkages to co-op membership is difficult to justify. While MSA protects all parties including farmers, is it reasonable to expect that a co-op member should only get his share of plc cashflows if he has signed an MSA with a joint venture company?

Kerry co-op pays out the Kerry Group plc dividend in a cheque every year to each shareholder. This is treated by farmers as a different source of income and a return on an investment that is directly related to the shareholding held in the co-op. However, the drawback is it has ended up that down through the years, many of the shares are now not owned by active members/dairy farmers. Another key difference is that Kerry dairy farmers don’t own or control their dairy processing arm. But looking at the recent milk price performance at GII, farmers may question what is the advantage of owning one? Is it time Glanbia removed the complexity around prices and simply paid the shareholder his share of the dividends or asset sales by means of a cheque each year?

Grain price

Glanbia plc purchased 210,000t of grain this year, making it the largest buyer and processor of grain in the country. However, the green barley price announced this week of €130/t with an €8 bonus for wheat, is up to €5 lower than other buyers.

While it is true Glanbia offers a forward-selling option, the green price sets a benchmark for others in the industry. Over 30% of its grain is now going to premium markets, such as malting barley, gluten free oats and roasting barley.

While co-op members can receive a bonus of €5 for each tonne, almost 800 grain suppliers are not co-op members. The co-op is addressing this and grain suppliers can now buy shares. But unlike the dairy farmer who can pay over the next four years, there is no deferred payment system for grain suppliers.

Comment

In the ethos of co-op principles, the Board of the co-op must deliver on its responsibility to all its members – be they grain or milk suppliers or dry shareholders. The board also has a responsibility to separate itself from the plc and GII, as they are commercial organisations set up to maximise returns for shareholders.

SHARING OPTIONS