North Cork followed up good January news with an improved February price. All the big players – Dairygold, Lakeland, Kerry, Arrabawn, and Glanbia – held price for February supplies.

The inclusion of an unconditional February 3c/litre bonus keeps LacPatrick (formerly Town of Monaghan & Ballyrashane) to the top of the February milk league. Aurivo (formerly Connacht Gold) also has a 0.2c/kg MS (1.5c/l) early calving bonus that all Aurivo suppliers get in February.

Hence they jump up to second position behind LacPatrick, paying €4.34 per kilo milk solids.

The other big movers in the February league are the west Cork Co-ops that lifted milk price 0.20c/kg MS or 1.5c/l in old money. The small co-op North Cork also lifted February milk price by 0.13c/kg MS or 1 c/l and that pushes them into division two with the big payers. After that, it was a case of holding what was there in January.

At the bottom of the table, Glanbia and Lakeland Dairies prop up the base as both held price at just under €4.10/kg MS. Lakeland does have a 5c/l early season bonus but this is conditional so not all suppliers get it and hence it is not included in the milk league.

This bonus was 4c/l last year, so Lakeland management are sending a stronger signal this year that they want more February milk. Tipperary Co-op paid a 2016 year-end bonus of 0.6c/l in the February milk cheque.

Average February price

The average Irish price ex-VAT for the February monthly milk league is €4.18/kg MS at national average milk solids. The average price at 3.3% protein and 3.6% fat is 29.9c/l ex-VAT.

All prices are quoted ex-VAT and excluding SDAS bonuses and conditional bonuses such as cell count bonuses, etc.

€474 difference in February milk cheque

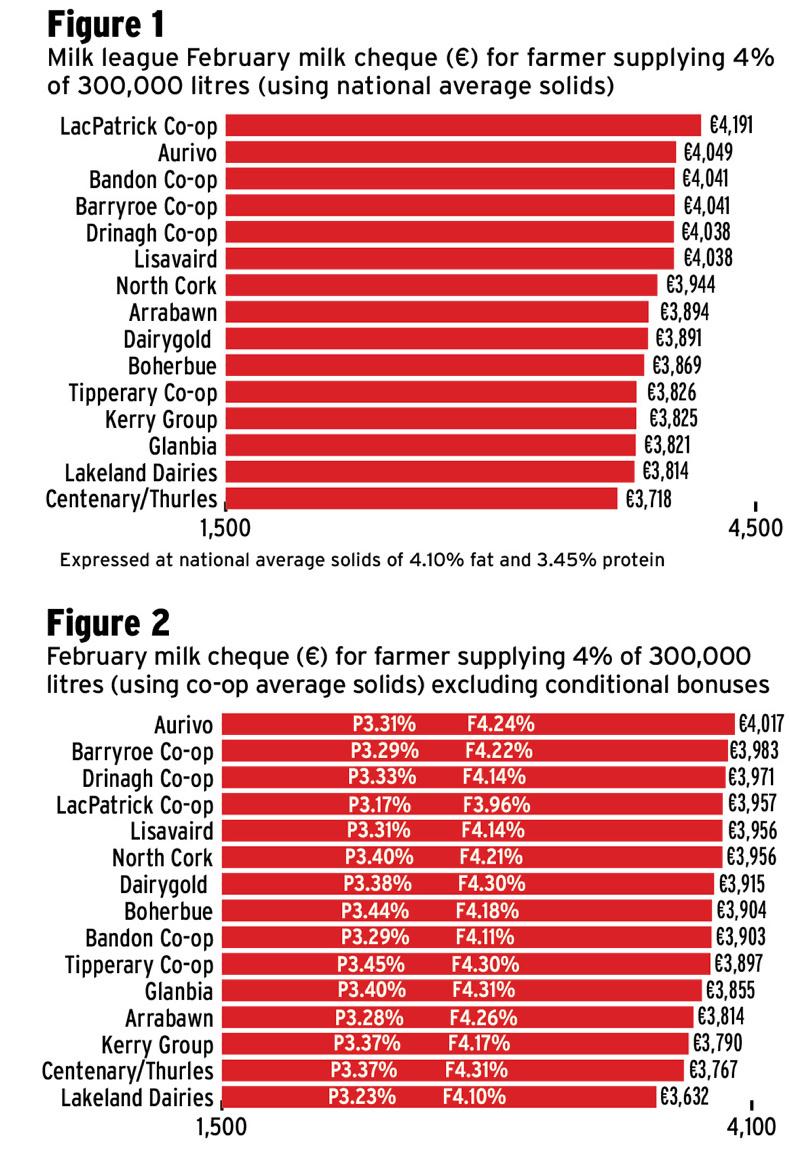

As supply is so small, when we compare the milk prices at the same milk solids (national average), there is only €474 of a difference in the base February milk cheque for a supplier delivering 4% in February. Figure 1 shows the difference in payout between processors for the standardised litre at 3.45% protein and 4.10% fat supplied during the month of February.

Actual February price paid

Figure 2 shows the difference in the actual February milk cheque delivered. When I say actual, I mean the money paid out for the different milk solids collected by each of the different processors.

Milk processors collect milk that varies in fat and protein percentage so in effect the quality of milk goes some way to deciding the milk price paid out. The processor can’t pay top price if the quality is poor. The higher the milk solids (fat and protein), the higher the milk cheque.

Farmers should be rewarded for better milk solids, so if a processor is getting less milk solids it will pay a lower price and rightly so as it can make less product from that milk. The combination of good milk price and good milk solids puts Aurivo to the top of this graph for February, followed by the west Cork Co-ops and LacPatrick for February. There is €385 of a difference between top and bottom.

Butter highs

Fat price continues to shine in the UK. UK butter prices rose again to £3,750, with cream at £1.78. Whey is also holding up. Skim milk powder (SMP) has fallen back to intervention prices so what UK processors are gaining on butter they are losing on skim.

Looking to the EU, butter prices are still winning, with German butter up €50 last week to €4,275, Dutch up €60 to €4,310 and French up €100 to €4,250. In contrast, powders are going in the other direction, with German WMP now at €2,800, down €155/t. Dutch Whole milk powder (WMP) is down €80 to €2,670 and French is down €50 to €2,800 per tonne.

SMP is effectively at interventon level prices, with German and French prices at €1,740 and €1,730 respectively and Dutch at €1,700/t. Feed grade SMP is at €1,640/t, close to last year. US block butter is up again to €4,486/t so it means the EU has a 6% advantage on price compared to the US and 5% over southern hemisphere prices.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: