Bovine Disease Eradication levy – BDE

Bovine disease levies were introduced in Ireland in 1979 under the Bovine Diseases (Levies) Act, to collect a financial contribution from the farming community towards the cost of the TB and brucellosis eradication programmes.

Under that act, a levy was imposed on all cattle slaughtered or exported live and on each gallon of milk delivered for processing. By 1996, farmers were contributing the equivalent (the euro wasn’t in place in 1996) of €35.5m annually by way of levy to support the operational cost of the bovine TB and brucellosis programmes, with the Government picking up the tab for the remainder of the costs. This levy was paid at the equivalent of €9.27 on every beef animal slaughtered or exported live and the equivalent of 0.37c/litre on milk delivered to creameries. A restructuring of the operation and financing of these schemes took place in 1996 and the levies were cut by almost two thirds to the equivalent of €3.17 on an animal and 0.14c/litre of milk.

Further reductions in the levy followed in 2004, 2005 and 2007, when the present rate of €1.27 on an animal slaughtered and 0.06c/litre of milk was reached. These reductions came in the era of the Celtic Tiger, when the Government was flush with money. However, the success of the eradication programmes in reducing the amount of TB and brucellosis in the Irish herd also allowed costs to farmers to be reduced. With all brucellosis testing now coming to an end and TB costs halving in the five years from 2008-13, this levy should be reviewed again, ideally with a view to eliminating it.

In Northern Ireland, introduction of a levy was contemplated under a cost and responsibility initiative by the direct rule administration prior to devolution in 2007. However, one of the early decisions after devolution by the Northern Ireland Minister for Agriculture at the time, Michelle Gildernew, was to abandon the cost and responsibility sharing idea and DARD has continued to fund TB and brucellosis eradication programmes.

Bord Bia Levy – ABB, Livestock and Meat Commission (LMC) levy Northern Ireland

Bord Bia was formed in 1994 by amalgamating CBF, the Irish Livestock and Meat Board, the food promotion and marketing functions of An Bord Tráchtála and the export promotion functions of An Bord Glas for edible horticultural produce. Since then it has expanded to include other sectors and now represents basically all Irish food promotion nationally and internationally. With cattle levies contributing around €3m annually, beef has a central role in Bord Bia activity – not just in promotion, but in collection and publication of market intelligence and price data.

The Bord Bia Act 1994 provides for a levy on all cattle, sheep and pigs slaughtered within the State or exported live from the State. The rates of the statutory levies are €1.90 on cattle either slaughtered or exported live, €0.25 on sheep and €0.25 on pigs.

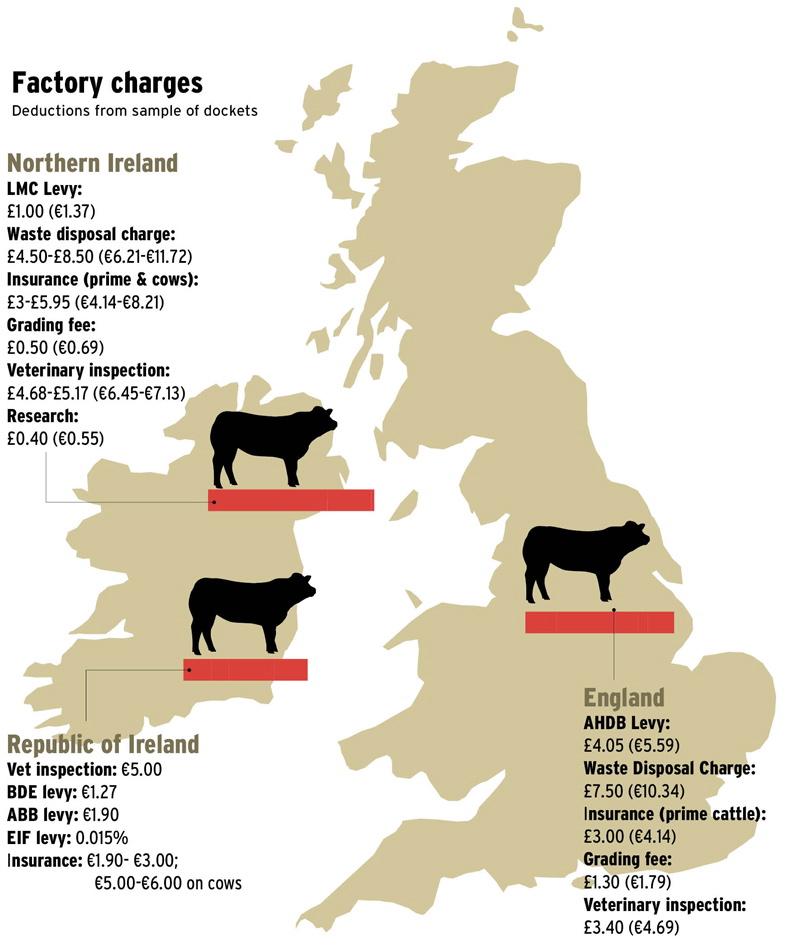

In Northern Ireland (NI), LMC was established by statute in 1967 to promote the marketing of cattle and sheep. Initially this was a live exports business but as the meat processing industry developed and LMC levies were collected on the basis of animals processed, the focus evolved to concentrate on serving the beef and sheep meat industries. Levies are paid by farmers and factories at £1 (€1.37) per head each, giving LMC revenue of £2 (€2.74) per head on cattle and 20p (28c) from farmers and 10p (14c) from factories on lambs, giving LMC a total revenue of 30p (42c) on all sheep slaughtered in NI. These levy rates have been in place since 2003.

Insurance

This is an arbitrary figure, charged by factories on cattle that they judge will be stamped by the vets on inspection as fit for the food chain. Usually if factories have any doubt about the fitness of an animal, they are entered as “owner’s risk”, with no “insurance” being collected, but if all or part of the animal is condemned, the farmer doesn’t get paid. Rates vary from between €1.90 and €3.00 on prime cattle and between €5 and €6 on cows; the rate is £3 (€4.13) and £5 (€6.90) in NI.

Factories will say this covers animals that appeared sound pre-slaughter but got condemned post-slaughter. They will also say that there are frequent and substantial losses from high-value beef cuts such as loin and silverside being damaged as a result of injections, with muscles either being lost entirely or at a minimum devalued and being used in a mince or diced product.

There may be validity in these points. Some cattle that appear sound prior to slaughter are condemned in whole or part, particularly in the case of older cows – hence the higher charge where they are not entered as owner’s risk.

However, this is a fund paid for by farmers that primarily benefits factories. Farmers do not have a discretion to opt out of this and take out a policy on cattle for slaughter elsewhere with a properly regulated insurance provider, nor is there any obligation on factories to “insure” all animals presented.

Veterinary inspection charge

This deduction is made by factories on farmers to cover the cost they are charged by the Departments as a contribution to factories’ meat inspection and veterinary services. It is an EU regulation that all animals slaughtered for human consumption receive an ante- and post-mortem veterinary inspection. The EU has decreed that every country must charge a minimum of €5 for cattle. Irish factories pass this charge on to farmer suppliers at the rate of €5, while in NI the rate is £4.50. In some factories in Britain the charge is absorbed as a factory cost.

In practice, this usually doesn’t cover the full meat inspection costs, with the Food Standards Agency in NI and the Department of Agriculture in Dublin picking up the balance. In the UK, there has been a debate for several years on whether to move towards full inspection cost recovery. This has been successfully resisted by the industry so far, and the latest discussions are focusing on reallocation of the meat inspection subsidy on a proportionate basis. In practice this would mean smaller factories having to pay more per unit slaughtered and larger ones with high throughput staying the same as at present.

European Investment Fund – EIF – Republic of Ireland

This is a payment collected on behalf of farmer representative organisations at a rate of €1.50 per €1,000 of sales of beef and milk. It is used to fund farmer representation at local, national and particularly EU level and operates on the principle of farmer contribution proportionate to the size of the farm business. Small farms with low-value sales will have a small overall payment, while large farm businesses with large sales make a big overall payment. In an industry where thousands of relatively small farm businesses engage with large corporations and are subject to Government and EU regulation and policies, strong well-funded farmer representation is a necessity.

Waste disposal charges - specified risk material (SRM) - Northern Ireland

NI factories charge farmers a waste disposal charge at varying rates. This is to cover their costs in for rendering material from the animal that has been banned from entering the food chain as a result of BSE controls. This material would previously have been a revenue for factories but since it had to be disposed of as Category 1 high risk material, it incurred a cost for rendering instead. Initially this charge was imposed both sides of the border but was removed in the south several years ago. For several years this charge was in the range of £4.50-£5.00, but it has been increased by some factories to as much as £8.50.

This charge causes much consternation among farmers killing cattle in Northern Ireland. Factories say this charge has been traditionally passed on to farmers because it was a whole new cost to the industry after BSE controls were imposed. There was a view that by making this cost visible to farmers they would be more motivated to lobby for its removal.

However, the transaction between farmer and factory is buying and selling of an animal. Cattle are paid for on the basis of dressed carcase. Everything that is removed before this point falls to the factory, with some of this byproduct being a cost to the factory and some being a revenue. If it is practice to charge farmers for disposal of waste, it should also be practice to pass on the revenue generated from revenue-generating products such as the hide as a waste disposal credit.

Classification charge (Northern Ireland)

When Northern Ireland moved to mechanical grading in 2011, a charge of 50p (68c) per animal was agreed between farmer representatives and meat factories. This replaced the £1.40 (€1.92) deducted by the factories when LMC was providing a manual classification charge prior to the introduction of mechanical grading.

There is no charge for classification in the Republic of Ireland.

Comment

Factory deductions on cattle slaughtered are at best an annoyance and at worst a passing on of factory operating costs to farmers.

There is no choice in the case of the Bord Bia and Bovine Disease Eradication levies and the LMC levy in NI, as these are statute-based.

The European Involvement Fund is a contribution to fund farmer representation, but other charges such as veterinary inspection plus classification and waste disposal charges in NI are costs of operating a meat processing business for which farmers are charged.

“Insurance”, as it is described, is primarily for the benefit of the factory but paid for by farmers, with no option for farmers to opt out or have a policy elsewhere to provide this cover.

It can be argued that if operational deductions were hidden they would come out of the overall beef price and indeed Irish beef factory deductions are much lower than in Northern Ireland or Britain.

However, farmers would prefer their cheque to more closely reflect the price they agreed.

SHARING OPTIONS