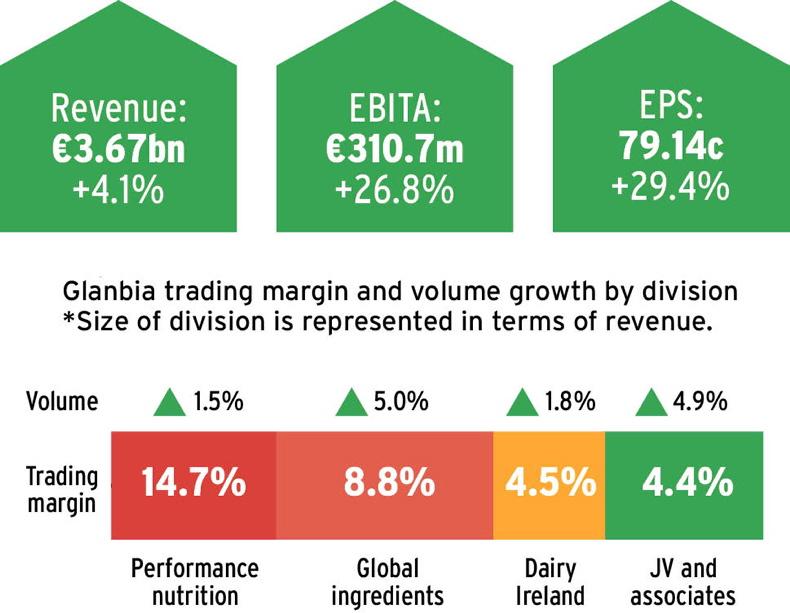

Glanbia delivered another very strong performance in 2015, with earnings (EBITA) soaring by 26.8% to €310.7m last year on the back of a bullish US dollar and strong margin growth across the entire business. Earnings were up by 9% in constant currency terms.

Over the year, Glanbia group margins improved by 150bps to 8.5%, with particularly strong margin gains within its Performance Nutrition and Dairy Ireland divisions. Adjusted earnings per share for the year grew by more than 29% to 79.14c.

Group revenues for the year increased by 4%, to €3.67bn, although in constant currency Glanbia’s turnover was actually down 7.4%, reflecting the general fall in global dairy prices over the last 12 months.

Net debt at year end stood at more than €584m, an increase of over 14%, mainly due to the thinkThin acquisition in November.

Despite the increase, the group’s net debt-to-earnings ratio remains comfortable at 1.75 times.

Glanbia is recommending a final shareholder dividend of 7.22c, while the total dividend for the year will increase by 10%, to 12.1c per share. At this dividend price, Glanbia plc will have returned more than €13m to its largest shareholder Glanbia co-op for 2015.

Commenting on the results, Glanbia chief executive Siobhan Talbot said she was pleased that Glanbia could deliver its sixth consecutive year of double-digit growth.

“The results demonstrate the resilience and diversification of the Glanbia model during a difficult year for dairy markets.

Glanbia Performance Nutrition was the main driver of earnings growth, supported by Dairy Ireland, which saw a recovery in performance in 2015.

The outlook for 2016 is positive, and we are guiding 8% to 10% growth in adjusted earnings per share, constant currency,” added Talbot.

Since the beginning of February, Glanbia shares have surged by as much as 17% and are now trading around the €18.50 mark.

Performance Nutrition

Glanbia’s performance nutrition division continues to drive the group’s performance, with revenues increasing by almost 24% to €923m in 2015.

Earnings (EBITA) from the division increased by a whopping 52% (28.3% in constant currency) to €135.6m for the year, while trading margins increased from 12% to 14.7%. Performance Nutrition now accounts for 44% of Glanbia’s total earnings.

Glanbia attributed the jump in earnings and increased margins to greater operating leverage, a drop in high-end whey prices and a greater product mix, thanks to better branded sales. Talbot said that like-for-like branded sales growth in the US was 6% last year.

During last year, Glanbia added to its stable of brands, including Optimum Nutrition, Isopure and Nutrimino. It acquired thinkThin in November for more than €200m.

This latest acquisition will be fully integrated in the coming year and is expected to deliver sales in the region of $90m.

Global ingredients

The deterioration in global dairy markets had a direct effect on the underlying performance of the group’s global ingredients division.

Although revenues were up by 3.6% in reported terms to €1.2bn for the year, sales were actually back almost 13% in constant currency.

Similarly, the division’s earnings grew by over 6% to €106.6m, but in constant currency terms were actually back almost 12%.

Glanbia said the declines in dairy market prices impacted the business by almost 18% year-on-year, which was only partially offset by a 5% increase in volumes.

Glanbia said its US cheese business saw increased volumes as cheese plants operated at full capacity, but this was not enough to offset product price declines, with US cheese prices back 25% year-on-year. Product pricing for dairy ingredients was also back substantially last year, in line with the market.

Dairy Ireland

Dairy Ireland delivered a good performance in 2015 with significant earnings and margin improvement, driven mainly by sales of consumer products.

Earnings (EBITA) for the year grew by almost 52% to €28.8m on the back of increased sales of €633.2m, up almost 3% year-on-year.

Sales volumes and bolt-on acquisitions contributed 1.8% and 1.4% respectively to revenue growth, which more than offset a 0.5% decline in pricing.

Margins improved by 140bps to a very healthy 4.5% as a result of greater value-added milk and cream brand sales. Margins were also helped by falling milk prices.

The agribusiness division performed in line with the prior year, despite reduced returns on fertiliser and feed sales.

Joint ventures and associates

Revenues from Glanbia’s share of joint ventures fell by over 9% to €893m, reflecting the broader decline of global dairy markets. Despite the decrease in revenues, the group’s share of earnings actually increased by 9% to €39.7m last year, with margins improving to 4.4%.

Within its joint ventures division, Glanbia Ingredients Ireland (GII) is by far the largest, accounting for almost a third of sales.

GII’s performance was described as being slightly ahead of the previous year.

Although margins reduced slightly, Glanbia said the absolute profitability of GII has increased due to the higher volumes processed last year.

With quotas gone, production for 2015 exceeded 2bn litres and was more than 18% ahead of the prior year.

In these results, Glanbia has delivered its sixth consecutive year of double-digit earnings growth. The achievement to attain this is remarkable in itself, but when taken in the context of the last year it is even more so. Performance nutrition continues to drive the business and now accounts for 25% of total revenue and 44% of earnings last year. For Glanbia suppliers, the question will always come back to milk price. The increased dividend will return more than €13m to Glanbia co-op to invest as they see fit. Farmers will look at the GII margin of around 4%, but Glanbia are firm it needs to remain as is to support the recent investments.

SHARING OPTIONS