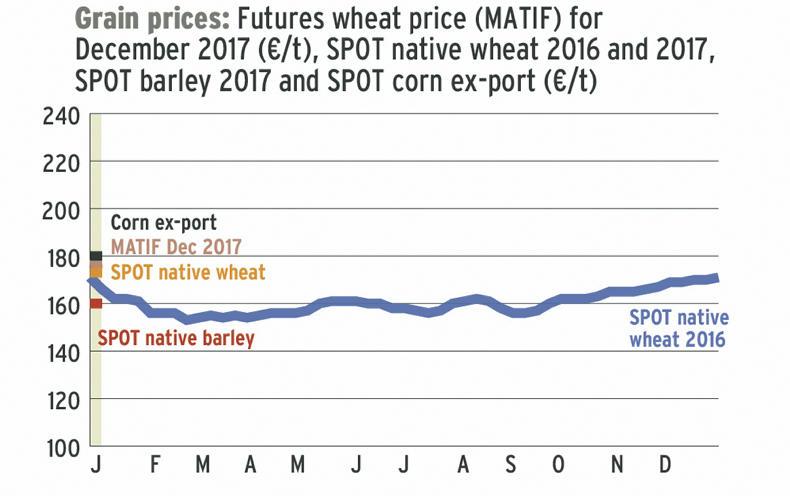

Native grain prices have taken on a stronger tone over the past week, with current crop up €2 to €4/t depending on the product and the position.

International wheat prices are generally up too, helped somewhat by the lower planted area in the US, which is down 10% on last year and leaves this area very low on a historic care basis.

The question now is what will be grown in these acres? Historically wheat drops converted to maize area gains. But maize acres themselves could well see some migration to soya beans based on the current price differential, which, at the time of going to press, stood at 2.9 for September 2017. Normally, a price differential of 2.3 or greater will encourage US acres to go to soya beans rather than maize, so the current differential will certainly drive towards soya.

Spot wheat prices might best be described as firmer in a market with increased interest amongst buyers. Spot prices are quoted around €175 to €177/t for wheat, but the price will rise as one pushes away from current delivery. May wheat has pushed towards the €178 to €180/t bracket, up from €175 to €176/t a week ago. Spot barley is €162 to €164/t and about €165 to €167/t out towards May.

November prices are largely static though, with wheat at around €172/t and barley still in the €160 to €162/t range.

Oilseed rape prices remain broadly similar at €410 to €412/t for nearby positions and €398 to €400/t for new crop – up slightly on the previous week.

SHARING OPTIONS