Although sandwich and food-to-go manufacturer Greencore is concerned about the outlook for the UK economy, it believes the short-term impact on the business is likely to be modest.

Supplying half of all the sandwiches sold in the UK, Greencore does not expect the weakening of sterling to affect profits in the current financial year. This is mainly because of forward purchasing arrangements and that less than a quarter of ingredients and packaging materials are imported for the UK businesses.

However, the company did warn that if current exchange rates persist, net debt at year end will be higher than expected due to translation of US dollar denominated borrowings.

Net debt more than doubled to £53m at year end last year due to increased capital expenditure as it continued to build capacity. A further £100m is planned this financial year.

CEO Patrick Coveney was one of the more vocal business leaders in the UK in the runup to the Brexit referendum. He advocated a remain vote, saying: “The food industry is better off in the EU than outside it, and a decision to leave would drive up the cost of production.”

Despite Greencore, with its large manufacturing footprint in the UK, depending on a low-cost labour business model, he reiterated that it was committed to the UK market regardless of the UK referendum decision.

Coveney has recently said there will be time for UK companies to adjust as the substantive issues of a UK exit were negotiated.

Revenue growth

Greencore reported a 4% increase in its third quarter revenues to £360.4m compared with the same period last year. This brings year to date revenues 6.7% ahead of last year at £1,052m. When the effect of currency is stripped out, third-quarter revenues increased 3.1%.

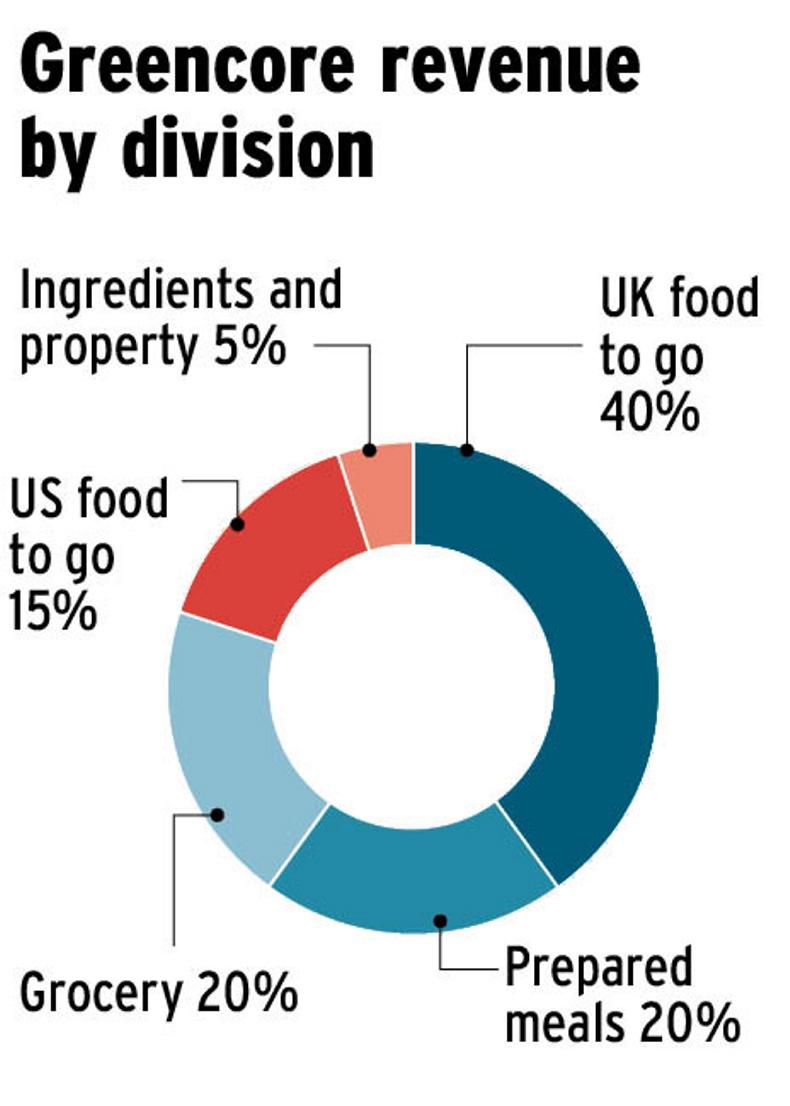

Revenues at its largest division, convenience foods rose 5.4% to £349.9m. In the UK, third-quarter revenue increased 5.7%, with its food-to-go business continuing to drive the growth.

In the US, third-quarter revenues increased 4.1% but were 1% lower when effect of currency was stripped out as it consolidated operations on to a purpose-built site at Rhode Island. The group has big ambitions for its US business where it expects to have sales of $1bn within five to 10 years. Last year, the US business grew by 28%, driven by its two main customers, Starbucks and convenience store 7-Eleven.

The ingredients and property division, which now represents less than 5% of group activity, saw revenues fall 28% to £10.5m in the quarter, reflecting lower commodity prices and a decrease in demand from milk powder producers.

This week Greencore acquired The Sandwich Factory from premium food producer Cranswick plc in a deal worth £15m. This extends Greencore’s UK food-to-go business and adds to its production capacity. In the year to 31 March 2016, the sandwich business with a manufacturing facility in Warwickshire generated revenues of £54m. This extends Greencore’s presence in the high-growth food-to-go category, which Greencore grew at 8.9% last year.

Shares in Greencore closed at £3.11 on Tuesday, 34% above its 52-week low of £2.35 set on 24 June, the day of the UK referendum result.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: