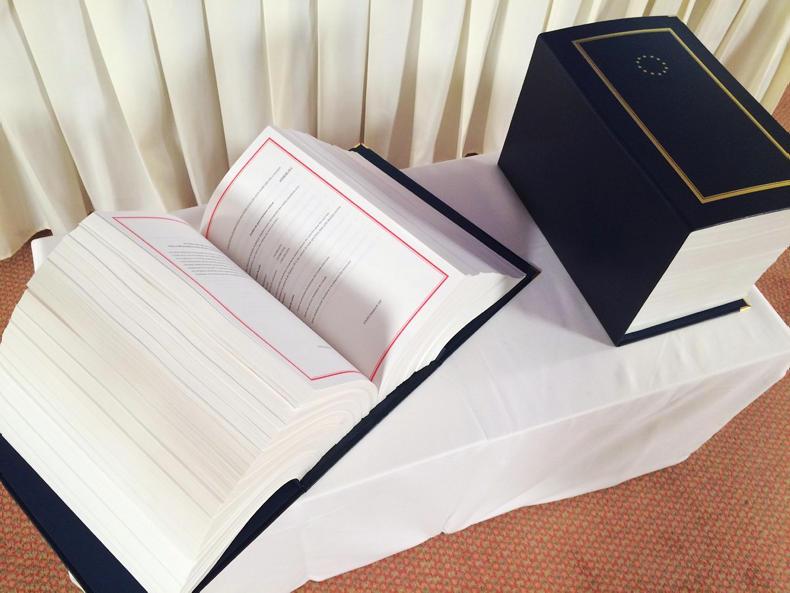

Now that the Comprehensive Economic and Trade Agreement (CETA) between the EU and Canada has been finally signed, we can consider what impact it will have on Irish farmers.

The CETA deal allows 50,000t carcase weight equivalent (CWE) of Canadian fresh and frozen beef and 75,000t CWE of pork access to the EU. In return the EU beef and sheep meat market gain access into Canada at fully liberalised zero in-quota rates.

For dairy, Canada is to get duty-free access into the EU dairy market. In return, there is to be a high-value cheese quota of 16,800t, with provision to allow newcomers, including Ireland and other member states, 30% access to the new quota.

Meat Industry Ireland, the trade association that represents meat factories, was positive about CETA while it was opposed by many politicians and the farm organisations. The IFA put it most succinctly when they said that in an EU where beef consumption has been in decline and production rising, there is no room for another 50,000 tonnes of beef coming into the market.

Opportunities

There is another side to trade with Canada that will present some opportunities for the Irish beef industry. Much attention has been given to the potential of the USA as a “new market” for Irish beef. Canada, while on a much smaller scale with a population of 35m people compared with 320m in the US, is like the US in that it is a major importer of beef, lamb and pork as well as exporter.

In 2015, Canada imported 163,000t of beef, 122,000t pig meat and 13,000t lamb. Much of the beef and lamb came from the US and Mexico with Australia, New Zealand and Uruguay being the main external suppliers.

Australia sent 36,000t of beef to Canada in 2015, 35,000t of which is covered by quota, the balance paying a 26.5% import tariff and 6,000t of sheep meat.

New Zealand sent almost 27,000t of beef and 11,000t of sheep meat to Canada in 2015. It has a 29,000t beef quota on which no tariff is paid while sheep meat is subject to a 4.3 Canadian cents/kg tariff. Uruguay sent 13,000t of beef and uses a Most Favoured Nation (MFN) quota for 11,800t and the reminder subject to 26.5% tariff.

Head start

Irish and UK meat companies have already started business with Canada in advance of CETA taking effect. In the first five months of 2016, permits were issues for 418t of beef, subject to a MFN tariff of 13.5% while up to the end of August this year Ireland exported 216t of beef to Canada, according to CSO statistics.

Exporters expect this business can be grown once the tariffs end completely under CETA with opportunities for high quality manufacturing beef and some cuts. The Knuckle, taken from the hindquarter and historically sold along the topside and silverside as a roasting cut, is currently in demand in Canada.

It is unlikely to develop as a high-volume market but if it can be developed as a better market for some parts of the carcase than are currently available, it will make a useful contribution to the Irish beef industry.

Read more

Full coverage and analysis: CETA

Now that the Comprehensive Economic and Trade Agreement (CETA) between the EU and Canada has been finally signed, we can consider what impact it will have on Irish farmers.

The CETA deal allows 50,000t carcase weight equivalent (CWE) of Canadian fresh and frozen beef and 75,000t CWE of pork access to the EU. In return the EU beef and sheep meat market gain access into Canada at fully liberalised zero in-quota rates.

For dairy, Canada is to get duty-free access into the EU dairy market. In return, there is to be a high-value cheese quota of 16,800t, with provision to allow newcomers, including Ireland and other member states, 30% access to the new quota.

Meat Industry Ireland, the trade association that represents meat factories, was positive about CETA while it was opposed by many politicians and the farm organisations. The IFA put it most succinctly when they said that in an EU where beef consumption has been in decline and production rising, there is no room for another 50,000 tonnes of beef coming into the market.

Opportunities

There is another side to trade with Canada that will present some opportunities for the Irish beef industry. Much attention has been given to the potential of the USA as a “new market” for Irish beef. Canada, while on a much smaller scale with a population of 35m people compared with 320m in the US, is like the US in that it is a major importer of beef, lamb and pork as well as exporter.

In 2015, Canada imported 163,000t of beef, 122,000t pig meat and 13,000t lamb. Much of the beef and lamb came from the US and Mexico with Australia, New Zealand and Uruguay being the main external suppliers.

Australia sent 36,000t of beef to Canada in 2015, 35,000t of which is covered by quota, the balance paying a 26.5% import tariff and 6,000t of sheep meat.

New Zealand sent almost 27,000t of beef and 11,000t of sheep meat to Canada in 2015. It has a 29,000t beef quota on which no tariff is paid while sheep meat is subject to a 4.3 Canadian cents/kg tariff. Uruguay sent 13,000t of beef and uses a Most Favoured Nation (MFN) quota for 11,800t and the reminder subject to 26.5% tariff.

Head start

Irish and UK meat companies have already started business with Canada in advance of CETA taking effect. In the first five months of 2016, permits were issues for 418t of beef, subject to a MFN tariff of 13.5% while up to the end of August this year Ireland exported 216t of beef to Canada, according to CSO statistics.

Exporters expect this business can be grown once the tariffs end completely under CETA with opportunities for high quality manufacturing beef and some cuts. The Knuckle, taken from the hindquarter and historically sold along the topside and silverside as a roasting cut, is currently in demand in Canada.

It is unlikely to develop as a high-volume market but if it can be developed as a better market for some parts of the carcase than are currently available, it will make a useful contribution to the Irish beef industry.

Read more

Full coverage and analysis: CETA

SHARING OPTIONS