So far this year just over 17,000 new cars have been sold. This is down on 2016 figures by 8.7% for the same period.

The resurgence of UK imported cars is undoubtedly making a dent in the new car figures.

Interestingly, Mercedes are back in the top 10 sellers, partially due to a 10% price reduction and a resurgance in the luxury car market.

For many buyers in the market, car finance is as important as the actual car itself. It can often be the deciding factor between buying certain cars. A good deal on finance coupled with a good service plan could also divert buyers’ attention away from the UK and back to the Irish market.

PCP

Personal Contract Plan (PCP) has become increasingly popular for customers, with competitive rates on offer and a lower monthly outlay than loans and hire purchase plans.

It sounds wonderful for many, driving a new car at a fraction of the cost of a personal bank loan.

Looking closely at PCP agreements, they’re not actually that difficult to understand. They are essentially a hire purchase (HP) agreement that places a guaranteed minimum future value (GMFV) on the car at the end of the agreed term. The repayment amount is lower, as the balance to be paid is the difference between the future value of the car and the purchase price of the car today. The GMFV amount is only paid off by the customer if they choose to buy the car at the end of the PCP deal.

PCP schemes normally require a cash deposit of between 10-30%. To incentivize this option, manufacturers have low 0% APR offers in some cases.

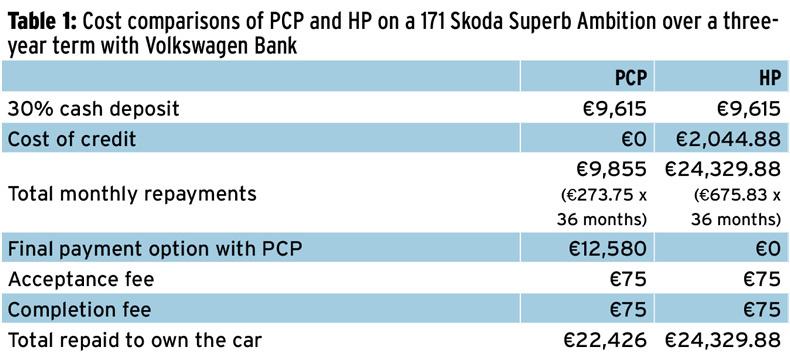

For our PCP comparison, we look at the options for buying a Skoda Superb Ambition, with PCP and HP through Skoda Finance, which is part of Volkswagen Bank. The criteria we set out for the finance term, is a three year deal, with a 30% cash deposit of €9,615.

At the end of the period, if the consumer decides to buy the car outright by paying the final settlement of €12,580, the PCP option still comes out about €1,900 cheaper than the HP option.

The main drawback with PCP options is the 20,000km/year driving limit. For every kilometre over the agreed limit, there is a 10c penalty charge. So, if the car is handed back with 10,000km over the contract agreement, the penalty charge is €1,000. Based on the calculations above were the car to be over the allowance by 20,000km it would incur a €2,000 penalty. This leaves the consumer €96 worse off versus the HP option. The advice is to look at your previous annual usage on the car clock, and try to agree a PCP contract close to that figure.

To obtain a sale value for a three-year-old Skoda Superb, I looked at a few dealer websites, with values ranging from €19,950 to €21,000 for an Ambition model with approximately 60,000km on the clock.

To roll over the PCP deal for another Skoda, the consumer could use the savings on repayments over the HP option to place a deposit for a new PCP deal. This would allow for the 30% deposit again to roll over the deal, meaning you could drive out of the showroom with a 2020 model, and never actually own either car outright.

Who will PCP suit

The answer is everyone really, as long as you can keep to the terms of the contract and are not concerned with outright ownership. Penalties on high kilometre usage over the agreed amount and the overall condition of the car are the areas where people can get burnt in PCP deals.

Poorly maintained cars will receive a lower valuation at the end of the term. This is not really any different to a high-mileage trade-in that has been on the road a lot, these cars are normally valued lower.

The same principle applies to PCP finance, with the only problem being you don’t own it, and the car is valued lower for the next deal. The buyout amount out of the PCP is fixed and will always remain the same, regardless of condition and the number of kilometres on the vehicle.

In theory, PCP deals are essentially good news for people, if the term and conditions are explained properly, and the buyer and the seller are happy that it is right fit.

SHARING OPTIONS