Read our archived live blog below for expert comment on the future of the sector.

9:45am

This concludes our live blog, don't miss the KPMG-Irish Farmers Journal agribusiness report in this week's print edition. Read the section on Brazil today for a flavour of the stories included in the publication.

9:43am

In the beef sector, Paul Finnerty says the "everyday low prices" model promoted by discount retailers has replaced traditional occasional promotions on more expensive products. "That's had a major impact," combined with a general "soft market" for beef in Europe. In addition, the British consumer wants British meat first, pushing UK prices up. As a result, although Irish cattle prices are now 30% higher than in 2010 and higher than EU everage, they are still below UK prices.

9:36am

IFA president Joe Healy says: "We are talking about sustainability, but what is not sustainable is the price currently paid to farmers. The big fear is the sustainability of margins for farmers who are currently producing below the cost of production."

Following surveys of British farmers on Brexit, especially a poll of young farmers showing 60% favoured leaving the UK, Healy says he advocated for a stay vote at last week's Balmoral Show."When I spoke with farmers there, they were looking at it more as a protest vote against the prices they are getting at the moment," he says.

9:36am

Back to Brexit: "This is a ridiculous referendum in which people have no idea they are voting on," says Graham Gudgin. The only party that has mentioned agricultural policy is UKIP, with a promise to keep single farm payments if the UK leaves the EU but no details.

9:32am

Irish Farmers Journal editor Justin McCarthy asks if the globalisation of food has failed in promoting trade. IBEC's Ciaran Fitzgerald answers that "there is a bad fit between the agri-food sector and the WTO". On the one hand, our food producing countries have raised sustainability standards; on the other hand, the WTO says "this is not an enforceable trade rule". As a result, our productive capacity is undermined in the face of competition from countries with lower standards.

9:27am

The discussion moves on to environmental sustainability of food production. Bord Bia chief executive Aidan Cotter says Ireland's Origin Green carbon footprinting programme aims to obtain "preference, other things being equal, from premium buyers" - in other words, the idea is not to fetch higher prices, but when buyers are looking for high quality foods, to win their decision on environmental credentials.

9:18am

The discussion now moves on to milk prices. "The timeframe for recovery is going to be longer than we initially expected," says Ian Proudfoot. "We didn't foresee the impact the quotas would have on the markets."

Proudfoot is putting too much hope on the end of the Russian ban: "The intelligence I get from inside Moscow is that the government is investing heavily in developing its domestic production and will never come back to the market."

Meanwhile, low grain prices mean that "even at the current prices, US producers are profitable."

With Chinese demand still a key factor in global prices, "we do not fully understand the supply chain in China, what is inside it and how it is evolving," says Proudfoot. "The Chinese government is trying to grow its domestic footprint as well."

"The markets will not rebound until we get a major event in agriculture, whether that be a drought or a biosecurity incident," he concludes.

9:11am

Gudging insists on the advantages of Brexit from a trade perspective: "The EU is declining as an export destination," he says, and it makes more sense to look elsewhere.

9:09am

Ian Proudfoot counters Graham Gudgin's argument on the ease of negotiating new trade agreements. "It took nine years to negotiate TPP", the Trans-Pacific Partnership agreement stretching from New Zealand to the US, he adds.

9:03am

"The big question for agri-food is whether the UK would revert to a cheap food policy, which is quite likely," says Gudgin. However, he dismisses concerns about the loss of free-trade agreements negotiated by the EU: "When you start with free trade, it is easy to get free trade," he says.

9am

Gudgin highlights the importance of migration in the size of the anti-EU sentiment: "The UK has become a cheap labour economy," he says. Combined with high housing costs, this means many people with jobs cannot afford accommodation and they grow frustrated.

Dr Graham Gudgin of Cambridge University now speaks in favour of leaving the EU @KPMG_Ireland #agribusiness #brexit pic.twitter.com/mYofUiuBRR

— Farmers Journal (@farmersjournal) May 17, 2016

8.58am

Dr Graham Gudgin of Cambridge University now speaks in favour of leaving the EU. "The EU is becoming increasingly dysfunctional, as we have seen in the migrant crisis," he says and UK business is slowly disassociating itself from the EU regardless of Brexit - "the UK is a semi-detached member of the EU and might as well do a clean break now". However, he expects the referendum to result in the UK staying in the EU.

8.52am

There will be impacts if public policies diverge between the UK and the EU, says Fitzgerald. For example, the new sugar tax in the UK, differences in alcohol excise already affect trade and where purchases are made between the two states. This would probably expand under a Brexit scenario.

"It would be a disaster for Ireland if the UK were to exit the EU," he concludes.

8.49am

If you're in the euro but not competitive in the UK, it's hard to sell your products, warns Fitzgerald. For example outside the UK, Ireland's main market for beef is Italy, and this is not enough.

8.48am

Ciaran Fitzgerald, ecomonist with IBEC, is next up. He looks back on the 2008 financial crisis: the sterling weakened and milk prices plummeted. "When sterling gets weak, there are shopping journeys taken out of the state," he says. "This is a unique threat to the Irish economy from Brexit."

8.43am

"Over 200,000t of Irish beef go into the UK every year. South American countries produce beef at €1-2/kg less than we do here. The tariff is worth between €3-5/kg," says Finnerty. You do the math: if the UK lifted tariff on South American beef, Irish beef would be undercut in its main market.

8.40am

Finnerty's first concern is that Brexit would make UK products less competitive. Restricted migration, too, would be an issue with migrant labour an important resource for the British industry.

8.36am

We're now starting an in/out debate on Brexit. The first speaker is Paul Finnerty, chief executive of ABP group, who says his company, as the largest beef processor in Europe with operations in the UK and across the EU, has a direct interest in this debate. "I'm woried that fora I'm involved in are in overwhelmingly in favour of staying, but when I talk one-on-one to informed individuals, the frustration with the EU and arguments to leave remain present."

8.34am

Proudfoot concludes by adding that social issues such as obesity, food waste, malnutrition and the debate on GM food will continue to affect the way we farm and sell food.

8.30am

Other "game changers" include "we food" personalised to suit consumer preferences such as religious rules, etc.; changes in retail formats; and antimicrobial resistance. The latter "is a life or death issue for humanity" and will affect food production deeply, Proudfoot warns.

8.25am

"Companies that were not competitors in the food industry will become competitors, such as pharmaceutical companies," Proudfoot says. This is because of increasing consumers' focus on health, including through the food they eat.

8.22am

Other examples of innovative farming studied by Ian Proudfoot include companies selling climate insurance or developing devices capable or irrigating crops by extracting water from the air at humidity rates as low as 40%.

Proudfoot lives in New Zealand, where he has seen insects farmed for protein production and used in protein-enriched milkshakes. He warns that such protein replacement may spread and shake-up farming, citing the example of the switch from wool to synthetic fibre for carpet manufacturing, which has overturned the wool industry.

He gives the example of Fairlife, which reduces sugar and fat content in milk and increases its protein content in the US. This is both a threat and an opportunity for producer of sugar-rich drinks such as Coca Cola.

8.20am

Proudfoot looks into new forms of farming that "take production where consumers want it" and mentions indoor vegetable farming in Chicago, and experiments to float farms on barges on the the sea off the shore of Barcelona.

Ian Proudfoot of @KPMG: new farming will "take production where consumers want it" (in cities, on floating barges) pic.twitter.com/QfDsIWENhE

— FJ AgriBusiness (@FJAgribiz) May 17, 2016

8.17am

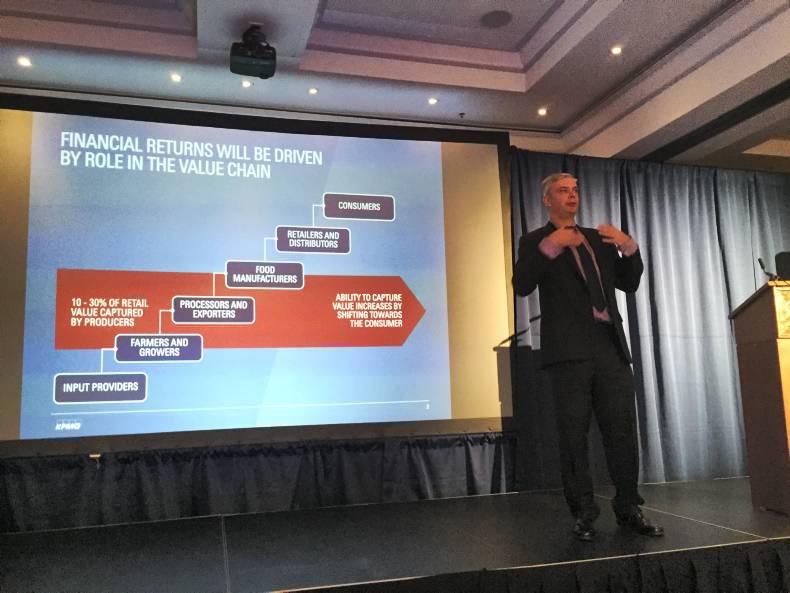

Ian Proudfoot, global head of agribusiness with KPMG, is now presenting. He says in the food supply chain, everything comes from the consumer and goes back to the consumer. KPMG analysis shows that only 10-30% of retail value typically goes back to the producers.

8.14am

Lowry highlights some of the challenges coming our way: "In the future, we may look at water exports rather than food exports. The world will grow its food in water rich areas," with demand coming from arid countries such as Saudi Arabia., he said.

Transport will therefore remain a key of competitiveness, with some areas such as Brazil already suffering: the cost of exporting from its Mato Grosso region to China can cost up to 40% of the values of commodities produced.

8.10am

Irish Farmers JournalAgribusiness editor Eoin Lowry says 91% of agri-food businesses surveyed with KPMG are planning to grow their business, but identify challenges in sustainability of production and current oversupply. "The commodity tap is fully open, whether it is oil or milk," says Lowry - and Chinese growth no longer absorbs it all.

8.05am

Irish Farmers Journal editor Justin McCarthy introduces the event highlighting that this year's report comes against the backdrop of increased uncertainty, especially that associated with Brexit. He said he was "shocked to see the number of farmers favouring a Brexit" at Balmoral Show last week.

7.55am

The room is filling up with industry figures ranging from chief executives of food processing and other agri-business companies as well as farming organisations and agencies including.

Stay tuned for presentations from 8am including a keynote address by Ian Proudfoot, Global Head of Agribusiness at KPMG.

SHARING OPTIONS