When we talk about sheep production on a global stage, most discussions generally commence talking about production in New Zealand or Australia.

Most people are of the opinion that these are the two largest sheep-producing nations.

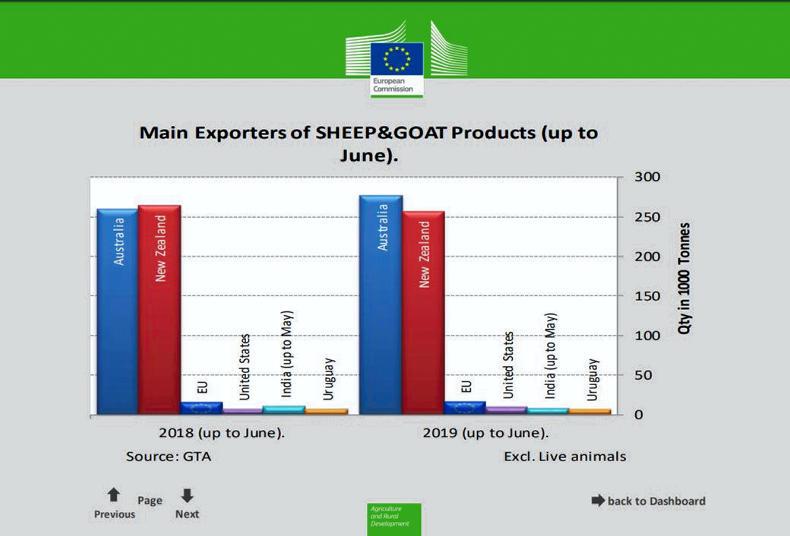

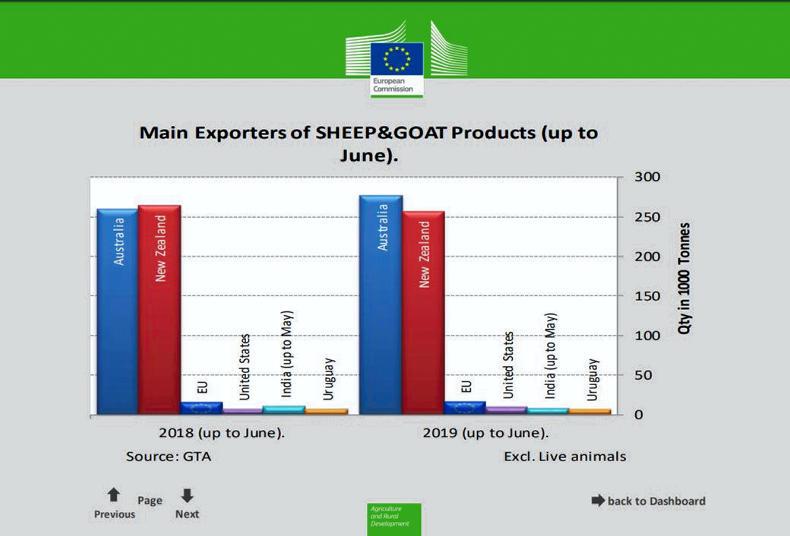

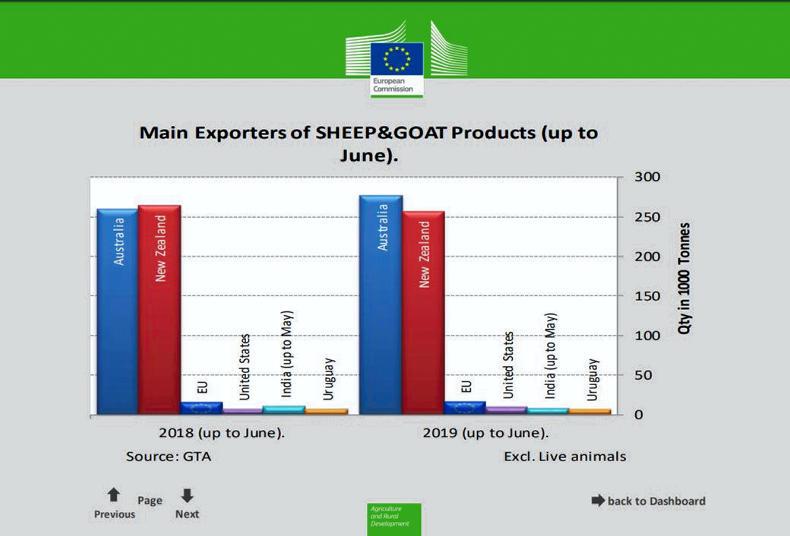

This is due to the fact that New Zealand and Australia are the major players on the global stage, accounting for over 90% of sheepmeat exports, as shown in the EU sheepmeat export bar charts for the first six months of 2019.

New Zealand and Australia are the two main players on the gloabl sheep market accounting for over 90% of sheepmeat exports.

However, it is China that holds the position of possessing the largest sheep flock in the world, with estimates pointing to a national flock in excess of 130m sheep.

The reason why there was relatively little discussed about China and sheepmeat is that the country was not a significant player in imports or exports, a situation which is changing drastically.

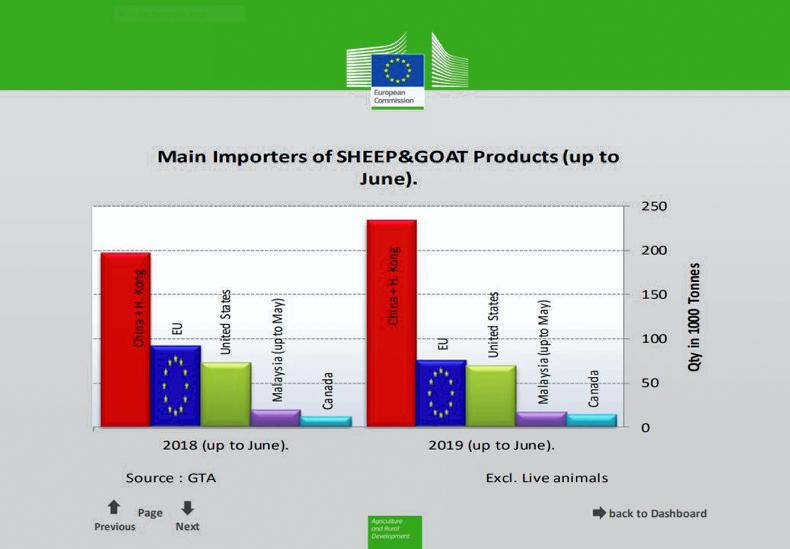

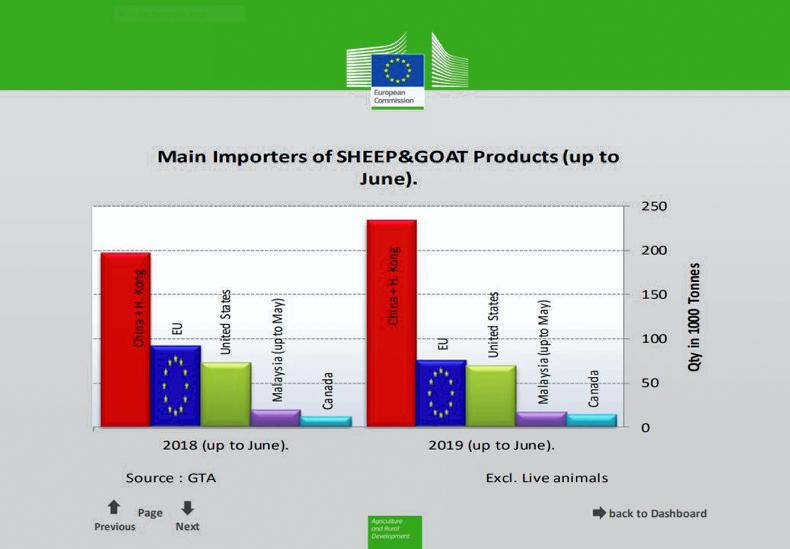

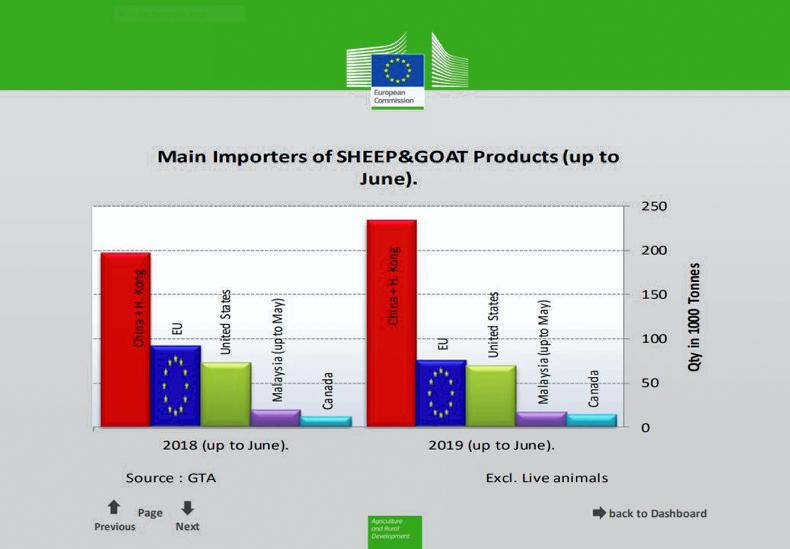

China is now the number one importer of sheepmeat, with in excess of 300,000t of sheepmeat entering the market in 2018, a massive jump of 30% on 2017 levels.

Growing appetite

China’s appetite for sheepmeat continues to grow rapidly.

China continues to record phonomenal growth in sheepmeat imports with an increase in the region of 35,000t for the first six months of the year.

As shown in the graph listing the main importers of sheep, China imported in the region of 235,000t of sheepmeat for the first six months of the year.

This increase of over 35,000t is massive when you take into account Irish sheepmeat exports have totalled 50,000t to 55,000t in recent years.

Growth is predicted to stay on this upward trend, with a reduction in pork availability caused by African swine fever said to be increasing demand for other meat proteins.

New Zealand exports

Chinese sheepmeat import demand was traditionally for fifth-quarter products and lower-value cuts.

However, this is also changing. New Zealand and Australia, which are the two big suppliers to the market, are diverting an increasing volume of lower value cuts there.

The US and EU markets still remain the most lucrative for high-value cuts, but a shorter supply chain and lower transport costs are making the Chinese market more competitive.

New Zealand sheepmeat exports to the EU market for the period January to June have fallen by 18% to 77,551t.

It is now accepted that the country will struggle to match export volumes which averaged in the region of 150,000t in recent years.

This is a positive for Irish and EU sheep producers, as it creates more market demand.

Securing access to the Chinese market for Irish sheepmeat would be a major step forward and open up a market which is recording phenomenal growth.

When we talk about sheep production on a global stage, most discussions generally commence talking about production in New Zealand or Australia.

Most people are of the opinion that these are the two largest sheep-producing nations.

This is due to the fact that New Zealand and Australia are the major players on the global stage, accounting for over 90% of sheepmeat exports, as shown in the EU sheepmeat export bar charts for the first six months of 2019.

New Zealand and Australia are the two main players on the gloabl sheep market accounting for over 90% of sheepmeat exports.

However, it is China that holds the position of possessing the largest sheep flock in the world, with estimates pointing to a national flock in excess of 130m sheep.

The reason why there was relatively little discussed about China and sheepmeat is that the country was not a significant player in imports or exports, a situation which is changing drastically.

China is now the number one importer of sheepmeat, with in excess of 300,000t of sheepmeat entering the market in 2018, a massive jump of 30% on 2017 levels.

Growing appetite

China’s appetite for sheepmeat continues to grow rapidly.

China continues to record phonomenal growth in sheepmeat imports with an increase in the region of 35,000t for the first six months of the year.

As shown in the graph listing the main importers of sheep, China imported in the region of 235,000t of sheepmeat for the first six months of the year.

This increase of over 35,000t is massive when you take into account Irish sheepmeat exports have totalled 50,000t to 55,000t in recent years.

Growth is predicted to stay on this upward trend, with a reduction in pork availability caused by African swine fever said to be increasing demand for other meat proteins.

New Zealand exports

Chinese sheepmeat import demand was traditionally for fifth-quarter products and lower-value cuts.

However, this is also changing. New Zealand and Australia, which are the two big suppliers to the market, are diverting an increasing volume of lower value cuts there.

The US and EU markets still remain the most lucrative for high-value cuts, but a shorter supply chain and lower transport costs are making the Chinese market more competitive.

New Zealand sheepmeat exports to the EU market for the period January to June have fallen by 18% to 77,551t.

It is now accepted that the country will struggle to match export volumes which averaged in the region of 150,000t in recent years.

This is a positive for Irish and EU sheep producers, as it creates more market demand.

Securing access to the Chinese market for Irish sheepmeat would be a major step forward and open up a market which is recording phenomenal growth.

SHARING OPTIONS