A new report on the economic impact of the tillage sector in Irish agriculture puts the overall value of the sector at €1.3bn and supporting 11,000 full-time job equivalents. This is the first comprehensive evaluation of the sector, which shows that it has been contracting in size for many years, and that it has managed to maintain cereal output despite the area reduction.

The report was prepared for Tillage Industry Ireland by Professor Michael Wallace from the School of Agriculture and Food Science at University College Dublin. It is seen as important to the recognition and evaluation of the tillage sector and the many different ways in which it contributes to the fabric of agriculture in this country.

It looks in detail at the trends that have occurred in and around the sector, the fall in the number of growers, the area declines, the loss of the milling sector, the expansion in the drinks sector and associated imports, the increasing reliance on imported feedstuffs, etc. It also addresses the environmental issues associated with the sector.

The report encompasses the areas growing cereals (wheat, barley, oats, other cereals), oilseed rape, pulses (peas, beans), potatoes and arable fodder crops (maize silage, whole crop cereals, fodder beet).

The economic impact analysis is based on average values across the five-year period from 2014 to 2018

It looks at the upstream input-supply sectors, and the downstream sectors that process crops for use in other areas such as livestock feed and food and drink manufacturing.

The economic impact analysis is based on average values across the five-year period from 2014 to 2018. This was done to help level out the effect of inter-year variability, which can be caused by occasional spikes and troughs in production and demand, to make it representative of a medium-term horizon.

Structure of the tillage sector

The report identified that there are just under 10,000 Irish farms growing tillage crops, representing 7.5% of all farm holdings in Ireland. Of these, almost 5,000 are classified as “specialist” tillage farms – those whose crop sales account for more than two-thirds of their output.

The remaining 5,000 holdings growing crops are mixed-enterprise farms. These generally have limited scale annual crop production, alongside livestock enterprises.

Nationally, the area under the tillage crops assessed from 2014 to 2018 averaged 338,000ha

The average area of specialist tillage farms is approximately 60ha, almost double the average for all farms in Ireland. The number of specialist tillage farms declined by 2% between 2005 and 2016, compared to a reduction of 3% in all farm holdings over the same period. However, the number of non-specialist tillage holdings decreased by around 40% in the same period.

The area under tillage crops, nationally, has declined by 15% (57,400ha) over the last decade and by 42% since 1980, dropping to 321,000ha by 2018. Nationally, the area under the tillage crops assessed from 2014 to 2018 averaged 338,000ha.

Within these area declines, the most substantial area decreases took place in the southeast and southwest regions where crop area fell by almost 35,000ha between 2008 and 2018.

While part of this reduction was precipitated by difficult weather seasons and poor incomes, especially in the south, the greatest driver of tillage area reduction in these regions was still the expansion in dairying. These regions alone accounted for 60% of the national decline in tillage in that period. It is thought that much of this former tillage land is now used for milk production.

Despite these area reductions, the volume of cereal output during the 2014 to 2018 period averaged 2.3m tonnes per annum

While the biggest area decrease was in the southeast and southwest, the largest percentage reductions in tillage area occurred in the border and western counties. Difficult growing seasons, and difficult harvests in particular, were a significant driver in these area reductions.

Despite these area reductions, the volume of cereal output during the 2014 to 2018 period averaged 2.3m tonnes per annum. This was possible due to continuous yield improvements and improved rotations, plus a swing from spring-sown cereals to higher-yielding winter-sown cereals.

The crop makeup

The makeup of the national cereals area is heavily weighted towards barley and this accounted for 57% of tillage area from 2014 to 2018, with wheat and oats accounting for 19% and 7%, respectively. The mix of break crops changed considerably in the past 20 years, with a doubling of oilseed rape area to around 10,000ha after 2005. This was driven initially by the drive to renewables and was fuelled by the Mineral Oil Tax Relief scheme at that time, but this was discontinued in 2010.

The area sown to pulse crops trebled to around 10,000ha on average between 2014 and 2018 following the introduction of the Protein Aid Scheme in 2015. This brought the indirect benefits of increased native protein production (but it is still tiny in comparison to demand for protein imports for livestock feed), higher yields in the following crops and also the double benefit of not applying any nitrogen input on that area of crops in that year, plus reduced nitrogen requirement in the following crops.

Potato area has decreased by two-thirds since the early 1990s

The area sown to potatoes fell by 37% since 2008 to 7,100ha in 2018. Potato area has decreased by two-thirds since the early 1990s, while the number growing the crop declined by over 90% in that time frame.

During the period from 2014 to 2018, the average annual production of potatoes was roughly 350,000t, compared to around 600,000t per annum in the 1990s. This reflects the falling demand for the crop, increased pressure from imports and the increasing level of specialisation and investment required to grow the crop.

The basic economics

The report states that “tillage is a commercially focused sector with strong farm income performance compared to the other main sectors of Irish agriculture”.

The average income from mainly tillage farms is second only to the average income for dairy farms, at around €34,000 per farm over the last five years.

While this is more than double the average income for drystock systems, it still does not represent a good return for the level of investment required in crop inputs and machinery.

The report also notes that direct payments are a critical part of tillage farm incomes. The “cheque” represents 22% of gross output and 71% of family farm income.

Tillage farms compare very favourably with other systems in terms of economic viability. Some 63% of “mainly tillage” farms were classified as economically viable in 2018, with a further 19% deemed financially sustainable due to the presence of off-farm income.

Studies have shown that Irish tillage farms are competitive with our counterparts in other EU member states based on costs of production.

However, it is no surprise that we have competitive disadvantages in relation to high land and labour costs compared to other EU states.

The report points out that average land rental costs in Ireland are the fourth highest in the EU. This is after the Netherlands, Denmark, and Austria.

Unlike some livestock enterprises, which can operate using purchased feed and fodder, tillage operations require land.

Dairy expansion

In recent years, land availability became a bigger issue following the expansion in dairying and the loss of tillage land to grassland. This happened from both within the rental land pool and the conversion of tillage farms to dairy. This expansion in demand brought a level of inflation to all land access costs.

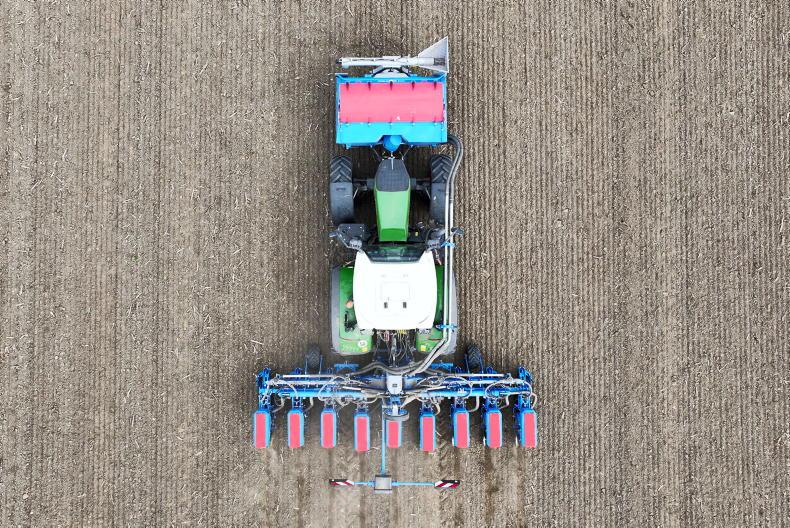

Given the need for scale to justify machinery in tillage enterprises, high land costs inhibit farm expansion and reduce the capacity to spread machinery and labour overheads over larger acreages.

Tillage farming is obviously of greater importance in some regions of the country than in others and more prevalent in some counties than others. In Table 1, Professor Wallace breaks down the national farm output from the different crops in the different regions as outlined.

The national tillage farm output averaged €636.6m per annum over the period from 2014 to 2018. That time span saw some area changes for different crops, and it saw the overall area decline due to the surge in dairy expansion.

Over 70% of the total crop output value was from cereals, with potatoes and tillage forage crops accounting for approximately 13% and 11%, respectively.

Almost 65% of national tillage output was concentrated in the tillage heartlands of the eastern and southeastern counties.

The economic impact of any agricultural sector is more than just the value of its output. This has been calculated by various economists in the past but this report looked at the impact of output derived from the tillage sector only. This involved a re-calibration of an older coefficient based on modern data in an industry that has had to be lean to survive.

The output multiplier calculates the upstream impact through the economy, so the net value of a sector is more than just its farmgate output value. The multiplier identifies how much additional output is initiated in other sectors from €1 of output in the chosen sector.

The re-calibration of the old coefficients found that the multiplier effect added a further €1.20 within the economy for every €1 of cereal output produced on tillage farms.

Different crops

The multiplier is different for different crops and enterprises and the report found that the average multiplier across all the crops under consideration was €1.05.

Every €1 of output from the tillage sector (based on values from 2014 to 2108 output composition) generates a further €1.05 in output in the Irish economy.

Older analysis of agricultural multipliers indicated that cereals had a higher multiplier than agriculture as a whole – 22% higher. This seems likely given the dependence of the sector on a range of different inputs sourced in the local economy and that all of its output is used locally. That same research indicated that higher multipliers are associated with sectors that are more embedded in the national economy, with stronger inter-sectoral linkages. The average value of tillage output during 2014-2018 was calculated at €636.6m.

Using the €1.05 multiplier, the additional contribution from this in the wider economy adds a further €668.4m to the value of the sector. This brought the total value of tillage output in the economy up to €1.3bn per annum. This equates to €4m for every 1,000ha in tillage.

This is a far cry from the old standard valuation put on the sector, which was based on farmgate value for only about 70% of cereal output. This was done because only 70% of the cereal output moved into the trade and the rest was not valued.

The contribution of the tillage sector to the Irish economy is put at €1.3bn. The sector accounts for 11,000 full-time equivalent jobs, or 32 jobs for every 1,000ha in these tillage crops.While it is the second most profitable enterprise, the area under tillage crops declined by 15% (57,400ha) over the last decade and by 42% since 1980.

A new report on the economic impact of the tillage sector in Irish agriculture puts the overall value of the sector at €1.3bn and supporting 11,000 full-time job equivalents. This is the first comprehensive evaluation of the sector, which shows that it has been contracting in size for many years, and that it has managed to maintain cereal output despite the area reduction.

The report was prepared for Tillage Industry Ireland by Professor Michael Wallace from the School of Agriculture and Food Science at University College Dublin. It is seen as important to the recognition and evaluation of the tillage sector and the many different ways in which it contributes to the fabric of agriculture in this country.

It looks in detail at the trends that have occurred in and around the sector, the fall in the number of growers, the area declines, the loss of the milling sector, the expansion in the drinks sector and associated imports, the increasing reliance on imported feedstuffs, etc. It also addresses the environmental issues associated with the sector.

The report encompasses the areas growing cereals (wheat, barley, oats, other cereals), oilseed rape, pulses (peas, beans), potatoes and arable fodder crops (maize silage, whole crop cereals, fodder beet).

The economic impact analysis is based on average values across the five-year period from 2014 to 2018

It looks at the upstream input-supply sectors, and the downstream sectors that process crops for use in other areas such as livestock feed and food and drink manufacturing.

The economic impact analysis is based on average values across the five-year period from 2014 to 2018. This was done to help level out the effect of inter-year variability, which can be caused by occasional spikes and troughs in production and demand, to make it representative of a medium-term horizon.

Structure of the tillage sector

The report identified that there are just under 10,000 Irish farms growing tillage crops, representing 7.5% of all farm holdings in Ireland. Of these, almost 5,000 are classified as “specialist” tillage farms – those whose crop sales account for more than two-thirds of their output.

The remaining 5,000 holdings growing crops are mixed-enterprise farms. These generally have limited scale annual crop production, alongside livestock enterprises.

Nationally, the area under the tillage crops assessed from 2014 to 2018 averaged 338,000ha

The average area of specialist tillage farms is approximately 60ha, almost double the average for all farms in Ireland. The number of specialist tillage farms declined by 2% between 2005 and 2016, compared to a reduction of 3% in all farm holdings over the same period. However, the number of non-specialist tillage holdings decreased by around 40% in the same period.

The area under tillage crops, nationally, has declined by 15% (57,400ha) over the last decade and by 42% since 1980, dropping to 321,000ha by 2018. Nationally, the area under the tillage crops assessed from 2014 to 2018 averaged 338,000ha.

Within these area declines, the most substantial area decreases took place in the southeast and southwest regions where crop area fell by almost 35,000ha between 2008 and 2018.

While part of this reduction was precipitated by difficult weather seasons and poor incomes, especially in the south, the greatest driver of tillage area reduction in these regions was still the expansion in dairying. These regions alone accounted for 60% of the national decline in tillage in that period. It is thought that much of this former tillage land is now used for milk production.

Despite these area reductions, the volume of cereal output during the 2014 to 2018 period averaged 2.3m tonnes per annum

While the biggest area decrease was in the southeast and southwest, the largest percentage reductions in tillage area occurred in the border and western counties. Difficult growing seasons, and difficult harvests in particular, were a significant driver in these area reductions.

Despite these area reductions, the volume of cereal output during the 2014 to 2018 period averaged 2.3m tonnes per annum. This was possible due to continuous yield improvements and improved rotations, plus a swing from spring-sown cereals to higher-yielding winter-sown cereals.

The crop makeup

The makeup of the national cereals area is heavily weighted towards barley and this accounted for 57% of tillage area from 2014 to 2018, with wheat and oats accounting for 19% and 7%, respectively. The mix of break crops changed considerably in the past 20 years, with a doubling of oilseed rape area to around 10,000ha after 2005. This was driven initially by the drive to renewables and was fuelled by the Mineral Oil Tax Relief scheme at that time, but this was discontinued in 2010.

The area sown to pulse crops trebled to around 10,000ha on average between 2014 and 2018 following the introduction of the Protein Aid Scheme in 2015. This brought the indirect benefits of increased native protein production (but it is still tiny in comparison to demand for protein imports for livestock feed), higher yields in the following crops and also the double benefit of not applying any nitrogen input on that area of crops in that year, plus reduced nitrogen requirement in the following crops.

Potato area has decreased by two-thirds since the early 1990s

The area sown to potatoes fell by 37% since 2008 to 7,100ha in 2018. Potato area has decreased by two-thirds since the early 1990s, while the number growing the crop declined by over 90% in that time frame.

During the period from 2014 to 2018, the average annual production of potatoes was roughly 350,000t, compared to around 600,000t per annum in the 1990s. This reflects the falling demand for the crop, increased pressure from imports and the increasing level of specialisation and investment required to grow the crop.

The basic economics

The report states that “tillage is a commercially focused sector with strong farm income performance compared to the other main sectors of Irish agriculture”.

The average income from mainly tillage farms is second only to the average income for dairy farms, at around €34,000 per farm over the last five years.

While this is more than double the average income for drystock systems, it still does not represent a good return for the level of investment required in crop inputs and machinery.

The report also notes that direct payments are a critical part of tillage farm incomes. The “cheque” represents 22% of gross output and 71% of family farm income.

Tillage farms compare very favourably with other systems in terms of economic viability. Some 63% of “mainly tillage” farms were classified as economically viable in 2018, with a further 19% deemed financially sustainable due to the presence of off-farm income.

Studies have shown that Irish tillage farms are competitive with our counterparts in other EU member states based on costs of production.

However, it is no surprise that we have competitive disadvantages in relation to high land and labour costs compared to other EU states.

The report points out that average land rental costs in Ireland are the fourth highest in the EU. This is after the Netherlands, Denmark, and Austria.

Unlike some livestock enterprises, which can operate using purchased feed and fodder, tillage operations require land.

Dairy expansion

In recent years, land availability became a bigger issue following the expansion in dairying and the loss of tillage land to grassland. This happened from both within the rental land pool and the conversion of tillage farms to dairy. This expansion in demand brought a level of inflation to all land access costs.

Given the need for scale to justify machinery in tillage enterprises, high land costs inhibit farm expansion and reduce the capacity to spread machinery and labour overheads over larger acreages.

Tillage farming is obviously of greater importance in some regions of the country than in others and more prevalent in some counties than others. In Table 1, Professor Wallace breaks down the national farm output from the different crops in the different regions as outlined.

The national tillage farm output averaged €636.6m per annum over the period from 2014 to 2018. That time span saw some area changes for different crops, and it saw the overall area decline due to the surge in dairy expansion.

Over 70% of the total crop output value was from cereals, with potatoes and tillage forage crops accounting for approximately 13% and 11%, respectively.

Almost 65% of national tillage output was concentrated in the tillage heartlands of the eastern and southeastern counties.

The economic impact of any agricultural sector is more than just the value of its output. This has been calculated by various economists in the past but this report looked at the impact of output derived from the tillage sector only. This involved a re-calibration of an older coefficient based on modern data in an industry that has had to be lean to survive.

The output multiplier calculates the upstream impact through the economy, so the net value of a sector is more than just its farmgate output value. The multiplier identifies how much additional output is initiated in other sectors from €1 of output in the chosen sector.

The re-calibration of the old coefficients found that the multiplier effect added a further €1.20 within the economy for every €1 of cereal output produced on tillage farms.

Different crops

The multiplier is different for different crops and enterprises and the report found that the average multiplier across all the crops under consideration was €1.05.

Every €1 of output from the tillage sector (based on values from 2014 to 2108 output composition) generates a further €1.05 in output in the Irish economy.

Older analysis of agricultural multipliers indicated that cereals had a higher multiplier than agriculture as a whole – 22% higher. This seems likely given the dependence of the sector on a range of different inputs sourced in the local economy and that all of its output is used locally. That same research indicated that higher multipliers are associated with sectors that are more embedded in the national economy, with stronger inter-sectoral linkages. The average value of tillage output during 2014-2018 was calculated at €636.6m.

Using the €1.05 multiplier, the additional contribution from this in the wider economy adds a further €668.4m to the value of the sector. This brought the total value of tillage output in the economy up to €1.3bn per annum. This equates to €4m for every 1,000ha in tillage.

This is a far cry from the old standard valuation put on the sector, which was based on farmgate value for only about 70% of cereal output. This was done because only 70% of the cereal output moved into the trade and the rest was not valued.

The contribution of the tillage sector to the Irish economy is put at €1.3bn. The sector accounts for 11,000 full-time equivalent jobs, or 32 jobs for every 1,000ha in these tillage crops.While it is the second most profitable enterprise, the area under tillage crops declined by 15% (57,400ha) over the last decade and by 42% since 1980.

SHARING OPTIONS