Two major Brazilian beef exporters say they will maintain their share of China’s beef market despite a confirmed case of BSE in the country.

Miverva and Marfig say they will now use supplies from their beef factories in Argentina and Uruguay to supply the Chinese market. In turn, the beef from their Brazilian factories will go to the markets which would have been filled by the Argentinian and Uruguayan supplies.

Brazilian beef exports to China were stalled last week following the confirmation of a case of atypical BSE or ‘mad cow disease’ in a suckler cow.

The news was a major blow to Brazilian beef farmers as in 2022, Brazil exported 1.238m tonnes of beef to China, half of its total exports of 2.264m tonnes.

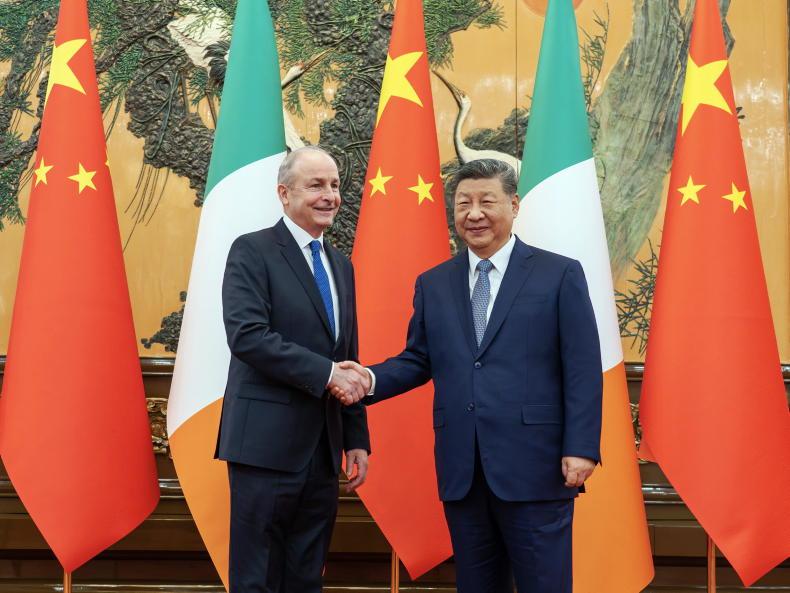

Brazilian officials have been in robust engagement with their Chinese peers in recent days, with the aim of regaining market access as quickly as possible.

When Brazil last confirmed a case of BSE in September 2019, it regained market access to China as early as mid-December of that year and it is expected market access will be reinstated in a similar, if not shorter, timeframe this time around.

The market ban comes as part of a 2015 animal health agreement between the two countries, a deal Brazilian officials now want scrapped.

Bord Bia

Bord Bia has also poured some cold water on the potential opportunity for Irish beef while Brazilian beef is locked out of China.

Its beef and livestock sector manager Joe Burke warned that it is “unlikely” Brazilian beef will be out of China for long.

He also said that while the Chinese suspension is ongoing, it is “expected that Brazilian beef exports will be more competitive in other markets”, creating more competition for Irish beef where there may not have been before.

Read more

Brazilian beef exporters to still meet Chinese demand

BSE impact on Brazil’s beef exports

Irish beef should gain ground while Brazil locked out of China - IFA

Two major Brazilian beef exporters say they will maintain their share of China’s beef market despite a confirmed case of BSE in the country.

Miverva and Marfig say they will now use supplies from their beef factories in Argentina and Uruguay to supply the Chinese market. In turn, the beef from their Brazilian factories will go to the markets which would have been filled by the Argentinian and Uruguayan supplies.

Brazilian beef exports to China were stalled last week following the confirmation of a case of atypical BSE or ‘mad cow disease’ in a suckler cow.

The news was a major blow to Brazilian beef farmers as in 2022, Brazil exported 1.238m tonnes of beef to China, half of its total exports of 2.264m tonnes.

Brazilian officials have been in robust engagement with their Chinese peers in recent days, with the aim of regaining market access as quickly as possible.

When Brazil last confirmed a case of BSE in September 2019, it regained market access to China as early as mid-December of that year and it is expected market access will be reinstated in a similar, if not shorter, timeframe this time around.

The market ban comes as part of a 2015 animal health agreement between the two countries, a deal Brazilian officials now want scrapped.

Bord Bia

Bord Bia has also poured some cold water on the potential opportunity for Irish beef while Brazilian beef is locked out of China.

Its beef and livestock sector manager Joe Burke warned that it is “unlikely” Brazilian beef will be out of China for long.

He also said that while the Chinese suspension is ongoing, it is “expected that Brazilian beef exports will be more competitive in other markets”, creating more competition for Irish beef where there may not have been before.

Read more

Brazilian beef exporters to still meet Chinese demand

BSE impact on Brazil’s beef exports

Irish beef should gain ground while Brazil locked out of China - IFA

SHARING OPTIONS