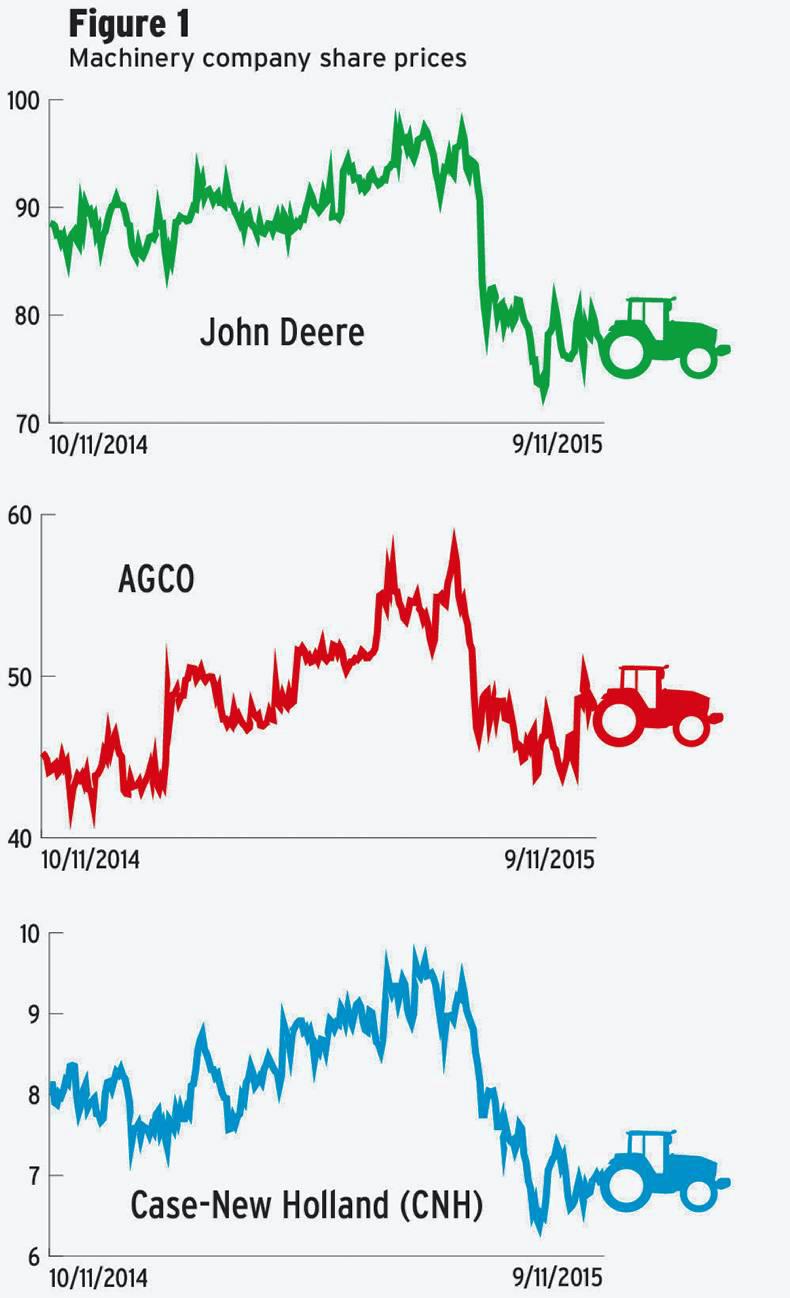

Scrolling through the latest financial reports of some of the world’s largest farm machinery companies can make for grim reading. The outlook among many of the largest machinery manufacturers right now is very pessimistic.

At this year’s Agritechnica show in Germany, the common consensus among the leading manufacturers was for an approximate 20% downturn in sales for the coming year, with 2016 being viewed as a far tougher 12 months to come than the current year.

The continued political uncertainty in Russia and Ukraine, coupled with a negative forecast for milk and grain commodity prices, has left manufacturers with slim hopes that farmers will invest in machinery in 2016.

Already this year, we have seen a spate of profit warnings and bearish forecasts from manufacturers. In its latest financial report, the world’s largest agricultural machinery producer, John Deere, said it expected a sales decline of more than 20% for its 2015 financial year.

Deere said equipment sales in the US and Canada, its largest markets, were back 17% in the year to date while sales outside its core region were back 26% year-on-year.

AGCO, the maker of Fendt, Massey Ferguson and Valtra tractors, has forecast a similar decline for its 2015 financial year, saying it expects sales to fall by as much as 23% for 2015. AGCO said that while sales of smaller horsepower machines and forage equipment were relatively stable, it was not enough to offset the decline of large agricultural equipment, particularly in North and South America.

Recent financial reports from Case-New Holland (CNH) are also predicting significant sales declines for its end-of-year results. CNH is guiding full year sales for 2015 in the region of $25bn to $26bn, which would represent a fall in sales of up to 24% compared with 2014.

And while the large European machinery manufacturers like SAME Deutz-Fahr and Claas remain largely in private ownership and have no recent financial filings, it is likely they too are feeling the effects of the headwinds facing the machinery sector right now.

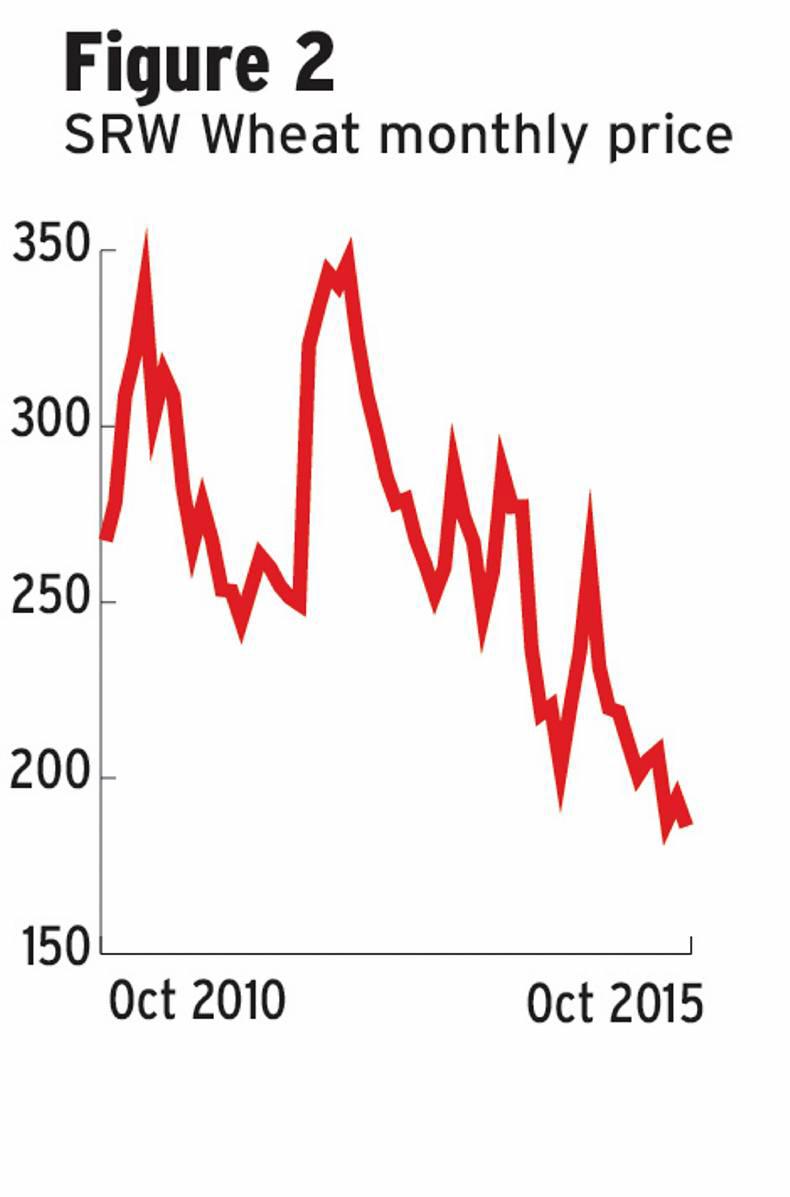

Grain prices

The global farm machinery sector has faced an almost perfect storm of challenges over the past 18 months.

Consecutive record grain harvests have dampened markets, leading to a third successive year of weak grain prices, which has eroded farmer incomes. Between September 2012 and September this year, the average price of wheat and maize in the US has fallen by 44% and 48% respectively.

And after another record harvest this year and no sign of a lift in grain prices, it means the current difficulties facing manufacturers are likely to spill into next year. Just this week, grain futures tumbled after the USDA released its latest world supply and demand report and US officials once again hiked estimates for this year’s harvest.

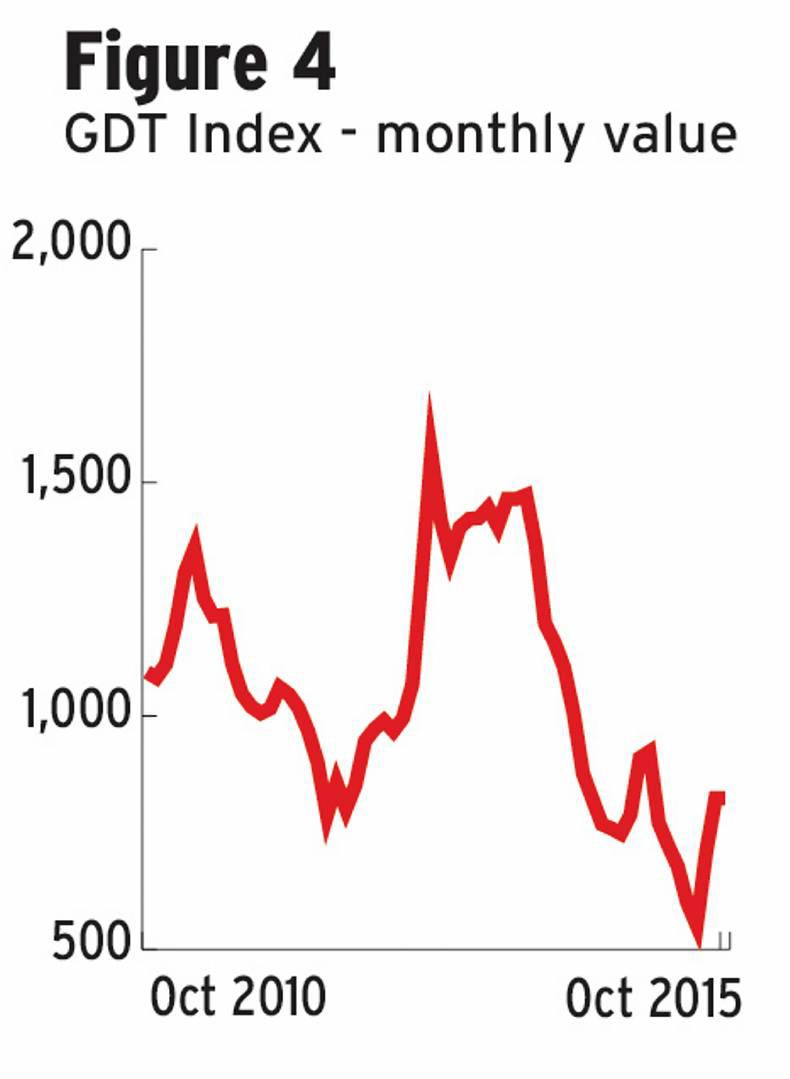

On the dairy side of things, the market performed strongly up until the midpoint of this year when prices really began to collapse. The Global Dairy Trade Index (GDT), a benchmark for prices in the dairy sector, has fallen by almost two-thirds from its peak in July 2013 to its current level. And while the rout in dairy prices does appear to have bottomed out, it will be at least a year before we see any noteworthy recovery in farmgate milk prices.

Sales of large-scale, high-horsepower combines and harvesters make up the back bone of revenues for many of these businesses. The weak prices of grain and dairy commodities have restricted farmer investment in the past year.

Not only are US manufacturers battling against low commodity prices, but currency exposure has also hampered sales this year.

Currency

Since the second half of 2014, the value of the US dollar has rallied strongly as the US economy kicked back into life with figures showing healthy economic growth and strong job creation in the world’s largest economy.

Between June 2014 and today, the US dollar has strengthened by more than 20% with some talk this week that we may see dollar-euro parity for the first time since 2002.

The hardening US dollar has only served to make US machinery exports uncompetitive in global markets, forcing manufacturers to trim margins or allow the price of their machinery to increase.

At the same time as the dollar has hardened, many currencies of the world’s major agriculture nations have gone in the other direction.

In the past 18 months, the value of the Brazilian Real has collapsed, falling by more than 70% against the US dollar over the period. Added to this, the general weakness in the Brazilian economy and the softness of the sugar sector, a major industry in Brazil, has significantly impacted machinery sales there.

Likewise in Russia, once a major market destination for large equipment, the Rouble has plummeted to record lows against the US dollar. The volatility of the Russian currency is a direct result of the sanctions imposed on Russia by the EU and US.

The big machinery companies have had a good run over the last five years. However, right now due to the move into the lower commodity price cycle, not only are sales falling for the major machinery manufacturers globally, but margins and profits continue to erode.

Manufacturing technology in the last decade increased output efficiency, allowing these businesses to manufacture more machines than ever at a time when demand began to outstrip supply. However, today, manufacturers are unable to work through built up inventory stocks due to the weak demand.

Grain, sugar and soya are the main drivers of machinery sales. Dairy is less so and this may be the reason why machinery sales are holding up in Ireland as the majority of tractors are relatively smaller and sold to livestock farmers.

Machinery manufacturers may need to reduce their prices if they want to shift volumes.

However, with market sentiment so poor in the big grain producing nations around the world, it is unlikely that any price reduction will bolster sales.

SHARING OPTIONS