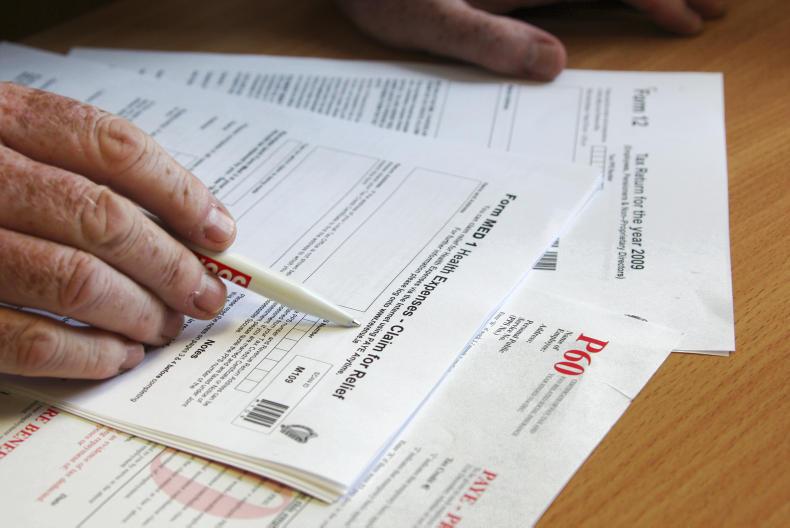

I had a number of queries in the last week about the pay and file deadlines and filling in form 12 for PAYE workers. There are really two deadlines: 31 October to get in the form and the money owed by post, and 13 November when you do it through Revenue’s online service. Since 19 September, Revenue is not accepting cheques, which proves an inconvenience for farmers who tend to use them the most.

How much should I pay this year?

Normally, farmers pay 100% of what they paid last year, but they also have the option of paying 90% of what you think it is likely to be in 2014. Declan McEvoy, IFAC, said dairy farmers this year are paying 100% of 2013. This is likely to be the best option as income will probably be increased this year. However, for beef, sheep and tillage farmers, working out what the likely tax bill will be in 2014 and paying 90% of it could significantly reduce the amount to be paid.

I have a PAYE job and run a small farm. I got a form 12 for the first time this year. Do I have to fill it out?

Yes. People whose primary sources of income are their PAYE jobs might have to fill out a form 12, but only if Revenue requests it. If you have a farm and receive entitlements, such as REPS and the Single Farm Payment, you will have to complete the form. In it, you will have to set out the different income types assessable under form 12. They include:

• Farm income after allowable costs.• Rental income – only 75% of interest paid is allowable against rental income. Remember costs and repairs can also be deducted. You will also have to pay USC and PRSI on this income.• Dividend income – a 20% dividend withholding tax is taken at source and a tax credit will be given, but more will be owed if you are at the 41% rate of tax.• Foreign incomes on British shares – you will be given a tax credit on next dividend.The main reason that Revenue requests that a form 12 is completed is because all income is liable for tax. For this reason, it is important to keep a record of your payments and receipts.

I have a full-time job and I am farming a small farm. I made a profit of €4,000 this year. I built a shed two years ago so have €7,000 in capital allowances to write down. Do I have to pay income tax, USC or PRSI on the farm income?

No. When the capital allowances are taken into account, you are deemed to have made a loss of €4,000 on the farm so do not have to pay any tax or USC.

As you already have adequate PRSI paid under your PAYE job, you do not need to pay that either. You have two options. You can claim €4,000 in capital reliefs this year and carry the remainder forward to write off profits in future years, or you can claim the full €7,000 and submit a loss of €3,000.

This can be used to claim back tax on income tax you paid on your PAYE job.

If you paid tax at 20% you would get back €600, but if you were paying at the high rate of tax you will only get back €140.

We made €15,000 on the farm last year. I work on the farm as well as my husband. He normally submits the income in his name, but I read that it might be more beneficial to split it between us this year.

Yes. In 2014, for the first time you can allocate income between spouses or civil partners that work on the farm. As you have no other income, you could submit €10,000 in his name and €5,000 in yours. The minimum needed to qualify you to pay PRSI is €5,000.

It means that you will each pay €500 PRSI and get 52 contributions, that will be counted towards your individual contributory old-age pension.

Remember, you must have at least 520 contributions (10 years) to qualify.

I did some drainage work in 2012 and forgot to claim back VAT. Can I still do it?

Yes. You can also go back over the last four tax years if you forgot to claim any previous VAT paid. VAT can be claimed back on fixed structures around the farm. This can be for things like construction of a farm road, sheds, drainage, fencing, etc. CL

I had a number of queries in the last week about the pay and file deadlines and filling in form 12 for PAYE workers. There are really two deadlines: 31 October to get in the form and the money owed by post, and 13 November when you do it through Revenue’s online service. Since 19 September, Revenue is not accepting cheques, which proves an inconvenience for farmers who tend to use them the most.

How much should I pay this year?

Normally, farmers pay 100% of what they paid last year, but they also have the option of paying 90% of what you think it is likely to be in 2014. Declan McEvoy, IFAC, said dairy farmers this year are paying 100% of 2013. This is likely to be the best option as income will probably be increased this year. However, for beef, sheep and tillage farmers, working out what the likely tax bill will be in 2014 and paying 90% of it could significantly reduce the amount to be paid.

I have a PAYE job and run a small farm. I got a form 12 for the first time this year. Do I have to fill it out?

Yes. People whose primary sources of income are their PAYE jobs might have to fill out a form 12, but only if Revenue requests it. If you have a farm and receive entitlements, such as REPS and the Single Farm Payment, you will have to complete the form. In it, you will have to set out the different income types assessable under form 12. They include:

• Farm income after allowable costs.• Rental income – only 75% of interest paid is allowable against rental income. Remember costs and repairs can also be deducted. You will also have to pay USC and PRSI on this income.• Dividend income – a 20% dividend withholding tax is taken at source and a tax credit will be given, but more will be owed if you are at the 41% rate of tax.• Foreign incomes on British shares – you will be given a tax credit on next dividend.The main reason that Revenue requests that a form 12 is completed is because all income is liable for tax. For this reason, it is important to keep a record of your payments and receipts.

I have a full-time job and I am farming a small farm. I made a profit of €4,000 this year. I built a shed two years ago so have €7,000 in capital allowances to write down. Do I have to pay income tax, USC or PRSI on the farm income?

No. When the capital allowances are taken into account, you are deemed to have made a loss of €4,000 on the farm so do not have to pay any tax or USC.

As you already have adequate PRSI paid under your PAYE job, you do not need to pay that either. You have two options. You can claim €4,000 in capital reliefs this year and carry the remainder forward to write off profits in future years, or you can claim the full €7,000 and submit a loss of €3,000.

This can be used to claim back tax on income tax you paid on your PAYE job.

If you paid tax at 20% you would get back €600, but if you were paying at the high rate of tax you will only get back €140.

We made €15,000 on the farm last year. I work on the farm as well as my husband. He normally submits the income in his name, but I read that it might be more beneficial to split it between us this year.

Yes. In 2014, for the first time you can allocate income between spouses or civil partners that work on the farm. As you have no other income, you could submit €10,000 in his name and €5,000 in yours. The minimum needed to qualify you to pay PRSI is €5,000.

It means that you will each pay €500 PRSI and get 52 contributions, that will be counted towards your individual contributory old-age pension.

Remember, you must have at least 520 contributions (10 years) to qualify.

I did some drainage work in 2012 and forgot to claim back VAT. Can I still do it?

Yes. You can also go back over the last four tax years if you forgot to claim any previous VAT paid. VAT can be claimed back on fixed structures around the farm. This can be for things like construction of a farm road, sheds, drainage, fencing, etc. CL

SHARING OPTIONS