Jean-Christophe Gilbert is one of four farmers in the GAEC du Champ Fleury partnership, a typical French farm with 160 milking cows and crops on 270ha in Brittany. Yet the farm also does something a lot more unusual: it injects a steady stream of biogas sufficient to heat 525 homes into the national network.

Since September 2015, an anaerobic digester has been producing biogas from organic waste on the farm. There are currently 29 digesters connected to the gas grid in France and this is expected to ramp up as the country implements legislation imposing at least 10% of local renewable sources in utility gas by 2030.

“There are 200 projects at the design stage and in 2017 and 2018, we will connect 30 to 35 sites per year,” said Pierre-Yves Eon, head of the biomethane project at France’s national gas distribution network (GRDF). “We expect 80% to 85% of installations to be on farms.”

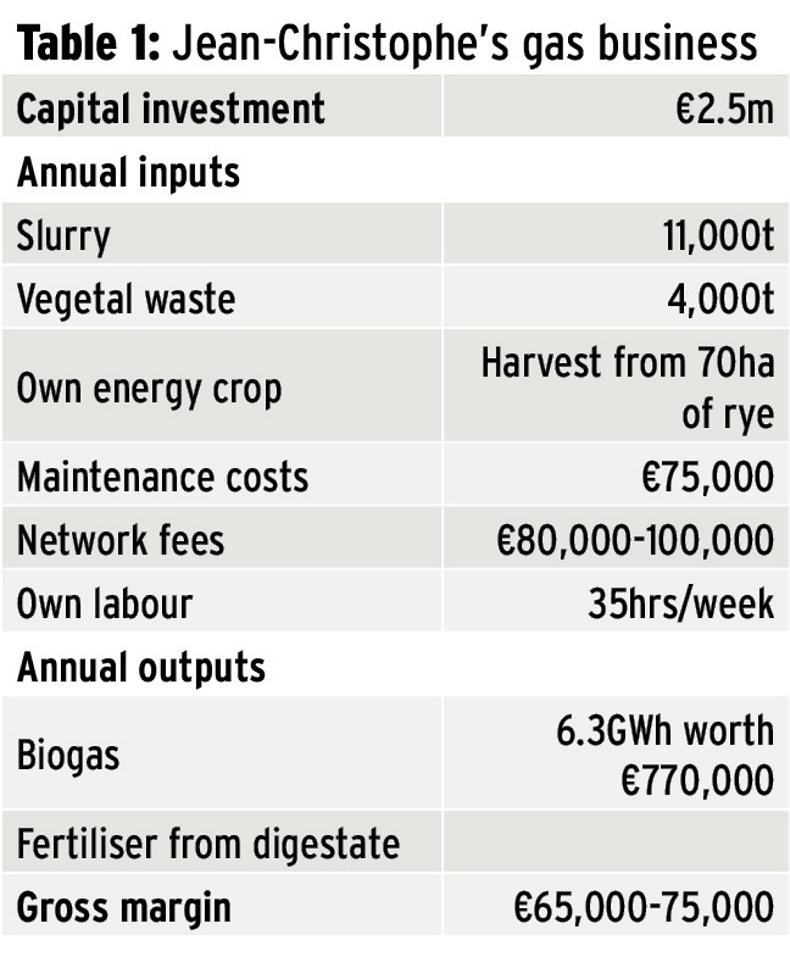

Jean-Christophe and his partners invested €2.5m in the installation, for which they received 18% grant aid. “We financed the rest through contract hire and a bank loan,” he said. The anaerobic digester takes in the slurry from their herd, rye grown on the farm as an energy crop, domestic waste from the local council, green waste from neighbouring landscaping contractors and apple waste from the local cider industry.

“We made the original investment on the basis of 46m3 of gas per hour because they would not commit to large volumes of waste, but we delivered 56m3/hr as soon as we started,” said Jean-Christophe. With a steady increase in the waste streams coming to the farm, the digester now produces 70m3/hr. This is the maximum volume that the gas network can take from the farm at any given time, so Jean-Christophe’s challenge is to keep production constant as close as possible to this ceiling to maximise income.

The bureaucracy behind the setup is complex. “We have a contract with the network operator and another one with the gas buyer of our choice,” the farmer said. The agreement with GRDF covers issues such as connection and gas quality control. Network fees amounted to €100,000 in the first year, when checks were more frequent, and have now decreased to €80,000/year.

By law, gas buyers must sign 15-year contracts with suppliers like Jean-Christophe’s farm. They pay a subsidised price indexed on market conditions – currently 12.25c/kWh. Gas companies can then use this input to guarantee a proportion of local, renewable gas in their offers to customers. One of the end users is the very local council delivering waste to the digester, which has built a business park and is advertising the availability of local gas as a marketing argument for businesses interested in renting units.

This is important to balance gas volumes in the network: “To inject biomethane in the network, you need an equivalent local consumption,” said GRDF’s regional director Eric Feuillet.

After the farm’s first year producing gas, full accounts are not yet available but Jean-Christophe estimates that the business had delivered a gross margin of €65,000 to €75,000 against a labour requirement of 35hrs/week.

Farmers interested in producing biogas think the sector could develop faster if red tape was cut and gas supply contracts guaranteed for 20 years instead of 15. “The farmers are taking the largest chunk of the risk,” said Mauritz Quaak, who started the French Association of Farm Methane Producers. He remarked that a previous government plan targeted 1,000 anaerobic digestors in place by 2020 – a long way off compared with the numbers achieved to date.

Mauritz, who produces biogas on his own farm near Paris, insisted that farmers are best placed to develop the industry. “They have upstream waste with livestock effluents and can take more from other sources. And they have a downstream outlet for the digestate through their nutrient management plan,” he said. With many farmers too remote from the gas network to get a connection, however, he also called for incentives for combined heat and electricity production in on-farm gas boilers.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: