History tells us that Russia’s colossal agricultural and natural resources have been an irresistible magnet for invasion and conquest. But the Russian landscape is littered with the whitened bones and the broken dreams of hordes of pillaging and rapacious invaders.

Winston Churchill said in 1939: “I cannot forecast for you the actions of Russia, because Russia is a riddle, wrapped in a mystery, enclosed inside an enigma. But perhaps there is a key: that key is Russia’s self-interest.”

Since the Russian ban on western food products, almost 400,000t of dairy exports from the EU have had to find a new home. And it seems Russia is more adamant on feeding itself than ever before.

The Russian minister for agriculture, Aleksander Tkachev, said last year: “We will complete the historical mission to feed our own Russian people. We should ensure national food security with actions, not just in words. Specifically, we will produce enough milk, meat, grains, protein and oilseed crops, vegetables and fruit, to at least satisfy domestic consumption. We also have the capacity, and the ambition, to generate a large volume of exports.”

So, anyone wondering what it takes to safely get into Russian farming and food markets must look at some recently successful case histories.

Successful agribusiness models that found a route into Russia

The Black Earth Farming Agribusiness Model (International Agribusiness PLC)

Black Earth Farming PLC (BEF) is a global agribusiness group that owns and operates a large-scale land acquisition and crop production conglomerate in Southern Russia. It was set up in 2006. Eight years later, the group had acquired nearly 300,000ha (750,000 acres) of the very best land in Russia. This is about the same size as counties Carlow or Louth. Prime agricultural land can be bought for as little as €40/acre in Russia.

BEF is bringing the best and the most scientific agricultural technologies to Russia – 68 combines, 37 self-propelled sprayers, 109 large tractors and 175 trucks form the basis of BEF’s machinery fleet. Everything is guided, monitored, and controlled by GPS and computers.

The main agricultural crops grown by BEF include maize, wheat, sunflower, potatoes and sugar beet. Long-term contracts are in place locally with PepsiCo/Frit-o-Lay and Quaker Cereals for the produce. In addition, BEF is shipping out huge quantities of grains and oilseeds direct to global markets.

The group owns all the essential infrastructure on-farm and at the ports to store, transport and export grain. Specifically, BEF has direct transport links to all the main Baltic and Black Sea ports. Port-side, BEF also has the complete range of grain stores, elevators, and facilities for loading grain direct on to ships. From here, BEF can ship its grains and oilseeds direct to any Irish, UK or mainland European port, for as little as €8/t.

The Hermitage Pedigree Pigs Model (Irish family agribusiness)

From a small base in Kilkenny, this family-owned pig breeding company has enjoyed stellar success in Russia. The Nolan family, owners of Hermitage Pedigree Pigs, broke into the Russian market when the Russian pig industry was on its last legs. On-farm losses were crippling.

Pig diseases were rampant and malnutrition was endemic. Pig breeding genetics and production systems were 60 to 70 years out of date.

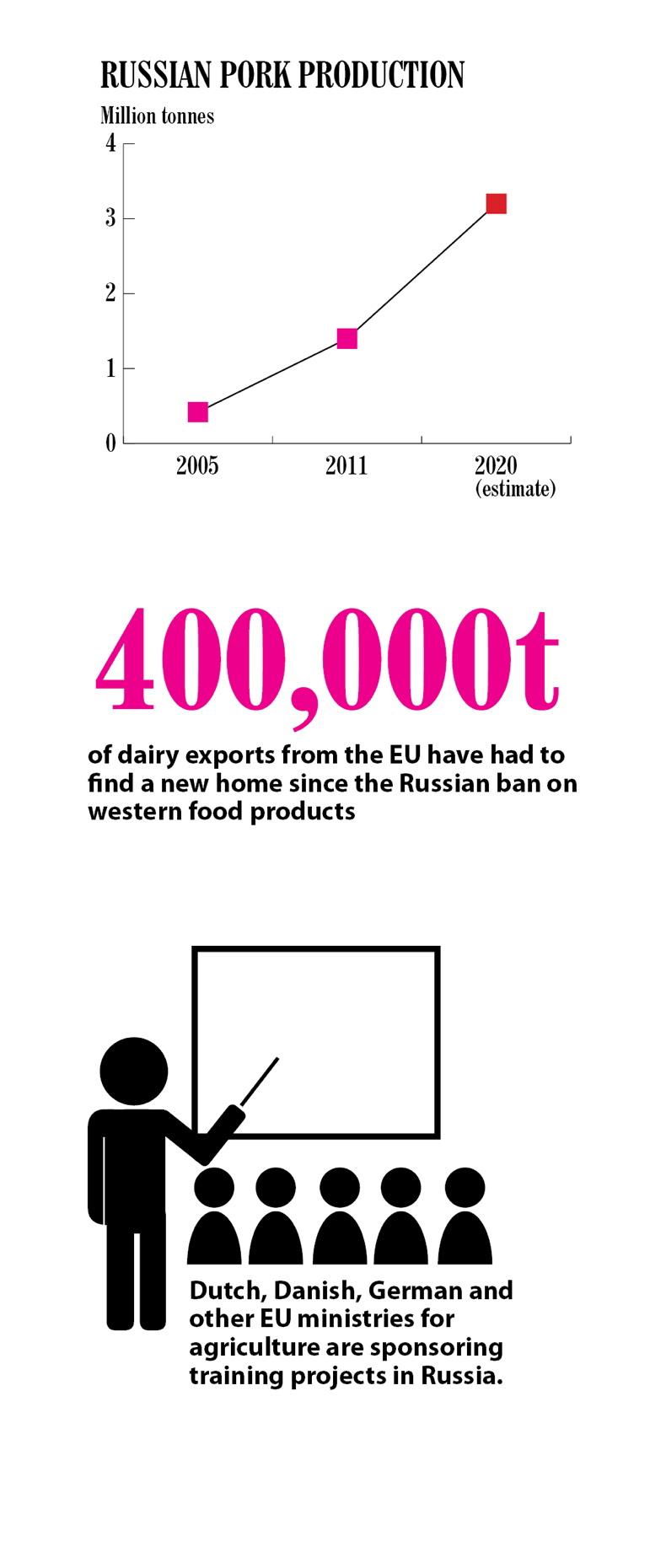

Pig-housing systems were totally obsolete and the buildings were actually collapsing and falling apart. Feed conversion efficiencies and pigs weaned per sow per year were less than 30% to 50% of Irish standards. Days to slaughter were at least three times longer than on Irish pig farms.Consequently, in the 13 years from 1992 to 2005, there was a four-fold decrease in Russian pig production. But from 2005 to 2011, the industry underwent a spectacular recovery. During these six years, industrial-scale pig production in Russia was turned around and increased three-fold.

Specifically, pork production in Russia recovered from 420,000t in 2005, and increased to over 1.4m tonnes by 2011. This rate of increase continues apace. By 2020, Russian pork production will have more than doubled again to nearly 3.2m tonnes.

Recently, Hermitage Pedigree Pigs set up a joint venture pig breeding farm about 1,200km northeast of Moscow. Over €10.5m was invested in the modern, fully integrated pig breeding and production farm.

EU Agricultural consultancy and training services models (State-sponsored Agribusiness)

Russia’s self-interest, now more than anything else, is to feed its people from its own resources. This looks set to remain the top priority in Russia into the future. Russia’s agricultural resources are indeed colossal, but they are also totally under-developed. Furthermore, the country doesn’t have any of the basic know-how or the practical farm managers to develop and exploit them. This is the single biggest deficiency in Russian farming, food and agribusiness today.

Dutch, Danish, German and other EU ministries for agriculture are sponsoring a wide range of agricultural consultancy and training projects throughout Russia. Leading Danish and German, agricultural trade organisations and agribusinesses co-fund and co-work these projects.

Their highly skilled agricultural consultants and farm managers deliver the projects to Russian farmers and agribusinesses. Automatically, these projects become trojan horses to get into Russian agricultural markets. Once in, they can sell unlimited quantities of their country’s farm machinery, equipment, pedigree livestock and agricultural seeds.

International dairy processors’ production and marketing models

With the demolition of the Berlin Wall in 1989, the first products Russians imported from Europe were not bread, butter or meat, but chocolate and ice cream. Overnight, sales of Mars bars, Snickers, fruit yoghurts and choc-ices went through the roof.

The Mars group, Valio, Parmalat, Cadbury, Unilever, Friesland-Campina, Danone and others, very quickly became established in the fast-growing Russian market. How they did this is one of the big lessons to be learnt about how to get into Russian food markets. Specifically, the Russian market entry and development strategies of these multinational food groups were simple, immediate, low-cost and highly effective.

Russian food market entry and development

Phase one (early 1990s)

The Mars Bars etc were produced by the multinational food groups firstly in Europe. Every day, these products were rushed across the continent into Russia in convoys of large, refrigerated containerised trucks.

The journey to the streets of Moscow from confectionery plants and dairies in Holland, France, Germany, Finland and Italy, took less than 12 to 24 hours.

Once they got on to the streets of Russia, sales of these products took off automatically.

This was critical, because 25 years ago, advertising systems in Russia were unknown and ineffective.

But at that time, no advertising programmes were necessary as once they got the taste for a Mars bar, they were hooked.

Phase two (2000 to 2005)

Once established, these companies moved into phase two of market development. This was done with great speed and efficiency. Phase two entailed replacing the finished confectionery products produced in Europe and exported directly to Russia, with exporting instead, their main ingredients, such as skim milk and whole milk powders, vegetable oils, sugar and cereals. There, these ingredients were recombined in newly constructed plants, prior to producing the same confectionery products in Russia. This was a lower-cost model, so the retail prices could be slashed. This, in turn, increased the sales and the profits of the EU-based multinational food groups. At that time, even Irish farmers profited from this evolution of Russian food markets.

Phase three (2005/ongoing)

In phase two, the multinationals perfected their match-winning formula for producing their best-selling food and confectionery brands in Russia. In phase three, they are going one step further. Specifically, today, they are directly sourcing Russian agricultural raw materials to produce these European products in their Russian dairies and food factories.

Brendan Dunleavy has over 20 years’ agribusiness project management experience in Russia and Ukraine.

Read more

To read the full Agribusiness report, click here.

History tells us that Russia’s colossal agricultural and natural resources have been an irresistible magnet for invasion and conquest. But the Russian landscape is littered with the whitened bones and the broken dreams of hordes of pillaging and rapacious invaders.

Winston Churchill said in 1939: “I cannot forecast for you the actions of Russia, because Russia is a riddle, wrapped in a mystery, enclosed inside an enigma. But perhaps there is a key: that key is Russia’s self-interest.”

Since the Russian ban on western food products, almost 400,000t of dairy exports from the EU have had to find a new home. And it seems Russia is more adamant on feeding itself than ever before.

The Russian minister for agriculture, Aleksander Tkachev, said last year: “We will complete the historical mission to feed our own Russian people. We should ensure national food security with actions, not just in words. Specifically, we will produce enough milk, meat, grains, protein and oilseed crops, vegetables and fruit, to at least satisfy domestic consumption. We also have the capacity, and the ambition, to generate a large volume of exports.”

So, anyone wondering what it takes to safely get into Russian farming and food markets must look at some recently successful case histories.

Successful agribusiness models that found a route into Russia

The Black Earth Farming Agribusiness Model (International Agribusiness PLC)

Black Earth Farming PLC (BEF) is a global agribusiness group that owns and operates a large-scale land acquisition and crop production conglomerate in Southern Russia. It was set up in 2006. Eight years later, the group had acquired nearly 300,000ha (750,000 acres) of the very best land in Russia. This is about the same size as counties Carlow or Louth. Prime agricultural land can be bought for as little as €40/acre in Russia.

BEF is bringing the best and the most scientific agricultural technologies to Russia – 68 combines, 37 self-propelled sprayers, 109 large tractors and 175 trucks form the basis of BEF’s machinery fleet. Everything is guided, monitored, and controlled by GPS and computers.

The main agricultural crops grown by BEF include maize, wheat, sunflower, potatoes and sugar beet. Long-term contracts are in place locally with PepsiCo/Frit-o-Lay and Quaker Cereals for the produce. In addition, BEF is shipping out huge quantities of grains and oilseeds direct to global markets.

The group owns all the essential infrastructure on-farm and at the ports to store, transport and export grain. Specifically, BEF has direct transport links to all the main Baltic and Black Sea ports. Port-side, BEF also has the complete range of grain stores, elevators, and facilities for loading grain direct on to ships. From here, BEF can ship its grains and oilseeds direct to any Irish, UK or mainland European port, for as little as €8/t.

The Hermitage Pedigree Pigs Model (Irish family agribusiness)

From a small base in Kilkenny, this family-owned pig breeding company has enjoyed stellar success in Russia. The Nolan family, owners of Hermitage Pedigree Pigs, broke into the Russian market when the Russian pig industry was on its last legs. On-farm losses were crippling.

Pig diseases were rampant and malnutrition was endemic. Pig breeding genetics and production systems were 60 to 70 years out of date.

Pig-housing systems were totally obsolete and the buildings were actually collapsing and falling apart. Feed conversion efficiencies and pigs weaned per sow per year were less than 30% to 50% of Irish standards. Days to slaughter were at least three times longer than on Irish pig farms.Consequently, in the 13 years from 1992 to 2005, there was a four-fold decrease in Russian pig production. But from 2005 to 2011, the industry underwent a spectacular recovery. During these six years, industrial-scale pig production in Russia was turned around and increased three-fold.

Specifically, pork production in Russia recovered from 420,000t in 2005, and increased to over 1.4m tonnes by 2011. This rate of increase continues apace. By 2020, Russian pork production will have more than doubled again to nearly 3.2m tonnes.

Recently, Hermitage Pedigree Pigs set up a joint venture pig breeding farm about 1,200km northeast of Moscow. Over €10.5m was invested in the modern, fully integrated pig breeding and production farm.

EU Agricultural consultancy and training services models (State-sponsored Agribusiness)

Russia’s self-interest, now more than anything else, is to feed its people from its own resources. This looks set to remain the top priority in Russia into the future. Russia’s agricultural resources are indeed colossal, but they are also totally under-developed. Furthermore, the country doesn’t have any of the basic know-how or the practical farm managers to develop and exploit them. This is the single biggest deficiency in Russian farming, food and agribusiness today.

Dutch, Danish, German and other EU ministries for agriculture are sponsoring a wide range of agricultural consultancy and training projects throughout Russia. Leading Danish and German, agricultural trade organisations and agribusinesses co-fund and co-work these projects.

Their highly skilled agricultural consultants and farm managers deliver the projects to Russian farmers and agribusinesses. Automatically, these projects become trojan horses to get into Russian agricultural markets. Once in, they can sell unlimited quantities of their country’s farm machinery, equipment, pedigree livestock and agricultural seeds.

International dairy processors’ production and marketing models

With the demolition of the Berlin Wall in 1989, the first products Russians imported from Europe were not bread, butter or meat, but chocolate and ice cream. Overnight, sales of Mars bars, Snickers, fruit yoghurts and choc-ices went through the roof.

The Mars group, Valio, Parmalat, Cadbury, Unilever, Friesland-Campina, Danone and others, very quickly became established in the fast-growing Russian market. How they did this is one of the big lessons to be learnt about how to get into Russian food markets. Specifically, the Russian market entry and development strategies of these multinational food groups were simple, immediate, low-cost and highly effective.

Russian food market entry and development

Phase one (early 1990s)

The Mars Bars etc were produced by the multinational food groups firstly in Europe. Every day, these products were rushed across the continent into Russia in convoys of large, refrigerated containerised trucks.

The journey to the streets of Moscow from confectionery plants and dairies in Holland, France, Germany, Finland and Italy, took less than 12 to 24 hours.

Once they got on to the streets of Russia, sales of these products took off automatically.

This was critical, because 25 years ago, advertising systems in Russia were unknown and ineffective.

But at that time, no advertising programmes were necessary as once they got the taste for a Mars bar, they were hooked.

Phase two (2000 to 2005)

Once established, these companies moved into phase two of market development. This was done with great speed and efficiency. Phase two entailed replacing the finished confectionery products produced in Europe and exported directly to Russia, with exporting instead, their main ingredients, such as skim milk and whole milk powders, vegetable oils, sugar and cereals. There, these ingredients were recombined in newly constructed plants, prior to producing the same confectionery products in Russia. This was a lower-cost model, so the retail prices could be slashed. This, in turn, increased the sales and the profits of the EU-based multinational food groups. At that time, even Irish farmers profited from this evolution of Russian food markets.

Phase three (2005/ongoing)

In phase two, the multinationals perfected their match-winning formula for producing their best-selling food and confectionery brands in Russia. In phase three, they are going one step further. Specifically, today, they are directly sourcing Russian agricultural raw materials to produce these European products in their Russian dairies and food factories.

Brendan Dunleavy has over 20 years’ agribusiness project management experience in Russia and Ukraine.

Read more

To read the full Agribusiness report, click here.

SHARING OPTIONS