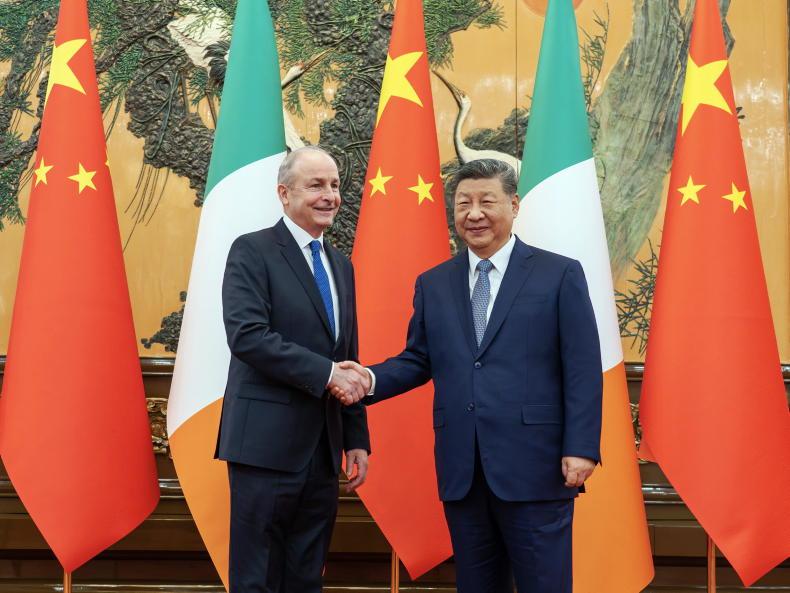

This coming weekend last year saw An Taoiseach Enda Kenny host Chinese prime minister Li Keqiang on an Irish farm, and we expected beef exports to be flowing to China very soon thereafter.

Li got back on his plane and continued his journey. His next stop was Brazil, which also had serious ambitions of exporting beef to China.

What happened next was a case of unfulfilled expectation in Ireland, with Brazil getting an initial seven factories approved and first shipments on their way by July 2015.

By November last year, with several more factories approved, Brazil was the number one beef supplier to China, sending 20,000t. Last month, Brazil was again China’s top beef supplier, sending 15,600t, a fifth of Brazil’s total frozen beef exports for April.

Meanwhile, Ireland has not got to the stage of having factories approved, with the systems check being completed at the end of January.

There are differences which help explain the speed at which Brazil got entry compared with Ireland. For Brazil, it was a case of re-entry, having been closed following an animal disease outbreak whereas Ireland is starting the approval process at the beginning.

The Irish Government oversold the level of progress with China last year and, while issues such as losing negligible BSE risk status and UN human rights votes will not have hastened the process, the reality is that we are more or less where we should have expected to be at this point.

China is a serious volume market as demonstrated by the levels achieved by Brazil, which was able to send the amount we typically send to the UK, our main market.

For other sectors in Ireland, the potential is being demonstrated. For instance, 40,000t of pigmeat was sent from Ireland to China last year. Since trading began in 2012, sales of pigmeat worth €200m have been achieved. Dairy sales were at €400m in 2014, a fourfold increase since 2010. China is now Ireland’s second most important market for dairy and pigmeat.

SHARING OPTIONS