A “meat perceptions and realities” 2025 report presented at a conference recently in the US suggests that millennials who are aged between 29 and 45 increased their beef consumption by 19% year on year.

According to the World Beef Report story, this segment of the population “seek animal proteins” and value ready to cook products, grass fed or organic beef and are conscious of animal welfare and sustainability.

The next generation, Generation Z who are under 28, are influenced by the combination of meat, lived experiences and social media. They relate best to brands that communicate with “humour and authenticity”. Meanwhile the older population continue to prioritise “traditional taste, safety and price” as their main motivators.

Supply shortage to sustain prices

World Beef Report also carried analysis on the likely direction of travel for cattle prices in the US. Economists speaking at a conference in Missouri linked the current high consumer beef price to exceptional demand being sustained through a period of exceptionally tight cattle supplies. There was consensus that the supply situation was likely to get worse before it gets better. They pointed out that there isn’t evidence of any meaningful heifer retention so herd rebuilding hasn’t commenced and the problem is likely to be made worse by the decline in feeder cattle imports from Mexico. This could reduce cattle numbers available for processing by up to 1m head over the next year.

The outcome of this according to the economists is that US cattle prices could remain high for the remainder of this decade. It was also noted that processors have now had eight quarters of losses in a row processing beef but the expectation is that they will withstand the pressure as long as possible to avoid losing market share.

Comment – not just the US

While both these reports are from the US, the cattle supply situation is similar in Ireland, the UK and across the EU. Irish suckler cow numbers have been in decline over a prolonged period and this year dairy cow numbers also dropped.

The number of cattle available for processing this year is likely to show the sharpest decline in years.

The Irish and EU emissions policy means that increased cattle production is unlikely to be encouraged whereas in the US, Agriculture Secretary, Brooke Rollins announced last month a plan to rebuild the cattle herd.

How effective this plan will be is debatable but again the sentiment is in the direction of encouraging production.

As for consumer demand, with higher farm gate cattle prices now feeding into higher beef prices in butchers and supermarkets, shoppers are spending more but getting less beef. There is no doubt that higher prices and pressure on consumer budgets will be reflected in consumer resistance but scarcity of supply in all of out major beef export markets is likely to underpin prices.

While we don’t have the information on factory performance that is available in the US, it is likely that lower throughput will be reflected in reduced factory profit margins. There is general agreement in the trade that reduced throughput impacts more on the factory bottom line than high prices, particularly when demand for beef is robust.

Read more

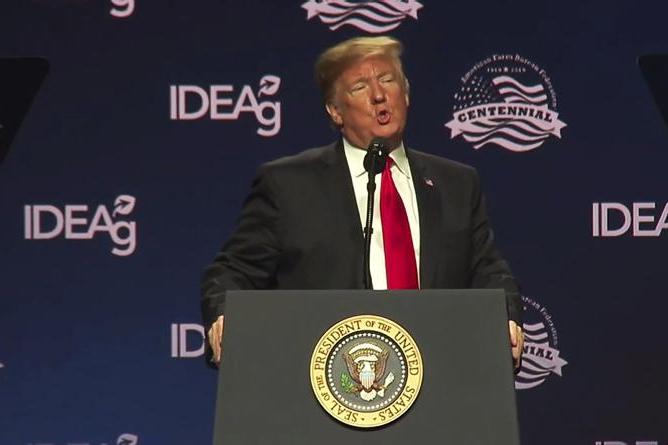

Trump tariff reversal will make US beef imports cheaper

Irish butter does battle on shop shelves in the US

Watch: future of meat consumption from World Meat Congress

A “meat perceptions and realities” 2025 report presented at a conference recently in the US suggests that millennials who are aged between 29 and 45 increased their beef consumption by 19% year on year.

According to the World Beef Report story, this segment of the population “seek animal proteins” and value ready to cook products, grass fed or organic beef and are conscious of animal welfare and sustainability.

The next generation, Generation Z who are under 28, are influenced by the combination of meat, lived experiences and social media. They relate best to brands that communicate with “humour and authenticity”. Meanwhile the older population continue to prioritise “traditional taste, safety and price” as their main motivators.

Supply shortage to sustain prices

World Beef Report also carried analysis on the likely direction of travel for cattle prices in the US. Economists speaking at a conference in Missouri linked the current high consumer beef price to exceptional demand being sustained through a period of exceptionally tight cattle supplies. There was consensus that the supply situation was likely to get worse before it gets better. They pointed out that there isn’t evidence of any meaningful heifer retention so herd rebuilding hasn’t commenced and the problem is likely to be made worse by the decline in feeder cattle imports from Mexico. This could reduce cattle numbers available for processing by up to 1m head over the next year.

The outcome of this according to the economists is that US cattle prices could remain high for the remainder of this decade. It was also noted that processors have now had eight quarters of losses in a row processing beef but the expectation is that they will withstand the pressure as long as possible to avoid losing market share.

Comment – not just the US

While both these reports are from the US, the cattle supply situation is similar in Ireland, the UK and across the EU. Irish suckler cow numbers have been in decline over a prolonged period and this year dairy cow numbers also dropped.

The number of cattle available for processing this year is likely to show the sharpest decline in years.

The Irish and EU emissions policy means that increased cattle production is unlikely to be encouraged whereas in the US, Agriculture Secretary, Brooke Rollins announced last month a plan to rebuild the cattle herd.

How effective this plan will be is debatable but again the sentiment is in the direction of encouraging production.

As for consumer demand, with higher farm gate cattle prices now feeding into higher beef prices in butchers and supermarkets, shoppers are spending more but getting less beef. There is no doubt that higher prices and pressure on consumer budgets will be reflected in consumer resistance but scarcity of supply in all of out major beef export markets is likely to underpin prices.

While we don’t have the information on factory performance that is available in the US, it is likely that lower throughput will be reflected in reduced factory profit margins. There is general agreement in the trade that reduced throughput impacts more on the factory bottom line than high prices, particularly when demand for beef is robust.

Read more

Trump tariff reversal will make US beef imports cheaper

Irish butter does battle on shop shelves in the US

Watch: future of meat consumption from World Meat Congress

SHARING OPTIONS