As the process to decide the future of LacPatrick draws to a close, Glanbia, the largest processor in Ireland, has decided not to progress talks with the cross-border co-op.

While Glanbia did not make any formal submission or bid, it had made an initial evaluation.

This leaves Lakeland, Dale Farm and Aurivo – the co-ops interested after the LacPatrick board invited participants to merger talks at the end of April.

The LacPatrick milk pool of 600m litres is attractive to any co-op with growth ambitions. This could be an unusual merger, in that the milk pool is split across the North and South, with around 500m litres in the North.

So not only would more supply bring synergies and efficiencies, it could also bring a Brexit solution to a co-op.

The elephant in the room is no doubt the risk of milk supply slippage any potential suitor will need to factor in.

The 100 ex-Ballyrashane farmers who now supply LacPatrick with approximately 100m litres, could be fertile hunting ground, depending on where LacPatrick goes next.

Dale Farm, which went through a difficult 10-year period losing many of its suppliers to rival co-ops, has stabilised its milk supply base and is delivering relatively strong milk prices. It is also looking for another 100m litres of milk to meet current demand.

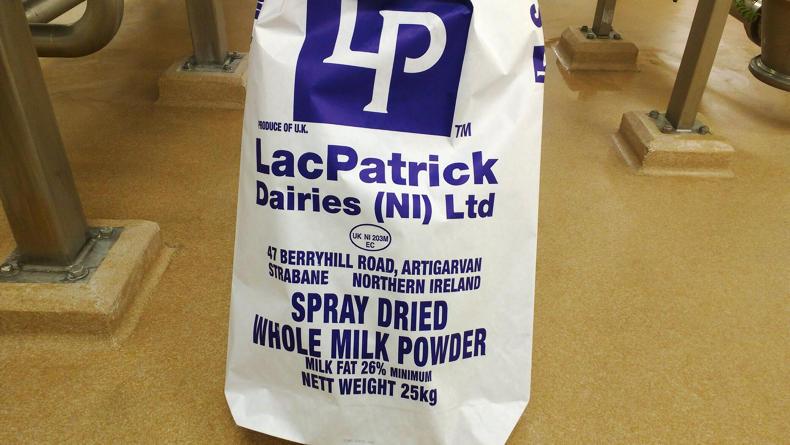

The LacPatrick whole milk powder brand is strong in emerging markets such as North Africa, but with butter prices strong its value must be carefully considered in the current market.

Glanbia Cheese, the joint venture between Glanbia Ireland and Leprino Foods that manufactures mozzarella cheese and buys around 100m litres from farmers directly in the North, may be interested in securing additional supplies. But with Glanbia out of the process, does it believe it can do this without buying the business?

The new 7t drier at Artigarvan is state-of-the-art and cost €40m to build. Its real value is a supply of milk in close proximity. LacPatrickhas plenty of spare capacity with any one of the three remaining players able to fill it in the future.

The Artigarvan drier may suit Aurivo as it reaches maximum capacity, but no doubt it will be looking for value. The northwest co-op collects about 75m litres of milk in Northern Ireland.

LacPatrick could provide a hard Brexit solution.

With around half of Lakeland’s 1.2bn litres of milk coming from Northern Ireland and mainly processed in the south, this could be a good fit.

Lakeland is well used to doing deals, having completed the Fane Valley acquisition recently. Then there is the debt figure. Whichever buyer, it must take on the significant debt level which is understood to be between €30m and €40m. While all could stretch to this, it may limit other investments that may be required in their current businesses – not to mention the management time involved to bring LacPatrick into the business. Brexit is the real unknown which does not help LacPatrick. An end to the process looks imminent in the coming days. Holding the milk supply will be key to the decision.

Read more

Waitrose issues a sombre profit warning for 2018

As the process to decide the future of LacPatrick draws to a close, Glanbia, the largest processor in Ireland, has decided not to progress talks with the cross-border co-op.

While Glanbia did not make any formal submission or bid, it had made an initial evaluation.

This leaves Lakeland, Dale Farm and Aurivo – the co-ops interested after the LacPatrick board invited participants to merger talks at the end of April.

The LacPatrick milk pool of 600m litres is attractive to any co-op with growth ambitions. This could be an unusual merger, in that the milk pool is split across the North and South, with around 500m litres in the North.

So not only would more supply bring synergies and efficiencies, it could also bring a Brexit solution to a co-op.

The elephant in the room is no doubt the risk of milk supply slippage any potential suitor will need to factor in.

The 100 ex-Ballyrashane farmers who now supply LacPatrick with approximately 100m litres, could be fertile hunting ground, depending on where LacPatrick goes next.

Dale Farm, which went through a difficult 10-year period losing many of its suppliers to rival co-ops, has stabilised its milk supply base and is delivering relatively strong milk prices. It is also looking for another 100m litres of milk to meet current demand.

The LacPatrick whole milk powder brand is strong in emerging markets such as North Africa, but with butter prices strong its value must be carefully considered in the current market.

Glanbia Cheese, the joint venture between Glanbia Ireland and Leprino Foods that manufactures mozzarella cheese and buys around 100m litres from farmers directly in the North, may be interested in securing additional supplies. But with Glanbia out of the process, does it believe it can do this without buying the business?

The new 7t drier at Artigarvan is state-of-the-art and cost €40m to build. Its real value is a supply of milk in close proximity. LacPatrickhas plenty of spare capacity with any one of the three remaining players able to fill it in the future.

The Artigarvan drier may suit Aurivo as it reaches maximum capacity, but no doubt it will be looking for value. The northwest co-op collects about 75m litres of milk in Northern Ireland.

LacPatrick could provide a hard Brexit solution.

With around half of Lakeland’s 1.2bn litres of milk coming from Northern Ireland and mainly processed in the south, this could be a good fit.

Lakeland is well used to doing deals, having completed the Fane Valley acquisition recently. Then there is the debt figure. Whichever buyer, it must take on the significant debt level which is understood to be between €30m and €40m. While all could stretch to this, it may limit other investments that may be required in their current businesses – not to mention the management time involved to bring LacPatrick into the business. Brexit is the real unknown which does not help LacPatrick. An end to the process looks imminent in the coming days. Holding the milk supply will be key to the decision.

Read more

Waitrose issues a sombre profit warning for 2018

SHARING OPTIONS