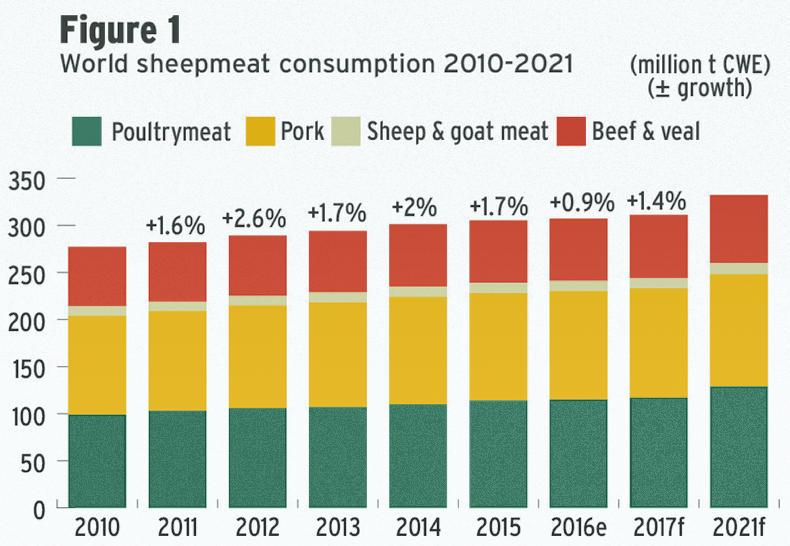

Delegates attending the recent Bord Bia meat market seminar were given a very positive forecast on global consumption of poultry meat in the next five years, with beef and pork also likely to see favourable growth. Consumption of sheepmeat on the other hand is forecast as stable, as demonstrated in Figure 1, with the greatest challenge in the EU.

Rupert Claxton from Gíra Consultancy and Research Prospective et Strategie summarised sheep consumption as challenging.

“When we look at per-capita consumption, it is hard to be positive apart from low-value markets. That’s not to say there is no growth. Markets are emerging, but they are tiny. A lot of hope is pinned on China.

“There has been some increase in domestic production and sheepmeat did grow, but it is not seen as a new product now and so demand is slowing. The increase in domestic production will satisfy most of the growth and it is pretty hard to see very significant volumes moving.”

When discussing the Chinese market, Rupert also says that exporters need to be cautious across all meat categories not to place too much reliance on the market.

“We know in recent years China can close the door (to imports) as quick as it opens. You need to have a contingency plan in place if this happens.”

China has approved more direct suppliers in 2016 to cope with a surge in meat imports. Another factor is the historically important grey market channel, via Hong Kong in particular, becoming more complicated and costly to move large volumes through.

That said, Rupert thinks the grey market route will continue to be used as a means of controlling direct market access.

“There were 2.1m tonnes of meat imported across the grey market. To put this in perspective, it takes 60 containers a day to move 600,000t through the grey market, so you are looking at big business.

“China will continue to play games on how they import meat. Figures released convey that the market is nearly self-sufficient, but the figures are very hard to distil and some are inaccurate.”

Demand flattening

Growth in Middle East markets has been hit by reduced consumer spending due to a downturn in oil prices. Demand is still predicted to remain solid, especially around key religious festivals, and will be helped if these countries return to the level of growth and economic activity experienced a short number of years ago.

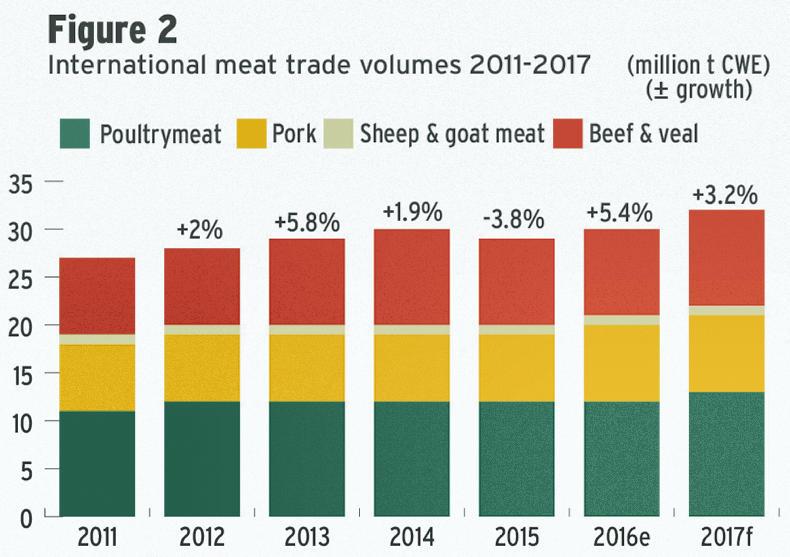

There is a similar situation in Europe, with consumption under pressure for quite a period of time. From an Irish perspective, the most worrying trend is what is becoming a continual downward trend in French consumption. The supply-demand balance has only remained in sync by a reduction in production in many EU countries and a fall-off over the last five years in imports from New Zealand. All of this is contributing to static predictions on the volume of sheepmeat traded globally, as reflected in Figure 2.

Flock growth

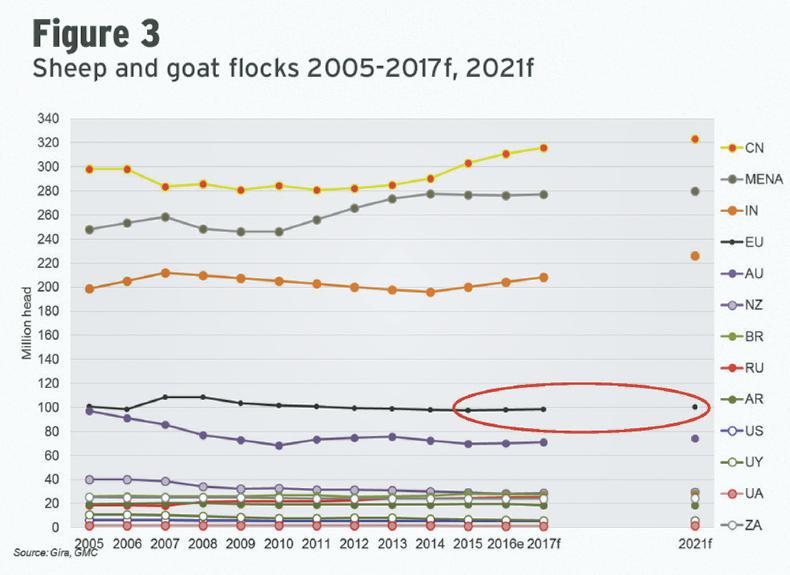

Rupert predicts flock growth will be concentrated in developing countries (shown in Figure 3), with a marginal increase expected in Australia and the EU (driven mainly by the UK and Ireland).

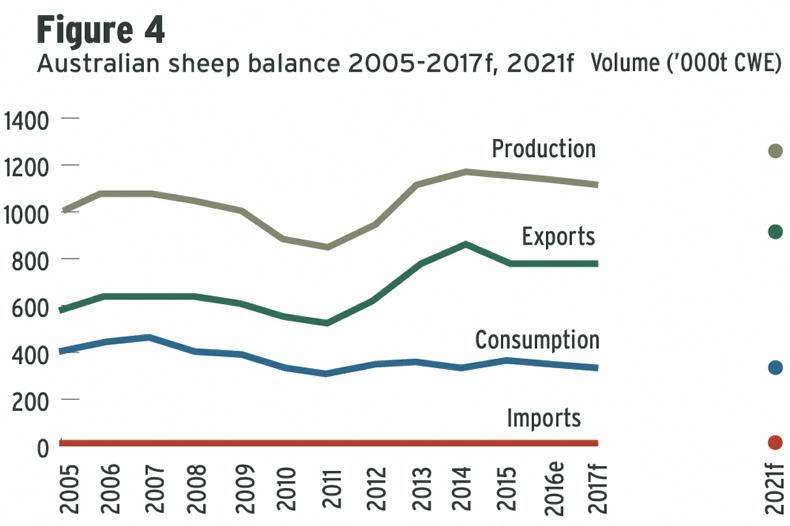

Drought has hammered beef production in Australia in the last three years, with 20% more cows per month culled than normal levels.

High prices have commenced recovery in breeding herds, but it will be a long process, with Rupert foreseeing that Australia will not rebuild to previous suckler herd levels for another three to four years.

The location of a high percentage of the sheep flock in the south of the country, where more rain fell and drought was less pronounced, somewhat limited the culling in sheep flocks, shown in Figure 4.

That, and a continued switchover from maintaining sheep for meat output as opposed to wool production, will be the driver of production realising forecast growth.

One caveat that may limit this growth is that in order for Australia to increase exports, farmgate prices will need to come down to make exports competitive. This may slow down recovery, but output will still increase as the emphasis changes from wool to meat production.

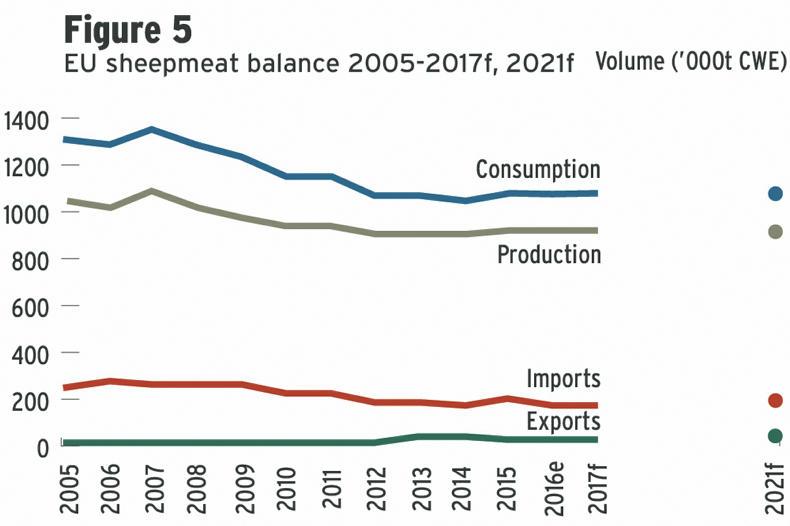

Consumption, production, imports and exports in the EU are all forecast by Gíra as not changing majorly in the next five years, as shown in Figure 5.

There is some slight growth forecast in the size of the EU flock, with a higher concentration of sheep in fewer countries.

Rupert says that the production increase will be lower than the increase in flock numbers, with a higher proportion of light lambs in the mix.

Overall, imports are predicted to stabilise at 200,000t with New Zealand exports not changing. Exports are forecast to rise slightly to 35,000t carcase weight equivalent in line with recent growth in exports to north African countries.

He says that population growth in the EU will outpace consumption growth, bringing about a reduction in the figure of per-capita consumption.

The other unknown not discussed that could greatly alter these predictions is the outcome of Brexit negotiations. The UK imported about 70,000t of New Zealand sheepmeat in 2016 and it remains to be seen what will come of the New Zealand EU tariff-free quota of 227,000t. Negotiations will centre on whether a portion of this quota is transferred to the UK on leaving the EU.

NZ flock stabilising

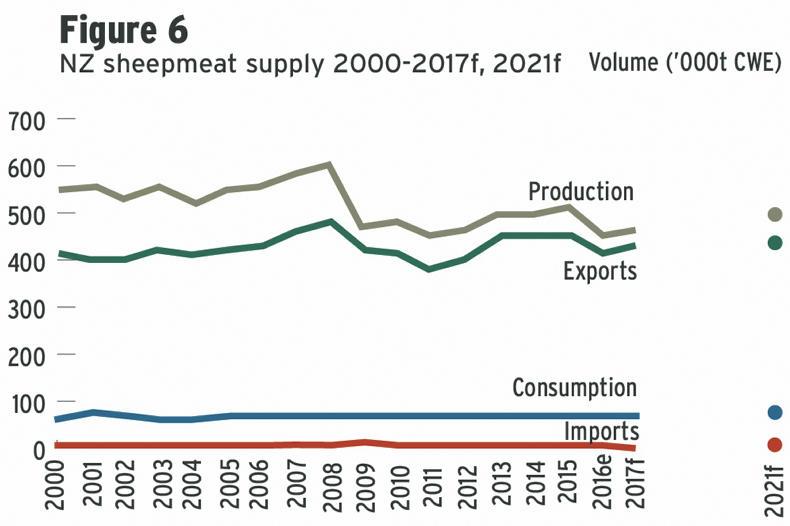

The last decade has been very tough for the New Zealand sheep sector. Sheep numbers have fallen by 2.9% per annum, with the sheep flock standing at 28.3m head in 2016.

Competition for land use, and in particular conversions to dairying, were responsible for this decline, but this has eased greatly following a reduction in global dairy prices and a greater focus on environmental regulations.

With low domestic consumption, the focus will remain on exports (Figure 6), with 90% of lamb produced and 95% of mutton destined for export markets.

Focus on Europe

Rupert concluded by saying that there is a big drive to get more sheepmeat out of the EU market and into existing and emerging markets. He said that this is the correct focus, but advised attendees that in Europe they are sitting on a massive market where there are consumers with good spending power.

“In reality, we are sitting on a massive market that is dying underneath us. We need to do more to stimulate this market and get consumption growing again.”

SHARING OPTIONS