Year-on-year timber prices for Coillte standing sales have made a remarkable recovery since the downturn in the economy and collapse in the housing market from 2007.

For example, average prices in 2008 and 2009 were €34.50/m3, but by 2014-2015, prices had more than doubled to €72.50 (Figure 1) despite a glut of timber coming on the market as a result of the windblow caused by Storm Darwin.

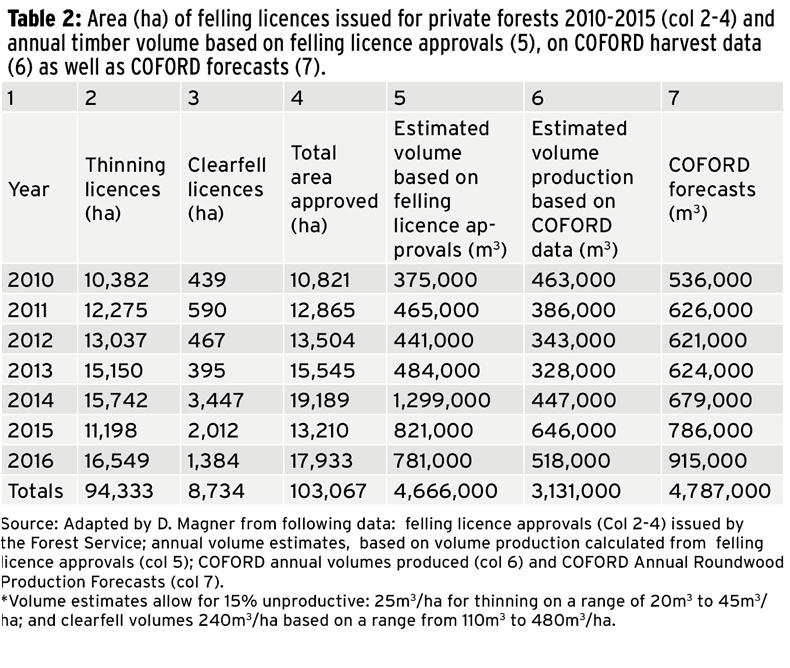

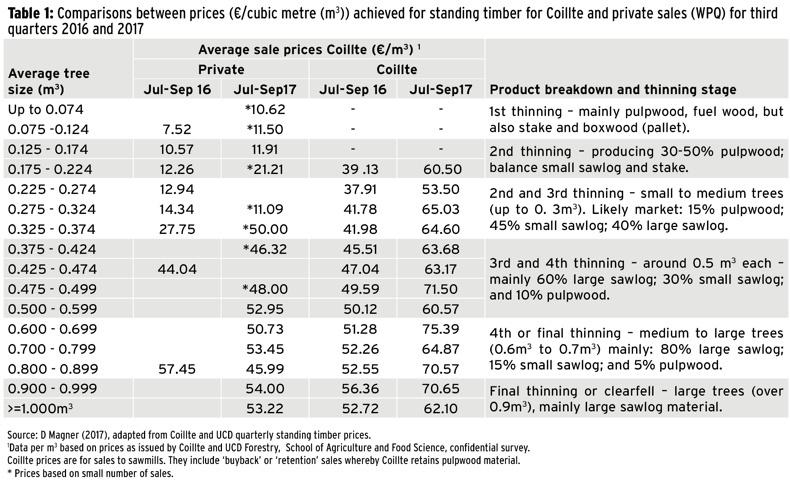

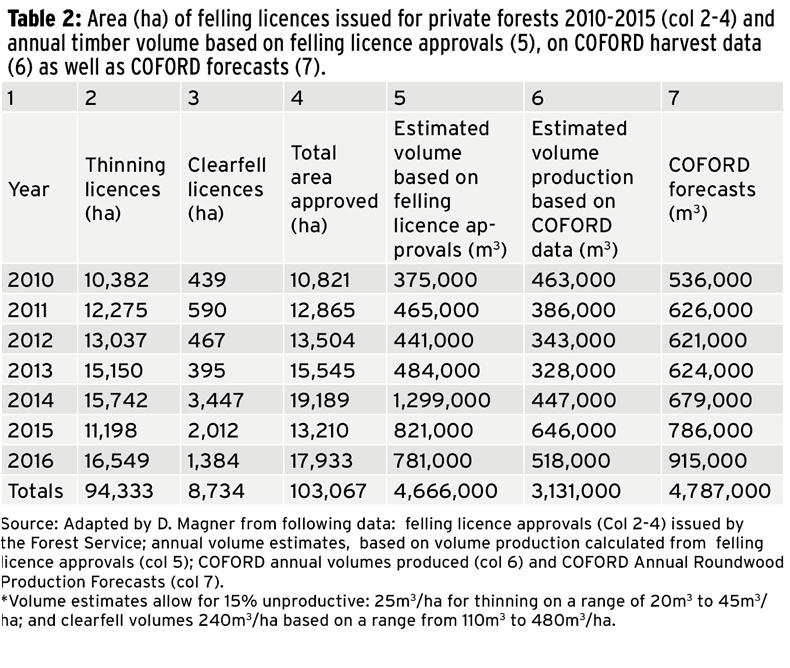

Average prices for the first three quarters of this year based on Coillte sales were €61.46. Private prices achieved were lower than Coillte’s rates in the medium to large sawlog categories.

Coillte log prices increased by up by 30% in the third quarter compared with the same period in 2016 for medium to large sawlog

An interesting trend has emerged which shows that there is little variation between timber prices regardless of category size, especially in the 0.275-0.324m3 to 0.700-0.799m3 range.

It should be remembered that Coillte prices are for standing sales of medium to large logs as the company retains small logs (pulpwood and fuelwood ) for its panel board mills and a small number of wood energy outlets.

As a result, the private sector relies on data from Wood Price Quarterly (WPQ) for small log prices usually from first thinnings but this information is more difficult to source.

Prices range from €10.62/m3 to €11.91/m3 for the three small log category sizes between 0.074m3 and 0.224m3.

There was insufficient price data available for the third quarter in 2016 to draw clear price comparisons for the same period this year. However, prices were down on 2015, which was expected as 2014 and 2015 were exceptionally buoyant years for all timber sales – private and Coillte.

The WPQ, which is issued by UCD in collaboration with the Irish Timber Growers Association (ITGA) for the private sector, still has some way to go before it can issue definitive data, simply because of the small number of sale transactions.

On the other hand, Coillte prices cover a much larger number of transactions and have greater geographical and species spread, so are more reliable nationally.

While the WPQ has to be treated with care in drawing conclusions on timber prices, it is a worthwhile exercise but it is vital that forestry companies, sawmills and forest owners provide information to the UCD team who compile the data on behalf of the ITGA.

The advice to forest owners with crops approaching first or second thinning is to sell, as prices are still solid. Postponing thinning is not a solution as the aim should be to benefit the final crop.

However, once the final crop is due for clearfell, the owner should delay harvesting if the price is not right. Clearfells can be postponed if windblow is not a risk and further thinning carried out.

Forest owners should shop around for prices at this stage as a negative 10-15% differential in a clearfell price could result in a revenue reduction of up to €3,000/ha, which would cover the cost of reforestation.

Brexit continues to cast a shadow over the sector but “Irish timber processors are highly competitive, well organised and determined to meet the challenges of Brexit,” said Mark McAuley, director of the Irish Forestry and Forest Products Association (IFFPA) in Ibec.

“However, the UK is the only viable market for the majority of our output in the short term,” he maintained. “Product and market diversification are not adequate solutions.

Free trade is an absolute prerequisite to the continuing trade in timber products between Ireland and the UK. The EU should negotiate a comprehensive free-trade agreement with the UK and, in the interim, provide an adequate transitional period in which time free trade arrangements apply.”

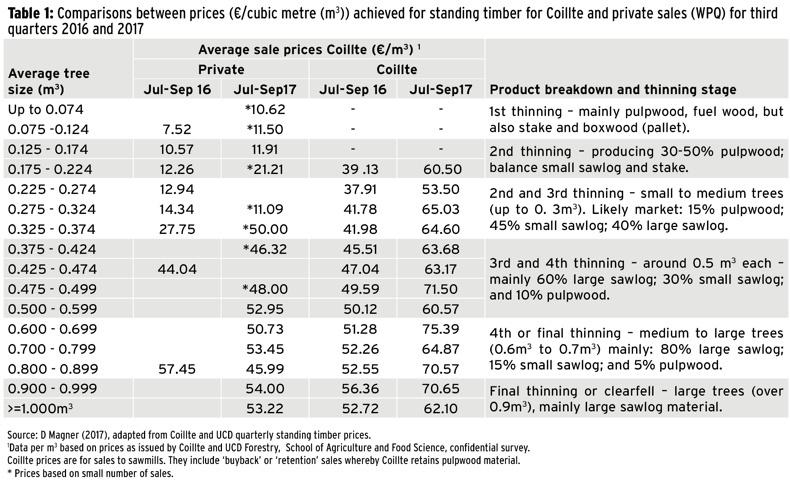

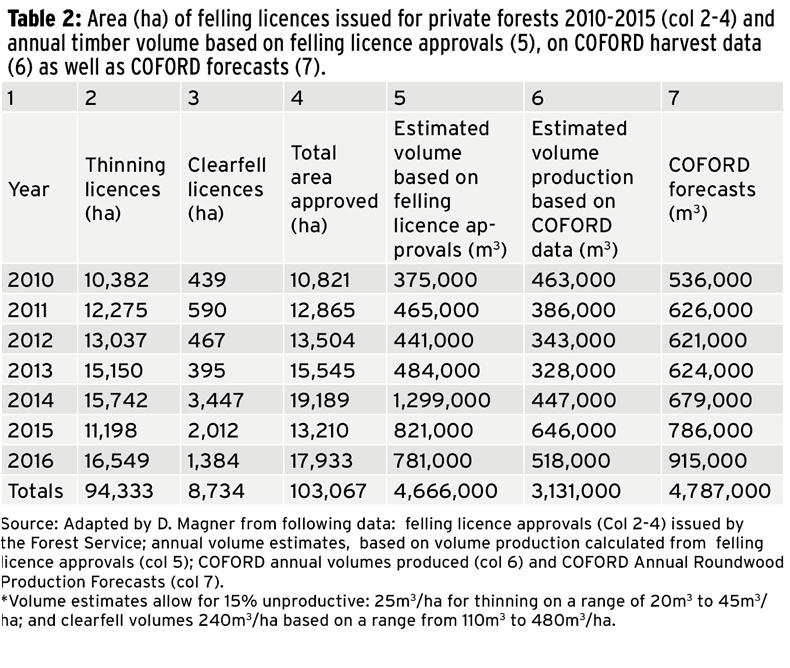

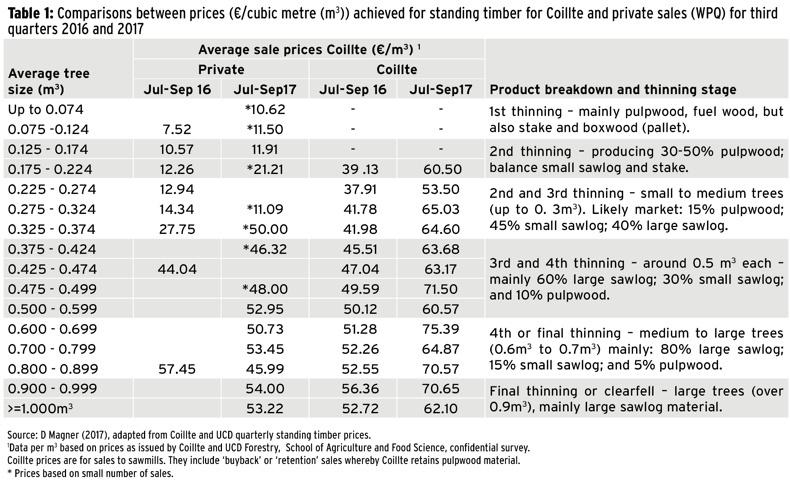

One of the big conundrums in private forestry is assessing actual volumes of timber harvested and reaching the market. During the seven-year period 2010 to 2016, average private supply was 447,000m3, peaking at 646,000m3 in 2015, according to COFORD data.

If harvesting is estimated from felling licence approvals, the average volume should be 666,000m3 based on conservative average thinning (25m3/ha) and clearfells (270m3/ha) to allow for low-yielding crops and premature clearfells, especially after windblow (Table 2). Optimum thinning volumes for conifers is 45m3/ha and 480m3/ha for clearfells.

Forest owners are now applying for felling licences, which is encouraging. Felling licences were approved by the Forest Service for 103,067ha of forest thinnings and clearfells during the seven-year period 2010-2016.

The cumulative COFORD volume forecast for the private sector during that period was 4.8 million m3, while 3.1 million m3 was achieved according to Department data.

This would appear to be an underestimation, as the yield, if based on felling licence approvals, should be 4.7 million m3, which is close to the forecast.

The forestry and forest products sector needs to agree a methodology to provide comprehensive annual production from private forests.

This is required to provide greater market certainty for forest owners and to allow timber processors to plan future investment and expansion as timber supply is forecast to reach eight million m3 within the next 18 years.

This approach will require a degree of trust and openness between the relevant stakeholders, which has been lacking to date.

Read more

Farmers to be paid more as forestry rules changed

‘Larry Goodmans of this world’ holding back forestry

Year-on-year timber prices for Coillte standing sales have made a remarkable recovery since the downturn in the economy and collapse in the housing market from 2007.

For example, average prices in 2008 and 2009 were €34.50/m3, but by 2014-2015, prices had more than doubled to €72.50 (Figure 1) despite a glut of timber coming on the market as a result of the windblow caused by Storm Darwin.

Average prices for the first three quarters of this year based on Coillte sales were €61.46. Private prices achieved were lower than Coillte’s rates in the medium to large sawlog categories.

Coillte log prices increased by up by 30% in the third quarter compared with the same period in 2016 for medium to large sawlog

An interesting trend has emerged which shows that there is little variation between timber prices regardless of category size, especially in the 0.275-0.324m3 to 0.700-0.799m3 range.

It should be remembered that Coillte prices are for standing sales of medium to large logs as the company retains small logs (pulpwood and fuelwood ) for its panel board mills and a small number of wood energy outlets.

As a result, the private sector relies on data from Wood Price Quarterly (WPQ) for small log prices usually from first thinnings but this information is more difficult to source.

Prices range from €10.62/m3 to €11.91/m3 for the three small log category sizes between 0.074m3 and 0.224m3.

There was insufficient price data available for the third quarter in 2016 to draw clear price comparisons for the same period this year. However, prices were down on 2015, which was expected as 2014 and 2015 were exceptionally buoyant years for all timber sales – private and Coillte.

The WPQ, which is issued by UCD in collaboration with the Irish Timber Growers Association (ITGA) for the private sector, still has some way to go before it can issue definitive data, simply because of the small number of sale transactions.

On the other hand, Coillte prices cover a much larger number of transactions and have greater geographical and species spread, so are more reliable nationally.

While the WPQ has to be treated with care in drawing conclusions on timber prices, it is a worthwhile exercise but it is vital that forestry companies, sawmills and forest owners provide information to the UCD team who compile the data on behalf of the ITGA.

The advice to forest owners with crops approaching first or second thinning is to sell, as prices are still solid. Postponing thinning is not a solution as the aim should be to benefit the final crop.

However, once the final crop is due for clearfell, the owner should delay harvesting if the price is not right. Clearfells can be postponed if windblow is not a risk and further thinning carried out.

Forest owners should shop around for prices at this stage as a negative 10-15% differential in a clearfell price could result in a revenue reduction of up to €3,000/ha, which would cover the cost of reforestation.

Brexit continues to cast a shadow over the sector but “Irish timber processors are highly competitive, well organised and determined to meet the challenges of Brexit,” said Mark McAuley, director of the Irish Forestry and Forest Products Association (IFFPA) in Ibec.

“However, the UK is the only viable market for the majority of our output in the short term,” he maintained. “Product and market diversification are not adequate solutions.

Free trade is an absolute prerequisite to the continuing trade in timber products between Ireland and the UK. The EU should negotiate a comprehensive free-trade agreement with the UK and, in the interim, provide an adequate transitional period in which time free trade arrangements apply.”

One of the big conundrums in private forestry is assessing actual volumes of timber harvested and reaching the market. During the seven-year period 2010 to 2016, average private supply was 447,000m3, peaking at 646,000m3 in 2015, according to COFORD data.

If harvesting is estimated from felling licence approvals, the average volume should be 666,000m3 based on conservative average thinning (25m3/ha) and clearfells (270m3/ha) to allow for low-yielding crops and premature clearfells, especially after windblow (Table 2). Optimum thinning volumes for conifers is 45m3/ha and 480m3/ha for clearfells.

Forest owners are now applying for felling licences, which is encouraging. Felling licences were approved by the Forest Service for 103,067ha of forest thinnings and clearfells during the seven-year period 2010-2016.

The cumulative COFORD volume forecast for the private sector during that period was 4.8 million m3, while 3.1 million m3 was achieved according to Department data.

This would appear to be an underestimation, as the yield, if based on felling licence approvals, should be 4.7 million m3, which is close to the forecast.

The forestry and forest products sector needs to agree a methodology to provide comprehensive annual production from private forests.

This is required to provide greater market certainty for forest owners and to allow timber processors to plan future investment and expansion as timber supply is forecast to reach eight million m3 within the next 18 years.

This approach will require a degree of trust and openness between the relevant stakeholders, which has been lacking to date.

Read more

Farmers to be paid more as forestry rules changed

‘Larry Goodmans of this world’ holding back forestry

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: