The Board of embattled Swiss baker Aryzta, plans to raise up to €800m in capital, mainly through issuing more shares through a rights issue. The proceeds from the capital increase are targeted mainly for debt reduction, which the group claims would give it more flexibility allowing it to implement its strategy.

The group, which owns the Cuisine de France brand, announced the plans in a statement released today. It also confirmed in the statement that its quarter four trading was in line with expectations, including meeting profit guidance targets for the full financial year.

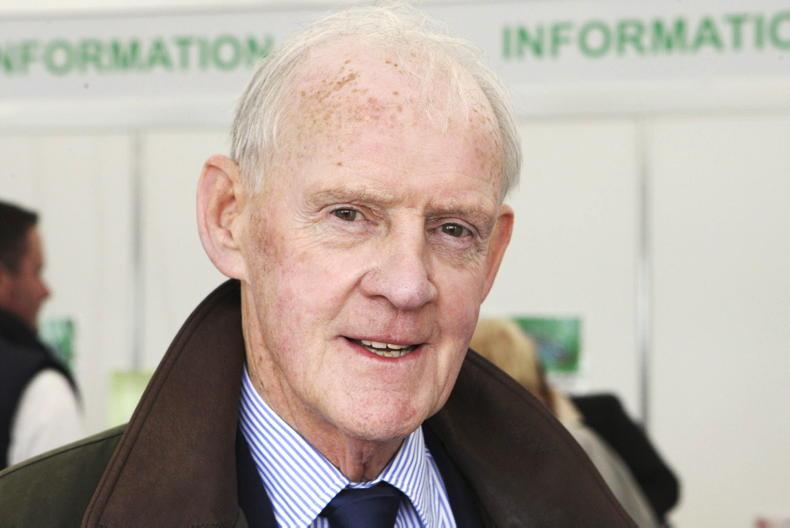

Aryzta’s CEO, Kevin Toland, said that “a significantly improved capital structure will provide Aryzta with the means to continue to take the necessary steps to re-position the business and deliver on our strategy”.

He added that “over the medium-term, we expect to generate significant cash flow which will be applied towards continued net debt reduction and to resource selective growth opportunities”.

Aryzta closed its 2018 financial year on 31 July. It said that it will include more details on the planned raising of capital in conjunction with the annual results on 1 October 2018. The group said the rights issue is targeted to be executed before the end of the year - subject to approval by shareholders.

The group also said that it remained committed to a €1bn de-leveraging plan over the next four years (announced in January), which includes at least €450m of asset disposals. The group is planning to dispose of its stake in French group, Picard.

Aryzta said that trading in the fourth quarter of 2018 was in line with expectations and expects to make a full-year profit (EBITDA) of between €296 and €304m, which is in line with guidance issued at the end of May.

Shares set a new low during Friday’s trading and reached €7.36. Over the last year, the share price is down 73%.

SHARING OPTIONS