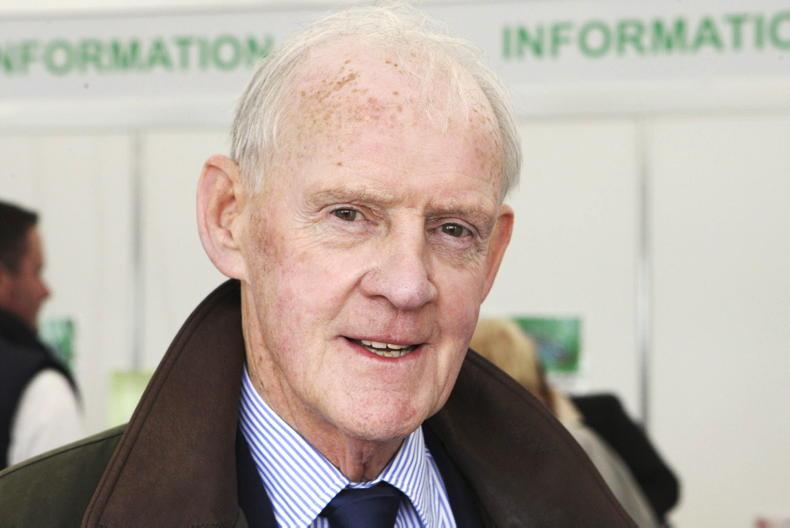

Financial accounts for the Goodman Foundation, the UK-based charity chaired by Larry Goodman and funded through an endowment from Jersey-based ABP Food Group, showed assets at the end of March 2025 of £126.1m (€144m). The foundation made charitable donations of £2.98m (€3.41m) during the financial year.

The foundation’s income for the 12 months to the end of March 2025 consisted of a £9.5m(€10.9m) endowment donation from ABP Food Group, and a £160,686 (€183,766) donation from the Goodman Family Trusts.

There was also £4.3m (€4.92m) in income from investments, much of which was cancelled out by a net loss of £3.4m (€3.9m) on the value of those investments due to changes in the market value of shares held by the foundation.

The assets of the foundation were a mixture of cash, shares and property. Cash balance dropped by £16.4m (€18.8m) to £33.4m (€38.2m), while the value of investment properties increased by £11.9m (€13.6m) to £32.9m (€37.6m), due to the purchase of an investment property during the year for that amount.

Those investment properties consist of arable lands of 1,363 acres and other investment properties valued at £3.9m (€4.5m) and £11.9m.

While there were no details given about the investment properties in the 2025 accounts, the 2024 accounts refer to the property valued at £3.9m as “Fonthill”.

The Irish Times reported in 2019 that Sean Mulryan had sold Fonthill House, the former corporate headquarters of Mulryan’s Ballymore property group located next to the Hermitage clinic, to Larry Goodman.

The foundation charged rent of £164,392 (€188,000) to another Goodman-controlled entity, Parma Management Services, during the year.

In movements on the financial assets, which ended the year valued at £58.7m (€67.1m), the foundation fully sold down its shareholding in Bank of Ireland, leaving it with no Irish-domiciled company shares.

The foundation held shares in UK housebuilders Persimmon and Crest Nicholson; carmakers BMW and Mercedes; consumer companies Unilever and Johnson & Johnson; and mining giant Glencore. Its single biggest shareholding was a £11.3m (€12.9m) stake in Nestle.

On the charity side, the foundation made donations of £2.14m (€2.45m) to children’s charities, £481,830 (€551,097) to the poor, elderly and disabled, and £321,874 (€368.146) to other charitable causes deemed worthy. Donations to third world and disasters were £28,151 (€32.197).

The foundation finished the year with £111.6m(€127.6m) in its endowment fund, which it says is invested to generate income to enable the trust to continue its work over the long term. It had unrestricted funds of £14.5m (€16.6m).

SHARING OPTIONS