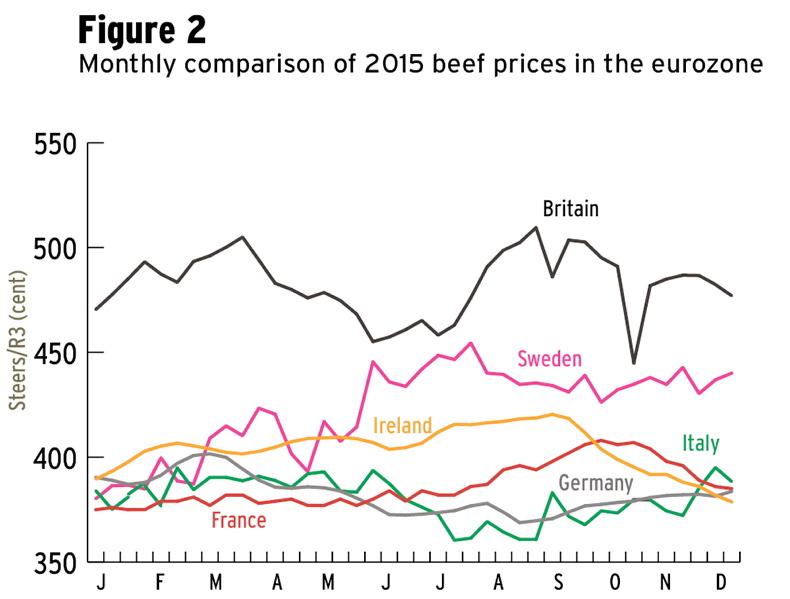

For most of this year, Irish farmgate beef prices have traded ahead of those in our main export destinations in the eurozone, with a very substantial gap opening up in the late spring compared with France, Italy and Germany. This has not been sustained and the price falls, experienced by Irish farmers have not happened in these countries. The result is that Irish prices were 22c/kg ahead of France, 50c/kg ahead of Germany and 37c/kg ahead of Italy at the end of July. This has now swung around completely and, by last week, Irish farmgate prices were 7c/kg behind France, 6c/kg behind Germany and 10c/kg behind Italy. It would have been much better if prices in these countries had increased and we might have expected Ireland to keep pace with them. However, with all of our main markets now ahead of us, dramatically ahead as in the case of Britain (€1/kg), it hopefully means that Irish prices are at the bottom of the cycle.

Sweden is an interesting market. Historically, it didn’t have much of a beef industry and its herd of 350,000 cows were virtually all for milk production with any beef almost a by-product. Its farmgate prices for beef have been on an upward curve and, interestingly, Scandinavia – and Sweden in particular – has been a growing market for the Irish beef industry. The best starting point in developing markets is accessing those with the highest value domestic beef price and present steer and heifer product which trumps domestically produced bull beef as is the normal production in most of Europe. Once that is established we should be in a position to grow both volume and value.

Volatile global market

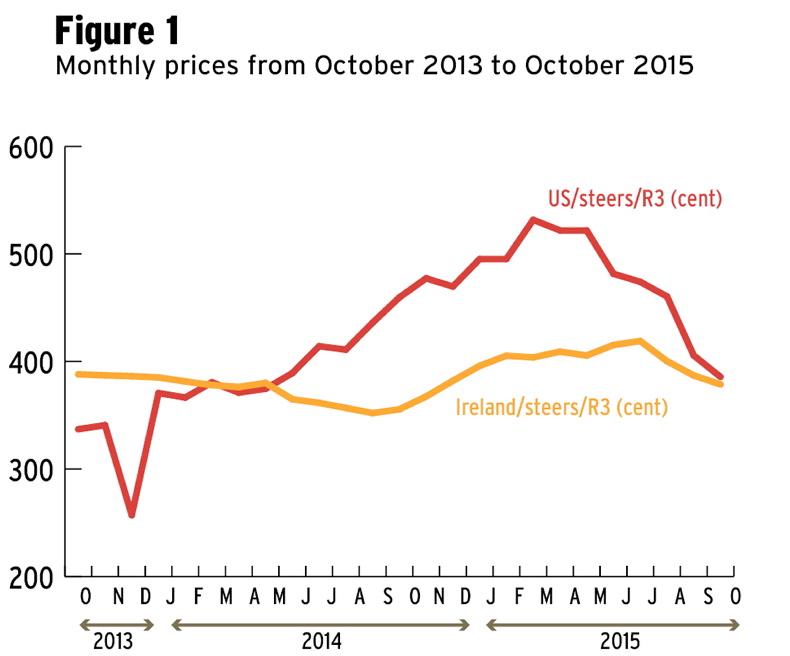

While there is a feeling in Ireland that the trade has steadied recently and farmers are hoping for an upward turn, it remains a volatile world market for beef. Given our frustrations in getting manufacturing beef into the US makes it of less immediate relevance, but it has been a particularly volatile market in recent times. Prices there had been trading in the €3 to €3.50/kg equivalent for several years until they started rising in late 2013, throughout 2014 and into the first half of this year. Severe droughts in the main cattle-producing regions meant that, at the start of 2015, cattle numbers were at their lowest since 1951. Prices surged by the equivalent of €2/kg, peaking at €5.45 in April this year.

Since then, it has been has been in freefall with prices back to the equivalent of €3.66 at the start of October though there seems to have been a 20c/kg equivalent bounceback last week. Falls have been particularly sharp in the last six weeks. US cattle prices were expected to have a soft landing. However, a combination of factors such as Australia and New Zealand almost doubling their sales to the US in the first half of this year, along with feedlots taking advantage of an abundance of cheap grain to drive carcase weights to an average of over 400kg and increasing by the week, means that supplies were never as scarce as expected. On the other side, rising consumer beef prices weakened consumer demand, and this was made worse by an abundance of cheaper pork and chicken, driven by the relatively low grain price.

Despite this, the US lean-manufacturing or burger beef market would still be attractive for Ireland. Prices may no longer be a euro ahead of what we can currently achieve, but it would still be several cents per kilo and a real competitor to current markets. The great frustration for the Irish beef industry is finding markets for the higher fat content manufacturing beef. This time last year, it was flying out the door to Philippines and the “grey” southeast Asian market. This year, Philippines is flooded with cheap Brazilian alternatives and China closed all the back doors into its market. There are stories of southeast Asian traders becoming more active recently, but no hard evidence of large shipments yet. That just leaves north and west African markets for the low-value offal and it is so marginal that many factories are ceasing to harvest, pack and store them.

Australia has enjoyed its best ever year of beef prices, achieving the equivalent of over €3.50/kg recently. The sharp decline in the value of the Australian dollar has made its beef attractive to importers in the US and meant the surge in value of cattle prices was of even more benefit for Australian farmers. It is likely they will continue strong as numbers are forecast to fall substantially, with drought being a problem.

SHARING OPTIONS