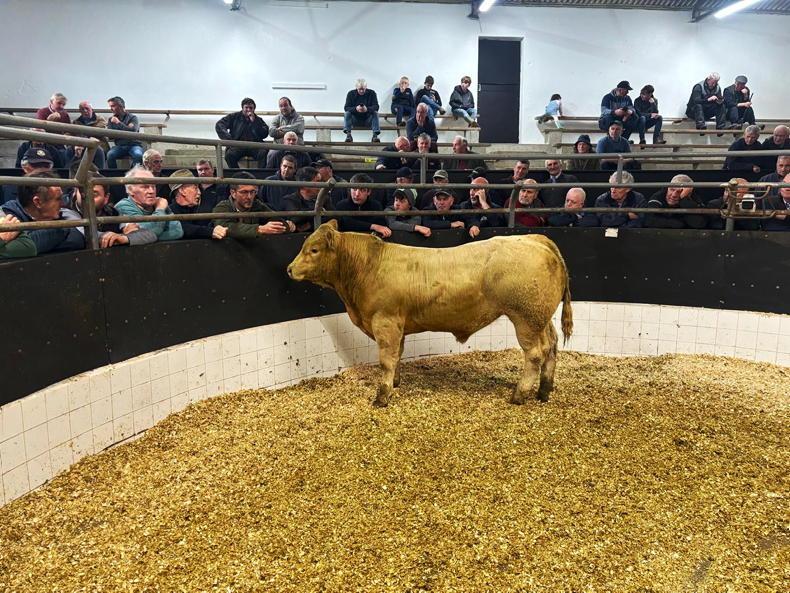

Sucklers: sour end to 2025

The weather gods, the beef price gods and the weanling price gods all aligned in 2025 to make it a memorable year for beef and suckler farmers.

The weather was right out of the textbook, a good spring, good silage-making weather, rain when we needed it, but not too much, and a decent back end.

Suckler farmers in particular have endured a lot of tough years in the two decades, with no real progress made on price or margins.

The last 12 months changed all that with suckling suddenly back in vogue again. Weanlings at €6/kg for much of autumn 2025 meant that farmers were receiving €1,000/head more than they were 12 months ago.

Headlines even started to appear with sucklers and tax bills in the same sentence.

Beef finishers also enjoyed a big lift in prices but they also had to contend with the ever-increasing replacement cost , something they say brings them back to a net-zero change in 2025. The last six weeks haven’t been as good on beef price and has left a sour taste in winter finishers’ mouths in particular.

The outlook for prices in 2026 is good with cattle supplies set to remain tight for much of the year.

There are some clouds on the horizon. Food inflation and particularly an increase in supermarket meat prices has meant shoppers are more price conscious when filling shopping baskets.

Bluetongue is also on the island and Irish farmers are braced for an almost inevitable outbreak in 2026.

Hopefully it won’t have as much disruption to trade or the health of animals as first envisaged with a vaccine rollout plan due to be launched in 2026.

Tillage: schemes should be guaranteed income

The outlook for 2026 in tillage is not positive at present. Premium markets have been lost from a reduction in malting barley and gluten-free oats contracts.

The price premium for malting barley has also declined. Family farm income on tillage farms for 2026 is estimated at €46,900 by Teagasc, down 1% on 2025.

The other enterprises on the farm are likely to help this figure. Fertiliser prices have been estimated upwards by 10% due to CBAM.

Teagasc places the net margin on cereal farms for 2026 at €235/ha, down €35/ha.

For 2025 it estimated the net margin at €270/ha, up €35/ha.

With oats and beans sitting in storage across the country, Irish farmers need to choose their crops carefully.

Promote Irish grain among your peers, but also be conscious that the demand for these products may not be there.

Check with your grain buyer(s) to ensure they will purchase what you grow.

On a positive note, Dairygold and Tirlán malting barley growers will have the chance to take part in a pilot sustainability assurance scheme which is to deliver a sustainability payment in 2026.

The Straw Incorporation Measure and Protein Aid Measure remain in place for 2026 and should be used as guaranteed income.

Dairy: farmers to cut costs to make a margin

While dairy farmers breathed a sigh of relief when the nitrates derogation extension was announced, the sector is taking a deep breath as it prepares for the milk price shock in 2026.

Over the last four months, almost 15c/l has been shaved off milk prices in what has surely been one of the most difficult times for the dairy market in recent memory. The outlook for 2026 in terms of milk prices and margins is not good and hopes of a fast recovery are probably overly optimistic.

The cause of the current downturn – a surge in milk volumes across the US and Europe – sees little sign of abating.

Beef prices in the US are so high that dairy farmers there will calve and milk cows just to get a calf on the ground, with Angus calves less than a week old making

€1,400/head.

Normally, milk supply is dictated by milk price, but the dynamics have shifted now that beef prices are driving more margin on dairy farms.

The high prices for beef will help to cushion the blow for Irish dairy

farmers.

To make money in 2026, Irish dairy farmers will have to cut costs sharply.

A task many haven’t had to do in a while.

Sheep: further drop in throughput predicted

The 2025 sheep kill is set to be the lowest since 2011 and, depending on throughput levels over the final two weeks of the year, could well be the lowest kill for over 35 years.

Throughput of 1.98m head has collapsed in 2025, falling by a massive figure of 437,499 sheep, or 18%, up to

week 50.

This comes on the back of the 2024 sheep kill falling by 377,476 head, or by 18%, with combined throughput falling by over 800,000 head, or upwards of 25%, in the space of just two years.

Breeding ewe numbers have fallen by under 200,000 head in the last two sheep census returns, with many industry stakeholders predicting a substantial fall in the 2025 sheep census – which takes place on 31 December.

As such, it is likely that the sheep kill will continue to fall in 2026.

Exports out of Northern Ireland to Ireland, Britain and further afield have also fallen greatly.

The export figure of 220,878 head for direct slaughter in Ireland is running 81,871 head lower, while exports to farms of 30,800 head are over 11,800 head lower.

In contrast, exports to Britain for direct slaughter, at 42,290 sheep, are running almost 24,000 head higher, while exports under breeding and production of over 100,000 head are running just shy of 50,000 head lower.

While it doesn’t seem like it at present – with prices running upwards of €1/kg higher than in 2024 – prices for the year as a whole are averaging 35c/kg higher at €8.16/kg.

All forecasts are that prices should follow a broadly similar price trend

in 2026.

One of the biggest developments over the next 12 months could be how the sheep sector is hit by the bluetongue

virus.

It looks inevitable – given the spread in cases – that there will be more cases found, but hopefully the level of infection in the environment remains low before the main midge vector

season.

Sucklers: sour end to 2025

The weather gods, the beef price gods and the weanling price gods all aligned in 2025 to make it a memorable year for beef and suckler farmers.

The weather was right out of the textbook, a good spring, good silage-making weather, rain when we needed it, but not too much, and a decent back end.

Suckler farmers in particular have endured a lot of tough years in the two decades, with no real progress made on price or margins.

The last 12 months changed all that with suckling suddenly back in vogue again. Weanlings at €6/kg for much of autumn 2025 meant that farmers were receiving €1,000/head more than they were 12 months ago.

Headlines even started to appear with sucklers and tax bills in the same sentence.

Beef finishers also enjoyed a big lift in prices but they also had to contend with the ever-increasing replacement cost , something they say brings them back to a net-zero change in 2025. The last six weeks haven’t been as good on beef price and has left a sour taste in winter finishers’ mouths in particular.

The outlook for prices in 2026 is good with cattle supplies set to remain tight for much of the year.

There are some clouds on the horizon. Food inflation and particularly an increase in supermarket meat prices has meant shoppers are more price conscious when filling shopping baskets.

Bluetongue is also on the island and Irish farmers are braced for an almost inevitable outbreak in 2026.

Hopefully it won’t have as much disruption to trade or the health of animals as first envisaged with a vaccine rollout plan due to be launched in 2026.

Tillage: schemes should be guaranteed income

The outlook for 2026 in tillage is not positive at present. Premium markets have been lost from a reduction in malting barley and gluten-free oats contracts.

The price premium for malting barley has also declined. Family farm income on tillage farms for 2026 is estimated at €46,900 by Teagasc, down 1% on 2025.

The other enterprises on the farm are likely to help this figure. Fertiliser prices have been estimated upwards by 10% due to CBAM.

Teagasc places the net margin on cereal farms for 2026 at €235/ha, down €35/ha.

For 2025 it estimated the net margin at €270/ha, up €35/ha.

With oats and beans sitting in storage across the country, Irish farmers need to choose their crops carefully.

Promote Irish grain among your peers, but also be conscious that the demand for these products may not be there.

Check with your grain buyer(s) to ensure they will purchase what you grow.

On a positive note, Dairygold and Tirlán malting barley growers will have the chance to take part in a pilot sustainability assurance scheme which is to deliver a sustainability payment in 2026.

The Straw Incorporation Measure and Protein Aid Measure remain in place for 2026 and should be used as guaranteed income.

Dairy: farmers to cut costs to make a margin

While dairy farmers breathed a sigh of relief when the nitrates derogation extension was announced, the sector is taking a deep breath as it prepares for the milk price shock in 2026.

Over the last four months, almost 15c/l has been shaved off milk prices in what has surely been one of the most difficult times for the dairy market in recent memory. The outlook for 2026 in terms of milk prices and margins is not good and hopes of a fast recovery are probably overly optimistic.

The cause of the current downturn – a surge in milk volumes across the US and Europe – sees little sign of abating.

Beef prices in the US are so high that dairy farmers there will calve and milk cows just to get a calf on the ground, with Angus calves less than a week old making

€1,400/head.

Normally, milk supply is dictated by milk price, but the dynamics have shifted now that beef prices are driving more margin on dairy farms.

The high prices for beef will help to cushion the blow for Irish dairy

farmers.

To make money in 2026, Irish dairy farmers will have to cut costs sharply.

A task many haven’t had to do in a while.

Sheep: further drop in throughput predicted

The 2025 sheep kill is set to be the lowest since 2011 and, depending on throughput levels over the final two weeks of the year, could well be the lowest kill for over 35 years.

Throughput of 1.98m head has collapsed in 2025, falling by a massive figure of 437,499 sheep, or 18%, up to

week 50.

This comes on the back of the 2024 sheep kill falling by 377,476 head, or by 18%, with combined throughput falling by over 800,000 head, or upwards of 25%, in the space of just two years.

Breeding ewe numbers have fallen by under 200,000 head in the last two sheep census returns, with many industry stakeholders predicting a substantial fall in the 2025 sheep census – which takes place on 31 December.

As such, it is likely that the sheep kill will continue to fall in 2026.

Exports out of Northern Ireland to Ireland, Britain and further afield have also fallen greatly.

The export figure of 220,878 head for direct slaughter in Ireland is running 81,871 head lower, while exports to farms of 30,800 head are over 11,800 head lower.

In contrast, exports to Britain for direct slaughter, at 42,290 sheep, are running almost 24,000 head higher, while exports under breeding and production of over 100,000 head are running just shy of 50,000 head lower.

While it doesn’t seem like it at present – with prices running upwards of €1/kg higher than in 2024 – prices for the year as a whole are averaging 35c/kg higher at €8.16/kg.

All forecasts are that prices should follow a broadly similar price trend

in 2026.

One of the biggest developments over the next 12 months could be how the sheep sector is hit by the bluetongue

virus.

It looks inevitable – given the spread in cases – that there will be more cases found, but hopefully the level of infection in the environment remains low before the main midge vector

season.

SHARING OPTIONS