I’m a young farmer with the Green Cert and my parents are considering gifting me cash next year to help me buy farmland. I know that in the past, you could still claim Agricultural Relief even if you were gifted cash, so long as you used it to buy land.

But I’ve heard there’s been a change in the rules. Is that true? And what’s all this about a ministerial order?

ANSWER: You’re not alone in your confusion – this has been one of the most common questions we’ve received in recent months. With succession planning top of mind for many farming families, and young farmers trying to get a foothold, it’s no wonder. The good news is that, as of now, you can still claim Agricultural Relief on a cash gift used to purchase farmland.

Current law

Right now, under Section 89 of the Capital Acquisitions Tax Consolidation Act 2003 (CATCA), a person can claim Agricultural Relief on a cash gift or inheritance – provided that cash is used within two years to purchase agricultural property.

This has been a hugely helpful practice. Imagine a young farmer receiving €300,000 from their parents to buy land nearby. As long as they meet several conditions – like passing the 80% agricultural assets test, holding the Green Cert, and actively farming or leasing the land for at least six years – they can reduce the taxable value of that gift by 90%.

This is what’s commonly referred to as a ‘conditional gift’ – the condition being that the money is spent on agri property. And up to now, Revenue has accepted this.

.

What’s changing

The Finance Act 2024, which was signed into law last November, includes a new section – Section 89A CATCA – which is set to replace the current Section 89, but it hasn’t come into effect yet.

Here’s the critical difference: under the new rules, cash gifts or inheritances will no longer qualify for Agricultural Relief – even if they are used to buy land.

So, if your parents give you €300,000 and you invest it in farmland, it will not be treated as agricultural property for Capital Acquisitions Tax (CAT) purposes. Unless you have any remaining tax-free threshold under Group A (currently €400,000 from parents to children), you could face a significant CAT bill.

When do the new rules start?

Here’s where it gets interesting. Although new Agricultural Relief is now part of the law (thanks to the Finance Act 2024), it is subject to a Ministerial Order. That means the Minister for Finance must sign a statutory order to actually commence the new section.

Until that happens, the old Agricultural Relief remains in effect.

So if your parents gift you cash and you use it to buy land – the current rules apply. And you may be able to claim Agricultural Relief, provided you meet all the other conditions.

No one yet knows when or if the new Agricultural Relief will be commenced.

In fact, the Minister for Agriculture stated in the recent budget that Agricultural Relief would remain on the current terms, so a change is not expected soon.

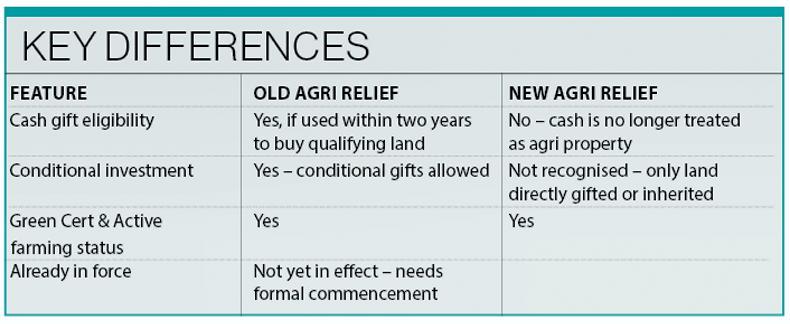

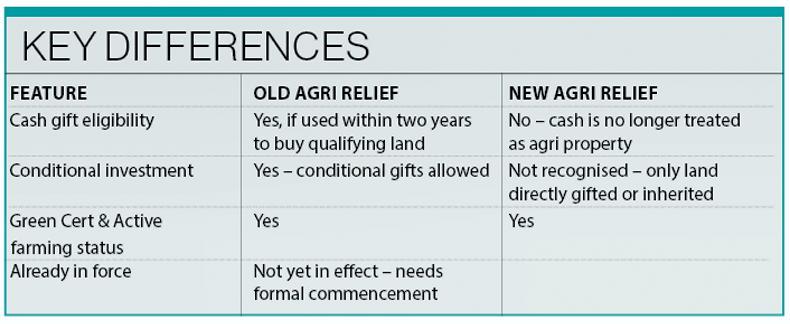

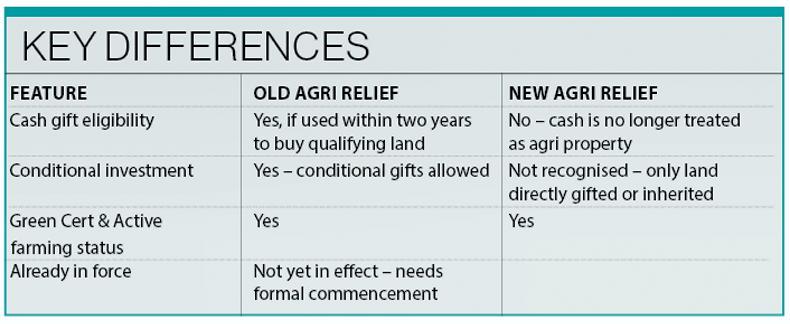

Figure 1.

The Department of Finance is also still reviewing the timing, possibly in response to industry concerns about the new rules and the potential impact on land mobility and young farmers.

However, it still is a bit of the unknown and I wouldn’t delay as acting before changes are made means you could claim Agricultural Relief on that gift – saving up to €100,000 or more in tax in some cases.

But you’ll need to be very careful:

Ensure the gift is made before the new rules kick in.Use the funds to buy qualifying agricultural property within two years.Keep all paperwork – including solicitor’s letters and transfer documents – to show that the money was in fact invested as intended.If you wait too long and the Minister signs the commencement order in the meantime, you could lose out.

There’s a lot of talk about simplifying reliefs and closing off ‘loopholes’ – but this isn’t a loophole. It’s been a practical tool, which the Minister for Agriculture says is worth €230m annually to Irish farms. It helps young farmers to get on the ladder and for parents to support them without triggering massive tax bills.

Whether the new Agricultural Relief gets rolled out in full or is reworked remains to be seen. My advice is to move promptly if you’re relying on the current regime.

It’s not often in tax that you get a “use it or lose it” window – but this may well be one of them.

Marty Murphy, head of tax with ifac.

I’m a young farmer with the Green Cert and my parents are considering gifting me cash next year to help me buy farmland. I know that in the past, you could still claim Agricultural Relief even if you were gifted cash, so long as you used it to buy land.

But I’ve heard there’s been a change in the rules. Is that true? And what’s all this about a ministerial order?

ANSWER: You’re not alone in your confusion – this has been one of the most common questions we’ve received in recent months. With succession planning top of mind for many farming families, and young farmers trying to get a foothold, it’s no wonder. The good news is that, as of now, you can still claim Agricultural Relief on a cash gift used to purchase farmland.

Current law

Right now, under Section 89 of the Capital Acquisitions Tax Consolidation Act 2003 (CATCA), a person can claim Agricultural Relief on a cash gift or inheritance – provided that cash is used within two years to purchase agricultural property.

This has been a hugely helpful practice. Imagine a young farmer receiving €300,000 from their parents to buy land nearby. As long as they meet several conditions – like passing the 80% agricultural assets test, holding the Green Cert, and actively farming or leasing the land for at least six years – they can reduce the taxable value of that gift by 90%.

This is what’s commonly referred to as a ‘conditional gift’ – the condition being that the money is spent on agri property. And up to now, Revenue has accepted this.

.

What’s changing

The Finance Act 2024, which was signed into law last November, includes a new section – Section 89A CATCA – which is set to replace the current Section 89, but it hasn’t come into effect yet.

Here’s the critical difference: under the new rules, cash gifts or inheritances will no longer qualify for Agricultural Relief – even if they are used to buy land.

So, if your parents give you €300,000 and you invest it in farmland, it will not be treated as agricultural property for Capital Acquisitions Tax (CAT) purposes. Unless you have any remaining tax-free threshold under Group A (currently €400,000 from parents to children), you could face a significant CAT bill.

When do the new rules start?

Here’s where it gets interesting. Although new Agricultural Relief is now part of the law (thanks to the Finance Act 2024), it is subject to a Ministerial Order. That means the Minister for Finance must sign a statutory order to actually commence the new section.

Until that happens, the old Agricultural Relief remains in effect.

So if your parents gift you cash and you use it to buy land – the current rules apply. And you may be able to claim Agricultural Relief, provided you meet all the other conditions.

No one yet knows when or if the new Agricultural Relief will be commenced.

In fact, the Minister for Agriculture stated in the recent budget that Agricultural Relief would remain on the current terms, so a change is not expected soon.

Figure 1.

The Department of Finance is also still reviewing the timing, possibly in response to industry concerns about the new rules and the potential impact on land mobility and young farmers.

However, it still is a bit of the unknown and I wouldn’t delay as acting before changes are made means you could claim Agricultural Relief on that gift – saving up to €100,000 or more in tax in some cases.

But you’ll need to be very careful:

Ensure the gift is made before the new rules kick in.Use the funds to buy qualifying agricultural property within two years.Keep all paperwork – including solicitor’s letters and transfer documents – to show that the money was in fact invested as intended.If you wait too long and the Minister signs the commencement order in the meantime, you could lose out.

There’s a lot of talk about simplifying reliefs and closing off ‘loopholes’ – but this isn’t a loophole. It’s been a practical tool, which the Minister for Agriculture says is worth €230m annually to Irish farms. It helps young farmers to get on the ladder and for parents to support them without triggering massive tax bills.

Whether the new Agricultural Relief gets rolled out in full or is reworked remains to be seen. My advice is to move promptly if you’re relying on the current regime.

It’s not often in tax that you get a “use it or lose it” window – but this may well be one of them.

Marty Murphy, head of tax with ifac.

SHARING OPTIONS