It was against a backdrop of low oil prices, weak currencies against the dollar and a swell in milk production globally since 2014 that Glanbia Ingredients Ireland (GII) recorded a 23% rise in operating profits to €47.5m last year.

Despite sales volumes being up 3%, turnover was down 4% to €833m as a result of prices down 7% year on year. It processed a record 2.14bn litres, up 5.4% over 2015.

The strong operating performance was driven by rising commodity prices in the latter part of the year from products that had been manufactured over the summer months.

Headline milk price

The GII headline milk price (3.6% butterfat and 3.3% protein) ranged from 24c/l at the start of 2016 moving to a low of 20c/litre for May and June supplies and then progressively rose each month over the second half of the year to reach 30c/litre for December supplies.

Overall, GII delivered an after-tax profit of €32.6m, which was a 7% increase on 2015. This translates into a 1.52c/l profit after tax, which is marginally ahead of the 1.5c/l recorded in 2015.

Operating margins rose significantly from the 4.4% recorded in 2015 to 5.7% in 2016.

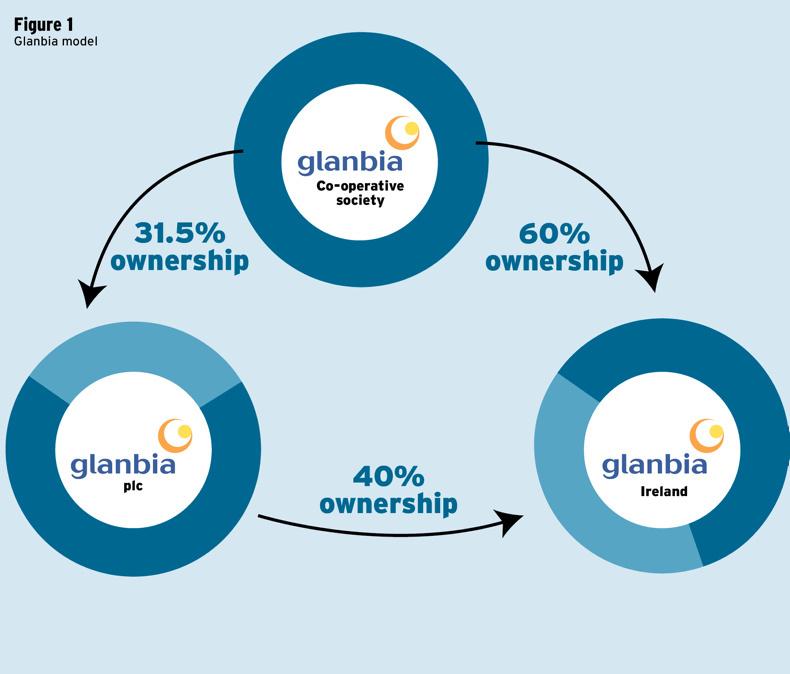

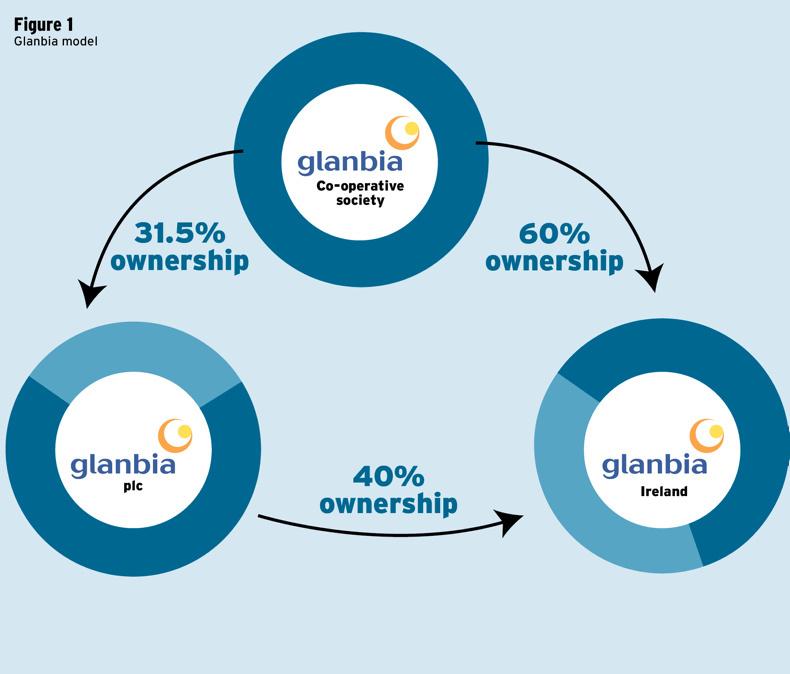

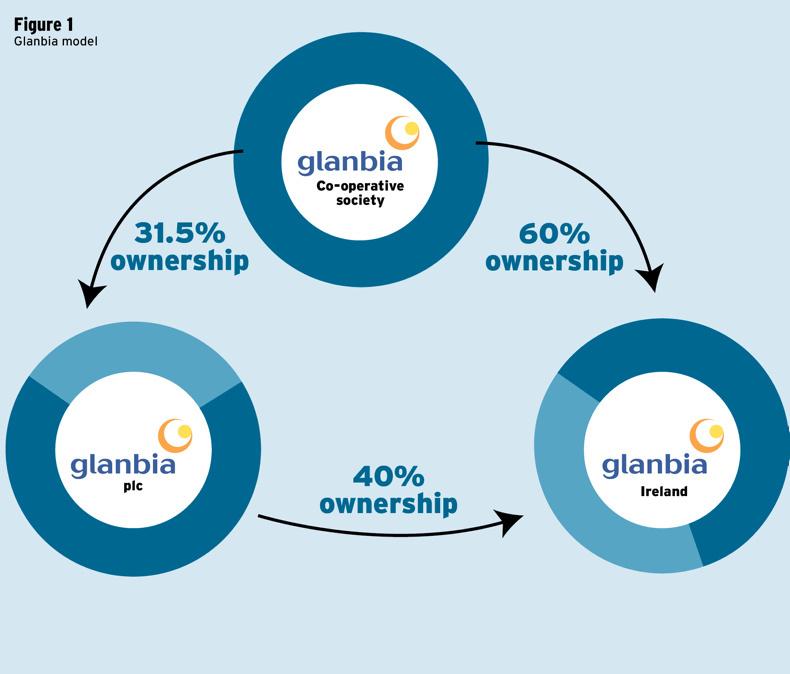

These are particularly strong and reflect the GII profit target, which was enshrined in 2012 when the joint venture, which is 60% owned by the co-op and 40% owned by the plc, was formed.

GII operates a fixed after-tax profit target of 1.5c/l.

Ironically, lower dairy commodity prices drive higher operating margins as the company operates an after-tax profit target that is a fixed amount per litre – no matter what the milk price is.

A fairer model for farmers

It must be noted that under the new Glanbia Ireland model, the 1.5c/l profit target has now evolved.

Glanbia Ireland will have an after-tax profit margin target of 3.2%.

The first €5m of profit over this is set aside for a volatility fund.

From financial year one (2018) onwards, 50% of the profits will flow back to the owners, of which the co-op will get 60%.

As the profit margin target is now a percentage of revenue, it better reflects the vagaries of the market.

Therefore, whether the dairy market is high or low, the profit margin percentage remains the same, which ultimately is fairer to all, including farmer owners.

GII has always stated that it will pay a competitive market price for milk.

The annual KPMG milk review placed Glanbia in second position, after west Cork co-ops/Carbery in 2016. However, this is after the plc dividend in the form of co-op supports is included, which amounted to 1.5c/l in 2016.

Take this out and GII moves down the list considerably.

However, other co-ops also support prices hitting either their profits (therefore margins) or, in some cases, their balance sheets.

The retention of this 1.5c/l target profit margin, which delivered a 5.5% margin for the business, did “hurt” milk prices to farmers in 2016.

If the new Glanbia Ireland model had been in place for 2016, there would have been another €7m available to milk suppliers. This would have boosted milk price by a further 0.3c to 0.5/l in 2016.

Directors’ remuneration amounted to €1.3m for its 22 board members

Therefore, under the new Glanbia Ireland model, with the fixed profit margin, it will be fairer for farmers in the future.

One disadvantage to the new model is that, as GII will now be subsumed into Glanbia Ireland and financial accounts will be filed for this entity, there will be less financial transparency around the dairy business.

Finance and debt

Finance costs increased €5.4m to €9.6m in 2016. The variance related to the amount of borrowing costs capitalised (mainly interest costs related to Belview site).

In 2015, €5.2m was capitalised, compared with €1.8m in 2016.

As this was the first full year of operating and trading at Belview, distribution costs increased almost 25% to €20.2m due to the increased volumes.

Administration costs increased 18% to €19.9m. Total payroll costs for 688 employees amounted to €56m. Earnings (EBITDA) increased 18% to €63.4m in 2016. Net debt decreased €25.4m to €203.3m at year end 2016.

Debt to earnings sits at 3.2 times, which, at first glance, can seem high.

However, €151m of total debt relates to stock for resale. This effectively means that some €52m of the debt relates to capital.

With €47m invested in 2016 to complete the total €35m investment in Wexford and completion in Belview, this level of debt is very low considering the total processing assets of the business.

Total shareholders’ equity increased 11% to reach €242.7m at year end.

The business plans to invest €250m to €300m in capacity expansion (mainly in powders, whey processing and value-adding projects) to cater for growth in milk supplies over the next five years.

Directors’ remuneration amounted to €1.3m for its 22 board members.

A sum of €1.1m was paid to executive directors under long-term incentive schemes.

Key management compensation amounted to €5.4m, with €2.2m of this relating to harmonisation of the long-term incentive plans for the previous four years.

Glanbia Ireland

Glanbia Ireland was created following the vote in May by Glanbia shareholders to purchase 60% of the consumer foods and agribusiness from Glanbia plc. The co-op paid €112m funded through selling 3% of its shares in the plc.

The consumer foods and agribusiness brings with it revenues of some €600m and profits (EBITA) of around €30m.

The new entity will have sales of €1.5bn, rising to €2bn by 2020 following a further 30% expected growth in milk supplies.

It will be the largest buyer of native Irish grain, purchasing more than 200,000t.

It will have 11 production facilities, 53 agri-branches, 1,800 employees and process in excess of 2.4bn litres of milk per year, around one third of Ireland’s milk pool. Between 2012 and 2016, €430m has been invested in Glanbia Ireland (through GII and Dairy Ireland) and it plans to invest up to €300m by 2020.

During the year, GII launched Truly Grass Fed, a consumer-facing brand which targets consumers interested in natural food and nutrition.

It stands for grass fed, antibiotic and hormone free, GMO free, environmentally responsible and animal welfare friendly.

Read more

Green light for Glanbia's third dryer at Belview

It was against a backdrop of low oil prices, weak currencies against the dollar and a swell in milk production globally since 2014 that Glanbia Ingredients Ireland (GII) recorded a 23% rise in operating profits to €47.5m last year.

Despite sales volumes being up 3%, turnover was down 4% to €833m as a result of prices down 7% year on year. It processed a record 2.14bn litres, up 5.4% over 2015.

The strong operating performance was driven by rising commodity prices in the latter part of the year from products that had been manufactured over the summer months.

Headline milk price

The GII headline milk price (3.6% butterfat and 3.3% protein) ranged from 24c/l at the start of 2016 moving to a low of 20c/litre for May and June supplies and then progressively rose each month over the second half of the year to reach 30c/litre for December supplies.

Overall, GII delivered an after-tax profit of €32.6m, which was a 7% increase on 2015. This translates into a 1.52c/l profit after tax, which is marginally ahead of the 1.5c/l recorded in 2015.

Operating margins rose significantly from the 4.4% recorded in 2015 to 5.7% in 2016.

These are particularly strong and reflect the GII profit target, which was enshrined in 2012 when the joint venture, which is 60% owned by the co-op and 40% owned by the plc, was formed.

GII operates a fixed after-tax profit target of 1.5c/l.

Ironically, lower dairy commodity prices drive higher operating margins as the company operates an after-tax profit target that is a fixed amount per litre – no matter what the milk price is.

A fairer model for farmers

It must be noted that under the new Glanbia Ireland model, the 1.5c/l profit target has now evolved.

Glanbia Ireland will have an after-tax profit margin target of 3.2%.

The first €5m of profit over this is set aside for a volatility fund.

From financial year one (2018) onwards, 50% of the profits will flow back to the owners, of which the co-op will get 60%.

As the profit margin target is now a percentage of revenue, it better reflects the vagaries of the market.

Therefore, whether the dairy market is high or low, the profit margin percentage remains the same, which ultimately is fairer to all, including farmer owners.

GII has always stated that it will pay a competitive market price for milk.

The annual KPMG milk review placed Glanbia in second position, after west Cork co-ops/Carbery in 2016. However, this is after the plc dividend in the form of co-op supports is included, which amounted to 1.5c/l in 2016.

Take this out and GII moves down the list considerably.

However, other co-ops also support prices hitting either their profits (therefore margins) or, in some cases, their balance sheets.

The retention of this 1.5c/l target profit margin, which delivered a 5.5% margin for the business, did “hurt” milk prices to farmers in 2016.

If the new Glanbia Ireland model had been in place for 2016, there would have been another €7m available to milk suppliers. This would have boosted milk price by a further 0.3c to 0.5/l in 2016.

Directors’ remuneration amounted to €1.3m for its 22 board members

Therefore, under the new Glanbia Ireland model, with the fixed profit margin, it will be fairer for farmers in the future.

One disadvantage to the new model is that, as GII will now be subsumed into Glanbia Ireland and financial accounts will be filed for this entity, there will be less financial transparency around the dairy business.

Finance and debt

Finance costs increased €5.4m to €9.6m in 2016. The variance related to the amount of borrowing costs capitalised (mainly interest costs related to Belview site).

In 2015, €5.2m was capitalised, compared with €1.8m in 2016.

As this was the first full year of operating and trading at Belview, distribution costs increased almost 25% to €20.2m due to the increased volumes.

Administration costs increased 18% to €19.9m. Total payroll costs for 688 employees amounted to €56m. Earnings (EBITDA) increased 18% to €63.4m in 2016. Net debt decreased €25.4m to €203.3m at year end 2016.

Debt to earnings sits at 3.2 times, which, at first glance, can seem high.

However, €151m of total debt relates to stock for resale. This effectively means that some €52m of the debt relates to capital.

With €47m invested in 2016 to complete the total €35m investment in Wexford and completion in Belview, this level of debt is very low considering the total processing assets of the business.

Total shareholders’ equity increased 11% to reach €242.7m at year end.

The business plans to invest €250m to €300m in capacity expansion (mainly in powders, whey processing and value-adding projects) to cater for growth in milk supplies over the next five years.

Directors’ remuneration amounted to €1.3m for its 22 board members.

A sum of €1.1m was paid to executive directors under long-term incentive schemes.

Key management compensation amounted to €5.4m, with €2.2m of this relating to harmonisation of the long-term incentive plans for the previous four years.

Glanbia Ireland

Glanbia Ireland was created following the vote in May by Glanbia shareholders to purchase 60% of the consumer foods and agribusiness from Glanbia plc. The co-op paid €112m funded through selling 3% of its shares in the plc.

The consumer foods and agribusiness brings with it revenues of some €600m and profits (EBITA) of around €30m.

The new entity will have sales of €1.5bn, rising to €2bn by 2020 following a further 30% expected growth in milk supplies.

It will be the largest buyer of native Irish grain, purchasing more than 200,000t.

It will have 11 production facilities, 53 agri-branches, 1,800 employees and process in excess of 2.4bn litres of milk per year, around one third of Ireland’s milk pool. Between 2012 and 2016, €430m has been invested in Glanbia Ireland (through GII and Dairy Ireland) and it plans to invest up to €300m by 2020.

During the year, GII launched Truly Grass Fed, a consumer-facing brand which targets consumers interested in natural food and nutrition.

It stands for grass fed, antibiotic and hormone free, GMO free, environmentally responsible and animal welfare friendly.

Read more

Green light for Glanbia's third dryer at Belview

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: