What amount of money do you need to make off the farm next year? That is the first and most important question for farmers who are going to commit to the Cashflow Challenge. After all, one of the main reasons you are farming is to produce enough to live.

When I asked this week’s Cashflow Challenge farmer Eoin that question, he didn’t have to think twice. “The farm must contribute €20,000 to the household each year,” he said.

The reason he knew was that Eoin had recently given up a job to become a full-time farmer on 84 acres.

“My wife works full-time and we have three children. We sat down and made a decision that if I was home full-time, I could be around to look after the children more,” said Eoin. “Otherwise, we would be just too busy to enjoy them,” he added.

It was a sensible decision that many couples make as more children come along. Yes, they might bring in more income if both worked, but they wanted to put family first and farming allowed them to do this.

The amount of money people need can be hugely different. For some of the farmers we have already profiled, the answer could be as low as zero when there are other sources of income coming in to the household. Where the farm is the only source of income, it could be over €60,000 before tax, or even more depending on borrowings and size and stage of the family.

Having one clear goal makes it easier to focus on what the farm has to achieve.

Eoin has built up numbers since he took over. He currently runs 25 suckler cows and 100 ewes.

“I have finished all their progeny to beef, but I want to change this and sell the bulls as weanlings,” said Eoin.

With the drop in stocking rate, he also wants to boost ewe numbers by 50% to 150 this year. Eoin sees more potential to hit his profit target by doing this.

He hopes he can increase output per hectare, while at the same time reducing costs.

As with the other farmers in the Cashflow Challenge, we went through each month to see when sales were made and money came in and went out.

Looking at cashflow a different way

In the last few weeks, I have gone through a step-by-step approach of filling in a cashflow plan. This week, I want to look at the plan in a different way.

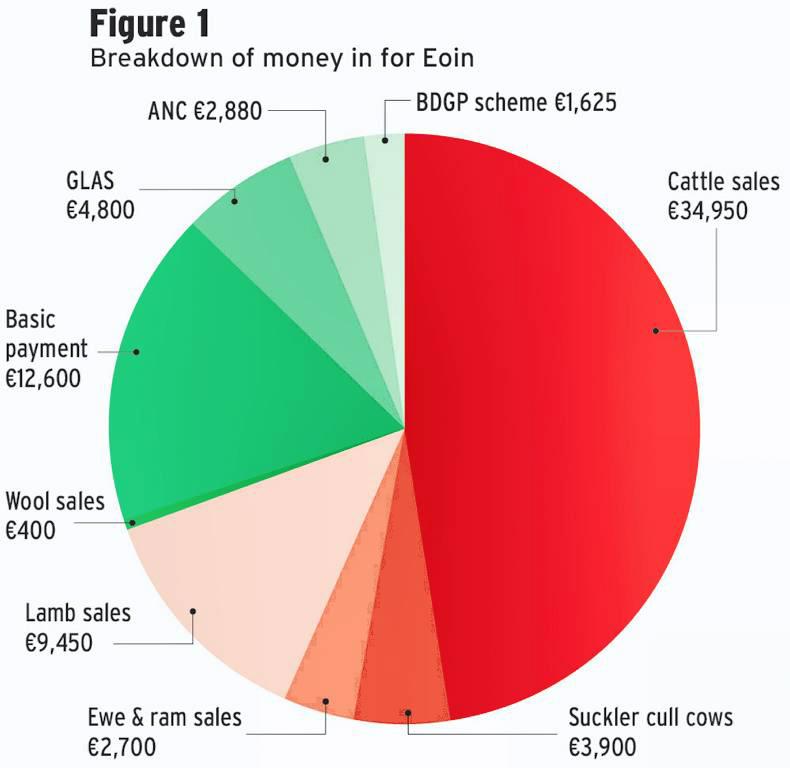

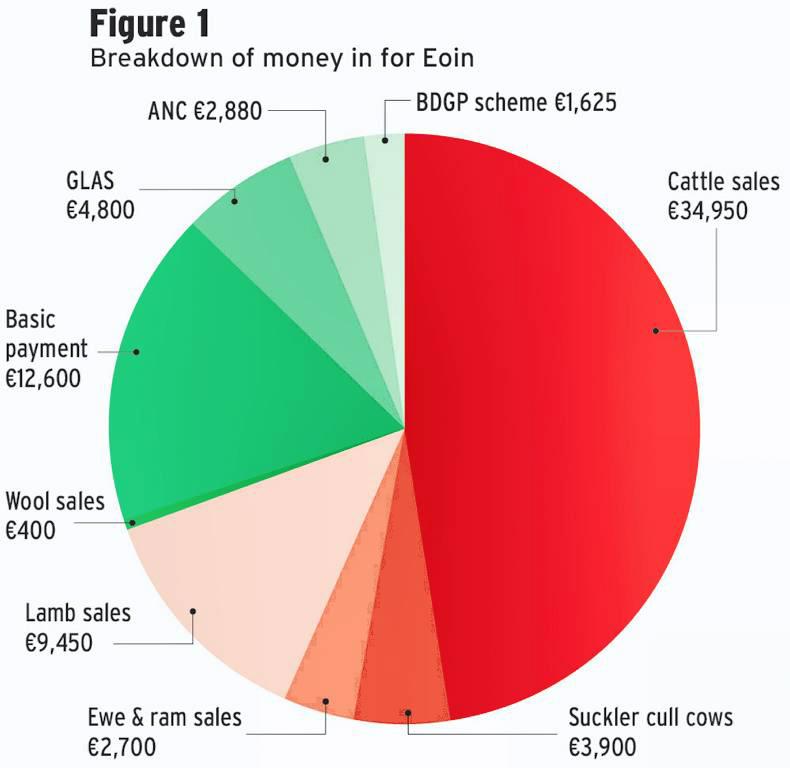

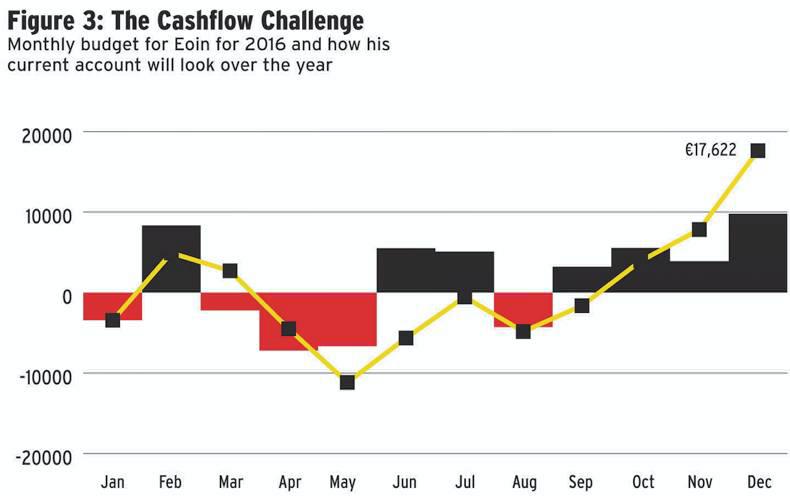

Figure 1 shows the money coming into the farm in 2016. Over 70% (€51,400) of the €73,000 income that comes into the farm is from sales of beef and lambs.

The remaining 30% (€22,000) comes in the form of direct payments from the Basic Payment Scheme, GLAS and the BDGP.

Figure 2 gives the money that flows out of the farm account. Feed, fertiliser and contractor costs as always are the big three and are the ones that Eoin will aim to tackle over the coming year.

While there is €34,000 in direct farm costs, there is €56,683 in total to come out of the account. It means that Eoin will spend 77% of the money that comes into the farm account. This gives him 23% to hold on to – €17,000.

You might say that this is a bit short of the €20,000 target, but we have taken out €9,360 for drawings already. So he is on target to get €26,000 out for the household.

The cashflow picture

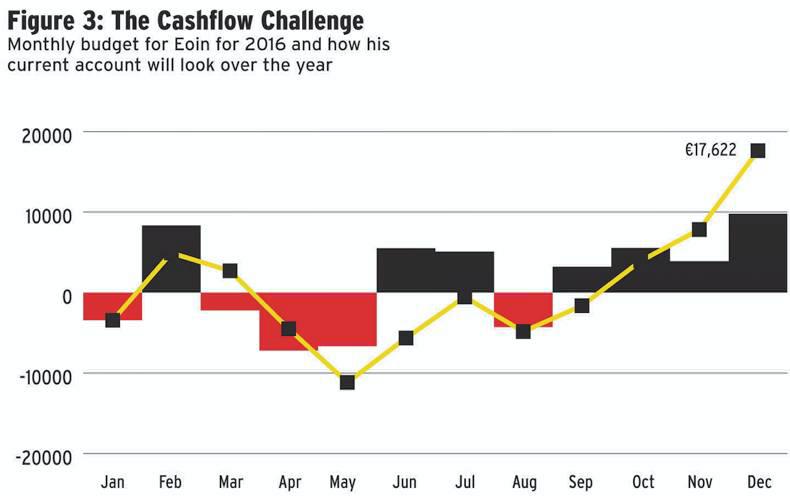

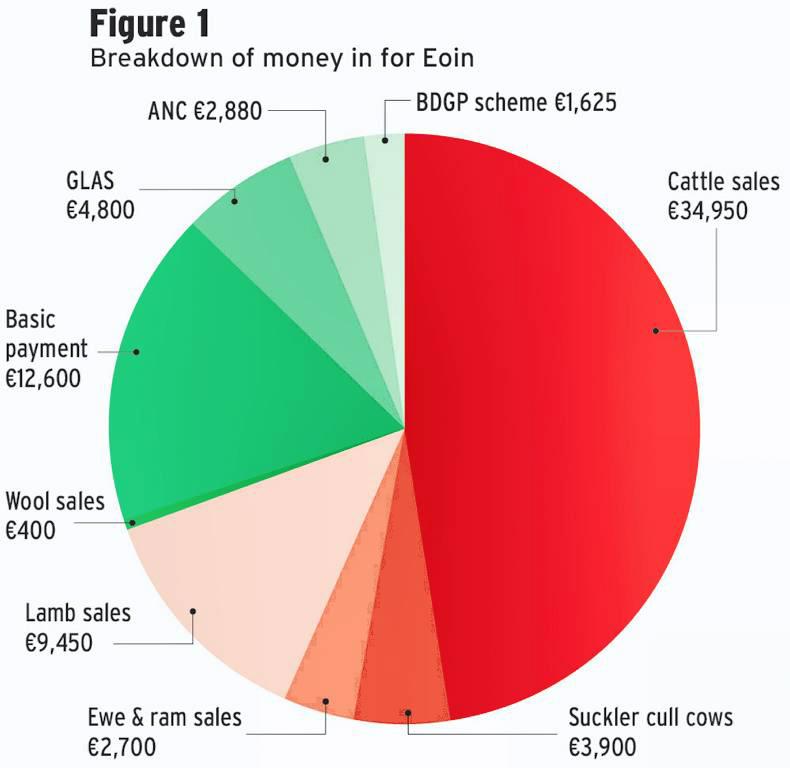

We look first at the monthly cashflow picture for Eoin (Figure 3). It is typical of a beef and sheep farmer, showing big fluctuations each month. Over the year, seven months have more money coming into the account than going out. For five months, there is more going out.

This is a simple picture that everyone should paint for their farm by doing a cashflow plan. It quickly shows if you are balancing money coming in with money going out.

For Eoin, February is the only month that he has more coming in early in the year. As you move towards the end of the year, the picture looks better.

The current account

More importantly, a cashflow plan shows how the current account is expected to go over the year.

Eoin’s current account is in the black in February but dips back into overdraft in March. It does not get out of it until October when the year is nearly finished.

Eoin has tended to pay for inputs for the farm when he buys them, avoiding costly merchant credit.

He has an overdraft of €7,000 for the farm. As you can see, this is clearly breached in May when it jumps to over €11,000. We will look at this again in February when he has sold the heifers.

What we also have to consider is the impact of the change in system.

By moving to sell weanlings next autumn, Eoin is effectively selling two years’ stock in one.

This can give a boost to cashflow, but it will be followed by a reduction the following year. There are also tax implications that we can look at during the year.

Identify the profit you want – backwards budget

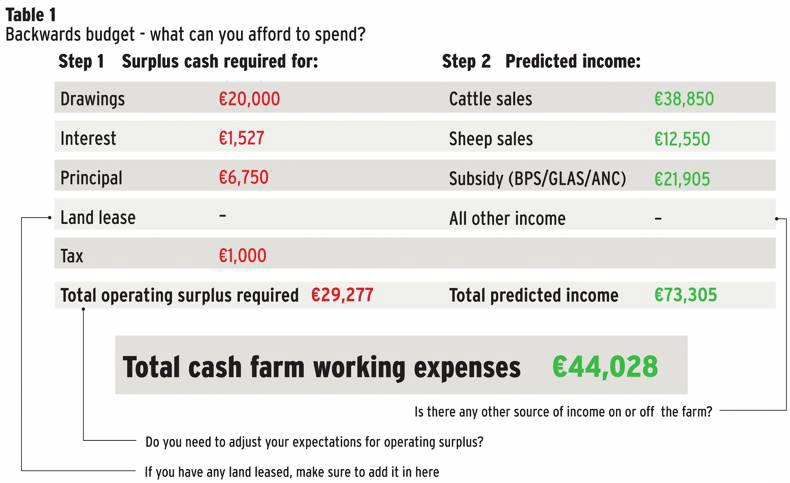

Eoin has set a clear target of needing €20,000 off the farm for drawings. It is a must-hit target. Some people always feel that profit is leftover after you farm for the year. A different way to look at it is to identify the profit you want and then farm to achieve it.

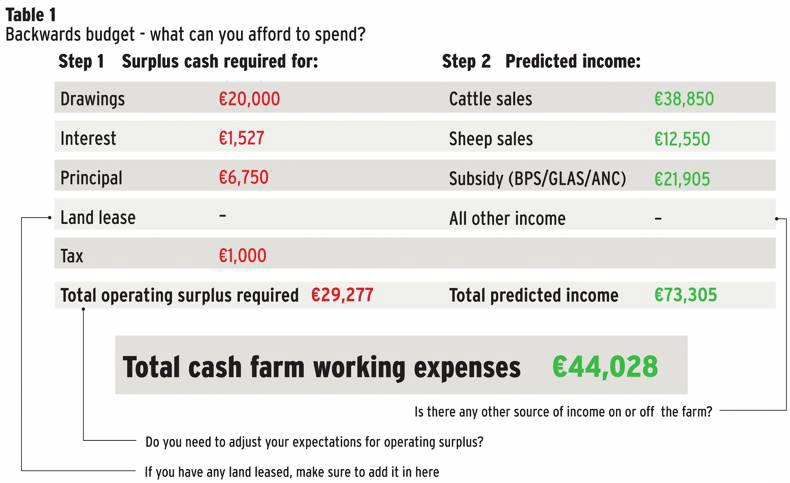

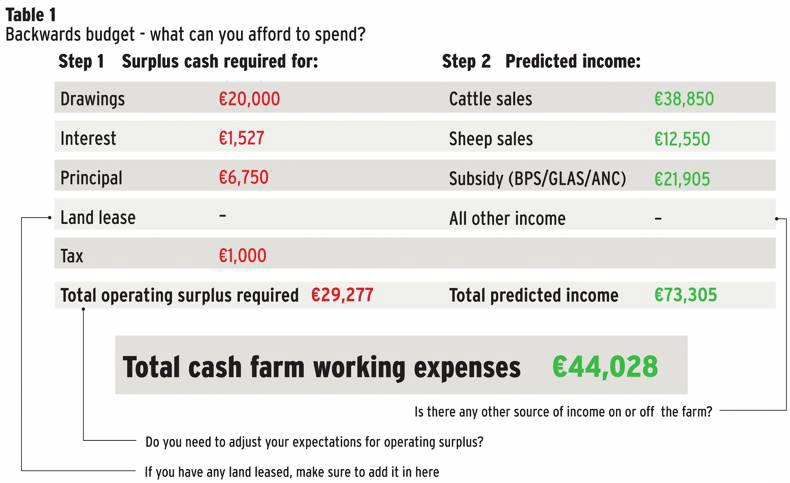

An interesting way to do this is called a backward budget. This is where you first identify what you have to get from the farm. At its simplest, it will be drawings, loan repayments, lease payments and tax.

So, in Eoin’s case, he needs the €20,000 in drawings and €8,277 in loan repayments for the year. He also needs €1,000 to pay tax. So he needs to get €29,227 in cash out of the farm in 2016.

The second step is to work out the predicted income. This is the first step of the cashflow plan and is probably the easiest part.

We put in cattle and sheep sales and also all the income he is due to receive from direct payments – a total of €73,305.

All you do now is take what is needed (€29,227) from the predicted income of €73,305 and you can quickly see that Eoin has €44,028.

By going through expenses, you can cut your cloth to measure. In other words, you cannot overspend if your goal is to have €29,227 at the end of the year.

Starting with what you need is an interesting way of going about building up a budget. I will return to this in the coming weeks to tease out how it can be used by farmers to make sure they hit their goals.

Clean bank accounts

One of the most important points to control your finances is to have a separate bank account for the farm and the house. Eoin and Mary have three accounts. The first is the farm account through which all the money coming in and out goes. Mary also has an account into which her wages are paid each month. They also have a joint account to which they each contribute a fixed amount each month. This goes to pay the mortgage and living expenses. It is a good system that makes sure there are clear lines.

Eoin said himself and Mary have a savings account. “I have a standing order of €20 a month coming out. It is not much, but it reminds me of the need to save and I would try to put more in if I had it. Mary is much better at saving,” he joked.

To see Eoin’s completed 2016 Cashflow budget click here .

What amount of money do you need to make off the farm next year? That is the first and most important question for farmers who are going to commit to the Cashflow Challenge. After all, one of the main reasons you are farming is to produce enough to live.

When I asked this week’s Cashflow Challenge farmer Eoin that question, he didn’t have to think twice. “The farm must contribute €20,000 to the household each year,” he said.

The reason he knew was that Eoin had recently given up a job to become a full-time farmer on 84 acres.

“My wife works full-time and we have three children. We sat down and made a decision that if I was home full-time, I could be around to look after the children more,” said Eoin. “Otherwise, we would be just too busy to enjoy them,” he added.

It was a sensible decision that many couples make as more children come along. Yes, they might bring in more income if both worked, but they wanted to put family first and farming allowed them to do this.

The amount of money people need can be hugely different. For some of the farmers we have already profiled, the answer could be as low as zero when there are other sources of income coming in to the household. Where the farm is the only source of income, it could be over €60,000 before tax, or even more depending on borrowings and size and stage of the family.

Having one clear goal makes it easier to focus on what the farm has to achieve.

Eoin has built up numbers since he took over. He currently runs 25 suckler cows and 100 ewes.

“I have finished all their progeny to beef, but I want to change this and sell the bulls as weanlings,” said Eoin.

With the drop in stocking rate, he also wants to boost ewe numbers by 50% to 150 this year. Eoin sees more potential to hit his profit target by doing this.

He hopes he can increase output per hectare, while at the same time reducing costs.

As with the other farmers in the Cashflow Challenge, we went through each month to see when sales were made and money came in and went out.

Looking at cashflow a different way

In the last few weeks, I have gone through a step-by-step approach of filling in a cashflow plan. This week, I want to look at the plan in a different way.

Figure 1 shows the money coming into the farm in 2016. Over 70% (€51,400) of the €73,000 income that comes into the farm is from sales of beef and lambs.

The remaining 30% (€22,000) comes in the form of direct payments from the Basic Payment Scheme, GLAS and the BDGP.

Figure 2 gives the money that flows out of the farm account. Feed, fertiliser and contractor costs as always are the big three and are the ones that Eoin will aim to tackle over the coming year.

While there is €34,000 in direct farm costs, there is €56,683 in total to come out of the account. It means that Eoin will spend 77% of the money that comes into the farm account. This gives him 23% to hold on to – €17,000.

You might say that this is a bit short of the €20,000 target, but we have taken out €9,360 for drawings already. So he is on target to get €26,000 out for the household.

The cashflow picture

We look first at the monthly cashflow picture for Eoin (Figure 3). It is typical of a beef and sheep farmer, showing big fluctuations each month. Over the year, seven months have more money coming into the account than going out. For five months, there is more going out.

This is a simple picture that everyone should paint for their farm by doing a cashflow plan. It quickly shows if you are balancing money coming in with money going out.

For Eoin, February is the only month that he has more coming in early in the year. As you move towards the end of the year, the picture looks better.

The current account

More importantly, a cashflow plan shows how the current account is expected to go over the year.

Eoin’s current account is in the black in February but dips back into overdraft in March. It does not get out of it until October when the year is nearly finished.

Eoin has tended to pay for inputs for the farm when he buys them, avoiding costly merchant credit.

He has an overdraft of €7,000 for the farm. As you can see, this is clearly breached in May when it jumps to over €11,000. We will look at this again in February when he has sold the heifers.

What we also have to consider is the impact of the change in system.

By moving to sell weanlings next autumn, Eoin is effectively selling two years’ stock in one.

This can give a boost to cashflow, but it will be followed by a reduction the following year. There are also tax implications that we can look at during the year.

Identify the profit you want – backwards budget

Eoin has set a clear target of needing €20,000 off the farm for drawings. It is a must-hit target. Some people always feel that profit is leftover after you farm for the year. A different way to look at it is to identify the profit you want and then farm to achieve it.

An interesting way to do this is called a backward budget. This is where you first identify what you have to get from the farm. At its simplest, it will be drawings, loan repayments, lease payments and tax.

So, in Eoin’s case, he needs the €20,000 in drawings and €8,277 in loan repayments for the year. He also needs €1,000 to pay tax. So he needs to get €29,227 in cash out of the farm in 2016.

The second step is to work out the predicted income. This is the first step of the cashflow plan and is probably the easiest part.

We put in cattle and sheep sales and also all the income he is due to receive from direct payments – a total of €73,305.

All you do now is take what is needed (€29,227) from the predicted income of €73,305 and you can quickly see that Eoin has €44,028.

By going through expenses, you can cut your cloth to measure. In other words, you cannot overspend if your goal is to have €29,227 at the end of the year.

Starting with what you need is an interesting way of going about building up a budget. I will return to this in the coming weeks to tease out how it can be used by farmers to make sure they hit their goals.

Clean bank accounts

One of the most important points to control your finances is to have a separate bank account for the farm and the house. Eoin and Mary have three accounts. The first is the farm account through which all the money coming in and out goes. Mary also has an account into which her wages are paid each month. They also have a joint account to which they each contribute a fixed amount each month. This goes to pay the mortgage and living expenses. It is a good system that makes sure there are clear lines.

Eoin said himself and Mary have a savings account. “I have a standing order of €20 a month coming out. It is not much, but it reminds me of the need to save and I would try to put more in if I had it. Mary is much better at saving,” he joked.

To see Eoin’s completed 2016 Cashflow budget click here .

SHARING OPTIONS